Excel is an essential tool for any business or financial analysis, and calculating the payback period is one of the most common and important tasks. The payback period is the time it takes for an investment to generate cash flows that equal the initial cost of the investment. In this article, we will explore how to calculate the payback period in Excel, including the formula, examples, and a step-by-step guide.

Understanding the Payback Period

The payback period is a critical metric in investment analysis, as it helps investors and businesses determine the feasibility of a project or investment. It is calculated by dividing the initial investment by the net cash flows generated by the investment. The payback period is expressed in years or months, and it represents the time it takes for the investment to break even.

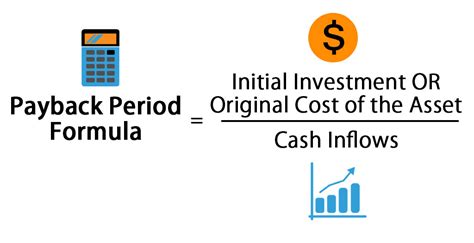

The Payback Period Formula

The payback period formula is straightforward:

Payback Period = Initial Investment / Net Cash Flows

Where:

- Initial Investment is the upfront cost of the investment

- Net Cash Flows are the cash inflows minus cash outflows generated by the investment

Calculating Payback Period in Excel

To calculate the payback period in Excel, you can use the following steps:

- Enter the initial investment in a cell, say A1.

- Enter the net cash flows for each year or period in a column, say B1:B5.

- Use the formula =-A1/SUM(B1:B5) to calculate the payback period.

Assuming the initial investment is $10,000 and the net cash flows are $2,000, $3,000, $4,000, $5,000, and $6,000 for each of the five years, the formula would be:

=-$10,000/SUM($2,000:$6,000)

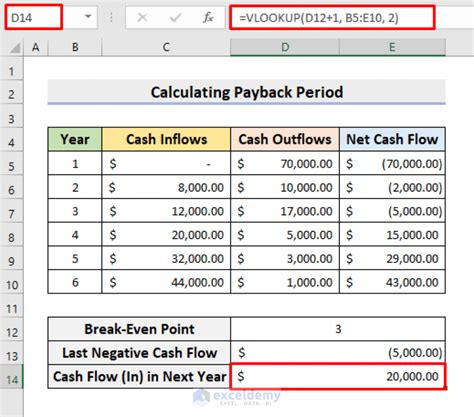

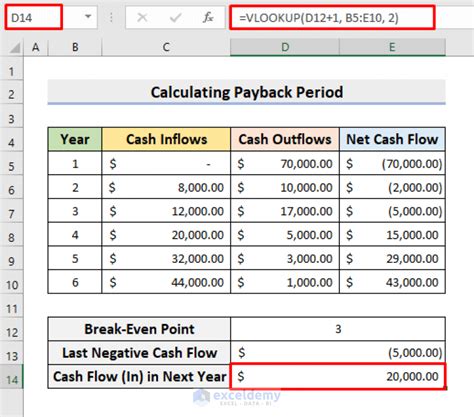

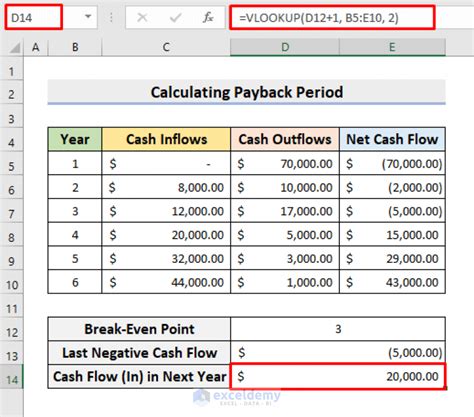

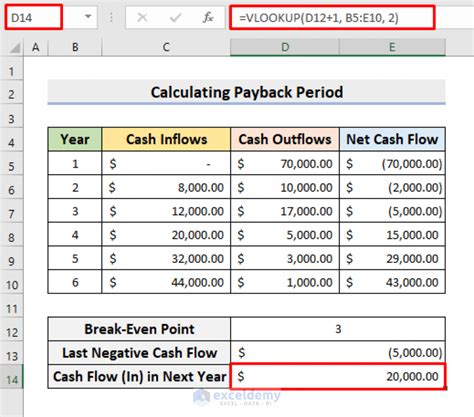

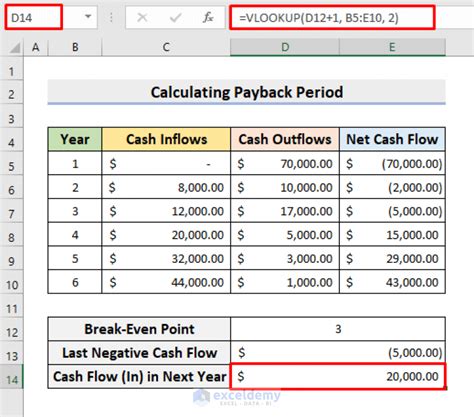

Image:

Example: Calculating Payback Period for a Project

Suppose we have a project with an initial investment of $50,000, and the net cash flows are $10,000, $15,000, $20,000, $25,000, and $30,000 for each of the five years.

Image:

Using the formula, we can calculate the payback period as follows:

=-$50,000/SUM($10,000:$30,000)

The result would be approximately 2.5 years.

