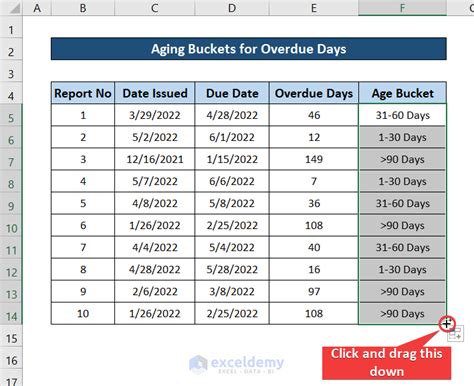

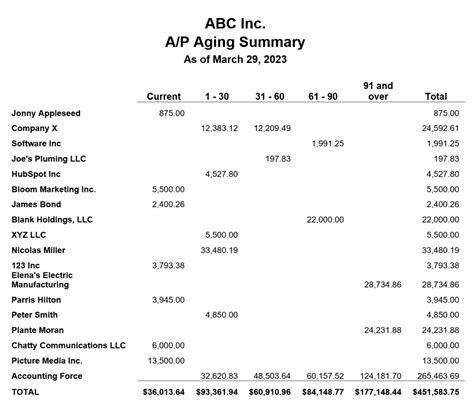

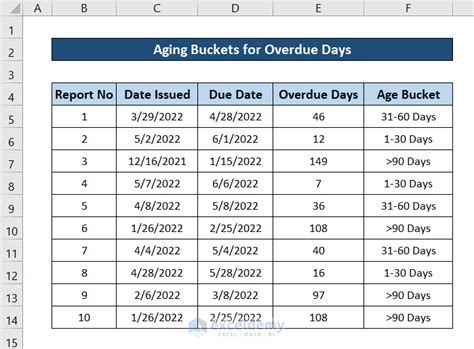

Aging buckets are a crucial tool for businesses to manage their accounts receivable and accounts payable. It helps them to identify the outstanding invoices that are due for payment and take necessary actions to collect the payments. In this article, we will discuss five ways to calculate aging buckets in Excel.

Understanding Aging Buckets

Aging buckets are a way to categorize outstanding invoices based on the number of days they are overdue. It helps businesses to prioritize their collection efforts and focus on the invoices that are closest to being written off. Aging buckets can be calculated for both accounts receivable and accounts payable.

Why Use Aging Buckets?

Aging buckets provide several benefits to businesses, including:

- Improved cash flow management

- Reduced bad debt expenses

- Increased efficiency in accounts receivable and accounts payable management

- Better decision-making with accurate and timely data

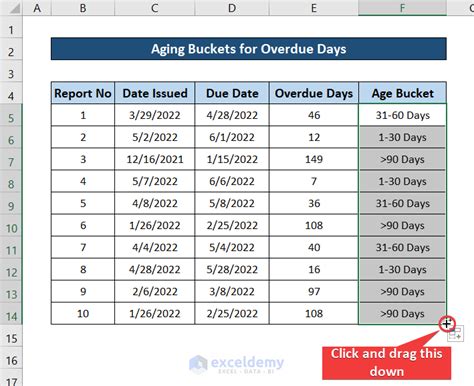

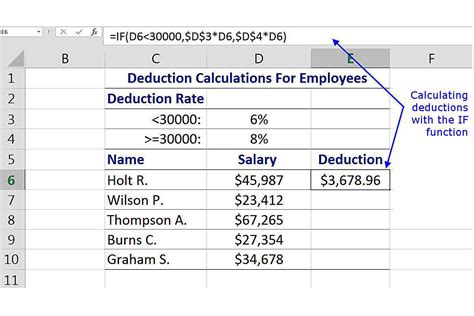

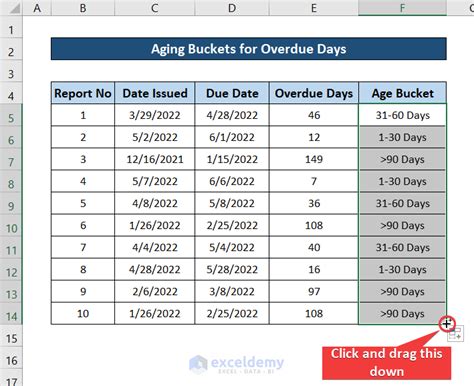

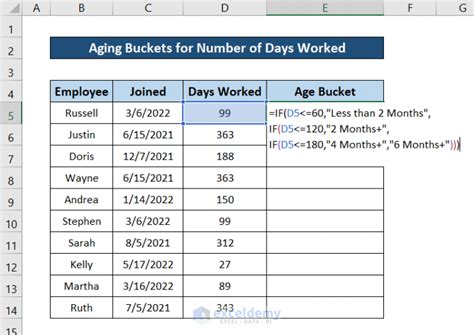

Method 1: Using the IF Function

One way to calculate aging buckets in Excel is by using the IF function. This function allows you to test a condition and return a value if the condition is true or false.

