Intro

Streamline your tax reporting with our free 1099-NEC Excel template. Easily manage non-employee compensation, accurately report payments, and meet IRS deadlines. Our template includes automatic calculations, data validation, and conditional formatting for effortless compliance. Simplify your paperwork, reduce errors, and stay organized with our intuitive and customizable template.

Are you a business owner or accountant struggling to manage and report 1099-Nec forms for your independent contractors and vendors? The good news is that you can simplify the process with a free 1099-Nec Excel template. This article will guide you through the importance of accurate 1099-Nec reporting, the benefits of using an Excel template, and provide a comprehensive step-by-step guide on how to use the template for easy reporting.

Understanding the Importance of 1099-Nec Reporting

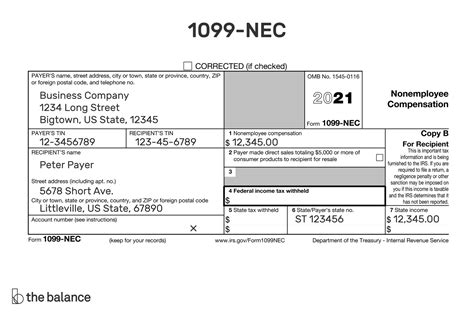

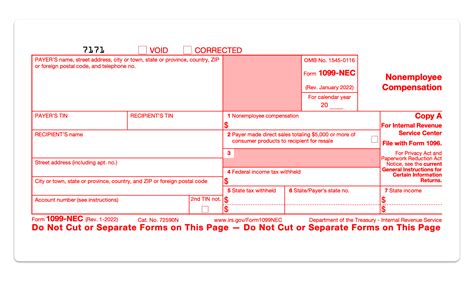

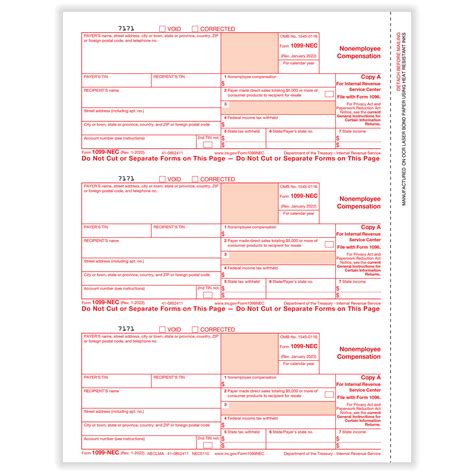

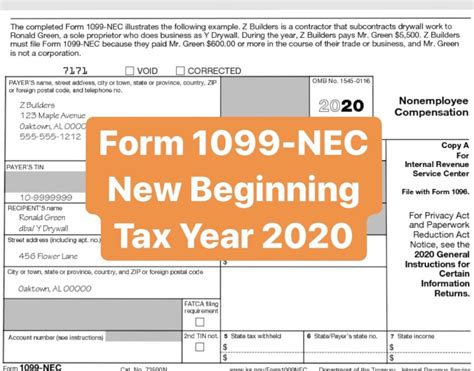

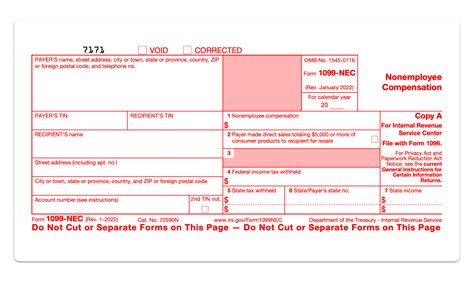

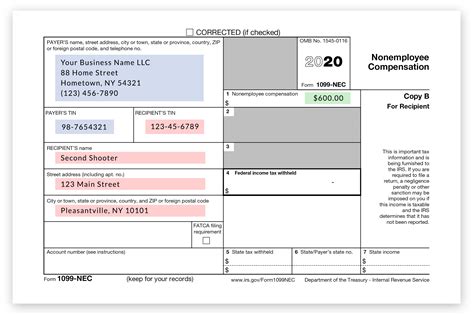

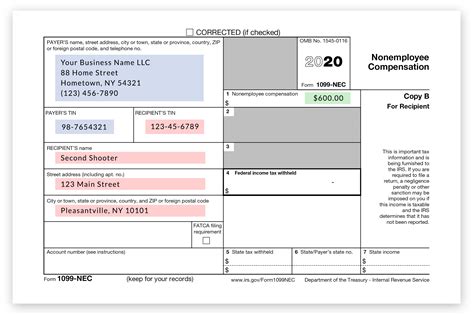

The 1099-Nec form is used to report non-employee compensation to the Internal Revenue Service (IRS). This form is typically used to report payments made to independent contractors, freelancers, and vendors who are not considered employees. Accurate and timely reporting of 1099-Nec forms is crucial for businesses to avoid penalties, fines, and even audits.

What are the Consequences of Late or Inaccurate 1099-Nec Reporting?

