Intro

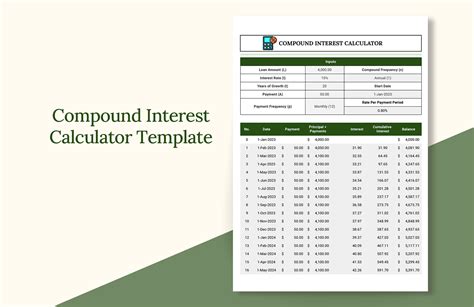

Boost your savings with Excels compound interest calculator template. Discover 5 ways to maximize its potential, from calculating future investments to determining optimal interest rates. Learn how to harness the power of compound interest, amortization schedules, and financial projections to make informed decisions and achieve your financial goals.

The power of compound interest can be a game-changer for individuals looking to grow their savings or investments over time. To harness this power, using an Excel compound interest calculator template can be a valuable tool. In this article, we will explore five ways to utilize an Excel compound interest calculator template to make informed financial decisions.

What is Compound Interest?

Before diving into the uses of an Excel compound interest calculator template, let's briefly review what compound interest is. Compound interest is the interest earned on both the principal amount and any accrued interest over time. This results in exponential growth, making it a powerful force in saving and investing.

Why Use an Excel Compound Interest Calculator Template?

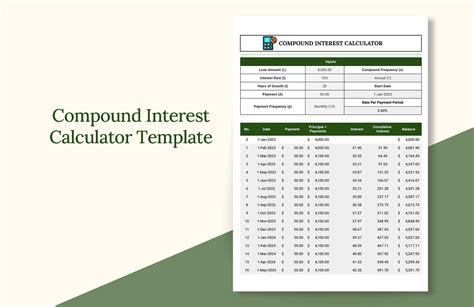

An Excel compound interest calculator template offers several benefits, including:

- Easy calculation of compound interest

- Customization to suit individual needs

- Scalability to accommodate various investment scenarios

- Visual representation of growth over time

5 Ways to Use an Excel Compound Interest Calculator Template

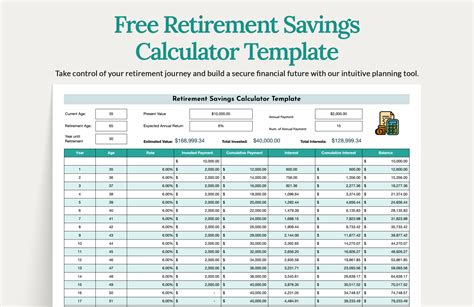

1. Saving for Retirement

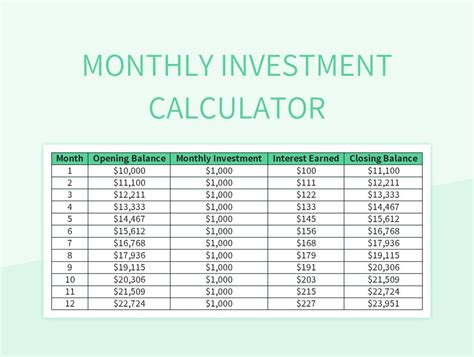

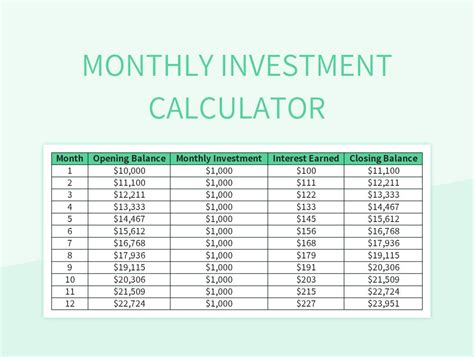

One of the most critical uses of an Excel compound interest calculator template is to plan for retirement. By inputting your current savings, monthly contributions, and expected interest rate, you can estimate how much you'll have in your retirement fund over time.

For example, let's say you start saving $500 per month at age 25, with an expected annual interest rate of 6%. Using the template, you can calculate that after 30 years, your retirement fund will grow to approximately $750,000.

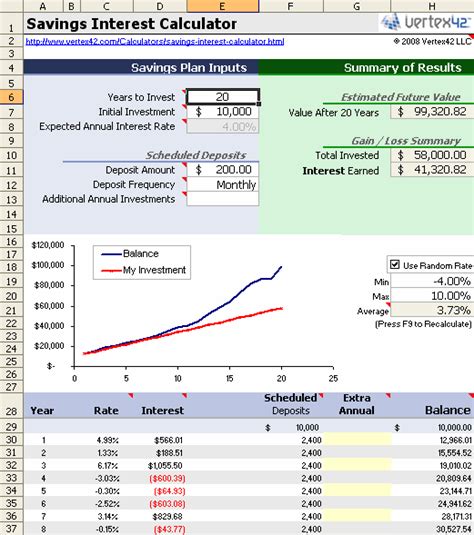

2. Investing in Certificates of Deposit (CDs)

Certificates of Deposit (CDs) are a type of savings account that typically offer higher interest rates than traditional savings accounts. By using an Excel compound interest calculator template, you can compare the growth of different CD options.

