Intro

Unlock the secrets to successful financial modeling with our expert guide on 5 Ways To Master Equity Roll Forward Template. Learn how to accurately forecast equity positions, balance sheets, and cash flow statements using this powerful tool. Discover best practices for creating a dynamic and customizable template that drives business growth and informs strategic decisions.

Mastering the equity roll forward template is a crucial skill for any finance professional, investor, or entrepreneur. The equity roll forward template is a powerful tool that helps track changes in a company's equity over time, providing valuable insights into its financial performance and growth prospects. In this article, we will explore five ways to master the equity roll forward template, making it easier for you to analyze and make informed decisions about your investments.

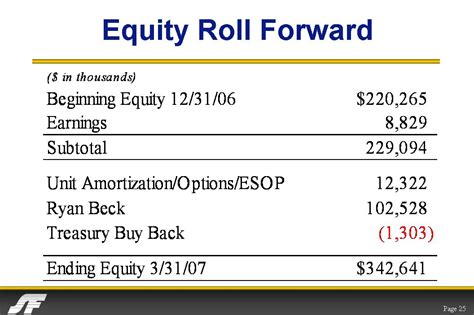

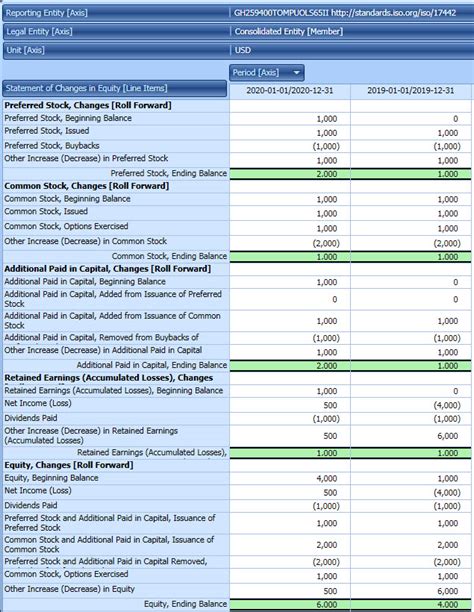

