Living with debt can be overwhelming and stressful, affecting not only your financial stability but also your mental and emotional well-being. The burden of debt can make it challenging to achieve your financial goals, whether it's buying a house, retirement, or simply enjoying a debt-free life. However, with the right strategy and tools, you can create a debt-free life and start building wealth.

The debt snowball method, popularized by financial expert Dave Ramsey, is a simple yet effective approach to paying off debt. This method involves paying off debts in a specific order, starting with the smallest balance first, while making minimum payments on other debts. The idea is to gain momentum and confidence as you quickly pay off smaller debts, creating a snowball effect that helps you tackle larger debts.

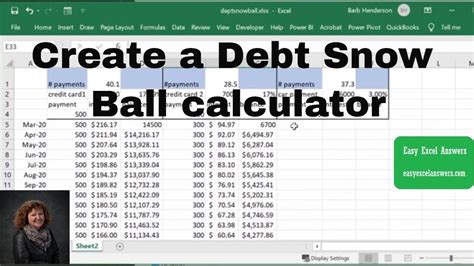

One of the most efficient ways to implement the debt snowball method is by using an Excel template. An Excel snowball template can help you track your debts, create a personalized plan, and stay organized throughout the process.

Understanding the Debt Snowball Method

Before diving into the Excel template, it's essential to understand the debt snowball method. Here's a step-by-step guide to get you started:

- List all your debts, starting with the smallest balance first.

- Determine the minimum payment for each debt.

- Pay the minimum payment for all debts except the smallest one.

- Apply as much money as possible towards the smallest debt until it's paid off.

- Once the smallest debt is paid off, move on to the next debt, and repeat the process.

Benefits of Using an Excel Snowball Template

Using an Excel snowball template offers several benefits, including:

- Easy tracking: Keep all your debt information in one place, making it easy to track your progress.

- Customization: Create a personalized plan tailored to your specific debt situation.

- Organization: Stay organized and focused throughout the debt repayment process.

- Visual motivation: See your progress and stay motivated as you pay off debts.

How to Use an Excel Snowball Template

To get started with an Excel snowball template, follow these steps:

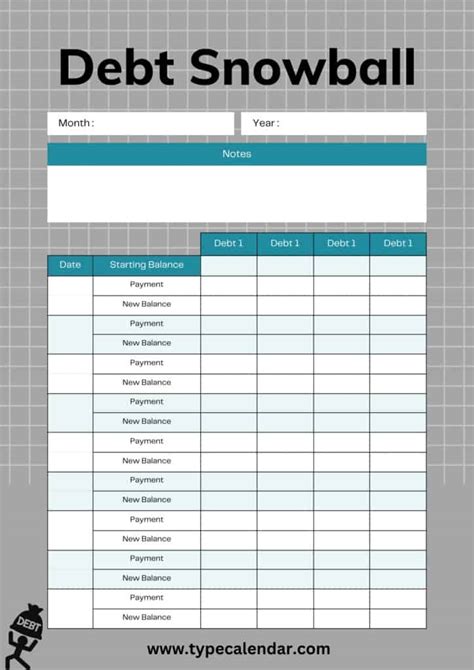

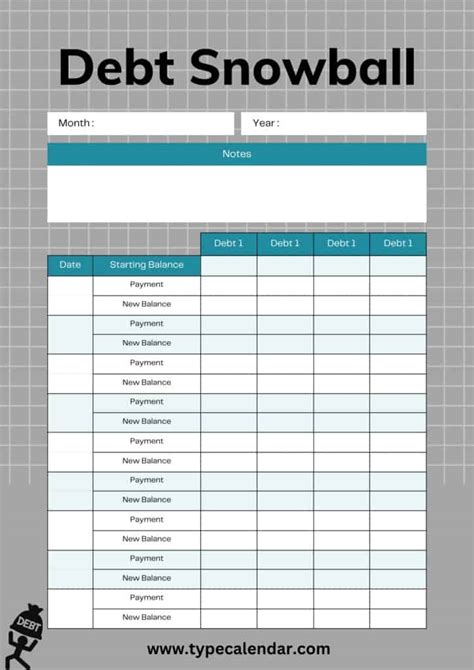

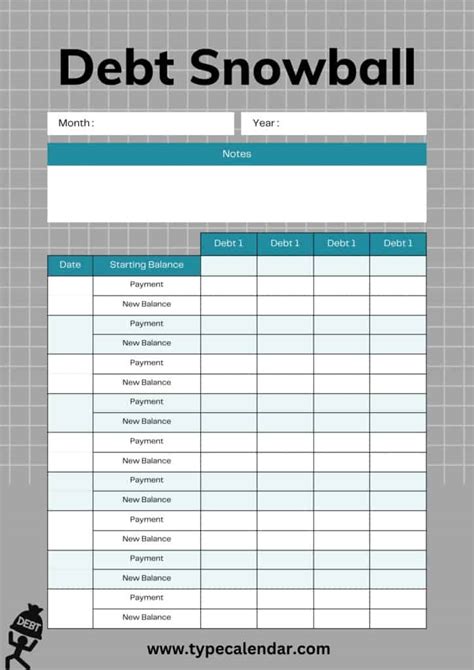

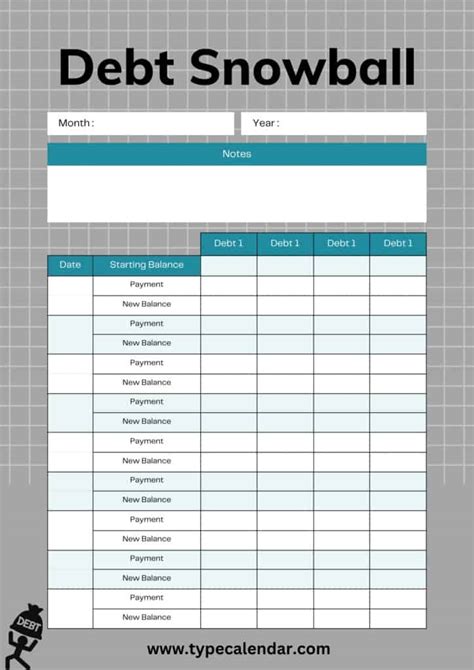

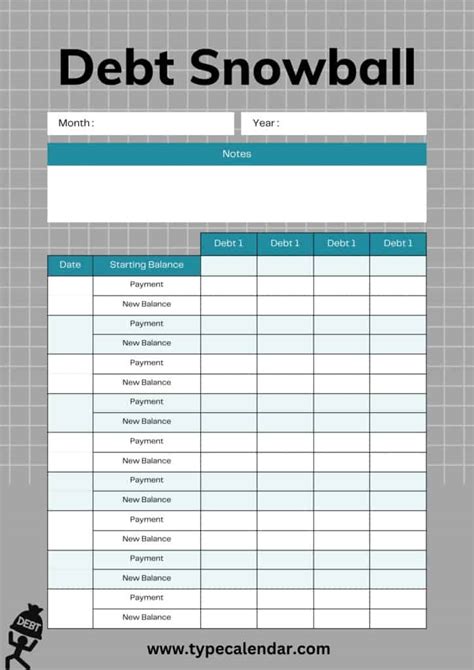

- Download an Excel snowball template or create your own using the following columns:

- Debt name

- Balance

- Minimum payment

- Interest rate

- Payoff amount

- Enter your debt information into the template.

- Sort your debts by balance, starting with the smallest.

- Determine your minimum payments and payoff amounts.

- Update the template regularly to track your progress.

Tips for Success with the Debt Snowball Method

While the debt snowball method is a powerful tool for paying off debt, it's essential to keep the following tips in mind:

- Create a budget: Track your income and expenses to ensure you have enough money to make minimum payments and payoff amounts.

- Cut expenses: Reduce unnecessary expenses to free up more money for debt repayment.

- Increase income: Consider taking on a side job or selling items you no longer need to increase your income.

- Stay motivated: Celebrate your successes and remind yourself why you're working towards a debt-free life.

Common Debt Snowball Template Formulas

When creating your Excel snowball template, you may need to use the following formulas:

- =SUM(B:B) to calculate the total debt balance

- =A2*B2 to calculate the minimum payment for each debt

- =A2*C2 to calculate the payoff amount for each debt

Overcoming Common Challenges

While the debt snowball method is a straightforward approach to paying off debt, you may encounter some challenges along the way. Here are some common obstacles and how to overcome them:

- Lack of motivation: Celebrate your successes and remind yourself why you're working towards a debt-free life.

- Insufficient funds: Cut expenses, increase income, or consider a side job to free up more money for debt repayment.

- High-interest rates: Consider consolidating debts or negotiating with creditors to reduce interest rates.

Gallery of Debt Snowball Templates

Debt Snowball Template Gallery

Frequently Asked Questions

Q: What is the debt snowball method? A: The debt snowball method is a debt reduction strategy that involves paying off debts in a specific order, starting with the smallest balance first.

Q: How do I create a debt snowball template in Excel? A: You can create a debt snowball template in Excel by using the following columns: debt name, balance, minimum payment, interest rate, and payoff amount.

Q: What are some common challenges when using the debt snowball method? A: Common challenges include lack of motivation, insufficient funds, and high-interest rates.

Take Control of Your Debt

Creating a debt-free life requires discipline, patience, and the right strategy. By using an Excel snowball template and following the debt snowball method, you can take control of your debt and start building wealth. Remember to stay motivated, overcome common challenges, and celebrate your successes along the way. With time and effort, you can achieve a debt-free life and enjoy financial freedom.