Intro

Stay safe from phishing scams! Learn 5 simple ways to spot a fake Capital One bank statement. Identify forged documents, detect malicious intent, and protect your account with our expert tips on verifying authenticity, checking for inconsistencies, and recognizing red flags. Shield your finances from cyber threats today!

In today's digital age, it's easier than ever for scammers to create fake documents, including bank statements. As a customer of Capital One Bank, it's essential to be able to spot a fake statement to avoid falling victim to financial fraud. In this article, we'll explore five ways to identify a fake Capital One Bank statement.

What's at Stake?

Before we dive into the ways to spot a fake statement, let's talk about what's at stake. If you receive a fake Capital One Bank statement, it could be a phishing attempt to steal your sensitive financial information. Scammers may use this information to gain access to your account, make unauthorized transactions, or even steal your identity.

1. Check the Logo and Branding

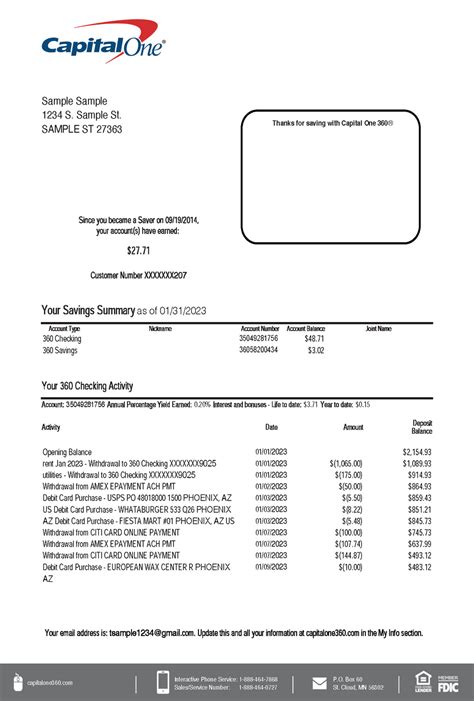

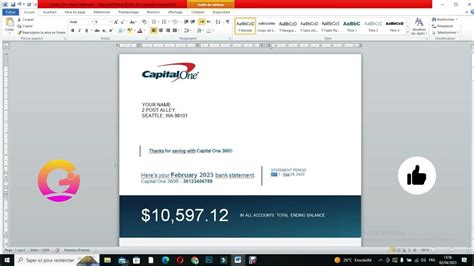

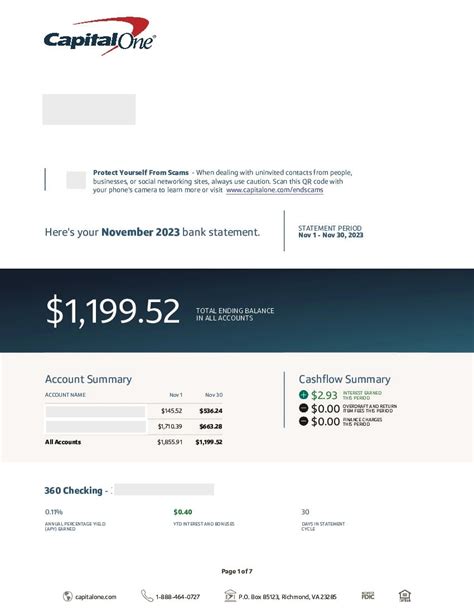

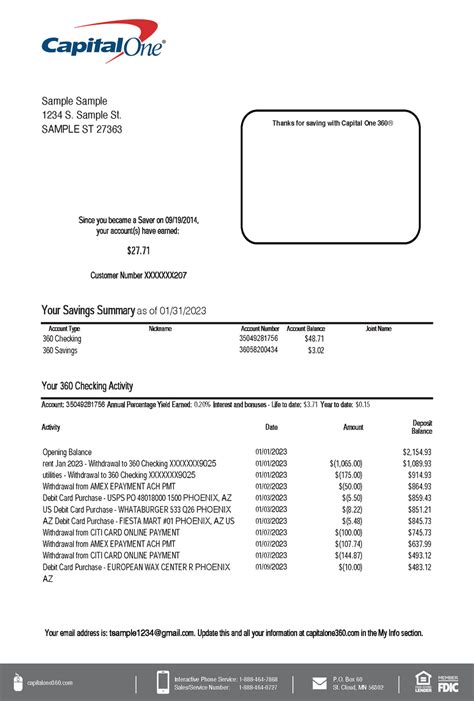

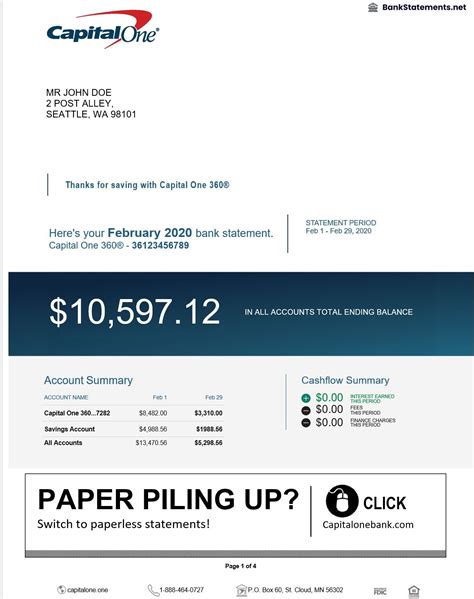

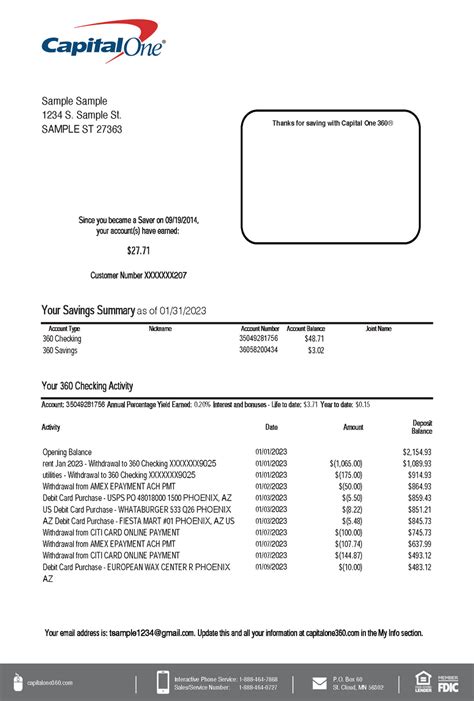

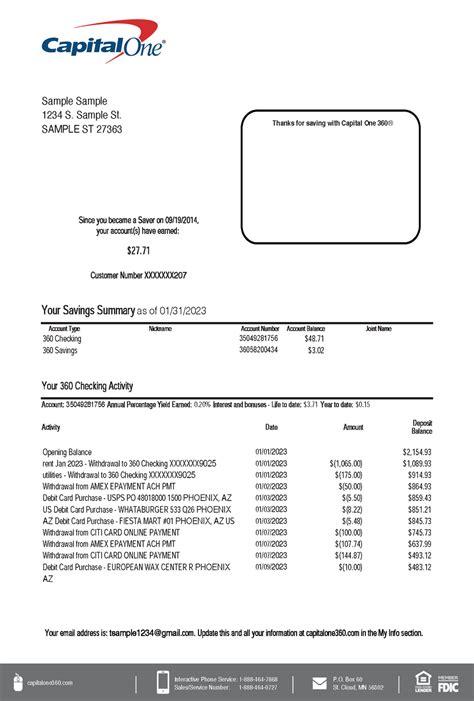