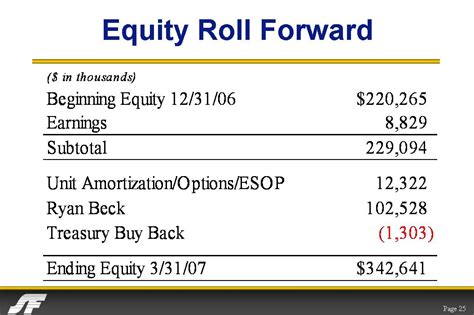

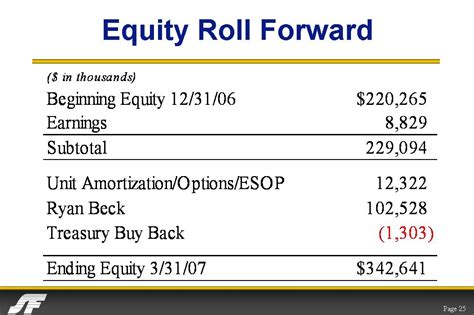

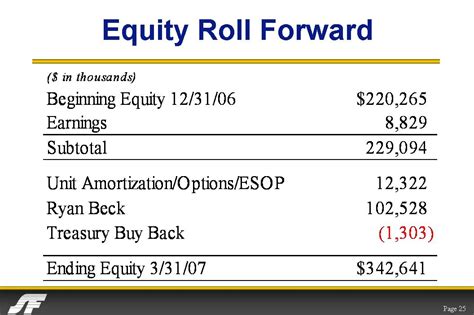

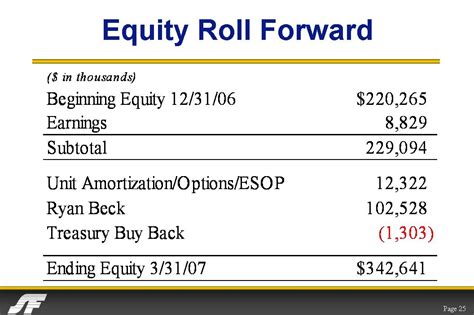

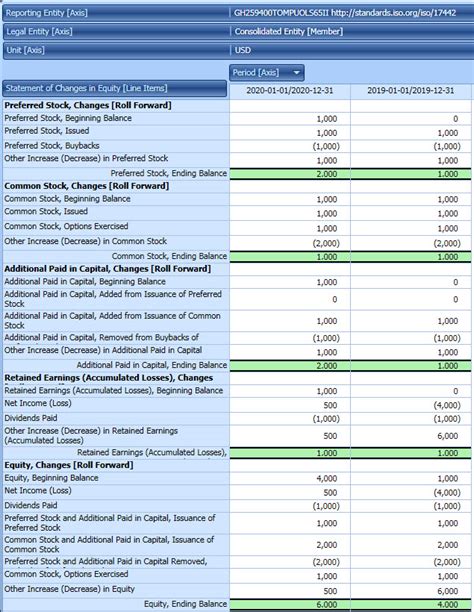

Understanding the Basics of Equity Roll Forward Template

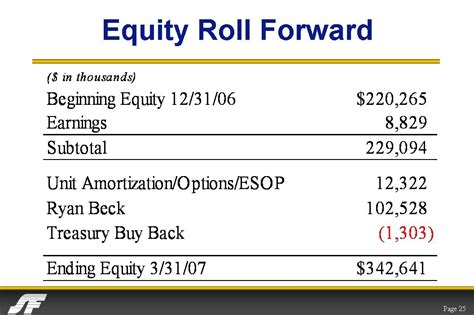

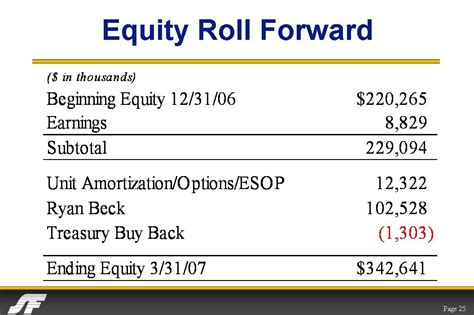

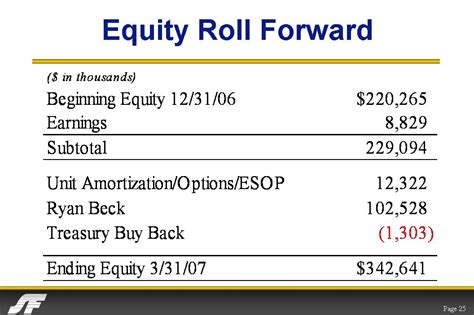

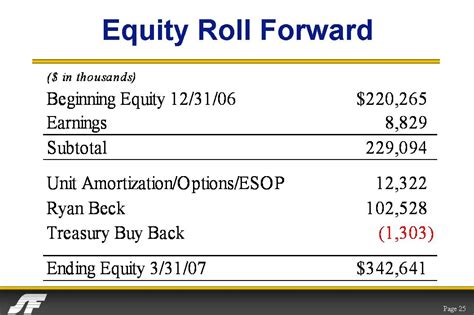

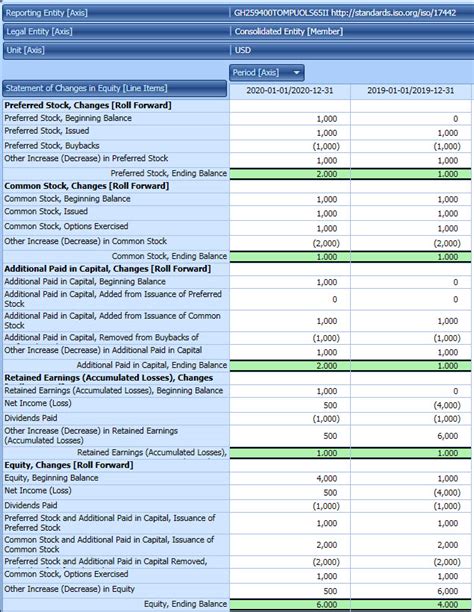

Before we dive into the advanced techniques, it's essential to understand the basics of the equity roll forward template. The template is a table that outlines the changes in a company's equity over a specific period, typically a quarter or a year. It includes columns for beginning equity, changes in equity, and ending equity. The template helps track the movement of equity due to various factors such as net income, dividends, share repurchases, and changes in share capital.

