Intro

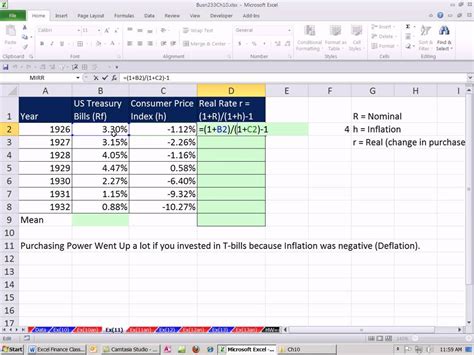

Learn how to calculate inflation adjustments in Excel using a simple formula. Discover the inflation adjustment formula, how to account for CPI changes, and create accurate inflation-adjusted values. Master Excel inflation calculations with our step-by-step guide, covering inflation rate, CPI index, and data analysis for precise financial forecasting.

Understanding inflation and its impact on financial calculations is crucial in today's economy. Inflation adjustment formulas in Excel are essential tools for financial analysts, economists, and individuals managing personal finances. This article will delve into the world of inflation adjustment, explaining its importance, how it works, and providing step-by-step guidance on implementing inflation adjustment formulas in Excel.

What is Inflation Adjustment?

Inflation adjustment is a method used to account for the decrease in purchasing power due to inflation over time. It ensures that financial data and forecasts reflect the true economic value by adjusting for the effects of inflation. This adjustment is critical for accurate financial analysis, budgeting, and forecasting.

Why is Inflation Adjustment Important?

- Accurate Financial Analysis: Inflation adjustment helps in comparing financial data across different periods, ensuring that the analysis is accurate and reflects the real economic situation.

- Better Forecasting: Adjusting for inflation improves the reliability of financial forecasts, enabling businesses and individuals to make informed decisions.

- Real Purchasing Power: It helps in understanding the real purchasing power of money, which is essential for personal and business financial planning.

Inflation Adjustment Formulas in Excel

Excel offers several formulas to adjust for inflation, including the FV (Future Value) function, the PV (Present Value) function, and the formula for Compound Annual Growth Rate (CAGR).

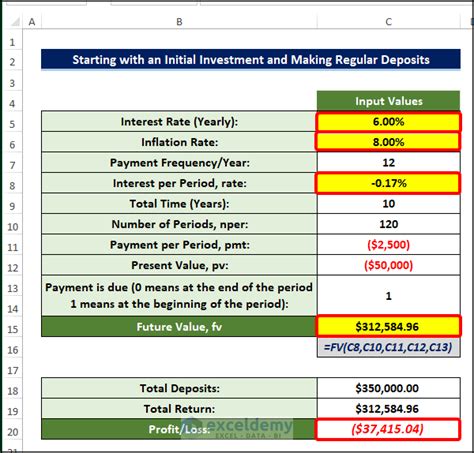

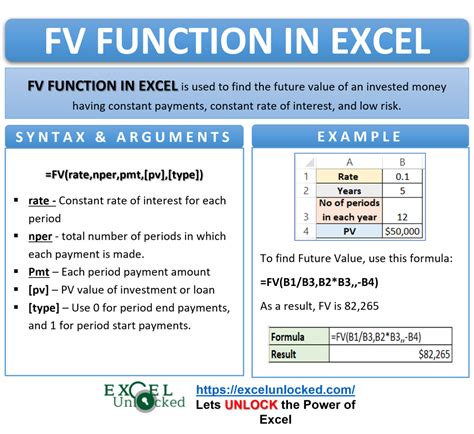

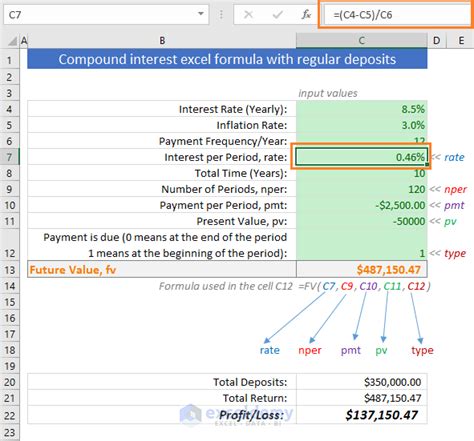

1. Using the FV Function

The FV function calculates the future value of an investment based on a constant interest rate. However, it can be adapted to calculate the future value adjusted for inflation by using the inflation rate as the interest rate.

