Managing personal finances effectively requires staying organized and having easy access to financial information. One crucial aspect of this is being able to download and analyze credit card statements. For individuals and businesses alike, the ability to import credit card statements into Excel can be a game-changer, allowing for deeper financial insights and more accurate budgeting.

Understanding the Importance of Credit Card Statements in Excel

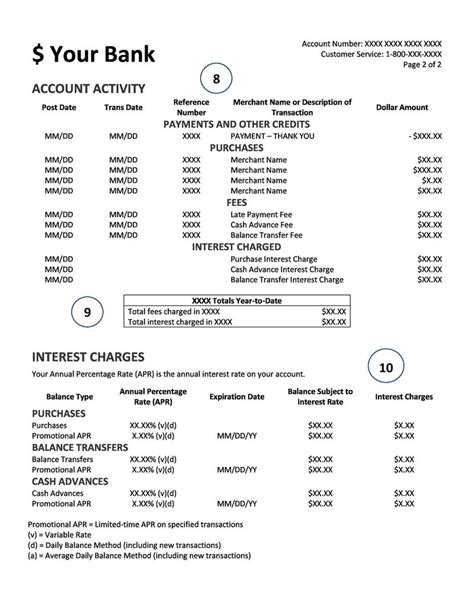

Being able to download credit card statements to Excel opens up a world of possibilities for financial management. It allows users to categorize transactions easily, track spending patterns, and make informed decisions about future purchases. By importing this data into Excel, individuals can leverage the software's powerful analysis tools to identify trends, create budgets, and even forecast future expenses.

The Benefits of Analyzing Credit Card Statements in Excel

Analyzing credit card statements in Excel can provide a multitude of benefits, including:

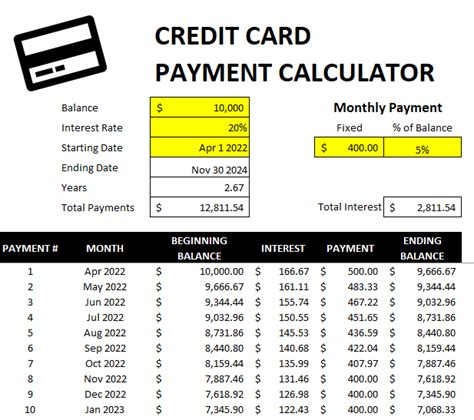

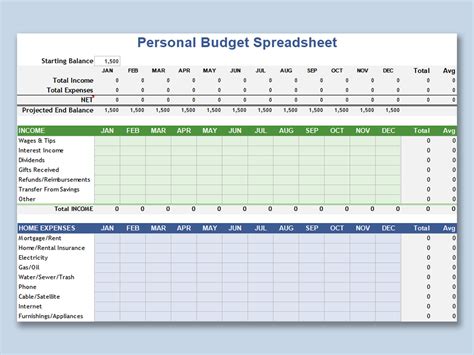

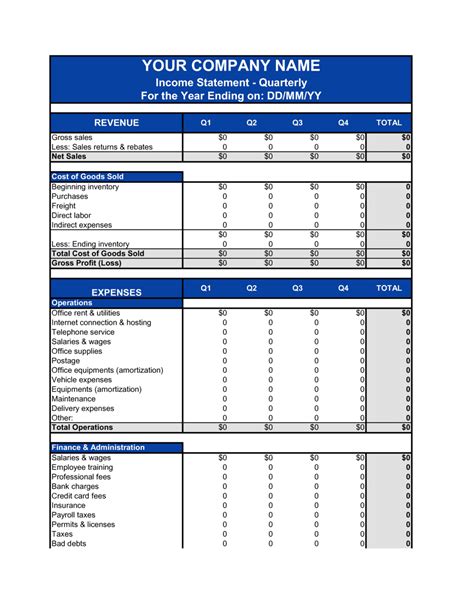

- Enhanced Budgeting: By categorizing transactions and tracking spending patterns, users can create more accurate budgets that reflect their real financial habits.

- Improved Financial Insights: Excel's analytical tools can help identify areas of unnecessary spending, enabling users to make adjustments and save money.

- Simplified Financial Planning: With the ability to forecast expenses and income, users can make more informed decisions about their financial futures.

