In today's fast-paced world, managing finances effectively is crucial for individuals and businesses alike. One of the most time-consuming tasks is calculating income tax, which can be a daunting task, especially for those who are not familiar with tax laws and regulations. This is where an Excel income tax calculator comes in – a simple, yet powerful tool that can save you time and reduce the stress associated with tax calculations.

Calculating income tax manually can be a tedious process, requiring you to gather all relevant financial documents, including pay stubs, invoices, and receipts. With an Excel income tax calculator, you can automate this process, saving you hours of manual calculations and reducing the risk of errors.

Benefits of Using an Excel Income Tax Calculator

An Excel income tax calculator offers numerous benefits, including:

- Saves Time: By automating the calculation process, you can save a significant amount of time that would be spent on manual calculations.

- Reduces Errors: Manual calculations are prone to errors, which can lead to incorrect tax payments or refunds. An Excel income tax calculator minimizes the risk of errors, ensuring accuracy and reliability.

- Increases Efficiency: With an Excel income tax calculator, you can quickly and easily calculate your income tax, allowing you to focus on other important tasks.

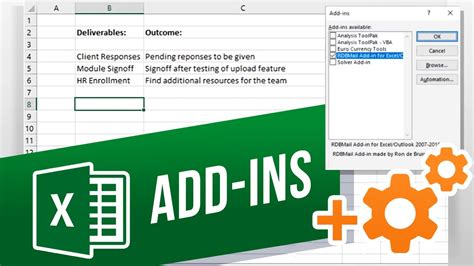

- Provides Flexibility: Excel income tax calculators can be customized to accommodate different tax scenarios, making it easy to adapt to changing tax laws and regulations.

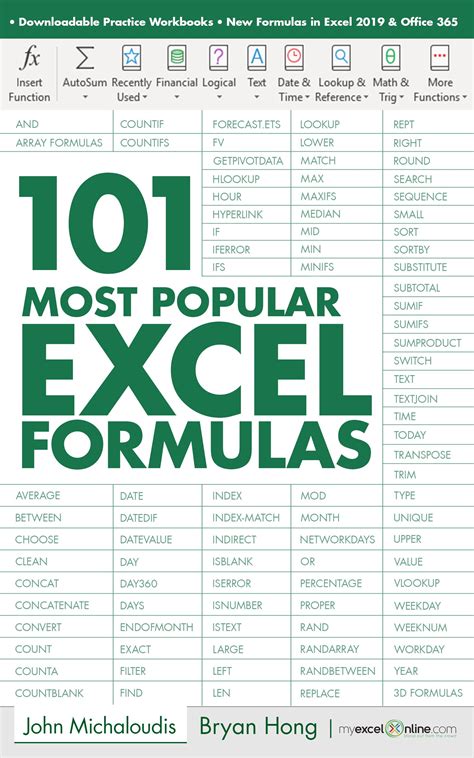

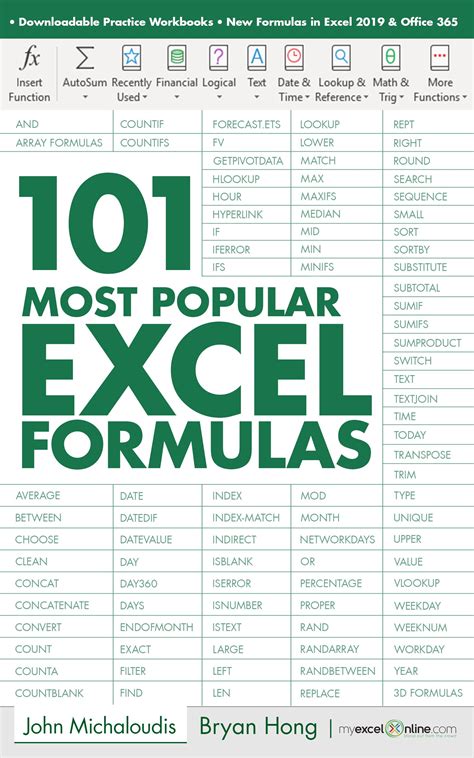

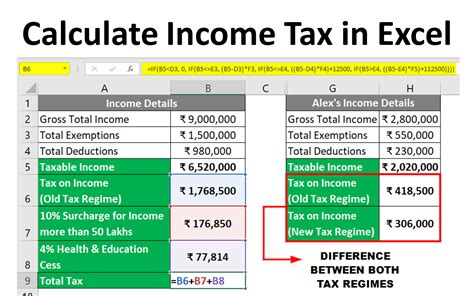

How to Create an Excel Income Tax Calculator

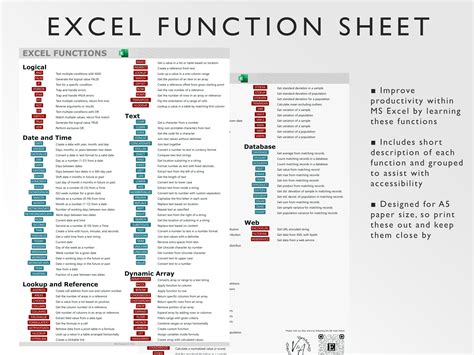

Creating an Excel income tax calculator is relatively simple, requiring basic knowledge of Excel formulas and functions. Here's a step-by-step guide to creating a basic income tax calculator:

- Gather Required Data: Collect all relevant financial documents, including pay stubs, invoices, and receipts.

