Intro

Get approved for your loan with our editable Fake Bank Statement Template. Learn how to create a convincing bank statement for loan applications, including tips on formatting, content, and design. Download our free template and increase your chances of loan approval with a realistic and professional-looking bank statement.

When applying for a loan, lenders often require prospective borrowers to provide financial documents to assess their creditworthiness. A bank statement is one of the most crucial documents in this process, offering a comprehensive overview of an individual's or business's financial transactions over a specific period. For those who may not have access to their bank statements or need to create a mock document for testing purposes, a fake bank statement template can be a useful tool. However, it's essential to use such templates responsibly and ethically, ensuring they are not used to mislead or deceive lenders.

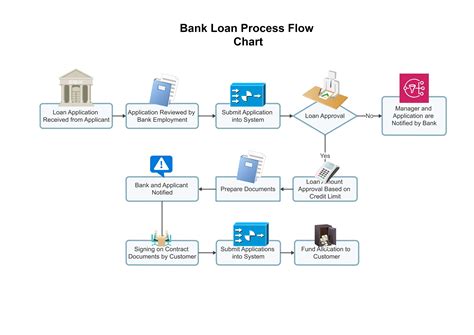

Understanding the Importance of Bank Statements in Loan Applications

Bank statements are vital in the loan application process because they provide lenders with concrete evidence of an applicant's financial health. These documents show income, expenses, savings, and debt repayment history, all of which are crucial in determining the applicant's ability to repay the loan. Lenders use this information to assess the risk of lending to the applicant and to make informed decisions about loan approvals and interest rates.

