Effective financial planning is crucial for individuals, businesses, and organizations to manage their expenses, income, and savings efficiently. One of the essential tools for financial planning is a payment calculator, which helps in estimating and tracking payments, interest rates, and loan terms. Microsoft Excel, a popular spreadsheet software, offers a convenient platform to create a payment calculator template. In this article, we will explore the benefits and working mechanism of an Excel payment calculator template and provide a step-by-step guide on how to create one.

Benefits of Using an Excel Payment Calculator Template

An Excel payment calculator template offers numerous benefits for individuals and businesses, including:

- Easy calculations: The template allows users to input various parameters, such as loan amount, interest rate, and loan term, to calculate the monthly payment amount.

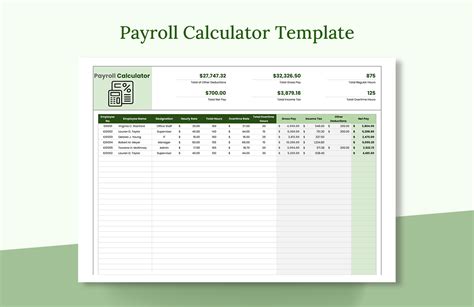

- Customization: Users can modify the template to suit their specific needs, including changing the interest rate, loan term, or payment frequency.

- Accuracy: The template ensures accurate calculations, reducing the risk of human error.

- Time-saving: The template saves time and effort, as users can quickly input data and obtain results.

- Reusability: The template can be reused for multiple calculations, making it a valuable tool for financial planning.

How to Create an Excel Payment Calculator Template

Creating an Excel payment calculator template is a straightforward process that requires basic knowledge of Excel formulas and functions. Here's a step-by-step guide to create a basic payment calculator template:

Step 1: Set up the template structure

- Open a new Excel spreadsheet and create a table with the following columns: Loan Amount, Interest Rate, Loan Term, and Monthly Payment.

- Set up the table headers and format the columns to make the template visually appealing.

Step 2: Enter the formulas

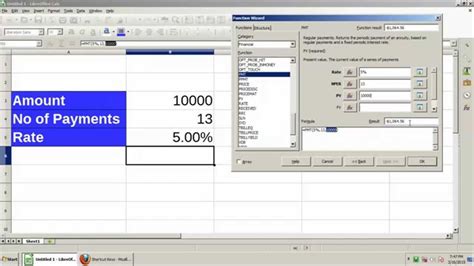

- In the Monthly Payment column, enter the formula:

=PMT(Interest Rate/12, Loan Term\*12, Loan Amount) - The PMT function calculates the monthly payment amount based on the interest rate, loan term, and loan amount.

Step 3: Format the template

- Format the template to display the results in a clear and readable format.

- Use Excel's built-in formatting options, such as borders, shading, and fonts, to make the template visually appealing.

Step 4: Add input fields

- Create input fields for the user to enter the loan amount, interest rate, and loan term.

- Use Excel's input field functionality to restrict input to specific formats, such as numbers or percentages.

Step 5: Test the template

- Test the template by entering different values for the loan amount, interest rate, and loan term.

- Verify that the template calculates the monthly payment amount accurately.

Advanced Features of an Excel Payment Calculator Template

While the basic template provides a solid foundation for financial planning, you can enhance it with advanced features to make it more comprehensive and user-friendly. Some advanced features to consider include:

