Intro

Unlock the secret to profitable equipment rentals with Excel. Learn 5 easy methods to calculate equipment rental rates, including depreciation, utilization, and operating costs. Master Excel formulas and functions to optimize your rental pricing strategy and boost your bottom line. Get the most out of your equipment rentals with these expert tips and tricks.

In today's fast-paced business world, equipment rental companies face numerous challenges, including managing inventory, handling logistics, and determining optimal rental rates. To remain competitive, these companies must have an effective pricing strategy in place. Excel, a widely used spreadsheet software, can be a valuable tool in calculating equipment rental rates. In this article, we will explore five ways to calculate equipment rental rates using Excel.

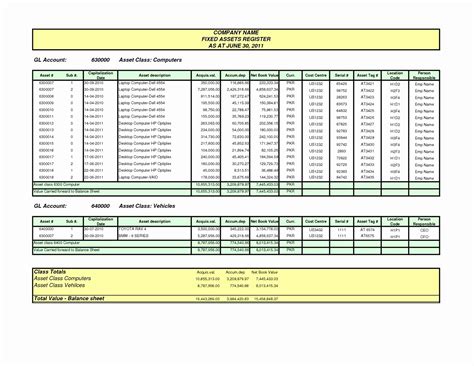

Equipment rental companies can use various methods to determine their rental rates, including the cost-based method, market-based method, and value-based method. The cost-based method involves calculating the total cost of ownership, including depreciation, maintenance, and other expenses, and then adding a markup to determine the rental rate. The market-based method involves researching competitors' rates and adjusting them based on the company's target market and pricing strategy. The value-based method involves determining the value that the equipment provides to the customer and pricing it accordingly.

Method 1: Cost-Based Method

The cost-based method is a widely used approach to calculating equipment rental rates. This method involves calculating the total cost of ownership, including depreciation, maintenance, and other expenses, and then adding a markup to determine the rental rate.

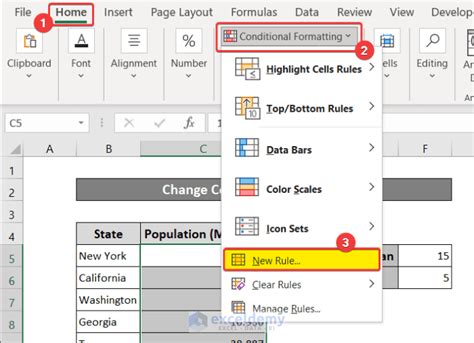

To calculate the rental rate using the cost-based method in Excel, follow these steps:

- Determine the total cost of ownership, including depreciation, maintenance, and other expenses.

- Calculate the daily, weekly, or monthly rental rate by dividing the total cost of ownership by the number of rental periods.

- Add a markup to the rental rate to determine the final rental rate.

For example, let's say a company purchases a piece of equipment for $10,000 and wants to rent it out for a period of one year. The company estimates that the equipment will depreciate by 20% per year and will require $1,000 in maintenance expenses per year. Using the cost-based method, the company can calculate the rental rate as follows:

| Category | Cost |

|---|---|

| Purchase Price | $10,000 |

| Depreciation (20% per year) | $2,000 |

| Maintenance Expenses | $1,000 |

| Total Cost of Ownership | $13,000 |

Rental Rate = Total Cost of Ownership / Number of Rental Periods = $13,000 / 52 weeks = $250 per week

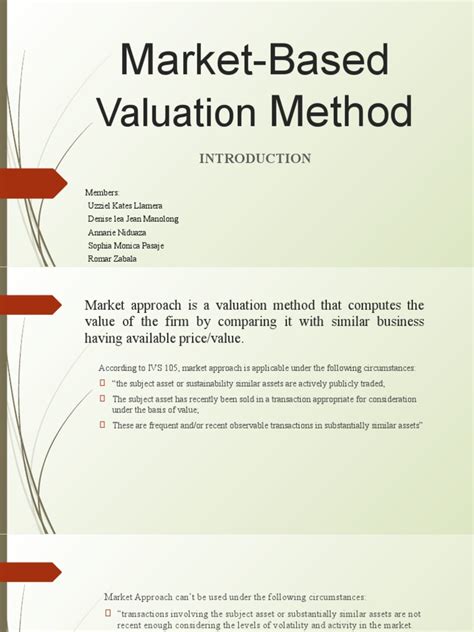

Method 2: Market-Based Method

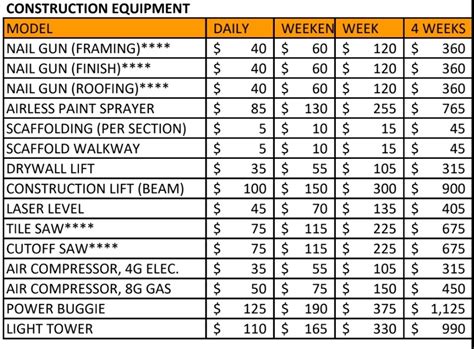

The market-based method involves researching competitors' rates and adjusting them based on the company's target market and pricing strategy. This method is useful when there is a high level of competition in the market and companies need to adjust their rates to remain competitive.

