The payback period is a crucial metric in finance and accounting, helping businesses and investors determine the feasibility of a project or investment. In this article, we will delve into the world of Excel payback period formula, exploring its significance, calculation methods, and practical applications.

Why is Payback Period Important?

The payback period represents the amount of time it takes for an investment to generate returns equal to its initial cost. This metric is essential for several reasons:

- It helps investors evaluate the viability of a project or investment by estimating the time it takes to recover their initial outlay.

- It enables businesses to compare different investment opportunities and prioritize those with shorter payback periods.

- It provides a simple and intuitive way to assess the risk associated with an investment, as shorter payback periods generally indicate lower risk.

Excel Payback Period Formula: Calculation Methods

Calculating the payback period in Excel is relatively straightforward. There are two common methods:

1. Basic Payback Period Formula

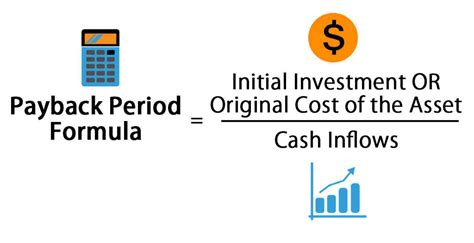

The basic payback period formula is:

Payback Period = Initial Investment / Annual Cash Flow

Where:

- Initial Investment is the upfront cost of the investment.

- Annual Cash Flow is the annual return on investment.

In Excel, you can calculate the payback period using the following formula:

=Initial Investment / Annual Cash Flow

For example, if the initial investment is $10,000 and the annual cash flow is $2,500, the payback period would be:

=10000 / 2500 =4 years

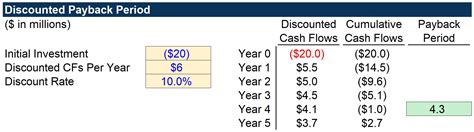

2. Discounted Payback Period Formula

The discounted payback period formula takes into account the time value of money, using the present value of future cash flows to calculate the payback period. The formula is:

Payback Period = Initial Investment / (Annual Cash Flow x (1 - Discount Rate)^Year)

Where:

- Initial Investment is the upfront cost of the investment.

- Annual Cash Flow is the annual return on investment.

- Discount Rate is the rate at which future cash flows are discounted.

- Year is the number of years.

In Excel, you can calculate the discounted payback period using the following formula:

=XNPV(Discount Rate, Annual Cash Flow, Years) / Annual Cash Flow

For example, if the initial investment is $10,000, the annual cash flow is $2,500, the discount rate is 10%, and the years is 5, the discounted payback period would be:

=XNPV(0.1, 2500, 5) / 2500 =4.17 years

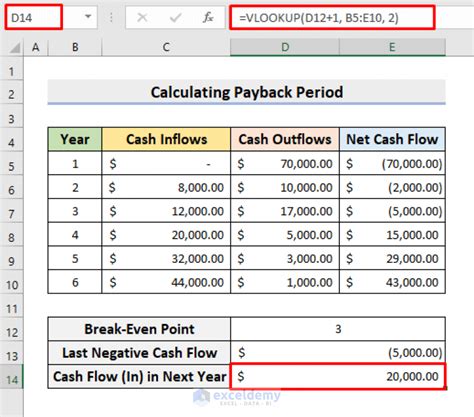

How to Calculate Payback Period in Excel: Step-by-Step Guide

To calculate the payback period in Excel, follow these steps:

- Set up your data: Enter the initial investment, annual cash flow, and discount rate (if applicable) into separate cells.

- Use the basic payback period formula: Type the formula

=Initial Investment / Annual Cash Flowinto a new cell. - Use the discounted payback period formula: Type the formula

=XNPV(Discount Rate, Annual Cash Flow, Years) / Annual Cash Flowinto a new cell. - Calculate the payback period: Press Enter to calculate the payback period.

Practical Applications of Payback Period Formula

The payback period formula has various practical applications in finance and accounting, including:

- Evaluating investment opportunities: Use the payback period formula to compare different investment opportunities and prioritize those with shorter payback periods.

- Assessing risk: Use the payback period formula to assess the risk associated with an investment, as shorter payback periods generally indicate lower risk.

- Budgeting and forecasting: Use the payback period formula to estimate the time it takes for an investment to generate returns equal to its initial cost.

Gallery of Payback Period Formula

Payback Period Formula Image Gallery

Frequently Asked Questions

Q: What is the payback period formula?

A: The payback period formula is a calculation used to determine the amount of time it takes for an investment to generate returns equal to its initial cost.

Q: How do I calculate the payback period in Excel?

A: To calculate the payback period in Excel, use the basic payback period formula =Initial Investment / Annual Cash Flow or the discounted payback period formula =XNPV(Discount Rate, Annual Cash Flow, Years) / Annual Cash Flow.

Q: What is the significance of the payback period?

A: The payback period is significant because it helps investors evaluate the viability of a project or investment, assess the risk associated with an investment, and prioritize investments with shorter payback periods.

Call to Action

In conclusion, the payback period formula is a valuable tool for investors and businesses to evaluate investment opportunities and prioritize those with shorter payback periods. By following the step-by-step guide and using the practical applications outlined in this article, you can master the payback period formula and make informed investment decisions. Share your experiences and ask questions in the comments section below!