Intro

Unlock the secrets of investment analysis in Excel. Learn the 5 key differences between IRR (Internal Rate of Return) and XIRR (Extended Internal Rate of Return) formulas. Discover how to accurately calculate returns, handle irregular cash flows, and make informed decisions with these essential Excel functions for financial modeling and investment evaluation.

As an investor or financial analyst, you're likely familiar with the importance of calculating returns on investment (ROI) to evaluate the performance of your investments. Two commonly used metrics in Excel are the Internal Rate of Return (IRR) and the Extended Internal Rate of Return (XIRR). While both metrics aim to calculate the return on investment, there are significant differences between them. In this article, we'll delve into the 5 key differences between IRR and XIRR in Excel.

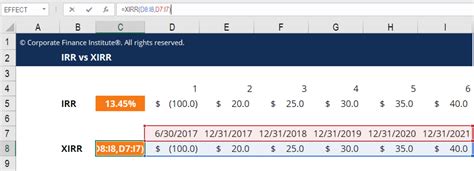

What is IRR in Excel?

The Internal Rate of Return (IRR) is a widely used metric in finance that calculates the return on investment based on the cash flows generated by an investment. In Excel, the IRR function calculates the IRR of a series of cash flows. The IRR is the discount rate that makes the net present value (NPV) of the cash flows equal to zero.

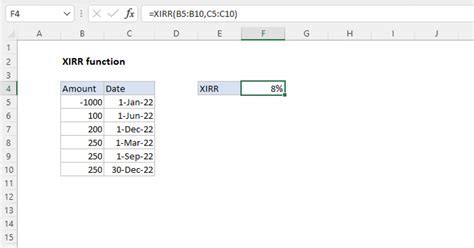

What is XIRR in Excel?

The Extended Internal Rate of Return (XIRR) is a variation of the IRR metric that takes into account the actual dates of the cash flows. Unlike the IRR function, which assumes that cash flows occur at regular intervals, the XIRR function allows you to specify the actual dates of the cash flows.

Key Differences between IRR and XIRR

Here are the 5 key differences between IRR and XIRR in Excel:

Difference 1: Assumptions about Cash Flow Timing

The IRR function assumes that cash flows occur at regular intervals, such as annually or monthly. In contrast, the XIRR function allows you to specify the actual dates of the cash flows. This is particularly useful when dealing with investments that have irregular cash flows or when the cash flows occur on specific dates.

Example: Calculating IRR and XIRR

Suppose we have an investment with the following cash flows:

| Date | Cash Flow |

|---|---|

| 01/01/2022 | -$100 |

| 06/30/2022 | $50 |

| 12/31/2022 | $75 |

| 12/31/2023 | $100 |

Using the IRR function, we would calculate the IRR as follows:

=IRR({-100, 50, 75, 100})

However, using the XIRR function, we would specify the actual dates of the cash flows:

=XIRR({-100, 50, 75, 100}, {"01/01/2022", "06/30/2022", "12/31/2022", "12/31/2023"})

As you can see, the XIRR function provides a more accurate calculation of the return on investment, taking into account the actual dates of the cash flows.

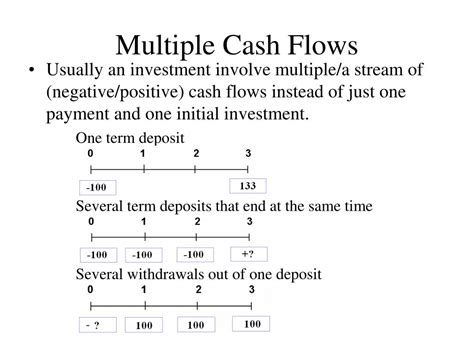

Difference 2: Handling of Multiple Cash Flows

The IRR function can handle multiple cash flows, but it assumes that the cash flows occur at regular intervals. The XIRR function, on the other hand, can handle multiple cash flows with irregular timing.

