Intro

Create a debt-free life with Dave Ramseys Excel budget template. Learn how to manage finances, track expenses, and achieve financial freedom. This article provides a step-by-step guide to using the template, including budgeting for savings, investments, and emergency funds, while avoiding debt and building wealth through smart financial planning.

Living a debt-free life is a dream shared by many, but achieved by few. However, with the right tools and strategies, anyone can take control of their finances and start building a brighter financial future. One such tool is the Dave Ramsey Excel budget template, which has helped millions of people achieve financial freedom. In this article, we will explore the importance of budgeting, the benefits of using the Dave Ramsey Excel budget template, and provide a step-by-step guide on how to use it.

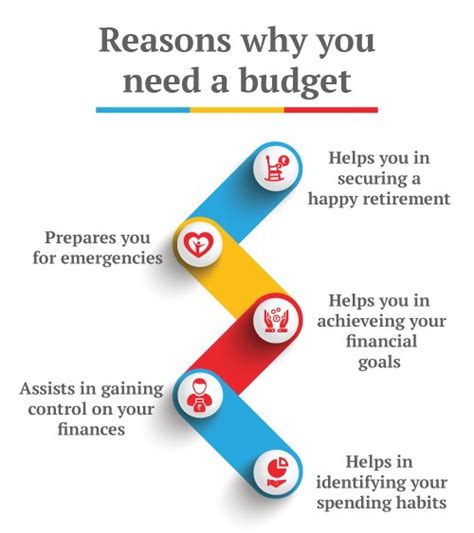

The Importance of Budgeting

Budgeting is the foundation of financial freedom. It allows you to track your income and expenses, identify areas of waste, and make informed decisions about how to allocate your resources. Without a budget, you may find yourself living paycheck to paycheck, struggling to make ends meet, and accumulating debt. By creating a budget, you can take control of your finances, prioritize your spending, and achieve your financial goals.

The Dave Ramsey Excel Budget Template

Dave Ramsey is a well-known personal finance expert who has helped millions of people get out of debt and build wealth. His Excel budget template is a powerful tool that can help you create a budget that works for you. The template is based on the zero-based budgeting principle, which means that every dollar is accounted for and assigned a job. This approach ensures that you are making the most of your money and achieving your financial goals.

Benefits of Using the Dave Ramsey Excel Budget Template

Using the Dave Ramsey Excel budget template offers several benefits, including:

- Easy to use: The template is easy to use and understand, even for those who are not familiar with Excel.

- Customizable: The template can be customized to fit your individual financial needs and goals.

- Zero-based budgeting: The template is based on the zero-based budgeting principle, which ensures that every dollar is accounted for and assigned a job.

- Prioritizes needs over wants: The template helps you prioritize your needs over your wants, ensuring that you are making the most of your money.

- Helps you achieve financial goals: The template helps you create a plan to achieve your financial goals, whether it's getting out of debt, building an emergency fund, or saving for retirement.

How to Use the Dave Ramsey Excel Budget Template

Using the Dave Ramsey Excel budget template is easy. Here's a step-by-step guide to get you started:

- Download the template: Download the Dave Ramsey Excel budget template from the Dave Ramsey website.

- Enter your income: Enter your monthly income in the "Income" section of the template.

- List your expenses: List all of your monthly expenses, including rent/mortgage, utilities, groceries, transportation, and entertainment.

- Categorize your expenses: Categorize your expenses into needs and wants. Needs include essential expenses such as rent/mortgage, utilities, and groceries. Wants include non-essential expenses such as entertainment and hobbies.

- Assign percentages: Assign a percentage of your income to each category based on your financial goals and priorities.

- Track your expenses: Track your expenses throughout the month to ensure that you are staying within your budget.

- Review and adjust: Review your budget regularly and make adjustments as needed.

