Intro

Unlock the power of compound interest with our free Excel template. Easily calculate compound interest rates, principal amounts, and time periods with this user-friendly template. Discover how to harness the snowball effect of compound interest to supercharge your savings and investments. Download now and start growing your wealth exponentially!

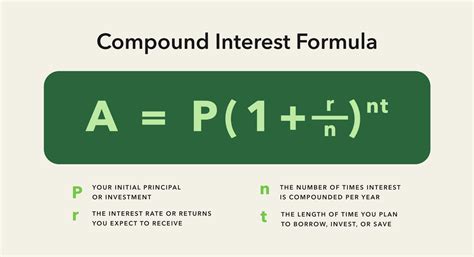

Understanding the power of compound interest is crucial for making informed investment decisions and achieving long-term financial goals. While calculating compound interest manually can be complex and time-consuming, using an Excel template can simplify the process and provide a clear picture of your investments. In this article, we will explore how to create an Excel template for compound interest calculation and provide a step-by-step guide on how to use it.

Why Use an Excel Template for Compound Interest Calculation?

Calculating compound interest using a formula can be daunting, especially for those who are not familiar with financial calculations. An Excel template provides a user-friendly interface that allows you to input variables and see the results instantly. Moreover, an Excel template can help you to:

- Calculate compound interest accurately and efficiently

- Compare different investment scenarios and make informed decisions

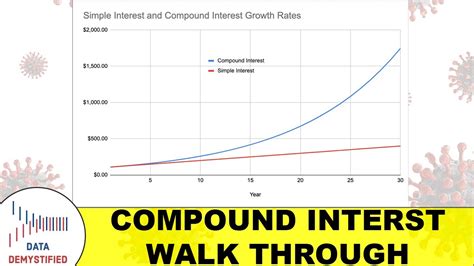

- Visualize the growth of your investments over time

- Identify the impact of different variables, such as interest rate and compounding frequency, on your investments

Creating an Excel Template for Compound Interest Calculation

To create an Excel template for compound interest calculation, follow these steps:

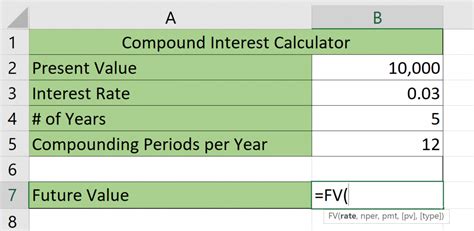

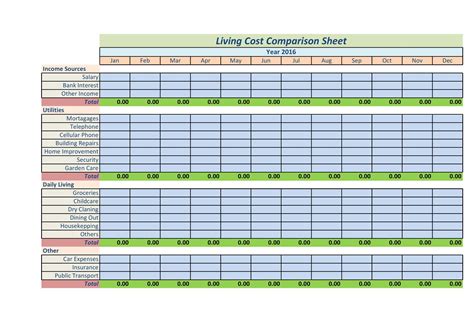

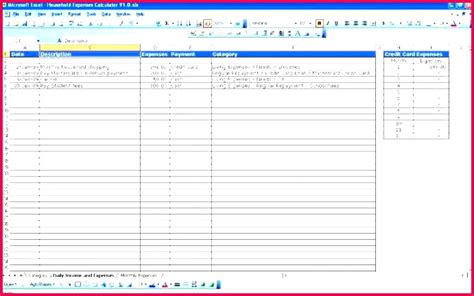

- Open a new Excel workbook and create a table with the following columns:

- Principal (initial investment)

- Interest Rate (annual interest rate)

- Compounding Frequency (number of times interest is compounded per year)

- Time (number of years the money is invested)

- Compound Interest (calculated compound interest)

