Excel forecasting is a powerful tool for predicting future trends and making informed business decisions. However, it's essential to understand the reliability of these forecasts by setting confidence intervals. In this article, we'll explore seven ways to set Excel forecast confidence intervals, ensuring that you can trust your predictions and make data-driven decisions.

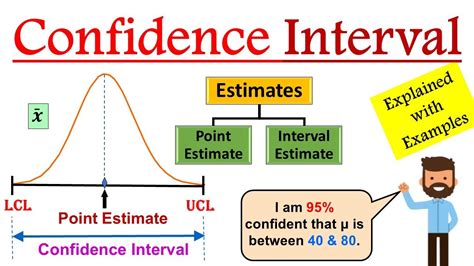

The Importance of Confidence Intervals in Forecasting

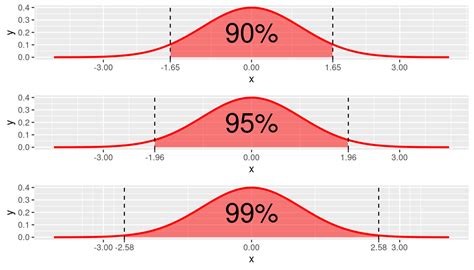

When working with forecasts, it's crucial to acknowledge the uncertainty associated with these predictions. Confidence intervals provide a range of values within which the true forecast is likely to lie, giving you a sense of the reliability of your predictions. By setting confidence intervals, you can:

- Quantify the uncertainty associated with your forecasts

- Make more informed decisions by considering the range of possible outcomes

- Improve the accuracy of your forecasts by identifying areas of high uncertainty

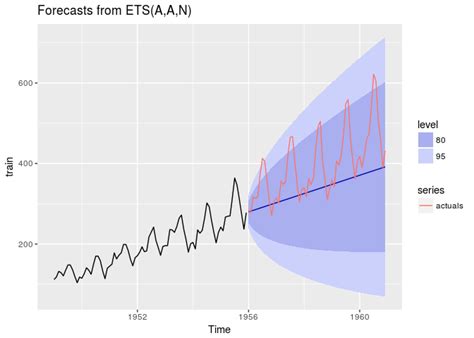

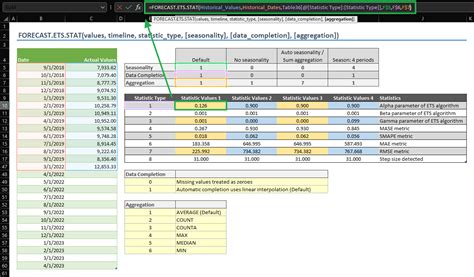

Method 1: Using the FORECAST.ETS Function

One way to set confidence intervals in Excel is by using the FORECAST.ETS function. This function returns a forecast value and its corresponding confidence interval.

To use the FORECAST.ETS function, follow these steps:

- Select the cell where you want to display the forecast value.

- Type

=FORECAST.ETS(and select the data range that you want to forecast. - Specify the confidence level using the

confidenceargument (e.g.,0.95for a 95% confidence interval). - Press Enter to calculate the forecast value and confidence interval.

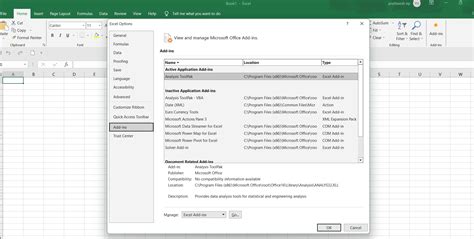

Method 2: Using the Analysis ToolPak

Another way to set confidence intervals in Excel is by using the Analysis ToolPak. This add-in provides a range of statistical tools, including the ability to calculate confidence intervals.

To use the Analysis ToolPak, follow these steps:

- Go to the "Data" tab in the Excel ribbon.

- Click on "Data Analysis" and select "Regression."

- Select the data range that you want to forecast.

- Check the "Confidence Level" box and specify the desired confidence level.

- Click "OK" to calculate the forecast value and confidence interval.

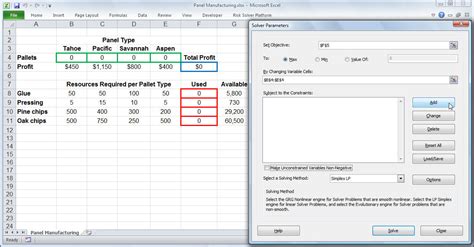

Method 3: Using the Excel Solver

The Excel Solver is a powerful tool that can be used to set confidence intervals by minimizing the difference between the forecast values and the actual values.

To use the Excel Solver, follow these steps:

- Go to the "Data" tab in the Excel ribbon.

- Click on "Solver" and select "Set Target Cell."

- Select the cell that contains the forecast value.

- Click "Add" and select the range of cells that contains the actual values.

- Set the "By Changing Variable Cells" range to the range of cells that contains the forecast parameters.

- Click "Solve" to minimize the difference between the forecast values and the actual values.

