Intro

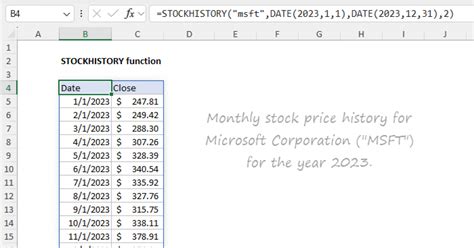

Master Excel data analysis with our practical guide to stock history example. Learn how to track, visualize, and analyze historical stock data using Excel formulas, charts, and pivot tables. Discover how to apply data visualization techniques, identify trends, and make informed investment decisions with our step-by-step tutorial and expert tips.

Unlocking the Power of Stock Market Analysis with Excel

Analyzing stock market trends and historical data is crucial for making informed investment decisions. Microsoft Excel is a powerful tool that can help you navigate the complex world of stock market analysis. With its extensive range of features and functions, Excel enables you to process, analyze, and visualize large datasets, making it an ideal choice for stock market enthusiasts and professionals alike. In this article, we will delve into the world of Excel stock history analysis, providing a comprehensive guide on how to harness the power of Excel to make data-driven investment decisions.

The Importance of Stock Market Analysis

Stock market analysis is a critical component of investment decision-making. By examining historical trends, identifying patterns, and forecasting future performance, investors can gain valuable insights into the potential risks and rewards associated with a particular stock. Effective analysis can help investors:

- Identify undervalued or overvalued stocks

- Develop informed investment strategies

- Manage risk and maximize returns

- Stay ahead of market trends and competitors

Setting Up Your Excel Stock History Template

To begin your Excel stock history analysis, you'll need to set up a template that can accommodate large datasets. Here's a step-by-step guide to creating a basic template:

- Open a new Excel workbook and create a worksheet for your stock history data.

- Set up a header row with the following columns:

- Date

- Open

- High

- Low

- Close

- Volume

- Adj Close

- Format the date column to display the desired date format.

- Use Excel's built-in functions to import historical stock data from reputable sources, such as Yahoo Finance or Quandl.

Working with Historical Stock Data

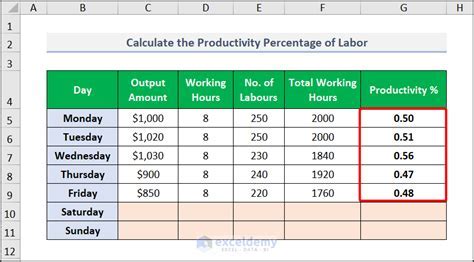

Once you've set up your template and imported historical data, you can begin analyzing the trends and patterns within the data. Here are some common techniques used in stock market analysis:

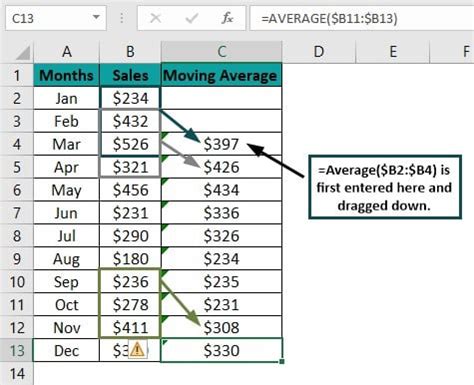

- Moving Averages: Calculate the average stock price over a specific period to identify trends and smooth out fluctuations.

- Relative Strength Index (RSI): Measure the magnitude of recent price changes to determine overbought or oversold conditions.

- Bollinger Bands: Plot the stock price and its volatility to identify trends and potential breakouts.

- Candlestick Charts: Visualize the stock price movement using open, high, low, and close prices to identify patterns and trends.

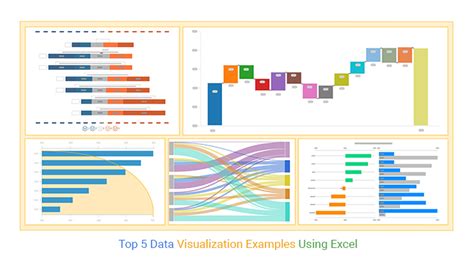

Visualizing Stock Market Trends with Excel Charts

Excel offers a wide range of charting options to help you visualize stock market trends and patterns. Here are some common chart types used in stock market analysis:

- Line Charts: Display the stock price movement over time to identify trends and patterns.

- Candlestick Charts: Visualize the stock price movement using open, high, low, and close prices to identify patterns and trends.

- Bar Charts: Compare the stock price movement across different time periods to identify trends and patterns.

