Equity Buyout Agreement Template For Business Owners Summary

Secure your business future with a comprehensive Equity Buyout Agreement Template. Learn how to protect your companys ownership and interests with a detailed template. Ensure a smooth transition of ownership with our expert guide, covering key clauses, valuation methods, and negotiation strategies for a successful equity buyout.

Understanding the Importance of Equity Buyout Agreements for Business Owners

As a business owner, it's essential to have a clear plan in place for the future of your company, including how ownership will be transferred or bought out. An equity buyout agreement template can help you establish a framework for buying or selling ownership shares, ensuring a smooth transition and minimizing potential conflicts. In this article, we'll explore the importance of equity buyout agreements, their key components, and provide a comprehensive template to help you get started.

Why Do You Need an Equity Buyout Agreement?

An equity buyout agreement is a crucial document that outlines the terms and conditions of buying or selling ownership shares in a company. This agreement is particularly important for businesses with multiple owners, as it helps to:

- Establish a clear plan for ownership transfer or buyout

- Minimize potential conflicts among owners

- Ensure a smooth transition of ownership

- Provide a framework for valuing the company and determining the purchase price

- Protect the interests of all parties involved

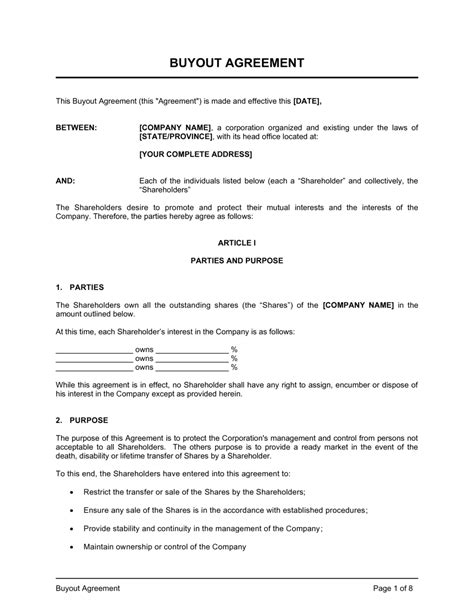

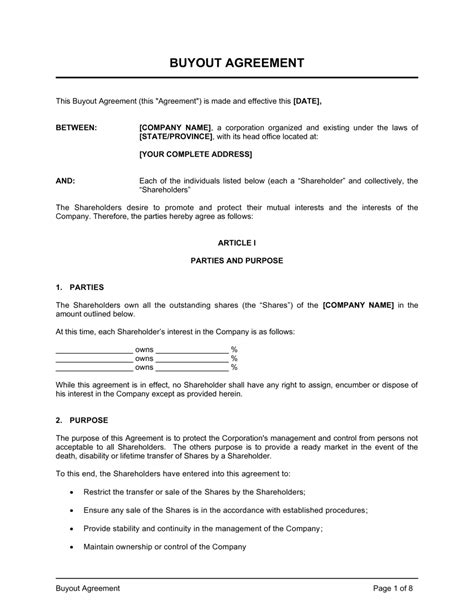

Key Components of an Equity Buyout Agreement Template

A comprehensive equity buyout agreement template should include the following key components:

- Introduction: A brief introduction that outlines the purpose and scope of the agreement.

- Definitions: A section that defines key terms, such as "equity," "ownership," and "buyout."

- Trigger Events: A section that outlines the events that trigger the buyout, such as the death or departure of an owner.

- Valuation Method: A section that describes the method used to determine the value of the company, such as an asset-based approach or an earnings-based approach.

- Purchase Price: A section that outlines the formula for calculating the purchase price, including any adjustments or discounts.

- Payment Terms: A section that describes the payment terms, including the payment schedule and any financing arrangements.

- Representations and Warranties: A section that outlines the representations and warranties made by the seller, including any indemnification provisions.

- Conditions Precedent: A section that outlines the conditions that must be met before the buyout can occur, such as the approval of the board of directors.

- Governing Law: A section that specifies the governing law and jurisdiction for any disputes arising from the agreement.