Formula: FV(inflation_rate, nper, pmt, [pv], [type])

- inflation_rate: The annual inflation rate.

- nper: The number of years.

- pmt: The annual payment. If omitted, it is assumed to be 0.

- [pv]: The present value. If omitted, it is assumed to be 0.

- [type]: The payment type (0 for end of period, 1 for beginning of period).

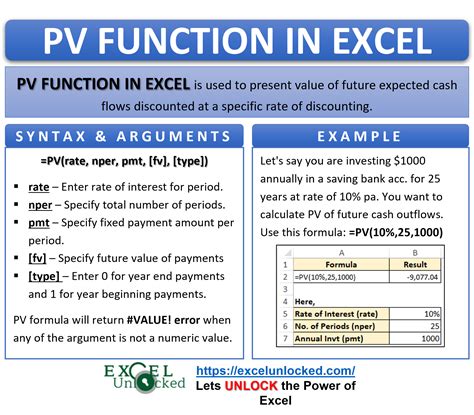

2. Using the PV Function

The PV function calculates the present value of an investment. Similar to the FV function, it can be used to adjust for inflation by inputting the inflation rate and other relevant financial data.

Formula: PV(inflation_rate, nper, pmt, [fv], [type])

- inflation_rate: The annual inflation rate.

- nper: The number of years.

- pmt: The annual payment.

- [fv]: The future value. If omitted, it is assumed to be 0.

- [type]: The payment type (0 for end of period, 1 for beginning of period).

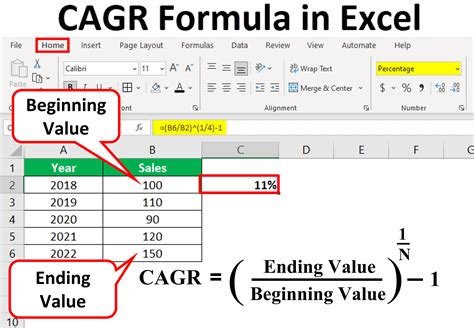

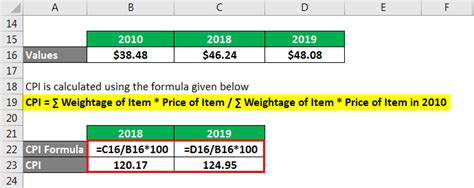

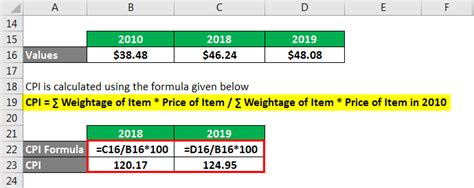

3. Compound Annual Growth Rate (CAGR)

CAGR calculates the average annual growth rate of an investment over a specified period. It can be used to determine the inflation-adjusted growth rate of an investment.

Formula: (End Value / Beginning Value)^(1 / Number of Years) - 1

Implementing Inflation Adjustment in Excel

Implementing inflation adjustment in Excel involves several steps:

- Determine the Inflation Rate: Find the average annual inflation rate over the period you are analyzing.

- Choose the Formula: Decide which formula best suits your needs based on whether you are calculating future or present value, or determining the CAGR.

- Input Data: Enter the required data into the chosen formula, including the inflation rate, number of years, and any payments or initial investments.

- Calculate: Execute the formula to get the inflation-adjusted value.

Gallery of Inflation Adjustment Formulas in Excel

Inflation Adjustment Formulas in Excel

Conclusion

Inflation adjustment is a critical aspect of financial analysis that ensures the accuracy and reliability of financial data. Excel provides powerful tools and formulas to adjust for inflation, including the FV, PV functions, and CAGR. By understanding how to use these formulas and implementing inflation adjustment in Excel, users can enhance their financial analysis, forecasting, and decision-making capabilities.

Do you have any questions or experiences with inflation adjustment in Excel? Share your thoughts in the comments below!