Calculating total interest on a loan can be a daunting task, but with Excel, it's made easy. In this article, we'll guide you through the process of calculating total interest on a loan using Excel.

Why is Calculating Total Interest Important?

Before we dive into the calculation, let's understand why calculating total interest is important. When you take out a loan, you're not just paying back the principal amount; you're also paying interest on that amount. The total interest paid over the life of the loan can add up quickly, and it's essential to understand how much you'll be paying in total.

How to Calculate Total Interest in Excel

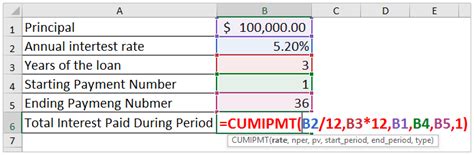

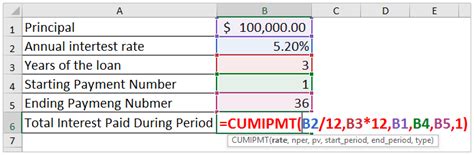

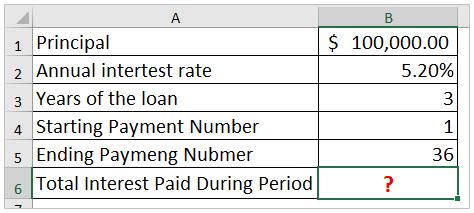

To calculate total interest in Excel, you'll need to know the following:

- Loan amount (principal)

- Interest rate

- Loan term (number of years or months)

- Payment frequency (monthly, quarterly, etc.)

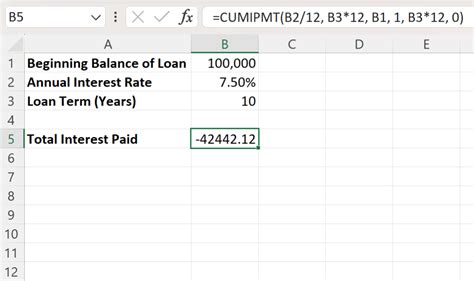

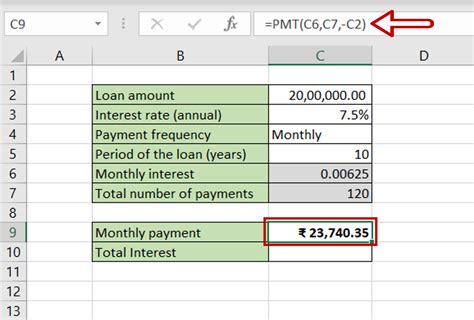

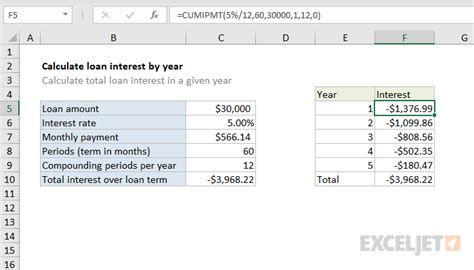

Once you have these values, you can use the following formula:

Formula: =IPMT(rate, nper, pv, [fv], [type])

Where:

- rate = interest rate per period

- nper = total number of payments

- pv = present value (loan amount)

- [fv] = future value (optional)

- [type] = payment type (optional)

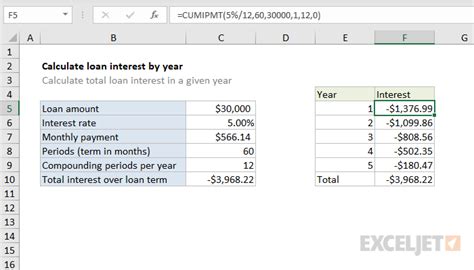

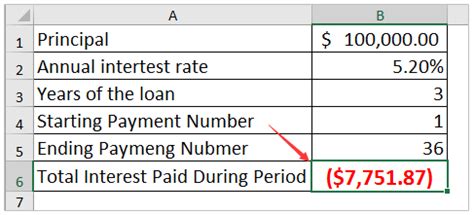

Example:

Let's say you have a loan of $10,000 with an interest rate of 6% per annum and a loan term of 5 years. You want to calculate the total interest paid over the life of the loan.

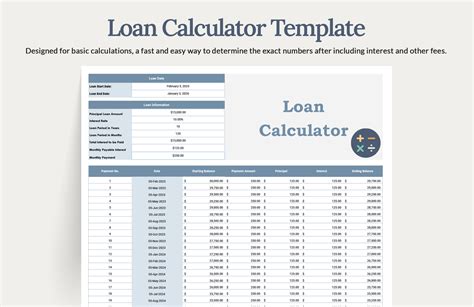

- Open Excel and create a new spreadsheet.

- Enter the loan amount, interest rate, and loan term in separate cells.

| Loan Amount | Interest Rate | Loan Term |

|---|---|---|

| $10,000 | 6% | 5 years |

- Use the IPMT function to calculate the monthly interest payment.

=IPMT(B2/12, A3*12, A2, 0, 0)

Where:

- B2 = interest rate (6%)

- A3 = loan term (5 years)

- A2 = loan amount ($10,000)

Result: $49.79 (monthly interest payment)

- To calculate the total interest paid over the life of the loan, multiply the monthly interest payment by the number of payments.

=49.79*A3*12

Result: $2,994.49 (total interest paid)

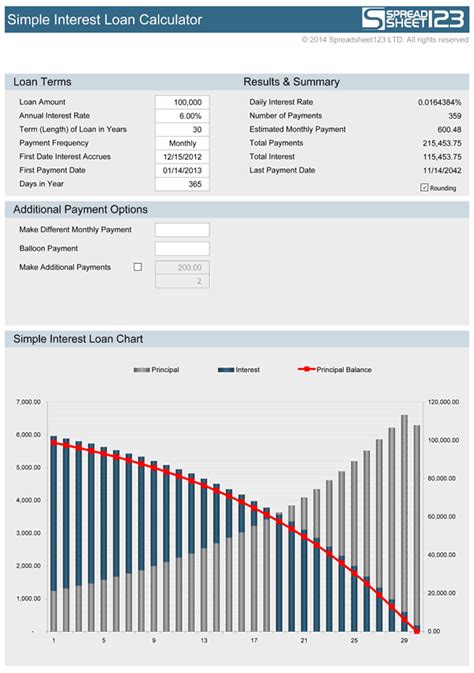

Visualizing the Calculation

To make the calculation more intuitive, you can create a chart to visualize the total interest paid over time.

- Create a new column to calculate the cumulative interest paid.

- Use the formula =SUM(B:B) to calculate the cumulative interest paid.

- Create a line chart to visualize the cumulative interest paid over time.

Tips and Variations

- Use the XNPV function to calculate the total interest paid on a loan with irregular payments.

- Use the XIRR function to calculate the internal rate of return on a loan.

- Use the PMT function to calculate the monthly payment on a loan.

Common Mistakes to Avoid

- Forgetting to divide the interest rate by 12 to convert it to a monthly rate.

- Forgetting to multiply the number of payments by 12 to convert it to a monthly payment.

- Using the wrong payment type (e.g., using 0 for a loan with monthly payments).

Conclusion

Calculating total interest on a loan in Excel is a straightforward process that can help you understand the true cost of borrowing. By using the IPMT function and visualizing the calculation, you can make informed decisions about your finances.

Gallery of Calculate Total Interest in Excel

Calculate Total Interest in Excel Image Gallery

We hope this article has helped you understand how to calculate total interest on a loan in Excel. Share your thoughts and experiences in the comments below!