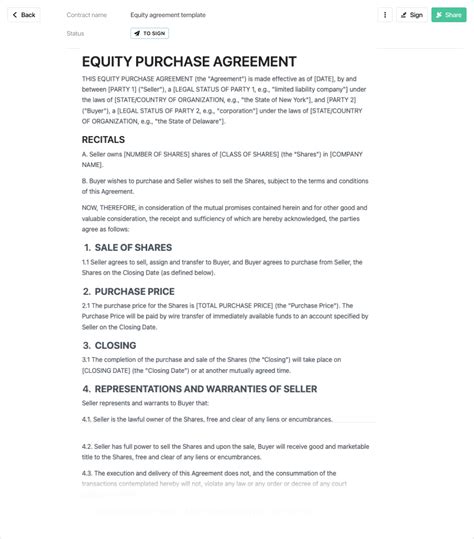

Sample Equity Buyout Agreement Template

Here is a sample equity buyout agreement template that you can use as a starting point:

[INTRODUCTION]

This Equity Buyout Agreement ("Agreement") is made and entered into on [DATE] by and among [COMPANY NAME], a [STATE] corporation ("Company"), and [OWNER NAME] ("Owner").

[DEFINITIONS]

For the purposes of this Agreement, the following terms shall have the following meanings:

- "Equity" means the ownership shares of the Company.

- "Ownership" means the percentage of equity owned by an Owner.

- "Buyout" means the purchase of an Owner's equity by the Company or another Owner.

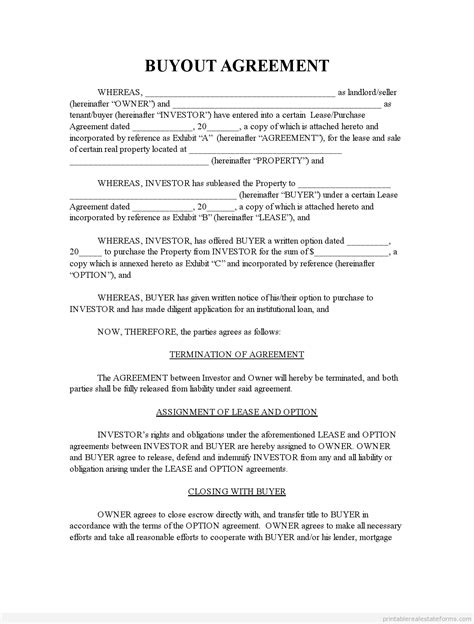

[TRIGGER EVENTS]

The following events shall trigger the buyout:

- The death or permanent disability of an Owner.

- The resignation or termination of an Owner.

- The bankruptcy or insolvency of an Owner.

[VALUATION METHOD]

The value of the Company shall be determined using an earnings-based approach, as follows:

- The Company's earnings before interest, taxes, depreciation, and amortization ("EBITDA") for the preceding fiscal year shall be multiplied by a factor of [X].

- The resulting value shall be adjusted to reflect any changes in the Company's financial condition or operations since the preceding fiscal year.

[PURCHASE PRICE]

The purchase price shall be calculated as follows:

- The value of the Company determined in accordance with the valuation method above shall be multiplied by the Owner's percentage of ownership.

- The resulting purchase price shall be adjusted to reflect any discounts or premiums applicable to the buyout.

[PAYMENT TERMS]

The purchase price shall be paid in [NUMBER] installments over a period of [TIME PERIOD], with each installment due on [DATE].

[REPRESENTATIONS AND WARRANTIES]

The Seller represents and warrants that:

- The Seller has the authority to enter into this Agreement and to sell the equity.

- The equity is free and clear of any liens or encumbrances.

- The Seller has complied with all applicable laws and regulations in connection with the sale of the equity.

[CONDITIONS PRECEDENT]

The buyout shall be subject to the following conditions precedent:

- The approval of the board of directors of the Company.

- The satisfaction of any financing arrangements.

[GOVERNING LAW]

This Agreement shall be governed by and construed in accordance with the laws of the [STATE]. Any disputes arising from this Agreement shall be resolved through arbitration in accordance with the rules of the [ARBITRATION ASSOCIATION].

Conclusion

An equity buyout agreement template is a vital document for business owners, as it provides a framework for buying or selling ownership shares and ensures a smooth transition of ownership. By including the key components outlined above, you can create a comprehensive agreement that protects the interests of all parties involved. Remember to seek the advice of a lawyer or financial advisor to ensure that your agreement is tailored to your specific needs and circumstances.

Next Steps

If you're considering using an equity buyout agreement template for your business, here are some next steps to take:

- Review the template and modify it to fit your specific needs and circumstances.

- Seek the advice of a lawyer or financial advisor to ensure that the agreement is comprehensive and protects the interests of all parties involved.

- Have the agreement reviewed and approved by all parties involved, including the board of directors and any financing institutions.

By following these steps, you can create a comprehensive equity buyout agreement that ensures a smooth transition of ownership and protects the interests of all parties involved.

Equity Buyout Agreement Template Image Gallery