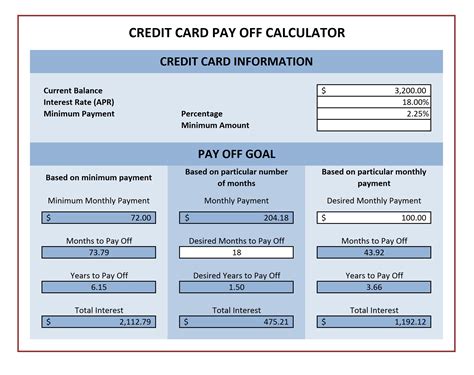

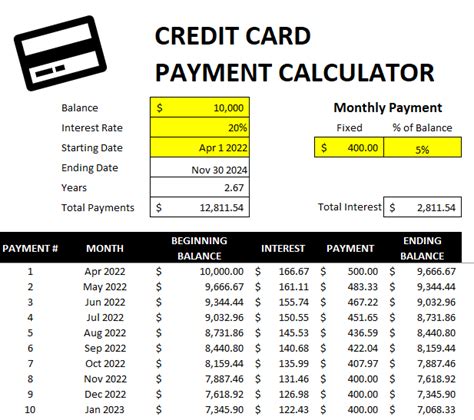

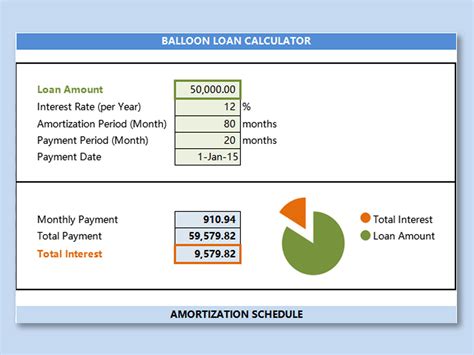

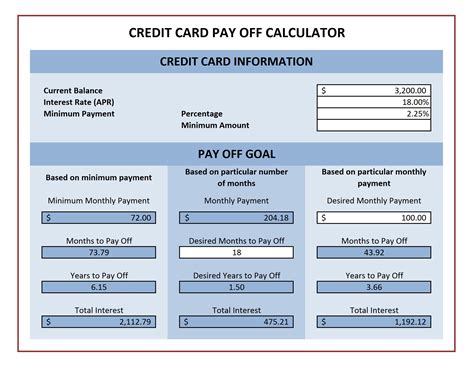

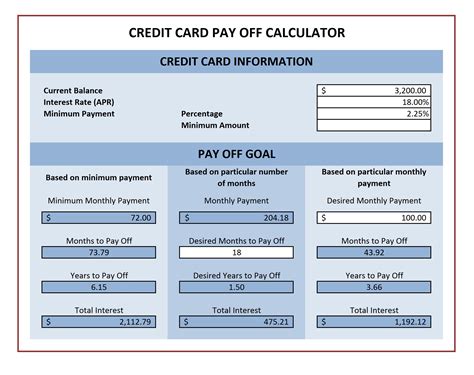

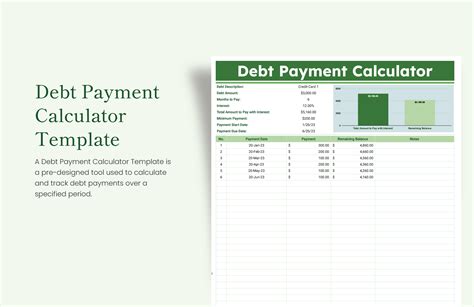

- Amortization schedule: Create a schedule that outlines the payment amount, interest paid, and principal balance for each payment period.

- Interest rate scenarios: Allow users to input different interest rate scenarios to compare the impact on monthly payments.

- Loan term scenarios: Allow users to input different loan term scenarios to compare the impact on monthly payments.

- Payment frequency: Allow users to input different payment frequencies, such as monthly, quarterly, or annually.

Tips and Tricks for Using an Excel Payment Calculator Template

To get the most out of your Excel payment calculator template, follow these tips and tricks:

- Use formulas and functions: Leverage Excel's built-in formulas and functions to create a robust and accurate template.

- Format for readability: Use formatting options to make the template easy to read and understand.

- Test and validate: Test the template thoroughly to ensure accuracy and validity.

- Customize for specific needs: Modify the template to suit specific financial planning needs, such as mortgage or car loan calculations.

Gallery of Payment Calculator Templates

Payment Calculator Template Gallery

Frequently Asked Questions

Q: What is a payment calculator template? A: A payment calculator template is a pre-designed spreadsheet that helps users calculate loan payments, interest rates, and loan terms.

Q: What are the benefits of using a payment calculator template? A: The benefits include easy calculations, customization, accuracy, time-saving, and reusability.

Q: How do I create a payment calculator template in Excel? A: Create a table with columns for loan amount, interest rate, loan term, and monthly payment. Enter the PMT formula to calculate the monthly payment amount.

Q: Can I customize the template for specific financial planning needs? A: Yes, you can modify the template to suit specific needs, such as mortgage or car loan calculations.

We hope this article has provided you with a comprehensive understanding of Excel payment calculator templates and how to create one. Whether you're an individual or a business, a payment calculator template can be a valuable tool for financial planning. Take the first step towards efficient financial management by creating your own template today!