Late or inaccurate 1099-Nec reporting can result in:

- Penalties ranging from $30 to $100 per form

- Interest on unpaid penalties

- Potential audits and fines

- Damage to your business reputation

Benefits of Using a 1099-Nec Excel Template

Using a 1099-Nec Excel template can help simplify the reporting process and reduce the risk of errors. Here are some benefits of using a template:

- Easy data entry and management

- Automatic calculations and formatting

- Reduced risk of errors and penalties

- Increased efficiency and productivity

- Customizable to meet your business needs

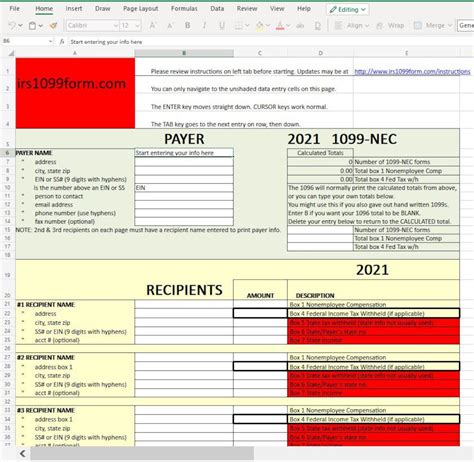

How to Use the Free 1099-Nec Excel Template

Here's a step-by-step guide on how to use the free 1099-Nec Excel template:

- Download the template: Click on the link to download the free 1099-Nec Excel template.

- Enter your business information: Enter your business name, address, and tax ID number in the designated cells.

- Enter contractor information: Enter the contractor's name, address, and tax ID number in the designated cells.

- Enter payment information: Enter the payment amount, payment date, and payment type in the designated cells.

- Calculate totals: The template will automatically calculate the totals for each contractor and the total amount paid.

- Review and edit: Review the template for accuracy and make any necessary edits.

- Print and file: Print the completed template and file it with the IRS by the deadline.

Tips and Best Practices for 1099-Nec Reporting

Here are some tips and best practices for 1099-Nec reporting:

- Keep accurate and detailed records of payments made to contractors and vendors.

- Use a template or software to simplify the reporting process.

- Review and edit the template carefully to avoid errors.

- File the completed template with the IRS by the deadline.

- Provide a copy of the completed template to the contractor or vendor.

Common Mistakes to Avoid in 1099-Nec Reporting

Here are some common mistakes to avoid in 1099-Nec reporting:

- Inaccurate or missing contractor information

- Incorrect payment amounts or dates

- Failure to report payments to the IRS

- Late filing or payment of penalties

Conclusion

Accurate and timely 1099-Nec reporting is crucial for businesses to avoid penalties, fines, and even audits. Using a free 1099-Nec Excel template can simplify the reporting process and reduce the risk of errors. By following the step-by-step guide and tips provided in this article, you can ensure accurate and compliant 1099-Nec reporting.

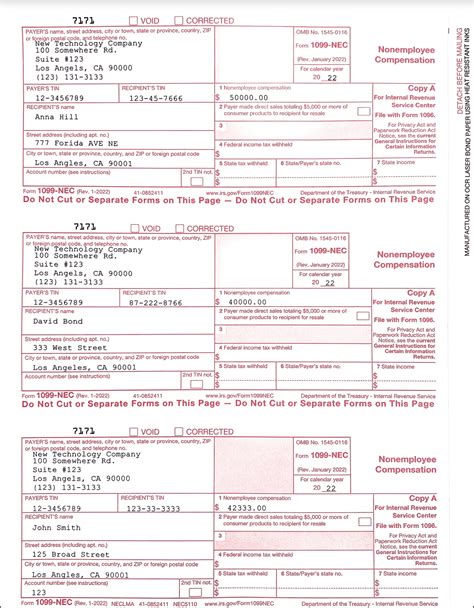

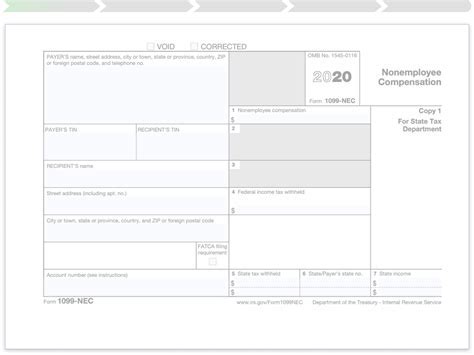

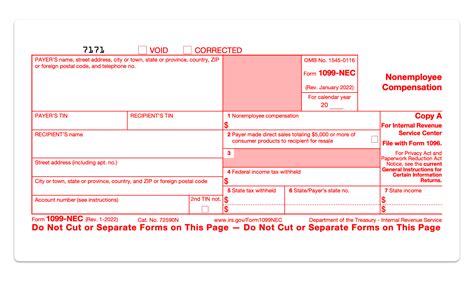

Gallery of 1099-Nec Reporting

1099-Nec Reporting Image Gallery

Frequently Asked Questions

Q: What is a 1099-Nec form? A: A 1099-Nec form is used to report non-employee compensation to the Internal Revenue Service (IRS).

Q: Who needs to file a 1099-Nec form? A: Businesses that make payments to independent contractors, freelancers, and vendors need to file a 1099-Nec form.

Q: What is the deadline for filing a 1099-Nec form? A: The deadline for filing a 1099-Nec form is January 31st of each year.

Q: Can I use a template to simplify the reporting process? A: Yes, you can use a free 1099-Nec Excel template to simplify the reporting process and reduce the risk of errors.

Q: What are the consequences of late or inaccurate 1099-Nec reporting? A: Late or inaccurate 1099-Nec reporting can result in penalties, fines, and even audits.

Share your thoughts and experiences with 1099-Nec reporting in the comments section below. Have you used a template to simplify the reporting process? What tips and best practices can you share with our readers?