Moving averages are a crucial tool in technical analysis, helping traders and investors identify trends, forecast future prices, and make informed decisions. Among various types of moving averages, the Exponential Moving Average (EMA) stands out due to its responsiveness to recent price movements. In this article, we will delve into the world of Excel Exponential Moving Average, exploring its importance, calculation methods, and step-by-step implementation in Microsoft Excel.

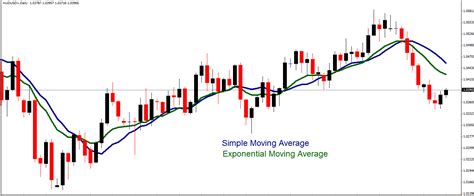

The Exponential Moving Average (EMA) is a type of moving average that gives more weight to recent prices, making it more sensitive to recent market movements. This is in contrast to the Simple Moving Average (SMA), which assigns equal weight to all prices in the calculation period. The EMA's responsiveness to recent prices makes it a popular choice among traders, who can use it to gauge the market's short-term momentum.

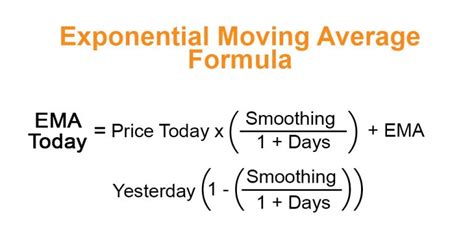

Understanding the Exponential Moving Average Formula

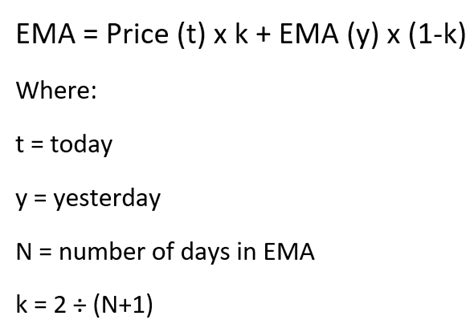

The EMA formula is based on the SMA calculation, with an additional smoothing factor that gives more weight to recent prices. The formula for EMA is:

EMA = (Current Price x Smoothing Factor) + (Previous EMA x (1 - Smoothing Factor))

where:

- Current Price is the current market price

- Smoothing Factor is a value between 0 and 1 that determines the weight given to recent prices

- Previous EMA is the previous EMA value

The smoothing factor is calculated as:

Smoothing Factor = 2 / (Number of Periods + 1)

where Number of Periods is the number of periods used in the EMA calculation.

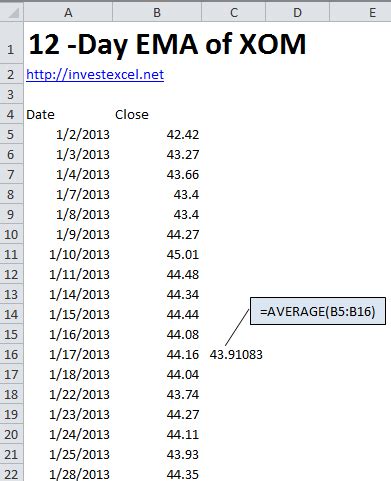

How to Calculate Exponential Moving Average in Excel

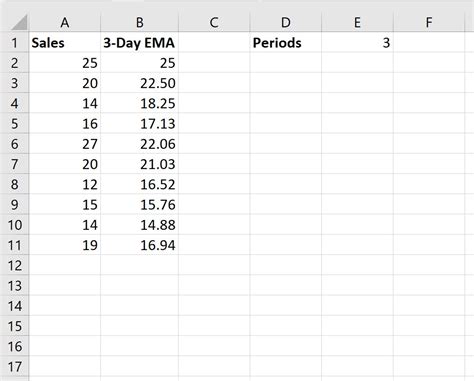

Calculating EMA in Excel is a straightforward process that involves using the EMA formula and the smoothing factor. Here's a step-by-step guide:

- Open your Excel spreadsheet and enter the historical price data in a column.

- Determine the number of periods you want to use for the EMA calculation.

- Calculate the smoothing factor using the formula: Smoothing Factor = 2 / (Number of Periods + 1)

- In a new column, enter the EMA formula: = (Current Price x Smoothing Factor) + (Previous EMA x (1 - Smoothing Factor))

- Copy the formula down to the rest of the cells in the column.

Excel Exponential Moving Average Example

Suppose we have a dataset of daily stock prices and we want to calculate the 10-day EMA. We can follow the steps outlined above to calculate the EMA.

| Date | Price | EMA |

|---|---|---|

| 2022-01-01 | 100 | |

| 2022-01-02 | 102 | 101 |

| 2022-01-03 | 105 | 103.5 |

| ... | ... | ... |

In this example, we calculate the smoothing factor as: Smoothing Factor = 2 / (10 + 1) = 0.1818

We then use the EMA formula to calculate the EMA values for each day.

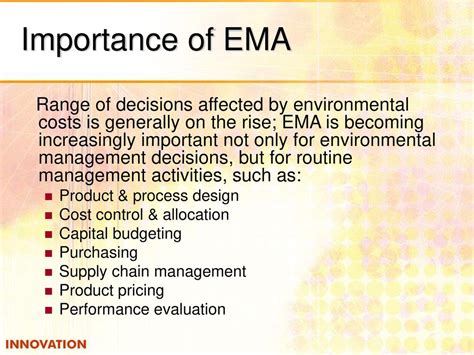

Benefits of Using Exponential Moving Average in Excel

Using EMA in Excel offers several benefits, including:

- Improved responsiveness to recent price movements

- Enhanced trend identification and forecasting

- Simplified calculation process using the EMA formula

Common Applications of Exponential Moving Average

EMA has several applications in technical analysis and trading, including:

- Trend identification: EMA can be used to identify the direction and strength of a trend.

- Trend reversal: EMA can be used to identify potential trend reversals.

- Momentum trading: EMA can be used to gauge the momentum of a security.

Limitations of Exponential Moving Average

While EMA is a powerful tool in technical analysis, it has several limitations, including:

- Sensitivity to recent price movements: EMA can be sensitive to recent price movements, which can result in false signals.

- Lag: EMA can lag behind price movements, which can result in delayed signals.

Conclusion and Next Steps

In this article, we explored the world of Excel Exponential Moving Average, including its importance, calculation methods, and step-by-step implementation in Microsoft Excel. We also discussed the benefits and limitations of using EMA in technical analysis and trading.

To take your analysis to the next level, try experimenting with different EMA periods and smoothing factors to find the optimal combination for your trading strategy. Additionally, consider combining EMA with other technical indicators to create a comprehensive trading system.

Exponential Moving Average Image Gallery

We hope this article has provided you with a comprehensive understanding of Excel Exponential Moving Average and its applications in technical analysis and trading. Do you have any questions or experiences with EMA? Share your thoughts in the comments section below!