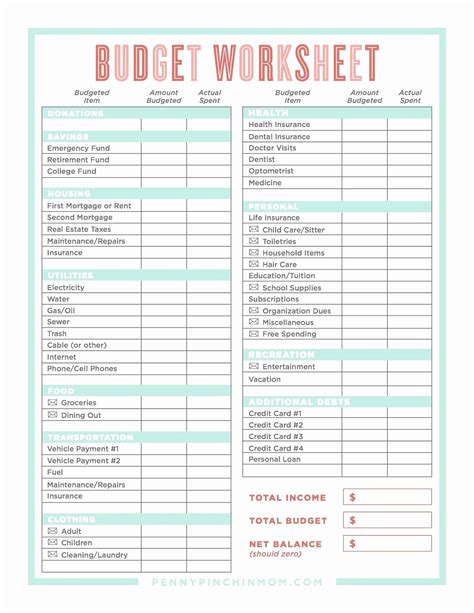

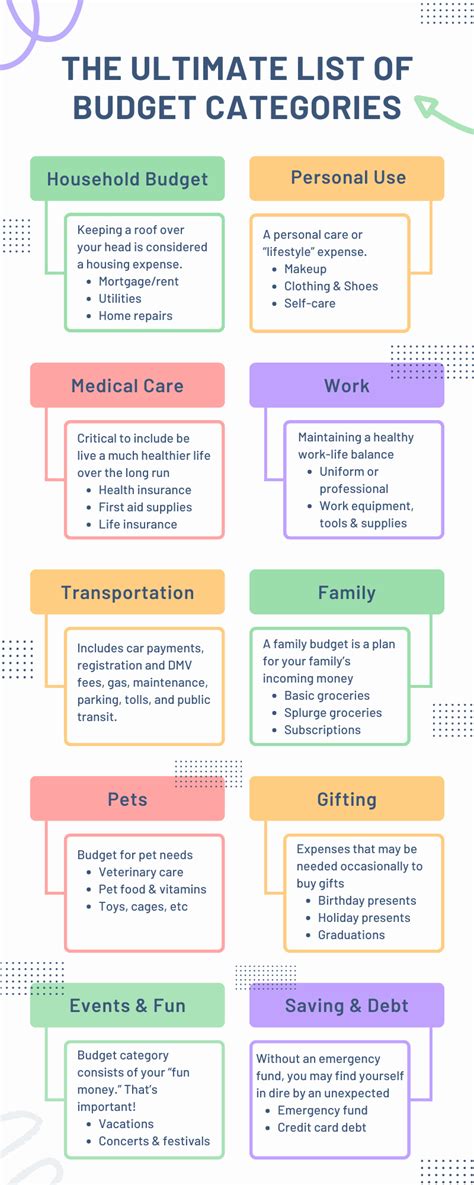

Setting Up Your Budget Categories

Setting up your budget categories is an essential part of using the Dave Ramsey Excel budget template. Here are some common budget categories to consider:

- Housing: rent/mortgage, utilities, maintenance

- Transportation: car loan/lease, gas, insurance, maintenance

- Food: groceries, dining out

- Insurance: health, life, disability

- Debt repayment: credit cards, student loans, personal loans

- Entertainment: hobbies, travel, entertainment

- Savings: emergency fund, retirement, other savings goals

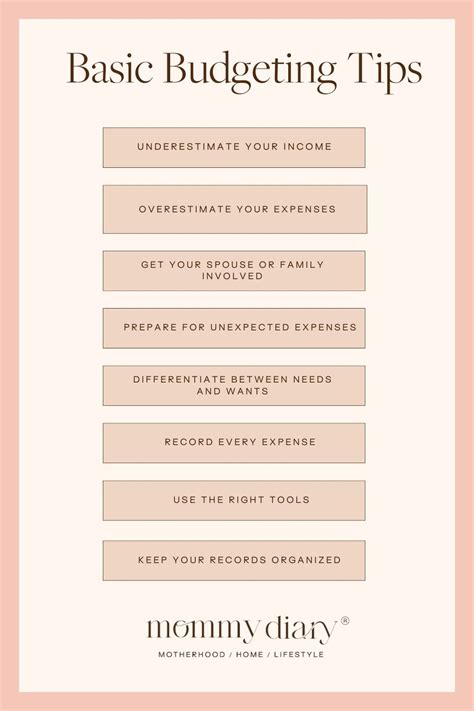

Tips for Using the Dave Ramsey Excel Budget Template

Here are some tips for using the Dave Ramsey Excel budget template:

- Be realistic: Be realistic about your income and expenses. Don't underestimate your expenses or overestimate your income.

- Prioritize needs over wants: Prioritize your needs over your wants. Make sure to allocate enough money for essential expenses such as rent/mortgage, utilities, and groceries.

- Track your expenses: Track your expenses throughout the month to ensure that you are staying within your budget.

- Review and adjust: Review your budget regularly and make adjustments as needed.

- Avoid impulse purchases: Avoid impulse purchases by creating a 30-day waiting period for non-essential purchases.

Common Mistakes to Avoid

Here are some common mistakes to avoid when using the Dave Ramsey Excel budget template:

- Underestimating expenses: Underestimating expenses can lead to budget blowouts and financial stress.

- Overestimating income: Overestimating income can lead to financial disappointment and budgeting challenges.

- Not tracking expenses: Not tracking expenses can lead to budget blowouts and financial stress.

- Not reviewing and adjusting: Not reviewing and adjusting your budget regularly can lead to financial stagnation and budgeting challenges.

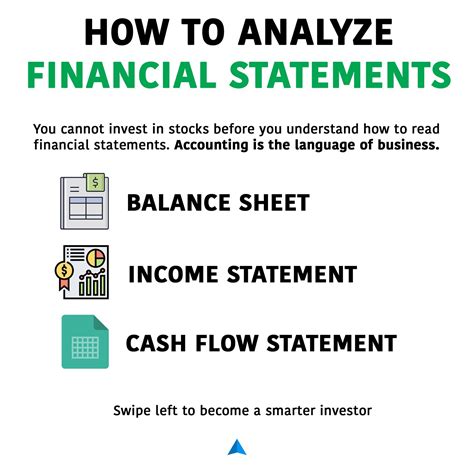

Gallery of Budgeting Images

Budgeting Image Gallery

Conclusion

Living a debt-free life is a dream shared by many, but achieved by few. However, with the right tools and strategies, anyone can take control of their finances and start building a brighter financial future. The Dave Ramsey Excel budget template is a powerful tool that can help you create a budget that works for you. By following the steps outlined in this article, you can use the template to achieve financial freedom and start living the life you deserve. So why wait? Download the template today and start taking control of your finances!