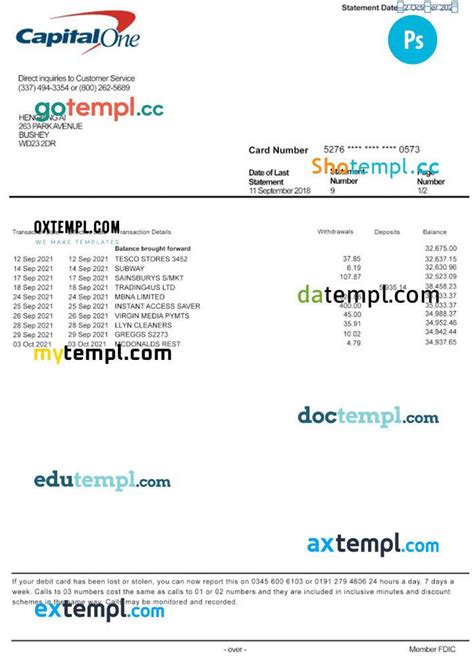

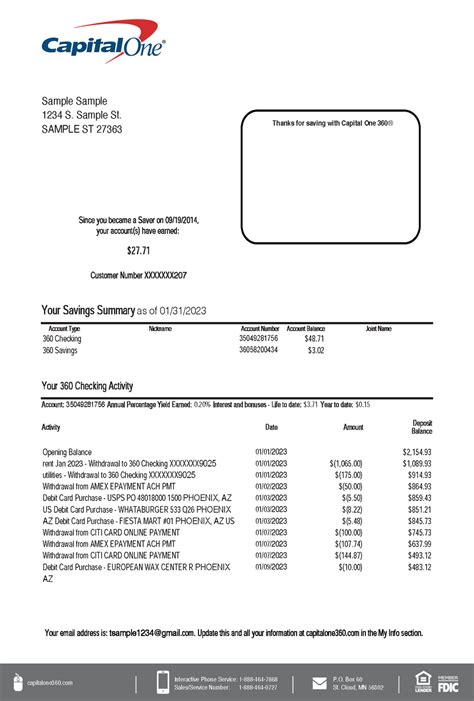

A genuine Capital One Bank statement will always feature the bank's official logo and branding. If the logo looks distorted, blurry, or different from the one on the bank's official website, it could be a sign of a fake statement.

Additionally, check the font and color scheme used in the statement. Capital One Bank uses a specific font and color scheme in their official communications. If the statement looks different, it may be a fake.

2. Verify the Account Information

A fake Capital One Bank statement may contain incorrect or inconsistent account information. Check the statement to ensure that your account number, name, and address are accurate. If any of this information is incorrect, it could be a sign of a fake statement.

3. Look for Grammar and Spelling Mistakes

A genuine Capital One Bank statement will be free of grammar and spelling mistakes. If the statement contains errors, it may indicate that it's a fake. Scammers often make mistakes when creating fake documents, so this can be a red flag.

4. Check the Transaction Details

A fake Capital One Bank statement may contain suspicious or unfamiliar transactions. Check the statement to ensure that all transactions are legitimate and familiar to you. If you notice any transactions that you don't recognize, it could be a sign of a fake statement.

5. Verify the Statement Date and Frequency

A genuine Capital One Bank statement will be sent to you on a regular basis, usually monthly. If you receive a statement outside of this frequency, it could be a sign of a fake statement. Additionally, check the statement date to ensure that it's consistent with your regular statement cycle.

What to Do If You Suspect a Fake Statement

If you suspect that you've received a fake Capital One Bank statement, there are several steps you can take:

- Contact Capital One Bank's customer service department immediately to report the incident.

- Do not respond to any emails or phone calls from the scammer.

- Keep a record of all communication with the scammer, including emails and phone calls.

- Monitor your account activity closely for any suspicious transactions.

Gallery of Capital One Bank Statement Images

Capital One Bank Statement Images

Conclusion

Spotting a fake Capital One Bank statement requires attention to detail and a healthy dose of skepticism. By following the five steps outlined in this article, you can protect yourself from financial fraud and ensure that your account information remains secure. Remember to always verify the authenticity of any statement you receive, and don't hesitate to contact Capital One Bank's customer service department if you have any concerns.