Warning signs of an impending economic collapse are flashing red. Discover the 5 alarming indicators that suggest a financial downturn is looming, including rising debt, stagnant wages, and market volatility. Learn how to prepare for the worst and protect your wealth from the impending economic storm.

As the world grapples with the aftermath of the COVID-19 pandemic, economic uncertainty has become a pressing concern for many. The global economy has been facing numerous challenges, from rising debt levels to stagnating growth, and many experts are warning of a potential collapse. But what are the signs that the economy is on the brink of disaster?

Sign #1: Rising Debt Levels

One of the most ominous signs of an impending economic collapse is the rising level of debt. Governments, corporations, and individuals have been accumulating debt at an alarming rate, and it's becoming increasingly difficult to service these debts. The global debt-to-GDP ratio has risen to over 320%, making it unsustainable in the long term. When debt levels become too high, it can lead to a credit crisis, where lenders become wary of lending and the entire financial system freezes up.

Debt Statistics: A Cause for Concern

- Global debt has risen to over $257 trillion, up from $142 trillion in 2008.

- The US national debt has surpassed $23 trillion, with the debt-to-GDP ratio exceeding 100%.

- Corporate debt has risen to over $75 trillion, with many companies struggling to service their debts.

Sign #2: Slowing Economic Growth

Another sign that the economy is on the brink of collapse is slowing economic growth. The global economy has been experiencing a slowdown in growth, with many countries facing stagnating or even contracting economies. This slowdown is largely due to a decline in consumer spending, reduced investment, and a decline in international trade.

Growth Statistics: A Slowing Economy

- Global economic growth has slowed to 2.9%, down from 3.2% in 2017.

- The US economy has slowed to 2.1%, down from 2.9% in 2018.

- The Eurozone economy has slowed to 1.2%, down from 1.8% in 2017.

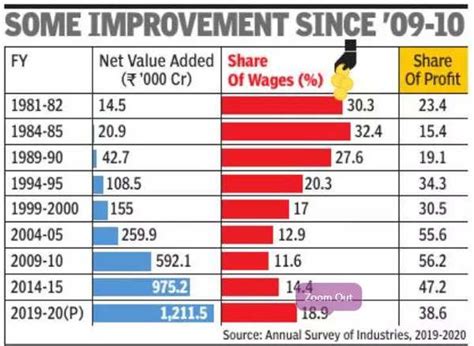

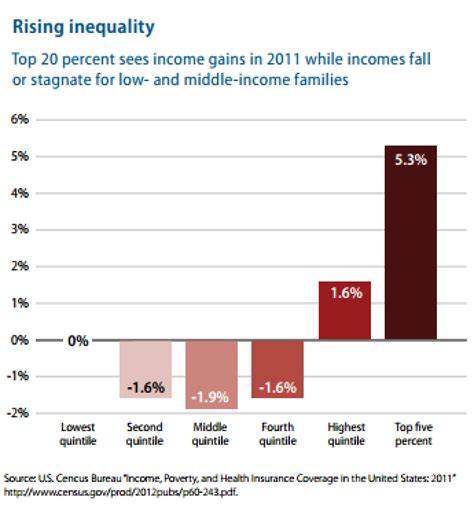

Sign #3: Increasing Inequality

Increasing income and wealth inequality is another sign that the economy is on the brink of collapse. When a small group of people hold a disproportionate amount of wealth and power, it can lead to social and economic instability. The widening gap between the rich and the poor can lead to reduced consumer spending, reduced investment, and a decline in economic growth.

Inequality Statistics: A Widening Gap

- The top 1% of earners in the US now hold over 40% of the country's wealth.

- The bottom 50% of earners in the US now hold less than 1% of the country's wealth.

- The global wealth gap has risen to historic levels, with the top 10% of earners holding over 85% of global wealth.

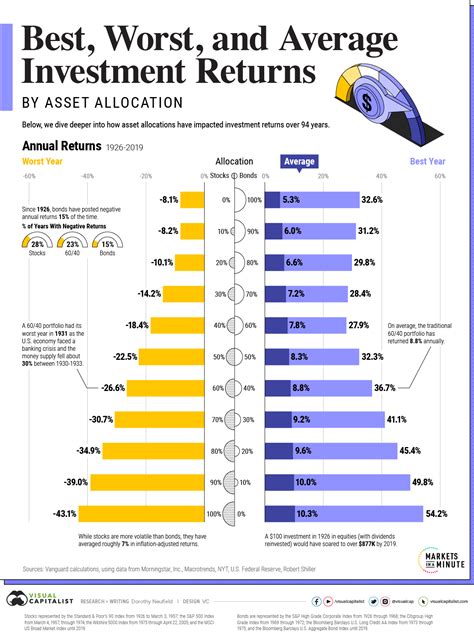

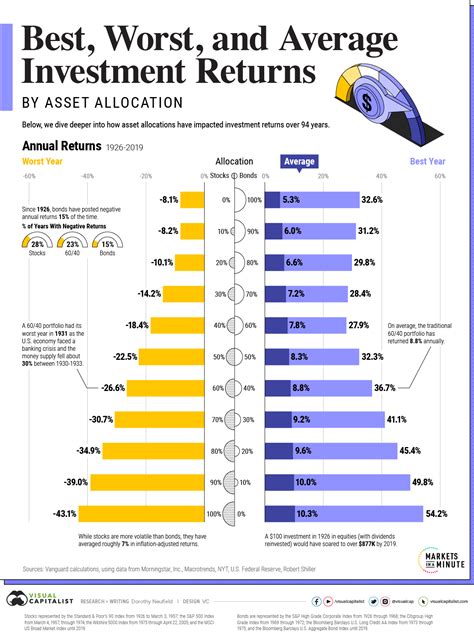

Sign #4: Rising Asset Prices

Rising asset prices, particularly in the stock market, are another sign that the economy is on the brink of collapse. When asset prices become detached from their underlying value, it can lead to a bubble that eventually bursts, causing widespread economic damage.

Asset Price Statistics: A Bubble Waiting to Burst

- The global stock market has risen to historic levels, with the S&P 500 index up over 300% since 2009.

- The global bond market has also risen to historic levels, with yields at historic lows.

- The global real estate market has risen to historic levels, with prices in many countries exceeding their pre-crisis peaks.

Sign #5: Central Bank Intervention

Finally, increased central bank intervention is another sign that the economy is on the brink of collapse. When central banks intervene in the economy, it can lead to a loss of confidence in the financial system, causing widespread economic damage.

Central Bank Statistics: A Loss of Confidence

- The US Federal Reserve has intervened in the economy numerous times since the 2008 financial crisis, with interest rates at historic lows.

- The European Central Bank has also intervened in the economy, with quantitative easing and negative interest rates.

- The global central banking system has become increasingly reliant on unconventional monetary policies, leading to a loss of confidence in the financial system.

Economic Collapse Image Gallery

As the signs of an impending economic collapse become increasingly clear, it's essential to take steps to protect yourself and your loved ones. By understanding the warning signs and taking proactive measures, you can reduce your exposure to the coming economic storm.

Don't wait until it's too late. Share this article with your friends and family, and start preparing for the economic collapse today.