Intro

Excel has long been a staple of financial analysis and planning, and one of its most powerful tools is the growing annuity formula. This formula allows users to calculate the future value of a series of investments that grow at a constant rate over time. Mastering the growing annuity formula can help you make more accurate financial projections, create more effective investment strategies, and achieve your long-term financial goals. In this article, we'll explore five ways to master the growing annuity formula in Excel.

Understanding the Growing Annuity Formula

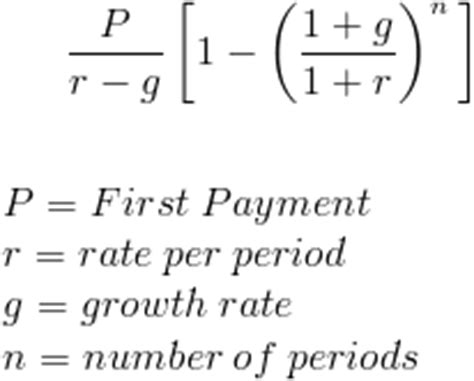

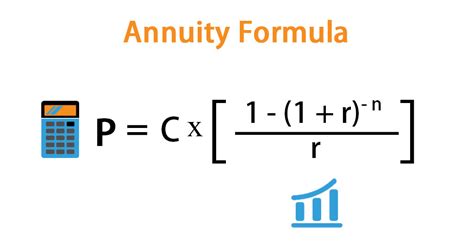

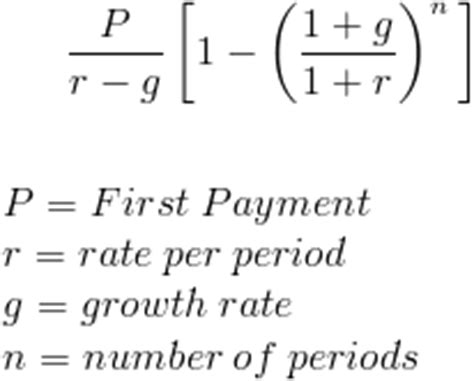

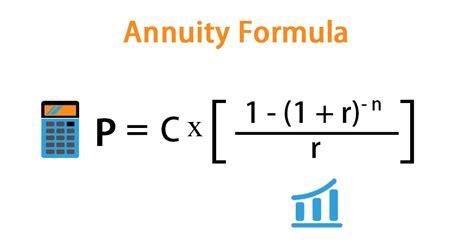

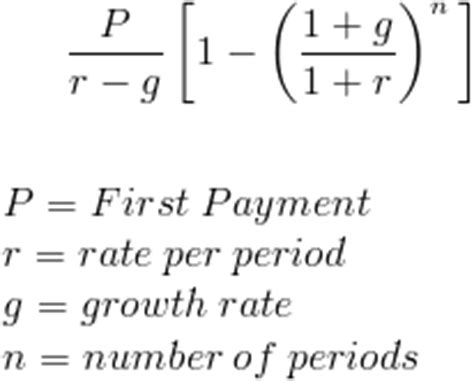

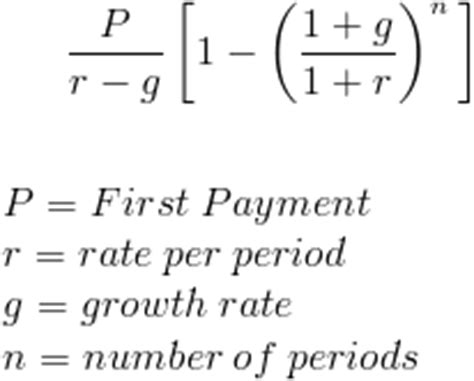

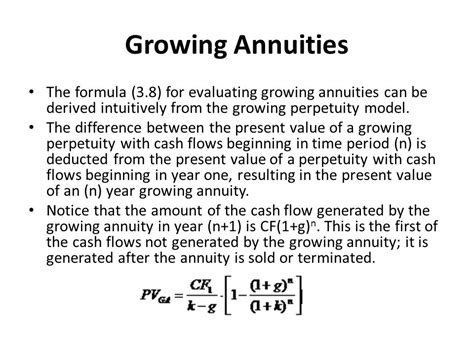

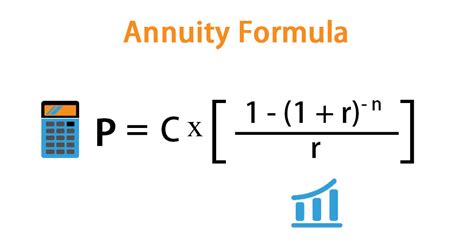

The growing annuity formula is a powerful tool for calculating the future value of a series of investments that grow at a constant rate over time. The formula takes into account the initial investment, the periodic payment, the interest rate, and the number of periods. The formula is as follows:

FV = PV x (1 + r)^n + PMT x (((1 + r)^n - 1) / r)

Where: FV = Future Value PV = Present Value (initial investment) PMT = Periodic Payment r = Interest Rate n = Number of Periods

Breaking Down the Formula

To master the growing annuity formula, it's essential to understand each component of the formula. Let's break down the formula into its individual parts:

- Present Value (PV): This is the initial investment or the current value of the annuity.