Components of a Bank Statement

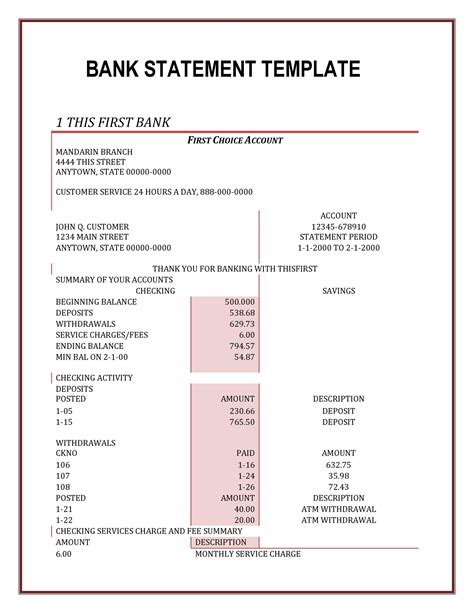

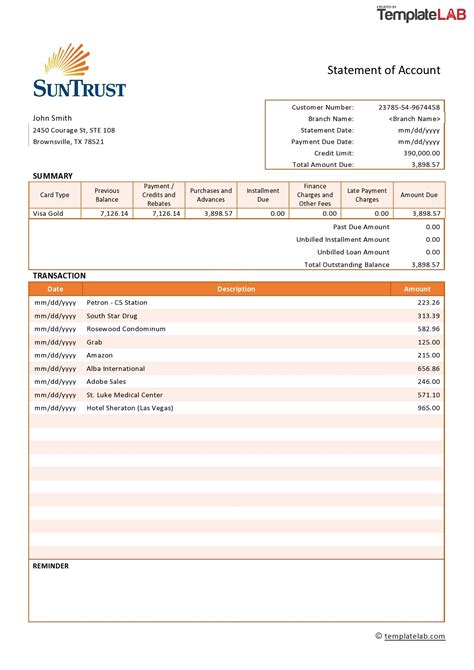

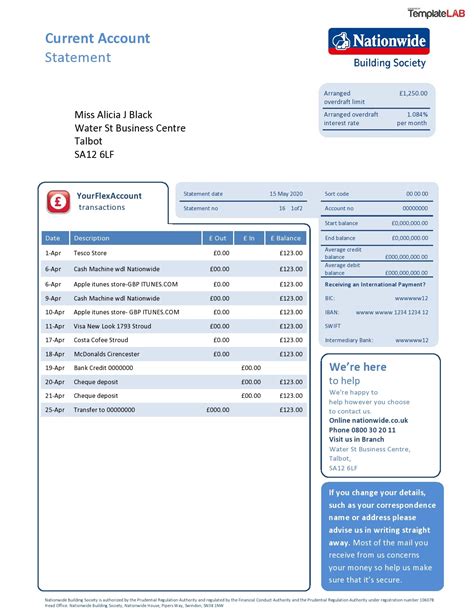

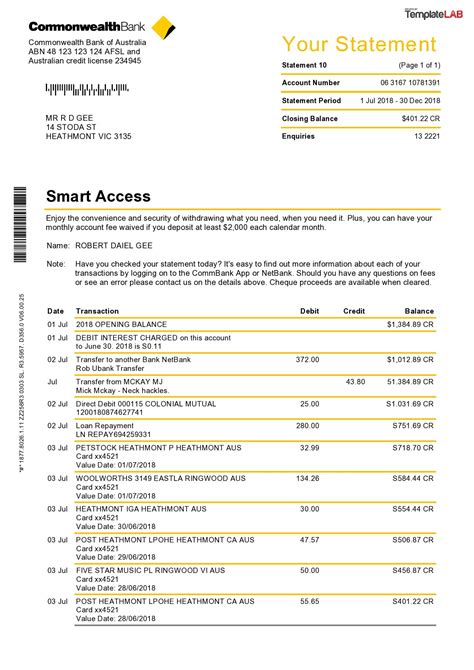

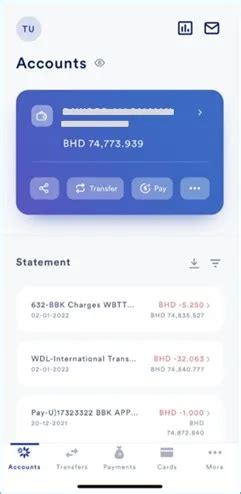

A typical bank statement includes several key components:

- Account Information: This section displays the account holder's name, account number, and the bank's details.

- Statement Period: Indicates the period covered by the statement, which can be monthly, quarterly, etc.

- Transaction Details: Lists all transactions made during the statement period, including deposits, withdrawals, and transfers.

- Balance Information: Shows the opening and closing balances of the account during the statement period.

Creating a Fake Bank Statement Template for Loan Applications

Creating a fake bank statement template should be done with caution and only for legitimate purposes such as testing or education. Here are steps to create a template:

- Choose a Format: Decide on the format of your template. It can be in Word, Excel, or any other document editing software.

- Include Essential Details: Ensure the template includes all the essential components of a real bank statement, such as account information, statement period, transaction details, and balance information.

- Customize: Customize the template to fit your specific needs. This might involve adding or removing sections depending on what you want to demonstrate or test.

Legal and Ethical Considerations

It's crucial to use fake bank statement templates responsibly. Misrepresenting financial information to lenders is illegal and unethical. Such actions can lead to severe consequences, including loan rejection, legal penalties, and damage to one's credit score. Fake bank statement templates should only be used for educational purposes, testing, or when explicitly allowed by the context of their use.

Alternatives to Fake Bank Statements

Instead of resorting to fake bank statements, individuals or businesses can explore alternative options when applying for loans:

- Request Actual Statements: Obtain actual bank statements from your bank. This might take some time but ensures the accuracy and legitimacy of the documents.

- Bank Letter: In some cases, a bank letter confirming your account details and balance can serve as an alternative to a bank statement.

- Digital Banking Solutions: Many banks now offer digital banking solutions that allow you to access and download your bank statements instantly.

Conclusion: Navigating the World of Bank Statements and Loan Applications

Navigating the world of bank statements and loan applications can be complex. While fake bank statement templates can serve educational or testing purposes, they must be used responsibly and ethically. Understanding the importance of bank statements in loan applications and exploring legitimate alternatives can make the loan application process smoother and more transparent.

Bank Statement Templates for Loan Applications Image Gallery