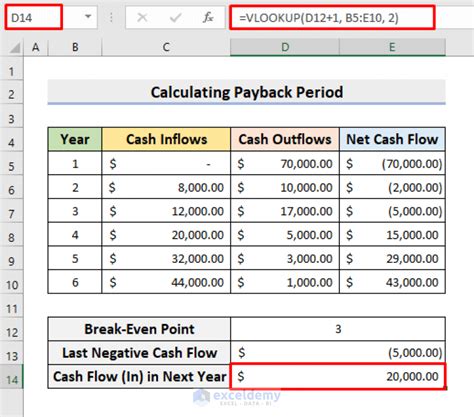

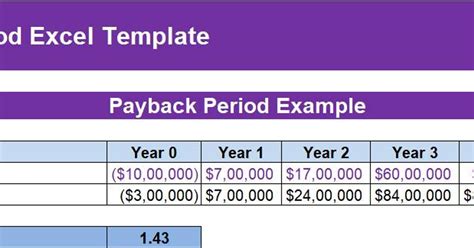

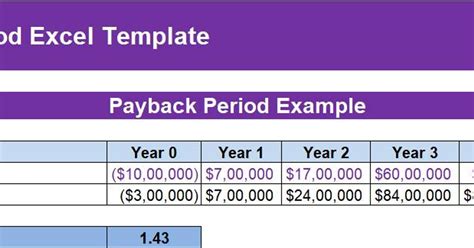

Payback Period Template in Excel

To make calculations easier, you can create a payback period template in Excel. Here's a simple template:

Image:

Step-by-Step Guide to Creating a Payback Period Template

To create a payback period template in Excel, follow these steps:

- Create a table with the following columns: Initial Investment, Net Cash Flows, and Payback Period.

- Enter the initial investment in the first column.

- Enter the net cash flows for each year or period in the second column.

- Use the formula =-A1/SUM(B1:B5) to calculate the payback period in the third column.

- Format the template to make it visually appealing.

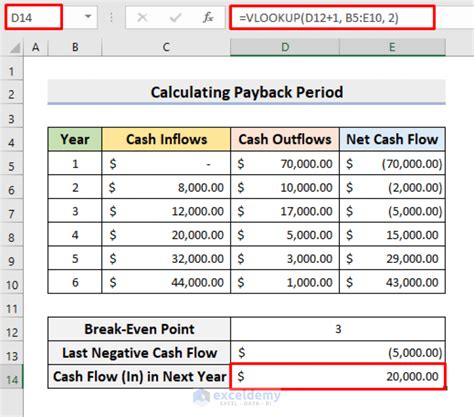

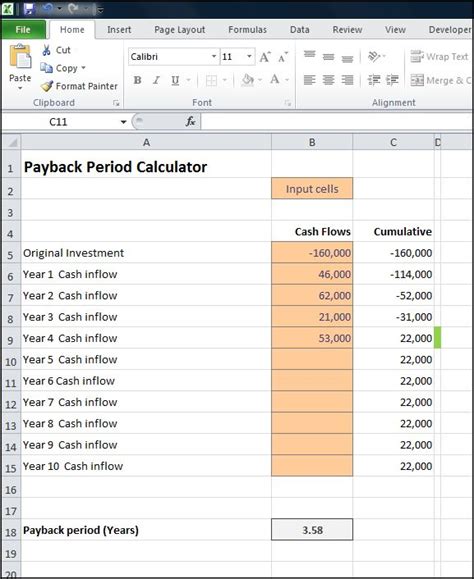

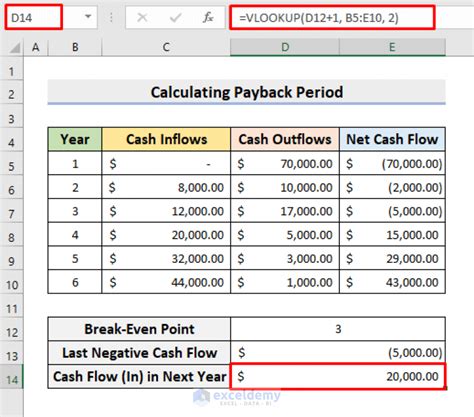

Payback Period Calculator

If you want to create a payback period calculator in Excel, you can use the following steps:

Image:

- Create a user interface with input fields for the initial investment and net cash flows.

- Use the formula =-A1/SUM(B1:B5) to calculate the payback period.

- Display the result in a separate cell or field.

Advantages and Disadvantages of Using Excel for Payback Period Calculation

Using Excel for payback period calculation has several advantages, including:

- Ease of use: Excel is a widely used software, and most people are familiar with its interface.

- Flexibility: Excel allows you to create custom templates and formulas to suit your specific needs.

- Accuracy: Excel calculations are accurate and reliable.

However, there are also some disadvantages to using Excel for payback period calculation, including:

- Complexity: Excel formulas can be complex and difficult to understand for beginners.

- Errors: Excel formulas can be prone to errors, especially if you are not careful with formatting and data entry.

Gallery of Payback Period Calculation Images

Payback Period Calculation Images

Conclusion

Calculating the payback period in Excel is a straightforward process that can be accomplished using a simple formula. By following the steps outlined in this article, you can create a payback period template or calculator in Excel to help you make informed investment decisions. Remember to always use accurate and reliable data, and to format your template to make it visually appealing.