- Periodic Payment (PMT): This is the amount of money invested at regular intervals.

- Interest Rate (r): This is the rate at which the investment grows over time.

- Number of Periods (n): This is the number of times the investment is made.

5 Ways to Master the Growing Annuity Formula

Now that we've broken down the formula, let's explore five ways to master the growing annuity formula in Excel:

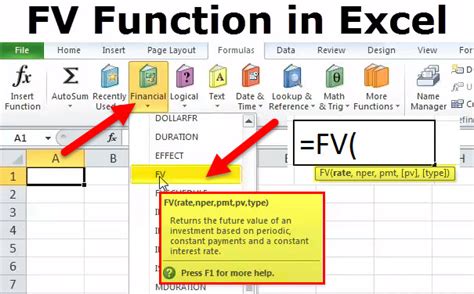

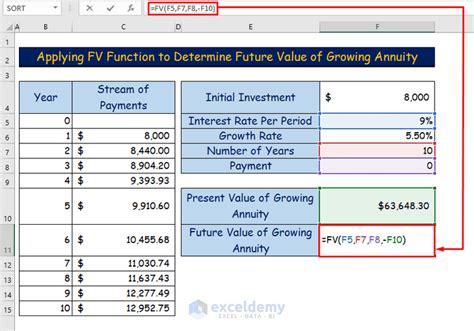

1. Use the FV Function

One of the easiest ways to calculate the future value of a growing annuity is to use the FV function in Excel. The FV function takes into account the present value, periodic payment, interest rate, and number of periods to calculate the future value.

To use the FV function, follow these steps:

- Open a new Excel spreadsheet and enter the present value, periodic payment, interest rate, and number of periods.

- Click on the cell where you want to display the future value.

- Type "=FV(" and select the interest rate, number of periods, and periodic payment.

- Press Enter to calculate the future value.

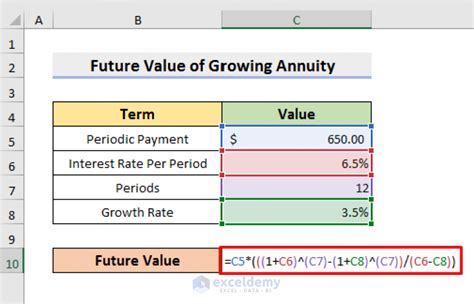

2. Create a Growing Annuity Formula Template

Another way to master the growing annuity formula is to create a template in Excel. A template allows you to plug in different values for the present value, periodic payment, interest rate, and number of periods to calculate the future value.

To create a template, follow these steps:

- Open a new Excel spreadsheet and create a table with the following columns: Present Value, Periodic Payment, Interest Rate, Number of Periods, and Future Value.

- Enter a formula in the Future Value column that references the other columns.

- Save the template and use it to calculate the future value of different growing annuities.

3. Use a Growing Annuity Formula Calculator

If you don't want to create a template or use the FV function, you can use a growing annuity formula calculator. A calculator allows you to plug in different values for the present value, periodic payment, interest rate, and number of periods to calculate the future value.

To use a calculator, follow these steps:

- Search for a growing annuity formula calculator online.

- Plug in the present value, periodic payment, interest rate, and number of periods.

- Click Calculate to display the future value.

4. Practice with Real-World Examples

To master the growing annuity formula, it's essential to practice with real-world examples. Real-world examples allow you to apply the formula to different scenarios and see how it works.

To practice with real-world examples, follow these steps:

- Search for real-world examples of growing annuities online.

- Plug in the values for the present value, periodic payment, interest rate, and number of periods.

- Calculate the future value using the growing annuity formula.

5. Take an Online Course or Tutorial

Finally, if you want to master the growing annuity formula, consider taking an online course or tutorial. An online course or tutorial allows you to learn the formula in a structured and interactive way.

To take an online course or tutorial, follow these steps:

- Search for online courses or tutorials on the growing annuity formula.

- Sign up for the course or tutorial and complete the lessons.

- Practice with real-world examples to reinforce your understanding.

Gallery of Growing Annuity Formula Images

In conclusion, mastering the growing annuity formula in Excel can help you make more accurate financial projections, create more effective investment strategies, and achieve your long-term financial goals. By using the FV function, creating a template, using a calculator, practicing with real-world examples, and taking an online course or tutorial, you can become proficient in using the growing annuity formula. So why not start today and take the first step towards mastering the growing annuity formula?