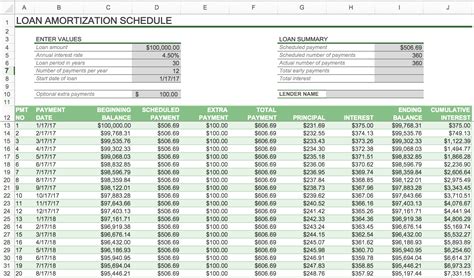

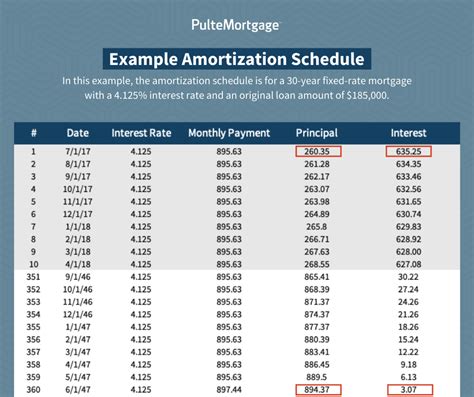

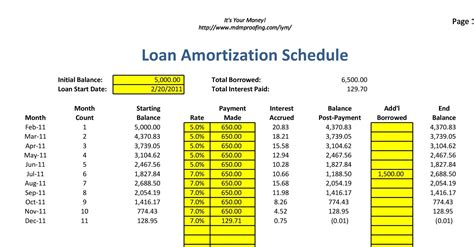

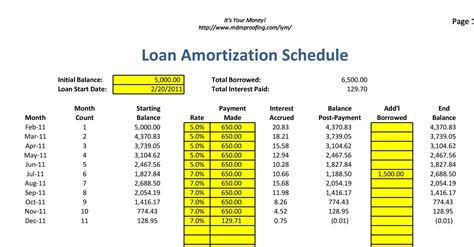

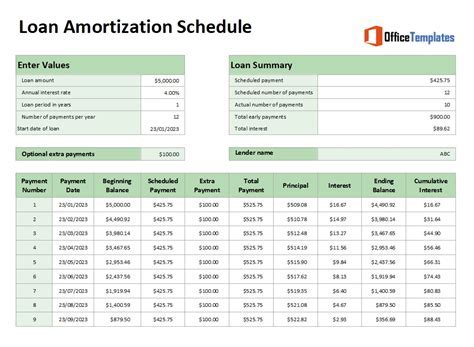

Managing loans and understanding how much you owe can be overwhelming, but having a clear picture of your repayment schedule can make all the difference. An Excel amortization schedule template can help you break down your loan into manageable chunks, showing you exactly how much you'll pay each month and how much of that goes towards interest versus principal. In this article, we'll explore five ways to create Excel amortization schedule templates, making it easier for you to take control of your finances.

Why Use an Excel Amortization Schedule Template?

Before we dive into the creation process, let's quickly discuss why using an Excel amortization schedule template is beneficial. For one, it helps you visualize your loan repayment process, making it easier to understand how much you owe and when you'll be debt-free. Additionally, an amortization schedule template can help you identify areas where you can save money, such as by making extra payments or refinancing your loan.

Method 1: Using Excel's Built-in Amortization Schedule Template

Excel offers a range of built-in templates, including an amortization schedule template. To access this template, follow these steps:

- Open Excel and click on the "File" tab.

- Select "New" and then search for "amortization schedule" in the template search bar.

- Choose the "Amortization Schedule" template and click "Create."

This template will provide you with a basic amortization schedule that you can customize to fit your loan terms.

Method 2: Creating an Amortization Schedule from Scratch

If you prefer to create your own amortization schedule from scratch, you can use the following steps:

- Set up a table with the following columns: "Payment Number," "Payment Date," "Payment Amount," "Interest Paid," "Principal Paid," and "Balance."