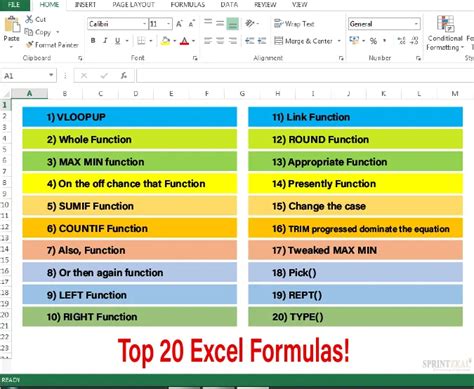

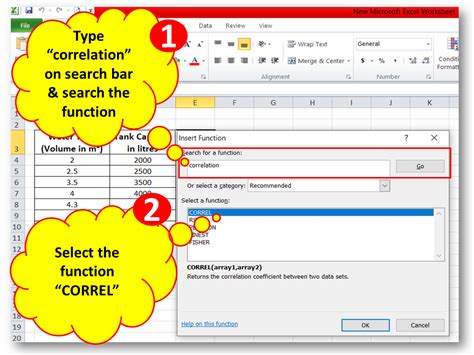

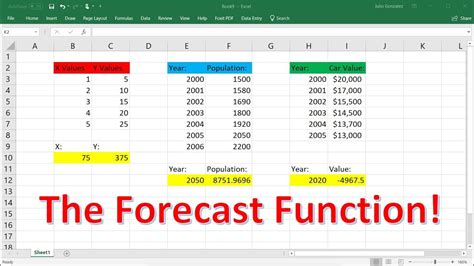

Excel Functions for Stock Market Analysis

Excel provides a range of functions that can help you analyze stock market data. Here are some common functions used in stock market analysis:

- AVERAGE: Calculate the average stock price over a specific period.

- STDEV: Calculate the standard deviation of the stock price movement.

- CORREL: Calculate the correlation between two or more stocks.

- FORECAST: Forecast future stock prices based on historical trends.

Advanced Stock Market Analysis Techniques

Once you've mastered the basics of Excel stock history analysis, you can move on to more advanced techniques, such as:

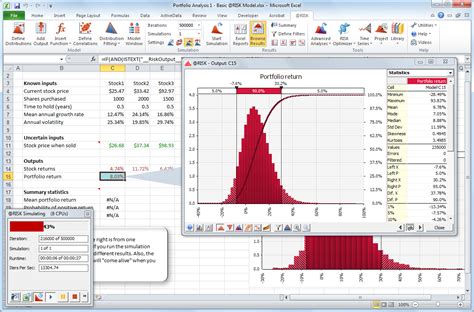

- Monte Carlo Simulations: Model the stock price movement using random sampling techniques to estimate potential returns.

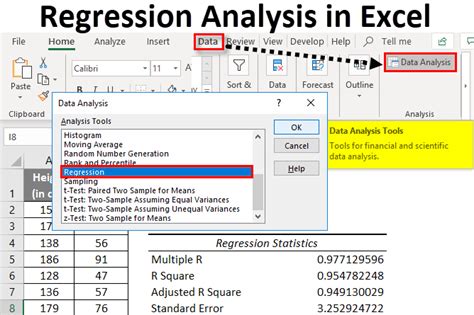

- Regression Analysis: Model the relationship between the stock price and other economic variables to forecast future prices.

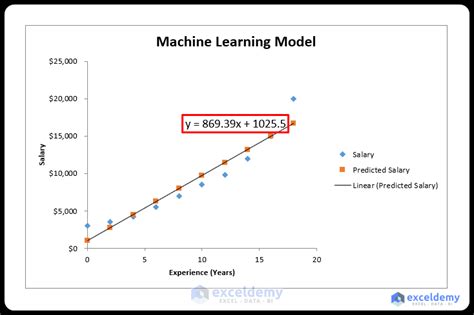

- Machine Learning: Use machine learning algorithms to identify patterns and trends in the stock market data.

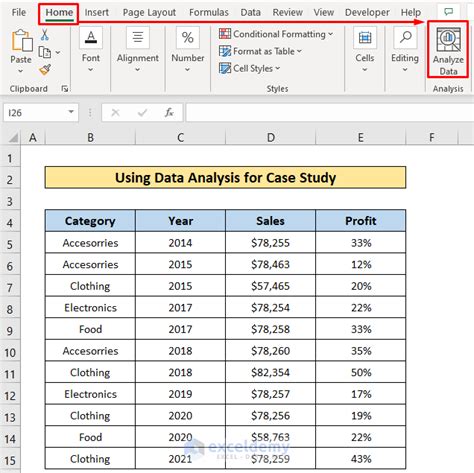

Excel Stock History Example: A Case Study

Let's apply the techniques discussed in this article to a real-world example. Suppose we want to analyze the historical stock price data for Apple Inc. (AAPL). We can use Excel to import the data, calculate moving averages, and visualize the trends using charts.

Gallery of Excel Stock History Examples

Excel Stock History Example Gallery

We hope this comprehensive guide has provided you with a deeper understanding of how to analyze stock market trends and historical data using Excel. Whether you're a seasoned investor or just starting out, Excel offers a powerful range of tools and techniques to help you make informed investment decisions. Remember to practice and apply these techniques to your own stock market analysis to unlock the full potential of Excel.

Share your thoughts! Have you used Excel for stock market analysis? What are your favorite techniques and tools? Share your experiences and insights in the comments section below.