To calculate the rental rate using the market-based method in Excel, follow these steps:

- Research competitors' rates and list them in a table.

- Calculate the average rental rate of the competitors.

- Adjust the average rental rate based on the company's target market and pricing strategy.

For example, let's say a company researches its competitors and finds that they are charging the following rental rates for a piece of equipment:

| Competitor | Rental Rate |

|---|---|

| Competitor A | $200 per week |

| Competitor B | $250 per week |

| Competitor C | $300 per week |

Average Rental Rate = (Competitor A + Competitor B + Competitor C) / 3 = ($200 + $250 + $300) / 3 = $250 per week

Method 3: Value-Based Method

The value-based method involves determining the value that the equipment provides to the customer and pricing it accordingly. This method is useful when the equipment provides a unique value proposition to the customer.

To calculate the rental rate using the value-based method in Excel, follow these steps:

- Determine the value that the equipment provides to the customer.

- Calculate the rental rate based on the value provided.

For example, let's say a company determines that a piece of equipment provides a value of $500 per week to the customer. The company can calculate the rental rate as follows:

Rental Rate = Value Provided / Number of Rental Periods = $500 per week / 1 week = $500 per week

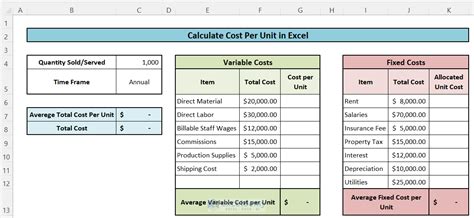

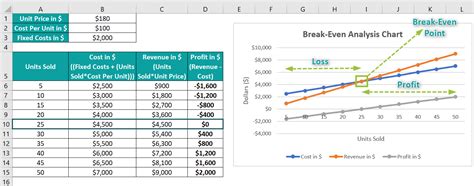

Method 4: Break-Even Analysis

Break-even analysis is a method used to calculate the rental rate based on the company's fixed and variable costs. This method is useful when the company wants to determine the minimum rental rate required to break even.

To calculate the rental rate using break-even analysis in Excel, follow these steps:

- Calculate the fixed costs, including depreciation, maintenance, and other expenses.

- Calculate the variable costs, including fuel, labor, and other expenses.

- Calculate the total costs by adding the fixed and variable costs.

- Calculate the break-even point by dividing the total costs by the number of rental periods.

For example, let's say a company calculates its fixed and variable costs as follows:

| Category | Cost |

|---|---|

| Fixed Costs | $10,000 per year |

| Variable Costs | $5,000 per year |

Total Costs = Fixed Costs + Variable Costs = $10,000 per year + $5,000 per year = $15,000 per year

Break-Even Point = Total Costs / Number of Rental Periods = $15,000 per year / 52 weeks = $288 per week

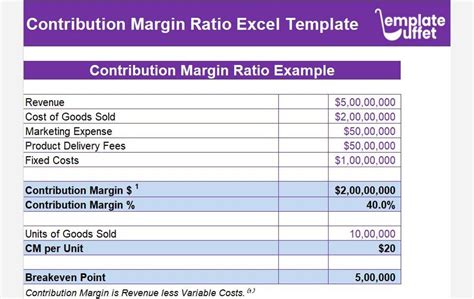

Method 5: Contribution Margin Analysis

Contribution margin analysis is a method used to calculate the rental rate based on the company's contribution margin. This method is useful when the company wants to determine the rental rate that will maximize its contribution margin.

To calculate the rental rate using contribution margin analysis in Excel, follow these steps:

- Calculate the contribution margin by subtracting the variable costs from the revenue.

- Calculate the rental rate by dividing the contribution margin by the number of rental periods.

For example, let's say a company calculates its contribution margin as follows:

| Category | Amount |

|---|---|

| Revenue | $100,000 per year |

| Variable Costs | $50,000 per year |

Contribution Margin = Revenue - Variable Costs = $100,000 per year - $50,000 per year = $50,000 per year

Rental Rate = Contribution Margin / Number of Rental Periods = $50,000 per year / 52 weeks = $961 per week

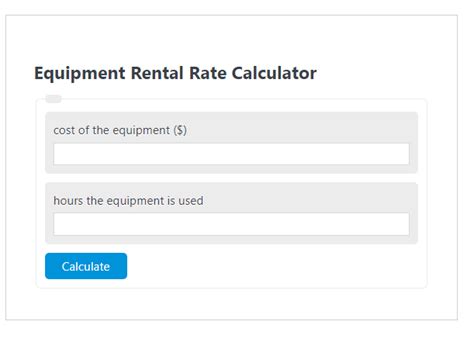

Equipment Rental Rates Calculator Gallery

In conclusion, calculating equipment rental rates requires careful consideration of various factors, including the cost of ownership, market rates, and the value provided to customers. By using the methods outlined in this article, equipment rental companies can determine optimal rental rates that balance their needs with those of their customers. Remember to stay flexible and adjust your pricing strategy as market conditions change.

We hope this article has provided you with valuable insights into calculating equipment rental rates using Excel. If you have any questions or need further assistance, please don't hesitate to comment below.