The Process of Downloading Credit Card Statements to Excel

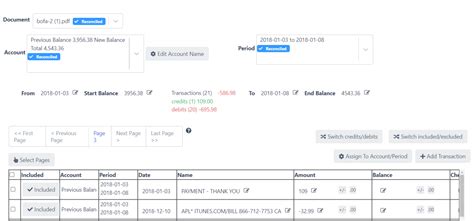

The process of downloading credit card statements to Excel varies slightly depending on the credit card issuer. However, the general steps are as follows:

- Log In to Your Account: Start by logging into your credit card account online.

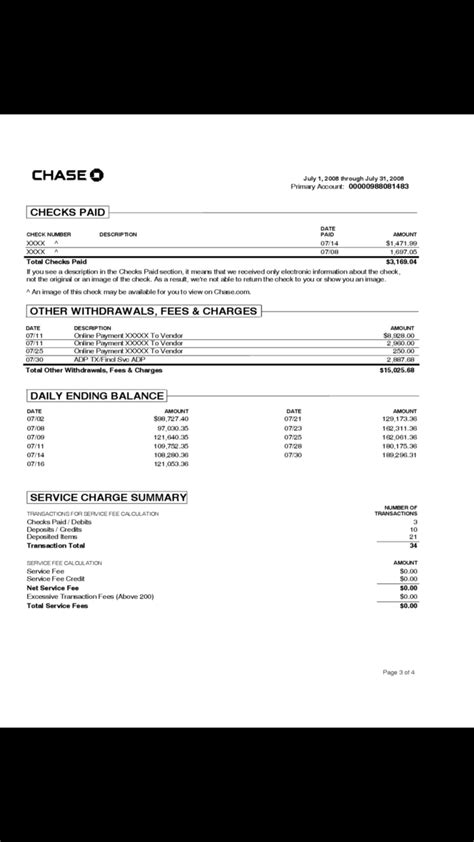

- Find the Statement Section: Navigate to the section where your credit card statements are stored.

- Select the Statement Period: Choose the statement period you wish to download.

- Choose the File Format: Select the option to download the statement in a format compatible with Excel, such as CSV.

- Import into Excel: Once downloaded, import the file into Excel for analysis.

Common Issues and Solutions

While the process is generally straightforward, users may encounter issues such as incompatible file formats or difficulty importing data into Excel. Solutions include:

- Checking the File Format: Ensure the file is in a format compatible with Excel.

- Using Excel's Import Function: Utilize Excel's built-in import functions to correctly import the data.

Maximizing the Use of Credit Card Statements in Excel

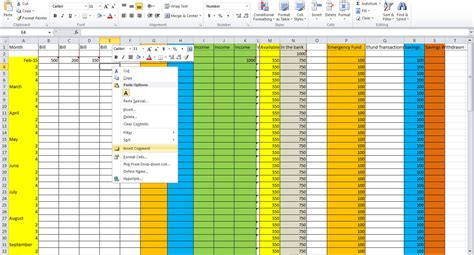

To maximize the use of credit card statements in Excel, consider the following tips:

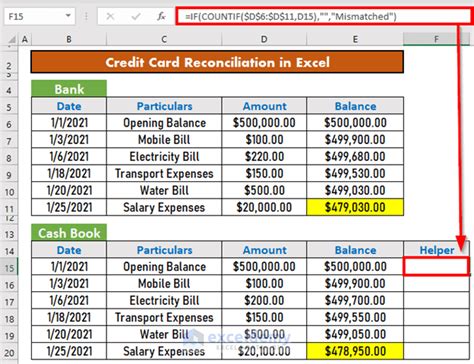

- Use PivotTables: Excel's PivotTable feature can help summarize and analyze large datasets.

- Create Budget Templates: Use Excel templates to create budgets that align with your financial goals.

- Set Up Alerts: Use Excel to set up financial alerts, such as notifications when spending exceeds a certain threshold.

Advanced Analysis Techniques

For those looking to dive deeper into financial analysis, consider using Excel's advanced features such as:

- VLOOKUP and INDEX/MATCH: Use these functions to categorize transactions and track spending patterns.

- Forecasting Tools: Leverage Excel's forecasting tools to predict future expenses and income.

Credit Card Statements in Excel Gallery

In conclusion, downloading credit card statements to Excel is a powerful tool for financial management. By following the steps outlined above and leveraging Excel's analytical tools, users can gain deeper insights into their financial habits, make informed decisions, and achieve their financial goals. Don't hesitate to share your experiences or tips for analyzing credit card statements in Excel in the comments below.