1. Identifying Key Components of Equity Roll Forward Template

To master the equity roll forward template, you need to identify the key components that make up the template. These components include:

- Beginning equity: The starting point of the equity roll forward template, which represents the company's equity at the beginning of the period.

- Net income: The company's net income for the period, which increases the equity.

- Dividends: The dividends paid out to shareholders, which decrease the equity.

- Share repurchases: The number of shares repurchased by the company, which decreases the equity.

- Changes in share capital: The changes in the company's share capital, which can increase or decrease the equity.

Example of Key Components

For example, let's say a company has a beginning equity of $100 million, net income of $20 million, dividends of $5 million, share repurchases of $10 million, and changes in share capital of $5 million. The ending equity would be $110 million.

2. Using Historical Data to Analyze Equity Roll Forward Template

Using historical data is crucial to analyzing the equity roll forward template. By examining the company's past performance, you can identify trends and patterns that can help you make informed decisions about your investments. Historical data can help you:

- Identify areas of improvement: Analyze the company's past performance to identify areas where it can improve, such as reducing dividends or increasing net income.

- Detect potential risks: Identify potential risks, such as a decline in net income or an increase in share repurchases.

- Make informed decisions: Use historical data to make informed decisions about your investments, such as buying or selling shares.

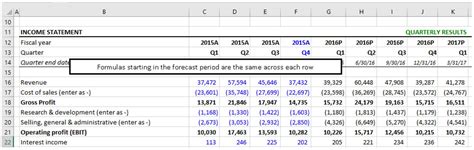

3. Creating Projections and Forecasts

Creating projections and forecasts is an essential part of mastering the equity roll forward template. By projecting future performance, you can estimate the company's future equity and make informed decisions about your investments. To create projections and forecasts, you can use:

- Historical data: Use historical data to estimate future performance.

- Industry trends: Use industry trends to estimate future performance.

- Management's guidance: Use management's guidance to estimate future performance.

Example of Projections and Forecasts

For example, let's say a company has a beginning equity of $100 million and projects a net income of $25 million, dividends of $5 million, share repurchases of $10 million, and changes in share capital of $5 million. The projected ending equity would be $120 million.

4. Analyzing Ratios and Metrics

Analyzing ratios and metrics is crucial to mastering the equity roll forward template. By examining various ratios and metrics, you can gain insights into the company's financial performance and growth prospects. Some essential ratios and metrics to analyze include:

- Return on equity (ROE): Measures the company's profitability.

- Dividend yield: Measures the company's dividend payments.

- Price-to-book ratio: Measures the company's valuation.

5. Identifying Red Flags and Areas of Concern

Identifying red flags and areas of concern is essential to mastering the equity roll forward template. By examining the company's equity roll forward template, you can identify potential risks and areas of concern, such as:

- Decline in net income: A decline in net income can indicate a decrease in profitability.

- Increase in share repurchases: An increase in share repurchases can indicate a decrease in equity.

- Changes in management's guidance: Changes in management's guidance can indicate a shift in the company's strategy.

Example of Red Flags and Areas of Concern

For example, let's say a company has a decline in net income of 20% and an increase in share repurchases of 30%. These red flags and areas of concern may indicate a decrease in equity and a shift in the company's strategy.

Equity Roll Forward Template Image Gallery

In conclusion, mastering the equity roll forward template is a crucial skill for any finance professional, investor, or entrepreneur. By understanding the basics, identifying key components, using historical data, creating projections and forecasts, analyzing ratios and metrics, and identifying red flags and areas of concern, you can gain valuable insights into a company's financial performance and growth prospects. Remember to use these techniques to analyze the equity roll forward template and make informed decisions about your investments.

We hope you found this article informative and helpful. If you have any questions or comments, please feel free to share them below.