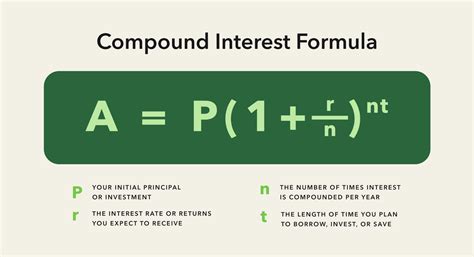

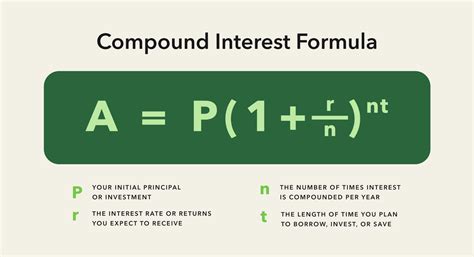

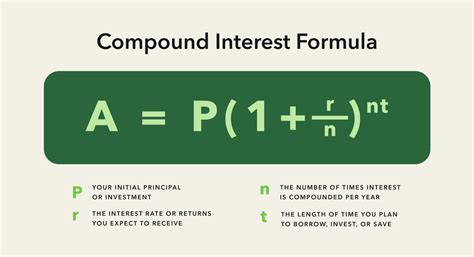

- Enter the following formula in the Compound Interest column:

=A1*(1+B1/C1)^(C1*D1)-A1- A1 is the Principal column

- B1 is the Interest Rate column

- C1 is the Compounding Frequency column

- D1 is the Time column

- Format the Compound Interest column to display the result as a currency value.

- Create a chart to visualize the growth of the investment over time.

How to Use the Excel Template for Compound Interest Calculation

Using the Excel template is straightforward. Simply enter the values for the Principal, Interest Rate, Compounding Frequency, and Time, and the template will calculate the compound interest automatically. Here's a step-by-step guide:

- Enter the Principal amount in the Principal column.

- Enter the annual Interest Rate in the Interest Rate column.

- Enter the Compounding Frequency in the Compounding Frequency column.

- Enter the Time period in the Time column.

- The template will calculate the Compound Interest and display the result in the Compound Interest column.

- Use the chart to visualize the growth of the investment over time.

Example Scenarios

Let's consider a few example scenarios to demonstrate the power of compound interest:

- Scenario 1: Investing $1,000 at an annual interest rate of 5% compounded monthly for 10 years.

- Scenario 2: Investing $5,000 at an annual interest rate of 7% compounded quarterly for 20 years.

- Scenario 3: Investing $10,000 at an annual interest rate of 3% compounded annually for 30 years.

Using the Excel template, we can calculate the compound interest for each scenario and compare the results.

Benefits of Using an Excel Template for Compound Interest Calculation

Using an Excel template for compound interest calculation offers several benefits, including:

- Accuracy: The template ensures accurate calculations, eliminating the risk of human error.

- Efficiency: The template saves time and effort, allowing you to focus on other important tasks.

- Flexibility: The template can be modified to accommodate different scenarios and variables.

- Visualization: The chart provides a clear visual representation of the investment's growth over time.

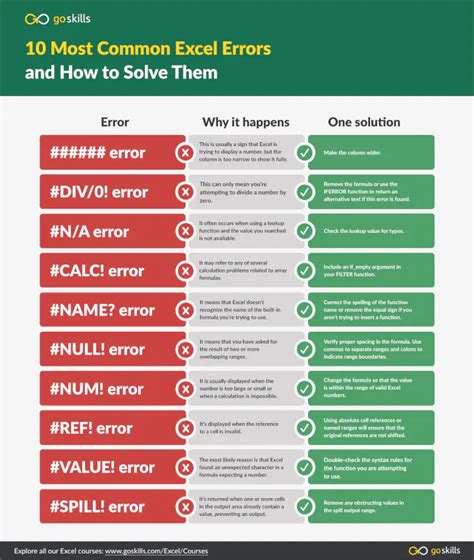

Common Mistakes to Avoid When Using an Excel Template for Compound Interest Calculation

When using an Excel template for compound interest calculation, avoid the following common mistakes:

- Incorrect formatting: Ensure that the template is formatted correctly to display the results as a currency value.

- Inconsistent units: Ensure that the units for the interest rate and compounding frequency are consistent.

- Incorrect formula: Double-check the formula to ensure that it is correct and accurate.

Best Practices for Using an Excel Template for Compound Interest Calculation

To get the most out of an Excel template for compound interest calculation, follow these best practices:

- Use clear and concise labels for the columns and rows.

- Use formatting to make the template easy to read and understand.

- Test the template with different scenarios to ensure accuracy and efficiency.

- Regularly update the template to reflect changes in interest rates or other variables.

Compound Interest Calculation Image Gallery

In conclusion, using an Excel template for compound interest calculation can simplify the process and provide a clear picture of your investments. By following the steps outlined in this article, you can create a template that meets your needs and helps you achieve your financial goals. Remember to avoid common mistakes and follow best practices to get the most out of your template.