Intro

Streamline accounts receivable management with our expert-designed Excel template. Easily track and analyze outstanding invoices, identify overdue payments, and optimize cash flow. Say goodbye to manual tracking and hello to effortless aging reports, invoice tracking, and financial insights. Download now and simplify your AR process.

Maintaining a healthy cash flow is crucial for the success of any business. One essential tool to achieve this is an accounts receivable aging template, which helps track and manage outstanding customer payments. An Excel accounts receivable aging template is a versatile and user-friendly solution for small to medium-sized businesses to streamline their accounts receivable management.

The Importance of Accounts Receivable Aging

Accounts receivable aging is a critical process that enables businesses to categorize and prioritize outstanding customer invoices based on their age. This process helps identify potential issues with payment collection, such as late payments or uncollectible debts. By using an accounts receivable aging template, businesses can:

- Improve cash flow management

- Reduce bad debts and uncollectible accounts

- Enhance customer relationships through timely communication

- Optimize accounting and bookkeeping processes

Benefits of Using an Excel Accounts Receivable Aging Template

An Excel accounts receivable aging template offers numerous benefits, including:

- Easy customization to suit specific business needs

- Simplified tracking and management of outstanding invoices

- Automated calculations and sorting of aged invoices

- Enhanced visibility and control over accounts receivable

- Reduced manual errors and increased accuracy

How to Create an Excel Accounts Receivable Aging Template

To create an effective Excel accounts receivable aging template, follow these steps:

- Set up a new Excel spreadsheet with the following columns:

- Customer name

- Invoice date

- Invoice amount

- Due date

- Current balance

- Aging category (e.g., 0-30 days, 31-60 days, 61-90 days, etc.)

- Create a drop-down list for the aging category column to simplify data entry and ensure consistency.

- Use formulas to calculate the aging category based on the invoice date and current date.

- Use conditional formatting to highlight invoices that are overdue or nearing their due date.

- Set up a pivot table to summarize the accounts receivable data and provide insights into outstanding balances and aging trends.

Using an Excel Accounts Receivable Aging Template

To get the most out of an Excel accounts receivable aging template, follow these best practices:

- Update the template regularly to reflect changes in customer payments and outstanding balances.

- Use the template to identify trends and patterns in customer payment behavior.

- Communicate with customers who have overdue or outstanding balances to resolve any issues.

- Review and adjust the aging categories and threshold dates as needed to ensure the template remains effective.

Common Mistakes to Avoid When Using an Excel Accounts Receivable Aging Template

When using an Excel accounts receivable aging template, be aware of the following common mistakes to avoid:

- Failing to update the template regularly, leading to inaccurate data and missed payment opportunities.

- Not customizing the template to suit specific business needs, resulting in ineffective tracking and management.

- Over-relying on the template, neglecting to communicate with customers and address underlying payment issues.

Tips for Implementing an Excel Accounts Receivable Aging Template

To successfully implement an Excel accounts receivable aging template, consider the following tips:

- Start with a simple template and gradually add complexity as needed.

- Train accounting staff on how to use the template effectively.

- Regularly review and analyze the data to identify areas for improvement.

- Use the template in conjunction with other accounting tools and software to streamline processes.

Advanced Features to Consider in an Excel Accounts Receivable Aging Template

To take your accounts receivable management to the next level, consider adding the following advanced features to your Excel template:

- Automated reminders and notifications for overdue payments

- Integration with other accounting software and tools

- Customizable dashboards and reports for real-time insights

- Machine learning algorithms to predict payment behavior and identify potential issues

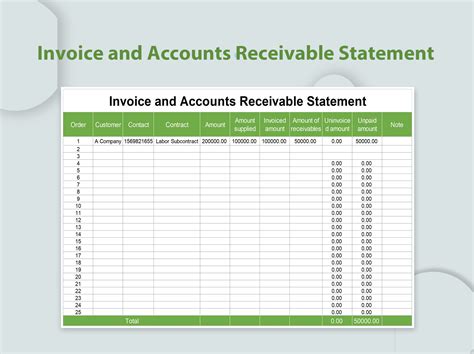

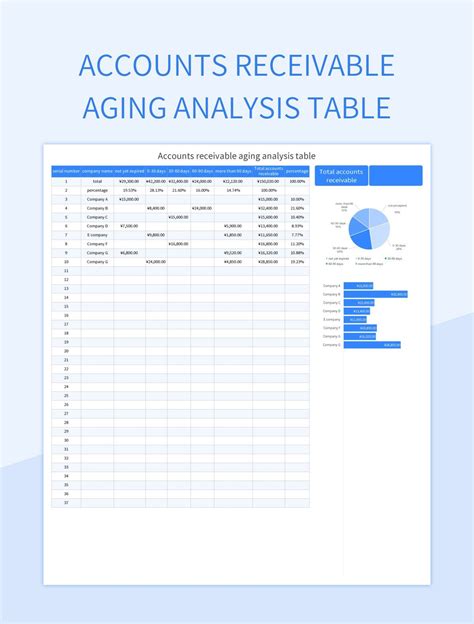

Accounts Receivable Aging Template Image Gallery

Conclusion

An Excel accounts receivable aging template is a powerful tool for small to medium-sized businesses to manage and track outstanding customer payments. By following the steps outlined in this article, businesses can create an effective template that streamlines their accounts receivable management and improves cash flow. Remember to avoid common mistakes, implement the template correctly, and consider advanced features to take your accounts receivable management to the next level.

We hope this article has provided valuable insights into the importance of accounts receivable aging and how to use an Excel template to manage it effectively. If you have any questions or would like to share your experiences with accounts receivable aging templates, please leave a comment below.