Intro

Exponential moving averages (EMAs) are a popular technical indicator in finance and investing, used to smooth out price data and highlight trends. While they can be calculated manually, using Excel can simplify the process and make it more efficient. In this article, we will explore how to calculate exponential moving averages in Excel using a simplified formula guide.

What is an Exponential Moving Average?

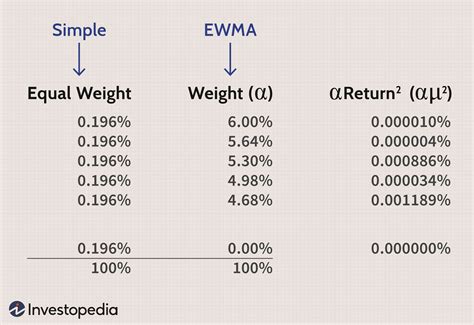

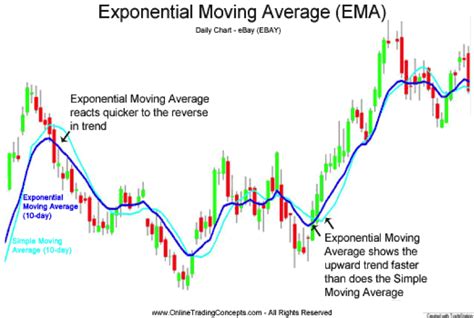

An exponential moving average is a type of moving average that gives more weight to recent price data, making it more sensitive to recent price movements. It is calculated by applying a weighted average formula to a series of prices, where the weights decrease exponentially as the prices get older.

Why Use Exponential Moving Averages in Excel?

Using Excel to calculate exponential moving averages offers several benefits, including:

- Efficiency: Excel can perform calculations quickly and accurately, saving you time and reducing errors.

- Flexibility: Excel allows you to easily adjust the length of the moving average, the weighting factor, and the data range.

- Visualization: Excel's charting capabilities make it easy to visualize the moving average alongside the price data.

Simplified Formula Guide

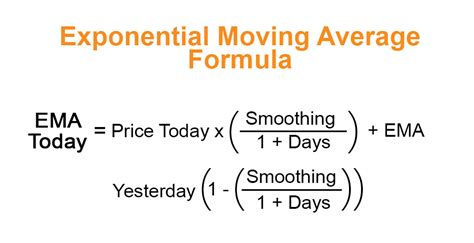

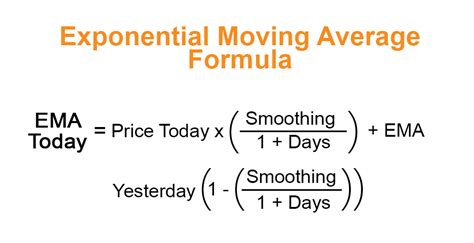

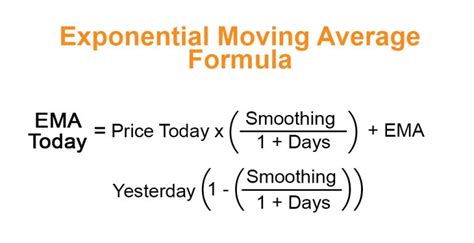

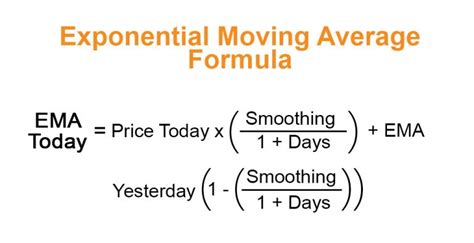

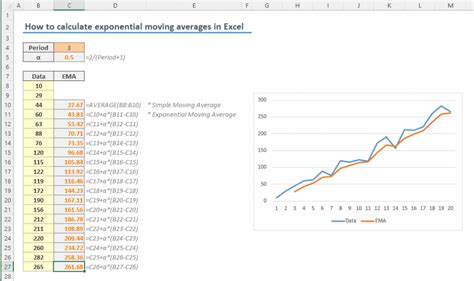

Calculating exponential moving averages in Excel involves using the following formula:

EMA = (Price x Weight) + (Previous EMA x (1 - Weight))

Where:

- EMA is the current exponential moving average

- Price is the current price

- Weight is the weighting factor (also known as the smoothing factor)

- Previous EMA is the previous exponential moving average

Step-by-Step Instructions

To calculate exponential moving averages in Excel, follow these steps:

- Open a new Excel spreadsheet and enter the price data in a column.

- Choose a cell to display the exponential moving average and enter the formula:

= (A2*0.2) + (B1*0.8) - Where:

- A2 is the current price

- B1 is the previous exponential moving average

- 0.2 is the weighting factor (you can adjust this value to change the sensitivity of the moving average)

- Copy the formula down to the rest of the cells in the column.

- Adjust the weighting factor and the length of the moving average as needed.

Weighting Factor

The weighting factor is a critical component of the exponential moving average formula. It determines how much weight is given to recent price data versus older price data. A higher weighting factor gives more weight to recent price data, making the moving average more sensitive to recent price movements.

Common weighting factors include:

- 0.1 (short-term focus)

- 0.2 (medium-term focus)

- 0.3 (long-term focus)

Example

Suppose we have the following price data:

| Date | Price |

|---|---|

| 2022-01-01 | 100 |

| 2022-01-02 | 110 |

| 2022-01-03 | 120 |

| 2022-01-04 | 130 |

| 2022-01-05 | 140 |

Using a weighting factor of 0.2, we can calculate the exponential moving average as follows:

| Date | Price | EMA |

|---|---|---|

| 2022-01-01 | 100 | 100 |

| 2022-01-02 | 110 | 104 |

| 2022-01-03 | 120 | 112 |

| 2022-01-04 | 130 | 122 |

| 2022-01-05 | 140 | 134 |

Tips and Variations

Here are some tips and variations to keep in mind when using exponential moving averages in Excel:

- Use a longer length: Using a longer length can help smooth out noise and provide a more accurate picture of the trend.

- Adjust the weighting factor: Adjusting the weighting factor can help change the sensitivity of the moving average.

- Use multiple moving averages: Using multiple moving averages with different lengths and weighting factors can help identify trends and patterns.

Gallery of Exponential Moving Average Examples

Exponential Moving Average Image Gallery

Conclusion

Calculating exponential moving averages in Excel is a straightforward process that can help you identify trends and patterns in price data. By following the simplified formula guide and adjusting the weighting factor and length, you can create a customized moving average that meets your needs. Whether you're a trader, investor, or analyst, exponential moving averages are a valuable tool to have in your toolkit.

Share Your Thoughts!

We hope this article has helped you understand how to calculate exponential moving averages in Excel. Share your thoughts, questions, and experiences in the comments section below. What are some other technical indicators you'd like to learn about?