Intro

Discover how workers compensation benefits impact food stamp eligibility. Learn if receiving workers comp affects your ability to receive SNAP benefits, and explore the intersection of disability benefits, income limits, and household eligibility. Get clarity on the rules and regulations surrounding workers comp and food stamp eligibility to ensure you receive the support you need.

Receiving workers' compensation benefits can have a significant impact on an individual's life, particularly when it comes to their financial situation. One crucial aspect to consider is how workers' comp affects eligibility for food stamps, a vital program that helps low-income households access nutritious food. In this article, we will delve into the relationship between workers' compensation and food stamp eligibility, exploring the key factors that determine whether an individual can receive both benefits simultaneously.

Understanding Workers' Compensation

Workers' compensation is a state-mandated insurance program that provides financial benefits to employees who suffer work-related injuries or illnesses. The primary purpose of workers' comp is to help injured workers cover medical expenses, lost wages, and other related costs while they recover from their injuries. The amount of workers' comp benefits varies depending on the state, the severity of the injury, and the worker's average weekly wage.

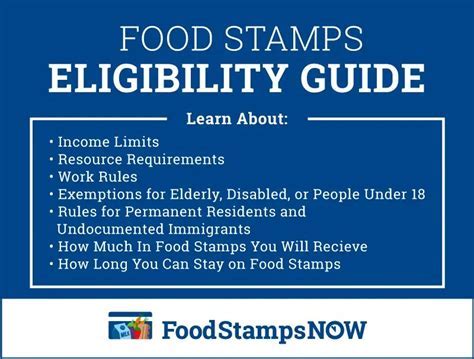

Understanding Food Stamp Eligibility

The Supplemental Nutrition Assistance Program (SNAP), commonly known as food stamps, is a federal program that helps low-income households purchase food. To be eligible for food stamps, applicants must meet specific income and resource requirements, which vary by state. Generally, households with gross incomes below 130% of the federal poverty level may be eligible for SNAP benefits.

How Workers' Comp Affects Food Stamp Eligibility

When an individual receives workers' compensation benefits, it can impact their eligibility for food stamps in several ways:

- Income Considerations: Workers' comp benefits are considered taxable income, which means they can affect an individual's gross income. If the workers' comp benefits push the household's gross income above the 130% poverty level threshold, the individual may no longer be eligible for food stamps.

- Resource Considerations: Some states consider workers' comp benefits as a resource, which can impact an individual's eligibility for food stamps. If the benefits are considered a resource, they may be counted towards the household's resource limit, potentially reducing or eliminating food stamp eligibility.

- Deductions and Exemptions: In some cases, workers' comp benefits may be exempt from income calculations or subject to deductions, which can help an individual remain eligible for food stamps. For example, some states exempt workers' comp benefits from income calculations if the individual is receiving disability benefits.

State-Specific Rules

It's essential to note that the impact of workers' comp on food stamp eligibility varies by state. Some states have more lenient rules, while others may be more restrictive. For example:

- California: Workers' comp benefits are considered taxable income, but the state allows for a deduction of 20% of the benefits received.

- New York: Workers' comp benefits are exempt from income calculations, but the state considers them as a resource.

- Texas: Workers' comp benefits are considered taxable income, but the state allows for a deduction of 30% of the benefits received.

Tips for Maintaining Food Stamp Eligibility

If you're receiving workers' comp benefits and concerned about maintaining food stamp eligibility, consider the following tips:

- Report Changes: Inform your local SNAP office about any changes in your income or resources, including workers' comp benefits.

- Request a Redetermination: If you're no longer eligible for food stamps due to workers' comp benefits, request a redetermination to reevaluate your eligibility.

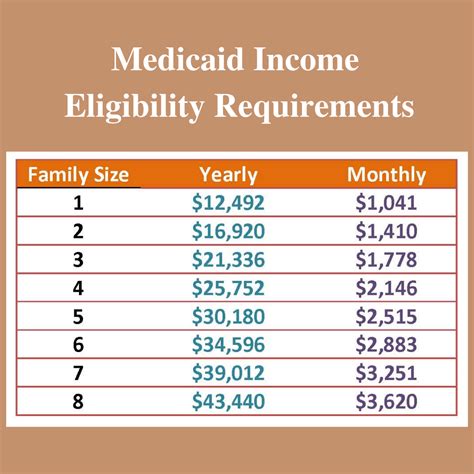

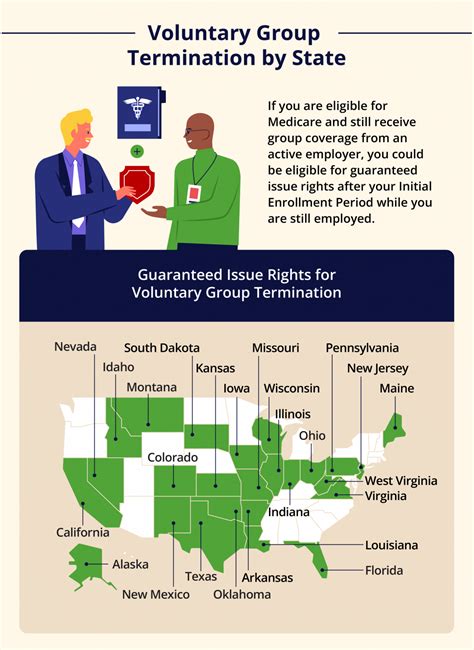

- Explore Other Assistance Programs: Look into other assistance programs, such as Medicaid or Temporary Assistance for Needy Families (TANF), which may be available to you.

Gallery of Workers Comp and Food Stamps

Workers Comp and Food Stamps Image Gallery

Conclusion

Receiving workers' comp benefits can have a significant impact on an individual's food stamp eligibility. While the rules vary by state, it's essential to understand how workers' comp affects income and resource calculations. By reporting changes, requesting redeterminations, and exploring other assistance programs, individuals can maintain their food stamp eligibility and ensure access to nutritious food. If you're concerned about your food stamp eligibility, consult with your local SNAP office or a qualified benefits counselor to determine the best course of action.

Frequently Asked Questions

-

Can I receive workers' comp benefits and food stamps simultaneously? Yes, but the specific rules and regulations vary by state.

-

How do workers' comp benefits affect my income eligibility for food stamps? Workers' comp benefits are considered taxable income, which can impact your gross income and affect your eligibility for food stamps.

-

Can I deduct workers' comp benefits from my income when applying for food stamps? Some states allow for deductions or exemptions, but this varies by state.

-

What happens if I'm no longer eligible for food stamps due to workers' comp benefits? You can request a redetermination or explore other assistance programs, such as Medicaid or TANF.

-

Can I appeal a decision regarding my food stamp eligibility? Yes, you can appeal a decision regarding your food stamp eligibility by contacting your local SNAP office or a qualified benefits counselor.

We hope this article has provided valuable insights into the complex relationship between workers' comp and food stamp eligibility. If you have any further questions or concerns, please don't hesitate to comment below or share this article with others who may benefit from this information.