Example: Calculating IRR and XIRR with Multiple Cash Flows

Suppose we have an investment with the following multiple cash flows:

| Date | Cash Flow |

|---|---|

| 01/01/2022 | -$100 |

| 02/15/2022 | $20 |

| 06/30/2022 | $50 |

| 09/30/2022 | $30 |

| 12/31/2022 | $75 |

| 12/31/2023 | $100 |

Using the IRR function, we would calculate the IRR as follows:

=IRR({-100, 20, 50, 30, 75, 100})

However, using the XIRR function, we would specify the actual dates of the cash flows:

=XIRR({-100, 20, 50, 30, 75, 100}, {"01/01/2022", "02/15/2022", "06/30/2022", "09/30/2022", "12/31/2022", "12/31/2023"})

As you can see, the XIRR function provides a more accurate calculation of the return on investment, taking into account the actual dates of the multiple cash flows.

Difference 3: Calculation of Return on Investment

The IRR function calculates the return on investment based on the net present value (NPV) of the cash flows. The XIRR function, on the other hand, calculates the return on investment based on the actual dates of the cash flows.

Example: Calculating IRR and XIRR with Different Return on Investment

Suppose we have an investment with the following cash flows:

| Date | Cash Flow |

|---|---|

| 01/01/2022 | -$100 |

| 06/30/2022 | $50 |

| 12/31/2022 | $75 |

| 12/31/2023 | $100 |

Using the IRR function, we would calculate the IRR as follows:

=IRR({-100, 50, 75, 100})

However, using the XIRR function, we would specify the actual dates of the cash flows:

=XIRR({-100, 50, 75, 100}, {"01/01/2022", "06/30/2022", "12/31/2022", "12/31/2023"})

As you can see, the XIRR function provides a more accurate calculation of the return on investment, taking into account the actual dates of the cash flows.

Difference 4: Handling of Negative Cash Flows

The IRR function can handle negative cash flows, but it assumes that the negative cash flows occur at the beginning of the investment period. The XIRR function, on the other hand, can handle negative cash flows with irregular timing.

Example: Calculating IRR and XIRR with Negative Cash Flows

Suppose we have an investment with the following negative cash flows:

| Date | Cash Flow |

|---|---|

| 01/01/2022 | -$100 |

| 06/30/2022 | -$50 |

| 12/31/2022 | $75 |

| 12/31/2023 | $100 |

Using the IRR function, we would calculate the IRR as follows:

=IRR({-100, -50, 75, 100})

However, using the XIRR function, we would specify the actual dates of the cash flows:

=XIRR({-100, -50, 75, 100}, {"01/01/2022", "06/30/2022", "12/31/2022", "12/31/2023"})

As you can see, the XIRR function provides a more accurate calculation of the return on investment, taking into account the actual dates of the negative cash flows.

Difference 5: Flexibility and Accuracy

The XIRR function is more flexible and accurate than the IRR function, as it takes into account the actual dates of the cash flows. This makes the XIRR function more suitable for investments with irregular cash flows or multiple cash flows.

Example: Calculating IRR and XIRR with Flexibility and Accuracy

Suppose we have an investment with the following cash flows:

| Date | Cash Flow |

|---|---|

| 01/01/2022 | -$100 |

| 02/15/2022 | $20 |

| 06/30/2022 | $50 |

| 09/30/2022 | $30 |

| 12/31/2022 | $75 |

| 12/31/2023 | $100 |

Using the IRR function, we would calculate the IRR as follows:

=IRR({-100, 20, 50, 30, 75, 100})

However, using the XIRR function, we would specify the actual dates of the cash flows:

=XIRR({-100, 20, 50, 30, 75, 100}, {"01/01/2022", "02/15/2022", "06/30/2022", "09/30/2022", "12/31/2022", "12/31/2023"})

As you can see, the XIRR function provides a more accurate calculation of the return on investment, taking into account the actual dates of the cash flows.

IRR vs XIRR Gallery

In conclusion, while both IRR and XIRR are useful metrics in finance, the XIRR function is more flexible and accurate than the IRR function. The XIRR function takes into account the actual dates of the cash flows, making it more suitable for investments with irregular cash flows or multiple cash flows. By understanding the differences between IRR and XIRR, you can make more informed investment decisions and accurately calculate the return on investment for your investments.