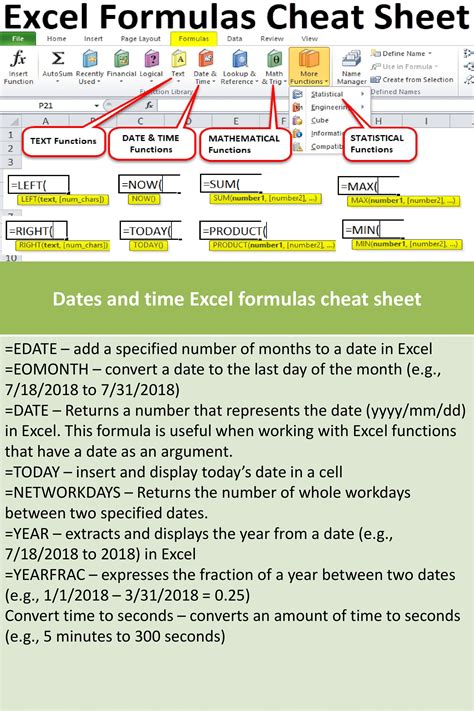

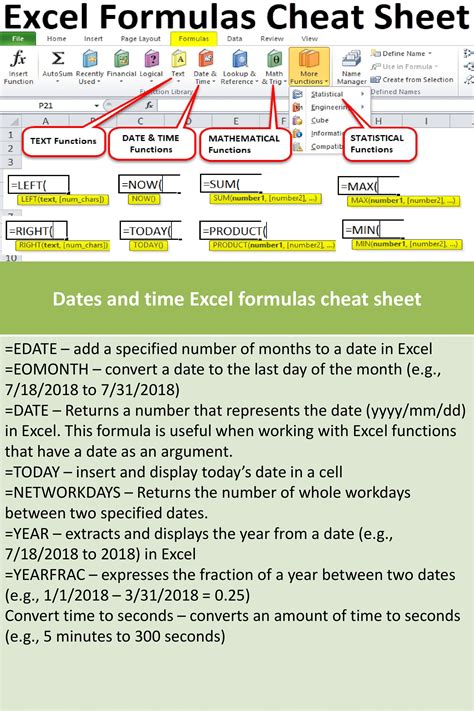

- Use Excel formulas to calculate the interest paid and principal paid for each payment period.

- Use the "PMT" function to calculate the monthly payment amount.

- Use the "IPMT" function to calculate the interest paid for each period.

- Use the "PPMT" function to calculate the principal paid for each period.

For example, if your loan has a balance of $10,000, an interest rate of 6%, and a term of 5 years, your formulas might look like this:

| Payment Number | Payment Date | Payment Amount | Interest Paid | Principal Paid | Balance |

|---|---|---|---|---|---|

| 1 | 01/01/2023 | =$10,000*6%/12 | =$10,000*6%/12 | =$500-$10,000*6%/12 | =$9,500 |

| 2 | 02/01/2023 | =$10,000*6%/12 | =$9,500*6%/12 | =$500-$9,500*6%/12 | =$9,000 |

Method 3: Using a Loan Amortization Formula

If you want to create an amortization schedule quickly and easily, you can use a loan amortization formula. This formula calculates the monthly payment amount based on the loan balance, interest rate, and term.

- Use the following formula:

=PMT(rate, nper, pv, [fv], [type]) - Where:

- Rate is the monthly interest rate (e.g., 6%/12)

- Nper is the number of payment periods (e.g., 5 years * 12 months/year)

- Pv is the present value (i.e., the loan balance)

- Fv is the future value (i.e., the balance after the loan is paid off)

- Type is the payment type (0 for end-of-period payments, 1 for beginning-of-period payments)

For example, if your loan has a balance of $10,000, an interest rate of 6%, and a term of 5 years, your formula might look like this:

=PMT(6%/12, 5*12, $10,000, 0)