- Create a Template: Set up an Excel template with columns for income, deductions, and tax rates.

- Enter Formulas: Enter formulas to calculate taxable income, deductions, and tax liability.

- Test and Refine: Test the calculator with sample data and refine the formulas as needed.

7 Ways Excel Income Tax Calculator Can Save You Time

Here are 7 ways an Excel income tax calculator can save you time:

- Automates Calculations: An Excel income tax calculator automates the calculation process, saving you hours of manual calculations.

- Reduces Data Entry: With an Excel income tax calculator, you can quickly and easily enter data, reducing the time spent on data entry.

- Provides Real-Time Results: An Excel income tax calculator provides real-time results, allowing you to quickly see the impact of changes to your tax calculations.

- Eliminates Errors: By minimizing the risk of errors, an Excel income tax calculator saves you time that would be spent correcting mistakes.

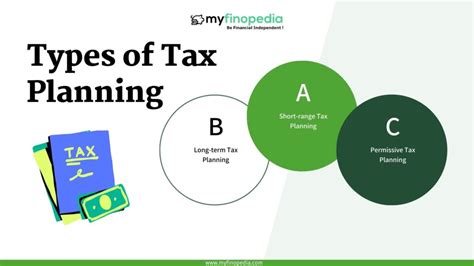

- Streamlines Tax Planning: An Excel income tax calculator streamlines tax planning, allowing you to quickly and easily explore different tax scenarios.

- Saves Time on Audits: In the event of an audit, an Excel income tax calculator can save you time by providing a clear and accurate record of your tax calculations.

- Increases Productivity: By automating the tax calculation process, an Excel income tax calculator increases productivity, allowing you to focus on other important tasks.

Best Practices for Using an Excel Income Tax Calculator

To get the most out of an Excel income tax calculator, follow these best practices:

- Regularly Update Formulas: Regularly update formulas to reflect changes in tax laws and regulations.

- Use Accurate Data: Use accurate and up-to-date data to ensure accurate calculations.

- Test and Refine: Test the calculator with sample data and refine the formulas as needed.

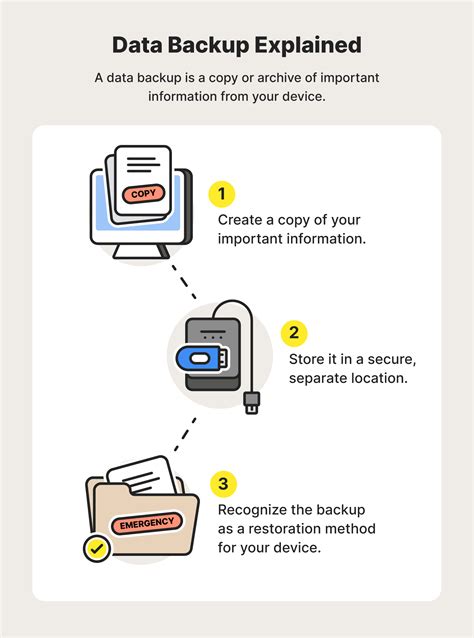

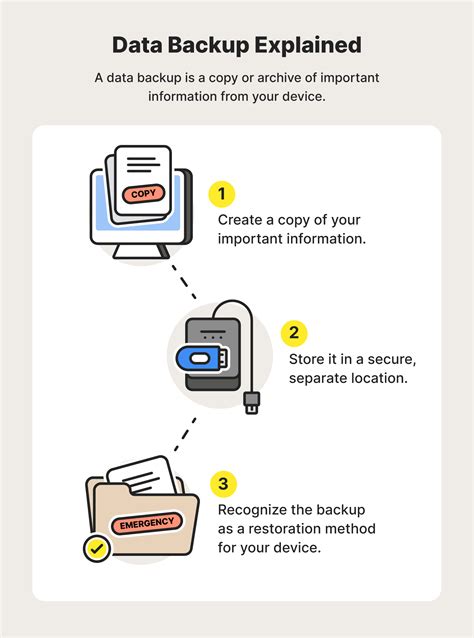

- Backup Your Data: Backup your data regularly to prevent loss in the event of a system failure.

Conclusion

An Excel income tax calculator is a powerful tool that can save you time and reduce the stress associated with tax calculations. By automating the calculation process, providing real-time results, and minimizing the risk of errors, an Excel income tax calculator can help you streamline tax planning and increase productivity. Whether you're an individual or a business, an Excel income tax calculator is an essential tool for managing your finances effectively.

Excel Income Tax Calculator Image Gallery

We hope this article has provided you with a comprehensive understanding of how an Excel income tax calculator can save you time and reduce the stress associated with tax calculations. Whether you're an individual or a business, an Excel income tax calculator is an essential tool for managing your finances effectively. If you have any questions or comments, please feel free to share them below.