Assuming you have a table with the following columns:

| Invoice Number | Invoice Date | Due Date | Payment Date |

|---|

You can use the IF function to calculate the aging bucket for each invoice as follows:

=IF(TODAY()-[Due Date]>30,"Over 30 days",IF(TODAY()-[Due Date]>60,"Over 60 days",IF(TODAY()-[Due Date]>90,"Over 90 days","Current")))

This formula checks if the due date is more than 30, 60, or 90 days ago and returns the corresponding aging bucket.

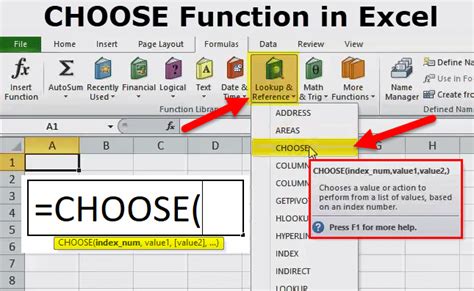

Method 2: Using the CHOOSE Function

Another way to calculate aging buckets in Excel is by using the CHOOSE function. This function allows you to select a value from a list based on a position number.

Assuming you have a table with the following columns:

| Invoice Number | Invoice Date | Due Date | Payment Date |

|---|

You can use the CHOOSE function to calculate the aging bucket for each invoice as follows:

=CHOOSE(1+(TODAY()-[Due Date])/30,"Current","Over 30 days","Over 60 days","Over 90 days")

This formula calculates the aging bucket by dividing the number of days since the due date by 30 and using the result as a position number to select a value from the list.

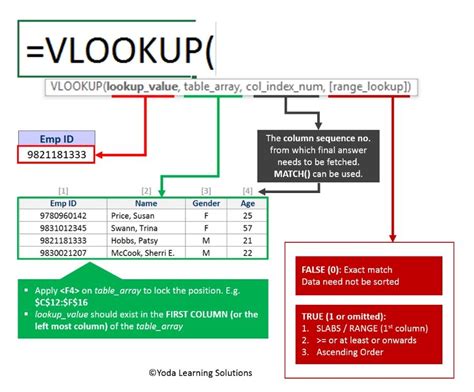

Method 3: Using the VLOOKUP Function

You can also use the VLOOKUP function to calculate aging buckets in Excel. This function allows you to look up a value in a table and return a corresponding value from another column.

Assuming you have a table with the following columns:

| Days Overdue | Aging Bucket |

|---|---|

| 0-30 | Current |

| 31-60 | Over 30 days |

| 61-90 | Over 60 days |

| 91+ | Over 90 days |

You can use the VLOOKUP function to calculate the aging bucket for each invoice as follows:

=VLOOKUP(TODAY()-[Due Date],A:B,2,FALSE)

This formula looks up the number of days since the due date in the table and returns the corresponding aging bucket.

Method 4: Using Power Query

Power Query is a powerful tool in Excel that allows you to create custom queries and calculations. You can use Power Query to calculate aging buckets by creating a custom column.

Assuming you have a table with the following columns:

| Invoice Number | Invoice Date | Due Date | Payment Date |

|---|

You can create a custom column in Power Query to calculate the aging bucket as follows:

=if Date.From([Due Date]) >= Date.AddDays(Date.From(Today()),-30) then "Current" else if Date.From([Due Date]) >= Date.AddDays(Date.From(Today()),-60) then "Over 30 days" else if Date.From([Due Date]) >= Date.AddDays(Date.From(Today()),-90) then "Over 60 days" else "Over 90 days"

This formula creates a custom column that calculates the aging bucket based on the due date and the current date.

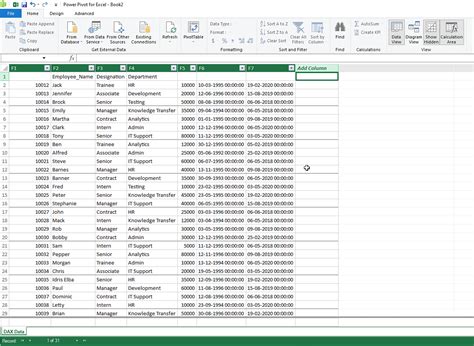

Method 5: Using DAX

DAX (Data Analysis Expressions) is a language used to create custom calculations in Power Pivot and Power BI. You can use DAX to calculate aging buckets by creating a measure.

Assuming you have a table with the following columns:

| Invoice Number | Invoice Date | Due Date | Payment Date |

|---|

You can create a measure in DAX to calculate the aging bucket as follows:

=Aging Bucket = if ('Table'[Due Date]) >= TODAY()-30 then "Current" else if ('Table'[Due Date]) >= TODAY()-60 then "Over 30 days" else if ('Table'[Due Date]) >= TODAY()-90 then "Over 60 days" else "Over 90 days"

This formula creates a measure that calculates the aging bucket based on the due date and the current date.

Aging Buckets Image Gallery

We hope this article has helped you to understand how to calculate aging buckets in Excel. Whether you use the IF function, CHOOSE function, VLOOKUP function, Power Query, or DAX, you can easily create aging buckets to manage your accounts receivable and accounts payable. Remember to customize the formulas and calculations to suit your specific needs and requirements.

Don't forget to share your thoughts and experiences with us in the comments section below. If you have any questions or need further assistance, feel free to ask.