Equal Monthly Installments (EMIs) are a crucial aspect of personal finance, and understanding how to calculate them can help individuals manage their debt more effectively. In this article, we will explore the EMI calculation formula in Excel and provide a step-by-step guide on how to use it.

The importance of EMI calculation cannot be overstated. It helps individuals determine the amount they need to pay each month towards their loan, making it easier to plan their finances. Moreover, EMI calculations can also help individuals decide whether they can afford a particular loan or not.

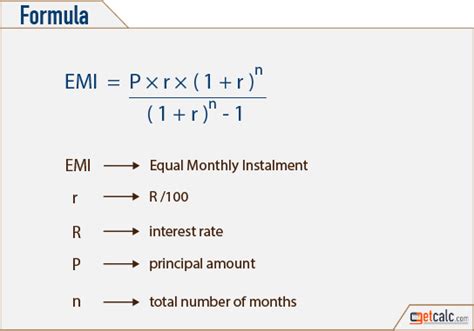

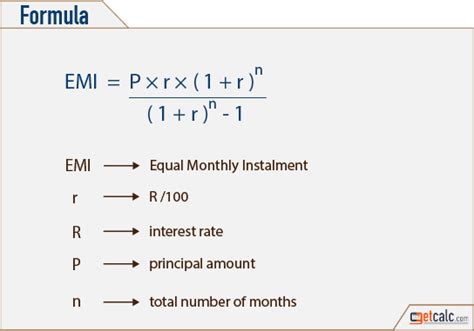

Understanding the EMI Calculation Formula

The EMI calculation formula is a mathematical formula that takes into account the principal amount, interest rate, and loan tenure to calculate the monthly installment amount. The formula is as follows:

EMI = (P x R x (1 + R)^N) / ((1 + R)^N – 1)

Where:

- EMI = Equal Monthly Installment

- P = Principal Amount (the amount borrowed)

- R = Monthly interest rate (annual interest rate divided by 12)

- N = Number of monthly installments (loan tenure in months)

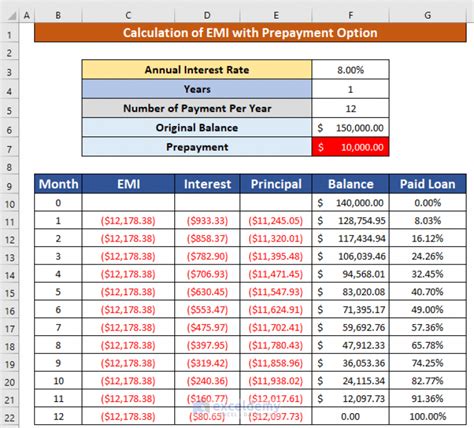

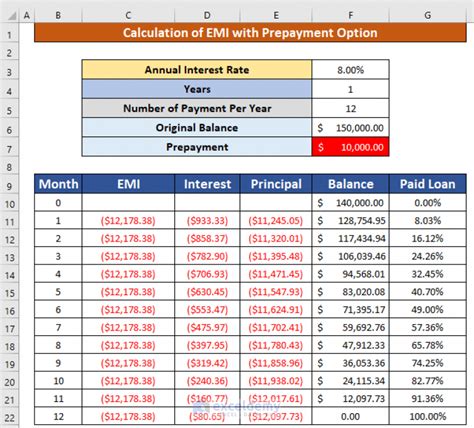

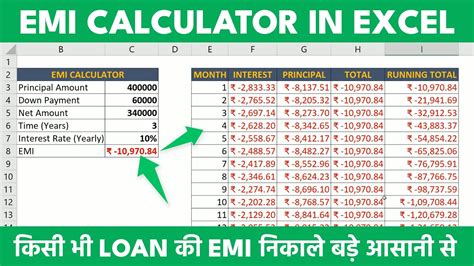

How to Calculate EMI in Excel

Calculating EMI in Excel is relatively straightforward. Here's a step-by-step guide:

- Open a new Excel spreadsheet and create a table with the following columns: Principal Amount, Interest Rate, Loan Tenure, and EMI.

- Enter the principal amount, interest rate, and loan tenure in the respective columns.

- Convert the annual interest rate to a monthly interest rate by dividing it by 12.

- Calculate the number of monthly installments by multiplying the loan tenure in years by 12.

- Use the EMI formula to calculate the monthly installment amount.

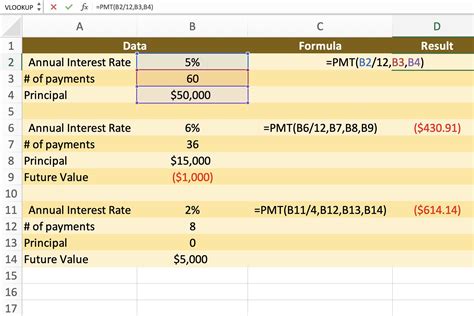

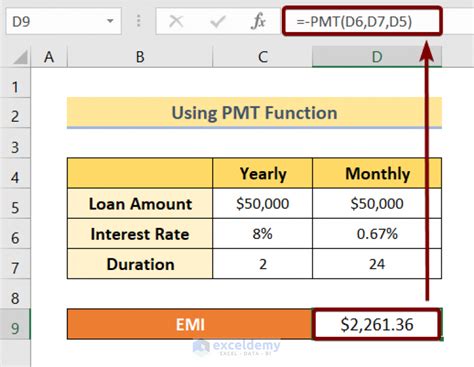

Using the PMT Function in Excel

Excel also has a built-in function called PMT (Payment) that can be used to calculate EMI. The PMT function takes into account the principal amount, interest rate, and loan tenure to calculate the monthly installment amount.

The syntax for the PMT function is as follows:

PMT(rate, nper, pv, [fv], [type])

Where:

- rate = Monthly interest rate

- nper = Number of monthly installments

- pv = Principal Amount

- [fv] = Optional argument that specifies the future value of the loan

- [type] = Optional argument that specifies whether the payment is made at the beginning or end of the period

To use the PMT function, follow these steps:

- Select the cell where you want to display the EMI amount.

- Type =PMT( and select the cells that contain the interest rate, loan tenure, and principal amount.

- Press Enter to calculate the EMI amount.

Advantages of Using Excel for EMI Calculation

Using Excel for EMI calculation has several advantages:

- It is easy to use and understand, even for those who are not familiar with financial calculations.

- It allows you to easily change the input values and recalculate the EMI amount.

- It provides a clear and concise way to compare different loan options and determine which one is the best for you.

- It can be used to calculate EMI for different types of loans, including home loans, car loans, and personal loans.

Conclusion

In conclusion, calculating EMI in Excel is a simple and effective way to manage your debt and make informed financial decisions. By using the EMI formula or the PMT function, you can easily determine the monthly installment amount for any loan and plan your finances accordingly.

EMI Calculation Formula Gallery

We hope this article has provided you with a clear understanding of the EMI calculation formula in Excel. If you have any questions or need further assistance, please leave a comment below. Don't forget to share this article with your friends and family who may benefit from it.