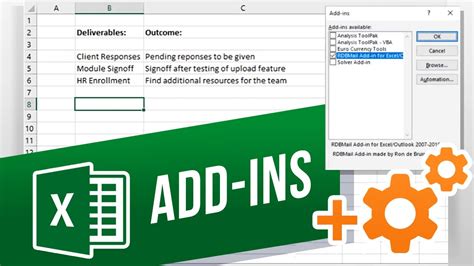

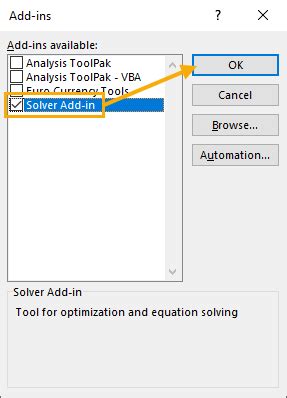

Method 4: Using an Add-in or Plug-in

If you want to create an amortization schedule quickly and easily, you can use an add-in or plug-in for Excel. These tools can automate the process of creating an amortization schedule and provide additional features such as customizable templates and charts.

- Search for "amortization schedule add-in" or "loan amortization plug-in" in the Excel store.

- Choose an add-in or plug-in that meets your needs and follow the installation instructions.

Some popular add-ins and plug-ins for creating amortization schedules include:

- Amortization Schedule Template by Vertex42

- Loan Amortization Calculator by Calculator.net

- Mortgage Amortization Schedule by Excel Is Fun

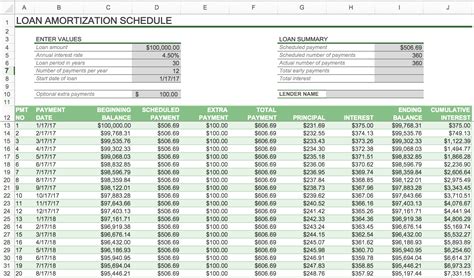

Method 5: Using a Pre-Made Template from a Third-Party Website

If you prefer to use a pre-made template from a third-party website, you can search for "amortization schedule template" or "loan amortization template" online. Many websites offer free or paid templates that you can download and customize to fit your loan terms.

- Search for "amortization schedule template" or "loan amortization template" online.

- Choose a template that meets your needs and follow the download instructions.

- Customize the template to fit your loan terms.

Some popular websites for downloading amortization schedule templates include:

- Vertex42

- Excel Is Fun

- Calculator.net

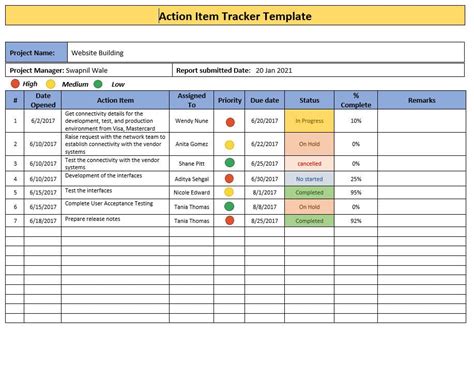

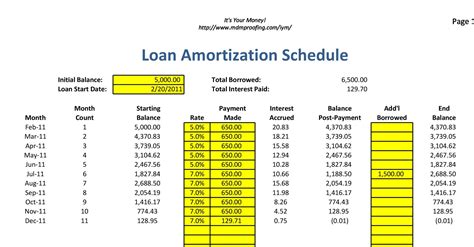

Gallery of Amortization Schedules

Amortization Schedule Templates

What's Next?

Creating an Excel amortization schedule template can help you take control of your finances and make informed decisions about your loan. Whether you choose to use a built-in template, create one from scratch, or use a pre-made template from a third-party website, the most important thing is to find a method that works for you. Experiment with different methods and find the one that best fits your needs.

We hope this article has provided you with the tools and resources you need to create an Excel amortization schedule template. If you have any questions or need further assistance, don't hesitate to ask. Share your experiences and tips for creating amortization schedules in the comments below!