Method 4: Using the Bootstrap Method

The bootstrap method is a resampling technique that can be used to estimate the confidence interval of a forecast value.

To use the bootstrap method, follow these steps:

- Select the range of cells that contains the data that you want to forecast.

- Use the

RAND()function to generate a random sample from the data. - Calculate the forecast value using the random sample.

- Repeat steps 2-3 several times to generate multiple forecast values.

- Calculate the mean and standard deviation of the forecast values.

- Use the mean and standard deviation to estimate the confidence interval.

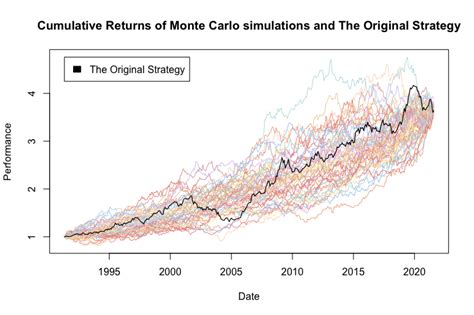

Method 5: Using the Monte Carlo Simulation

A Monte Carlo simulation is a method that uses random sampling to estimate the confidence interval of a forecast value.

To use a Monte Carlo simulation, follow these steps:

- Select the range of cells that contains the data that you want to forecast.

- Use the

RAND()function to generate a random sample from the data. - Calculate the forecast value using the random sample.

- Repeat steps 2-3 several times to generate multiple forecast values.

- Calculate the mean and standard deviation of the forecast values.

- Use the mean and standard deviation to estimate the confidence interval.

Method 6: Using the Historical Data

Using historical data to estimate the confidence interval of a forecast value is a simple and effective method.

To use historical data, follow these steps:

- Select the range of cells that contains the historical data.

- Calculate the mean and standard deviation of the historical data.

- Use the mean and standard deviation to estimate the confidence interval.

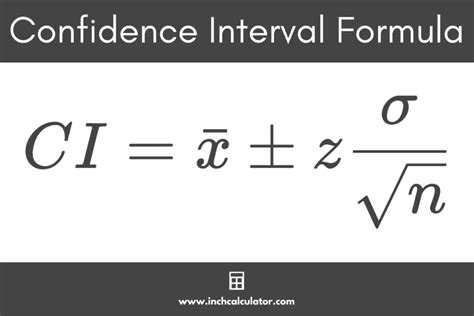

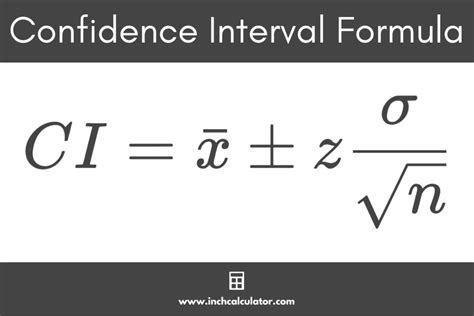

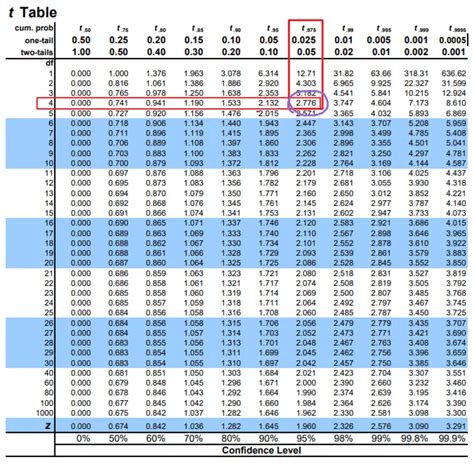

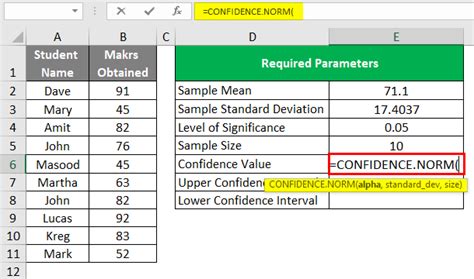

Method 7: Using the Formula

Finally, you can use a formula to estimate the confidence interval of a forecast value.

To use a formula, follow these steps:

- Select the cell that contains the forecast value.

- Type

=forecast_value ± (z-score \* standard_deviation)where:forecast_valueis the forecast valuez-scoreis the z-score corresponding to the desired confidence levelstandard_deviationis the standard deviation of the historical data

- Press Enter to calculate the confidence interval.

Gallery of Confidence Interval Images

Confidence Interval Image Gallery

Conclusion

Setting confidence intervals in Excel is an essential step in ensuring the reliability of your forecasts. By using one of the seven methods outlined in this article, you can estimate the confidence interval of your forecast values and make more informed decisions. Remember to choose the method that best suits your needs and to always consider the uncertainty associated with your forecasts.

We hope this article has been helpful in understanding the importance of confidence intervals in forecasting. If you have any questions or need further clarification, please don't hesitate to comment below.