Intro

Streamline your financial management with our expert guide to balance sheet reconciliation in Excel. Learn 5 actionable tips to create an accurate and efficient reconciliation template, including automating data imports, using pivot tables, and implementing rolling forecasts. Ensure financial accuracy and reduce errors with our step-by-step tutorial.

Maintaining accurate financial records is crucial for any business, and one of the most critical components of this process is the balance sheet reconciliation. A balance sheet reconciliation template in Excel can be a powerful tool in ensuring that your financial statements are accurate and reliable. In this article, we will explore the importance of balance sheet reconciliation and provide five tips on how to create an effective template in Excel.

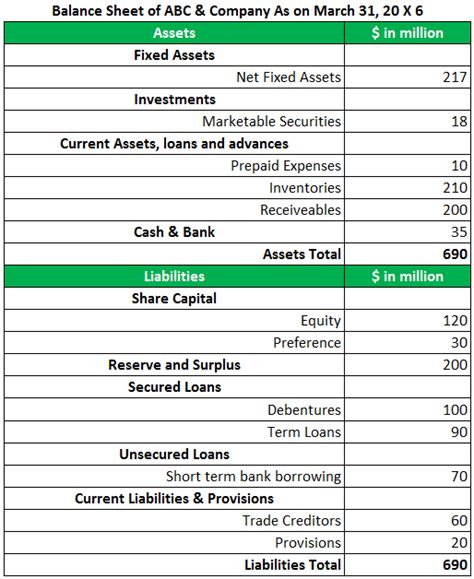

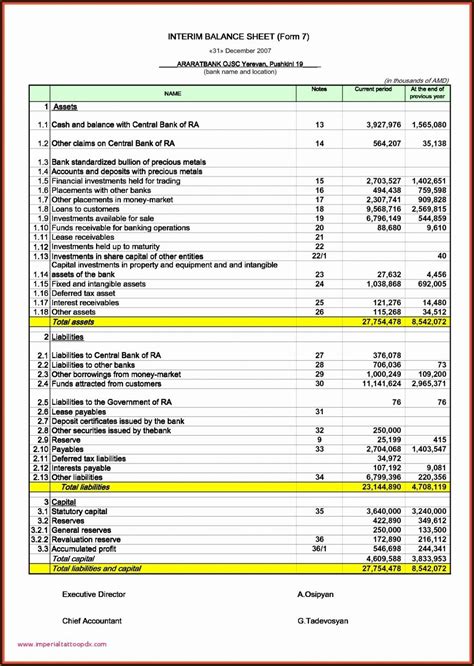

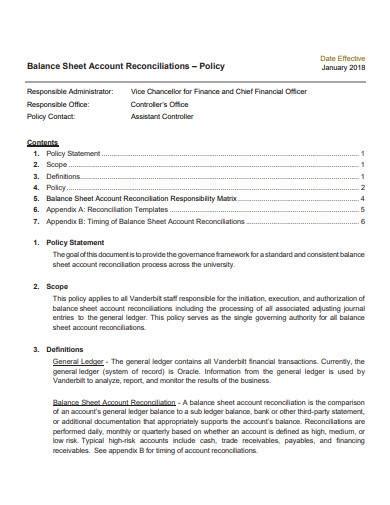

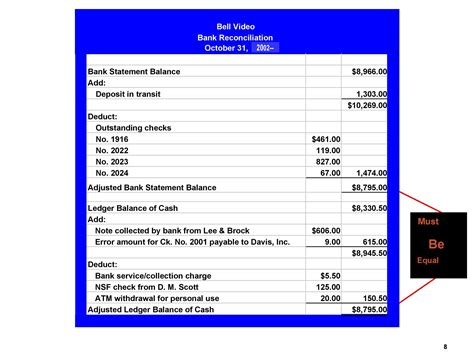

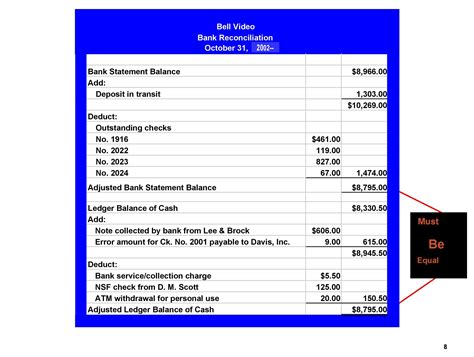

The balance sheet is a snapshot of a company's financial position at a specific point in time, and it provides a comprehensive view of the company's assets, liabilities, and equity. However, errors can occur, and it is essential to reconcile the balance sheet to ensure that it accurately reflects the company's financial position.

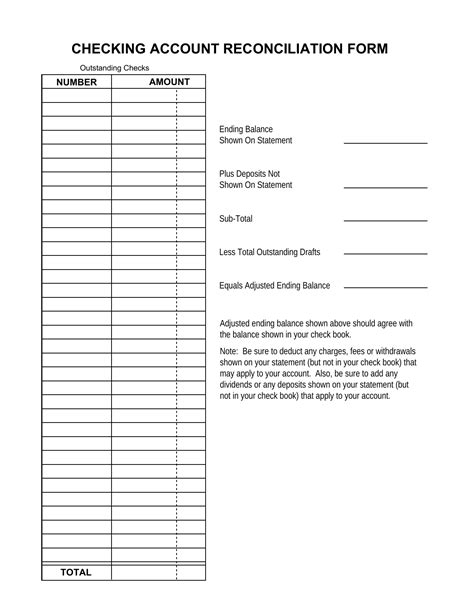

Reconciling the balance sheet involves verifying the accuracy of the financial data by comparing it to external sources, such as bank statements and vendor invoices. This process helps to identify and correct any errors or discrepancies, ensuring that the financial statements are reliable and accurate.

