The rise of digital banking has made it easier for scammers to create fake bank statements, including those that appear to be from Chime Bank. Chime Bank is a popular online banking service that offers mobile banking, fee-free accounts, and early direct deposit. However, scammers have found ways to create convincing fake Chime Bank statements to deceive unsuspecting victims. In this article, we will discuss five ways to spot a fake Chime Bank statement.

Red Flags to Watch Out For

Before we dive into the five ways to spot a fake Chime Bank statement, it's essential to be aware of some common red flags. These include:

- Urgent or threatening language

- Requests for personal or financial information

- Unusual or unexpected transactions

- Poor grammar or spelling

- Lack of personalization

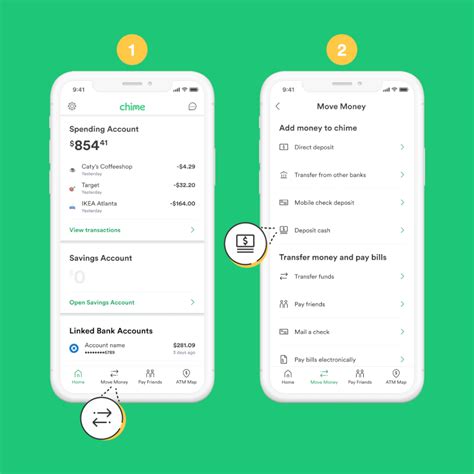

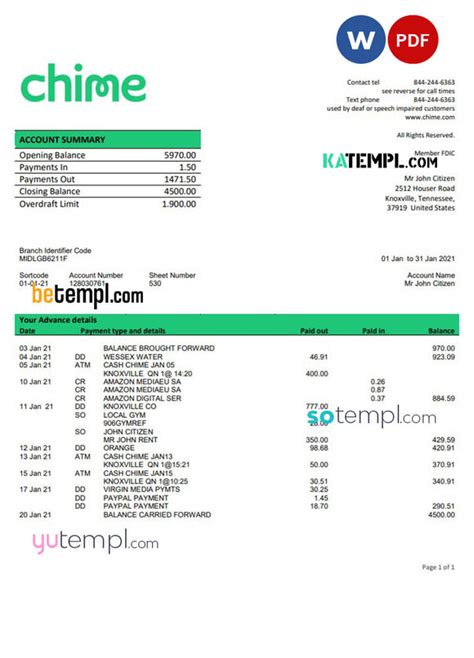

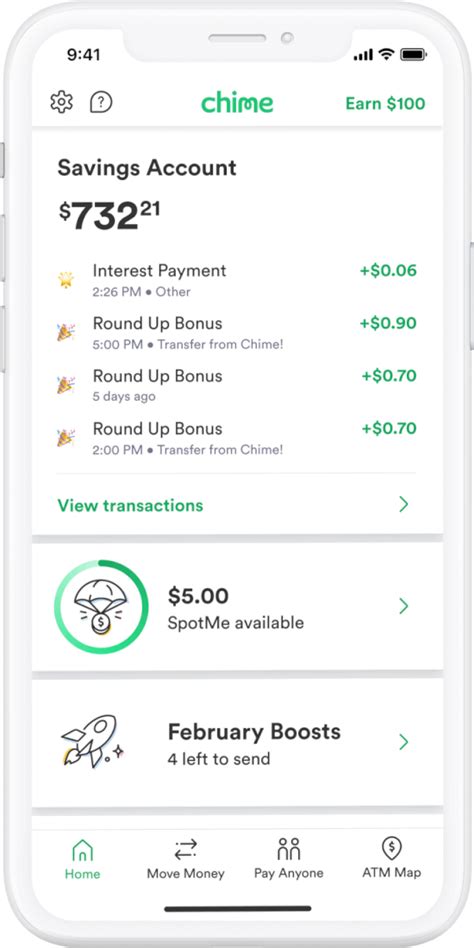

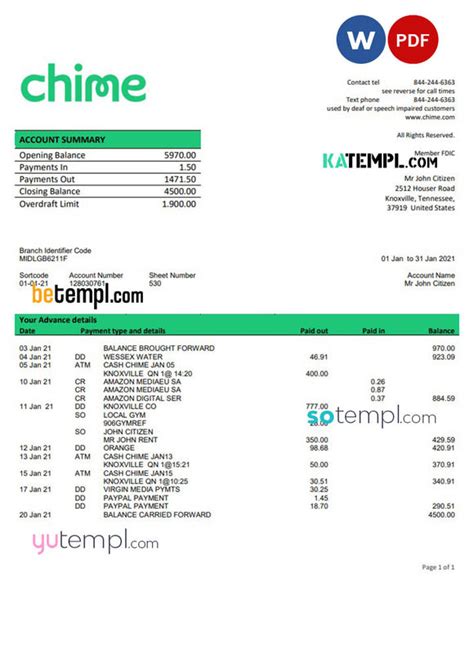

1. Verify the Account Information

A legitimate Chime Bank statement will always include your account information, such as your account number, routing number, and account type. Check to see if the account information matches your records. If it doesn't, it could be a sign that the statement is fake.

Check for the Following:

- Account number: Verify that the account number matches your records.

- Routing number: Check that the routing number is correct and matches Chime Bank's routing number.

- Account type: Ensure that the account type matches your account type (e.g., Spending Account, Savings Account).

2. Look for the Chime Bank Logo

A legitimate Chime Bank statement will always include the Chime Bank logo. Check to see if the logo is present and if it matches the official Chime Bank logo.

Verify the Logo:

- Check that the logo is present and prominently displayed.

- Verify that the logo matches the official Chime Bank logo.

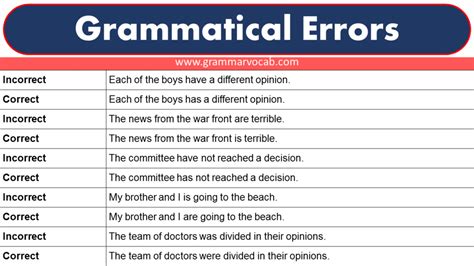

3. Check for Grammatical Errors

Scammers often make grammatical errors when creating fake documents. Check the statement for any grammatical errors, such as misspelled words, incorrect punctuation, or awkward phrasing.

Watch Out for:

- Misspelled words

- Incorrect punctuation

- Awkward phrasing

4. Verify the Statement Date and Period

A legitimate Chime Bank statement will always include the statement date and period. Check to see if the statement date and period match your records.

Verify the Following:

- Statement date: Ensure that the statement date matches your records.

- Statement period: Verify that the statement period matches your records.

5. Check for Unusual Transactions

Scammers often use fake bank statements to try to convince victims that they have made a transaction or have a balance that they don't. Check the statement for any unusual transactions or balances that don't match your records.

Watch Out for:

- Unusual transactions

- Unexpected balances

- Unfamiliar payees or merchants

Chime Bank Statement Gallery

By following these five ways to spot a fake Chime Bank statement, you can protect yourself from falling victim to scams and phishing attempts. Remember to always verify the account information, look for the Chime Bank logo, check for grammatical errors, verify the statement date and period, and check for unusual transactions.

If you suspect that you have received a fake Chime Bank statement, do not respond to it or provide any personal or financial information. Instead, contact Chime Bank's customer support directly to report the incident and seek assistance.

Stay safe, and stay informed!