For instance, let's say you invest $10,000 in a 5-year CD with a 3.5% annual interest rate. Using the template, you can calculate that after 5 years, your investment will grow to approximately $11,841.

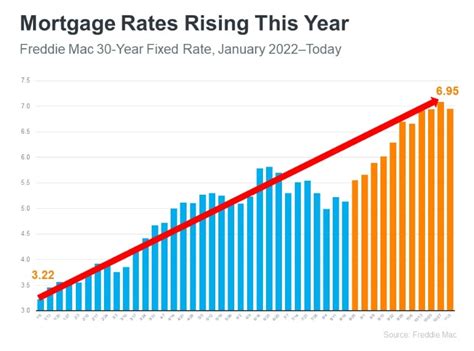

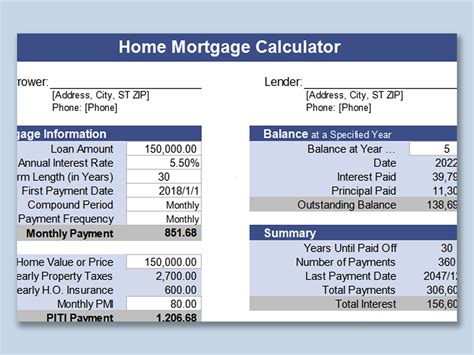

3. Calculating Mortgage Interest

When taking out a mortgage, understanding the total interest paid over the life of the loan is essential. An Excel compound interest calculator template can help you calculate this amount.

For example, let's say you purchase a home with a $200,000 mortgage at a 4% annual interest rate over 30 years. Using the template, you can calculate that the total interest paid over the life of the loan will be approximately $143,739.

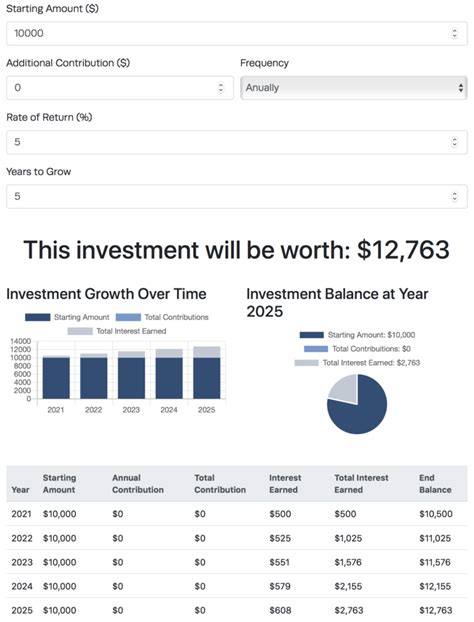

4. Evaluating Investment Opportunities

When considering different investment opportunities, an Excel compound interest calculator template can help you compare the potential returns.

For instance, let's say you're deciding between two investment options: a high-yield savings account with a 2.5% annual interest rate or a stock investment with an expected 8% annual return. Using the template, you can calculate the growth of each investment over time and make a more informed decision.

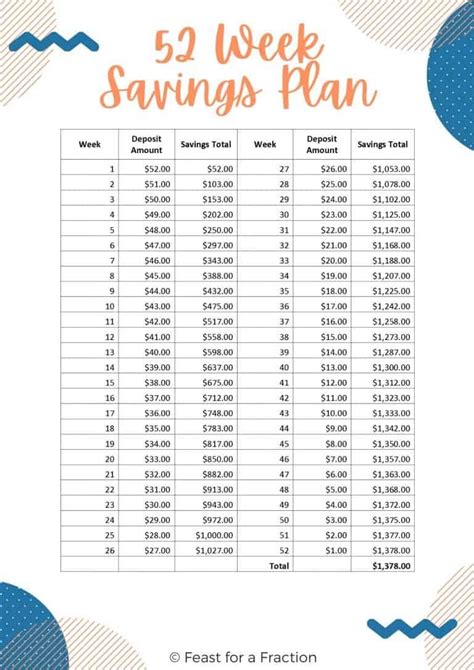

5. Creating a Savings Plan

Finally, an Excel compound interest calculator template can be used to create a personalized savings plan. By inputting your savings goals, current savings, and expected interest rate, you can determine how much you need to save each month to reach your goals.

For example, let's say you want to save $10,000 in 2 years for a down payment on a home. Using the template, you can calculate that you need to save approximately $417 per month with an expected 2% annual interest rate.

Gallery of Compound Interest Calculator Templates

Compound Interest Calculator Template Images

In conclusion, an Excel compound interest calculator template is a versatile tool that can be used in various financial planning scenarios. By following the five ways outlined in this article, you can harness the power of compound interest to make informed decisions and achieve your financial goals. Whether you're saving for retirement, investing in CDs, or creating a personalized savings plan, an Excel compound interest calculator template can help you get started.