Benefits of Balance Sheet Reconciliation

Before we dive into the tips for creating a balance sheet reconciliation template in Excel, let's explore the benefits of this process:

- Improved accuracy: Reconciling the balance sheet ensures that the financial data is accurate and reliable.

- Reduced errors: The reconciliation process helps to identify and correct errors, reducing the risk of misstatements.

- Enhanced transparency: The reconciliation process provides a clear and transparent view of the company's financial position.

- Better decision-making: Accurate financial data enables management to make informed decisions.

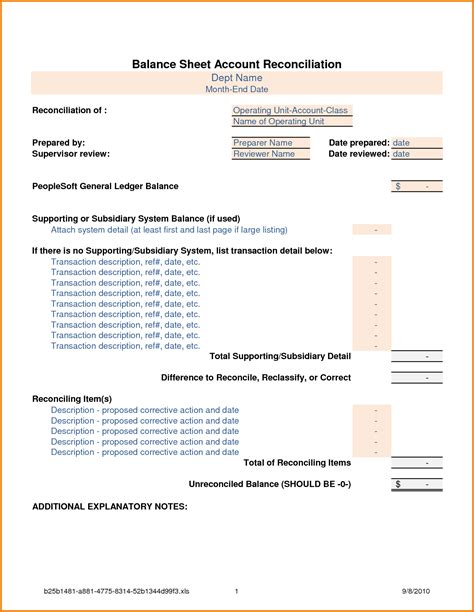

Tip 1: Create a Comprehensive Template

A comprehensive template is essential for effective balance sheet reconciliation. The template should include the following components:

- Assets: Cash, accounts receivable, inventory, and other assets.

- Liabilities: Accounts payable, loans, and other liabilities.

- Equity: Share capital, retained earnings, and other equity components.

The template should also include columns for the account balances, reconciliations, and adjustments.

Tip 2: Use Formulas and Functions

Formulas and functions can help to automate the reconciliation process and reduce errors. The following formulas and functions can be used:

- VLOOKUP: To retrieve data from external sources, such as bank statements.

- INDEX/MATCH: To retrieve data from external sources, such as vendor invoices.

- SUMIF: To calculate the total value of assets, liabilities, and equity.

- IFERROR: To handle errors and discrepancies.

By using formulas and functions, you can automate the reconciliation process and reduce the risk of errors.

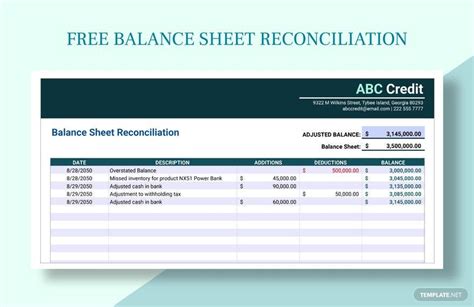

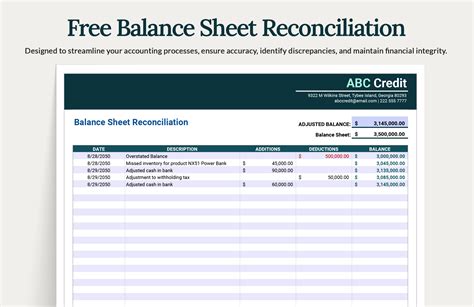

Tip 3: Include Reconciliation Columns

Reconciliation columns are essential for tracking and resolving discrepancies. The following columns can be included:

- Reconciliation column: To track the reconciliations and adjustments.

- Variance column: To track the variances between the account balances and the external sources.

- Adjustment column: To track the adjustments made to the account balances.

By including reconciliation columns, you can track and resolve discrepancies efficiently.

Tip 4: Use Conditional Formatting

Conditional formatting can help to highlight errors and discrepancies, making it easier to identify and resolve issues. The following formatting can be used:

- Highlight cells with errors or discrepancies.

- Use different colors to differentiate between reconciliations and adjustments.

- Use icons to indicate the status of the reconciliation process.

By using conditional formatting, you can visualize the reconciliation process and identify areas that require attention.

Tip 5: Review and Update Regularly

The balance sheet reconciliation template should be reviewed and updated regularly to ensure that it remains accurate and effective. The following steps can be taken:

- Review the template quarterly to ensure that it is accurate and up-to-date.

- Update the template to reflect changes in the company's financial position.

- Verify the accuracy of the external sources, such as bank statements and vendor invoices.

By reviewing and updating the template regularly, you can ensure that it remains effective and accurate.

Balance Sheet Reconciliation Image Gallery

In conclusion, a balance sheet reconciliation template in Excel can be a powerful tool in ensuring that your financial statements are accurate and reliable. By following the five tips outlined in this article, you can create an effective template that streamlines the reconciliation process and reduces errors. Remember to review and update the template regularly to ensure that it remains accurate and effective.

What's Next?

Take the next step in improving your financial management by implementing a balance sheet reconciliation template in Excel. Share your experiences and tips in the comments below, and don't forget to download our free balance sheet reconciliation template to get started.

We would love to hear from you! What are your favorite tips and tricks for creating an effective balance sheet reconciliation template in Excel? Share your thoughts in the comments below, and let's start a conversation.