Reading your Fifth Third Bank statements can seem like a daunting task, but it's essential to understanding your financial situation and making informed decisions about your money. In this article, we'll break down five easy ways to read your Fifth Third Bank statements, so you can feel more confident and in control of your finances.

Managing your finances effectively requires regular monitoring of your bank statements. Your Fifth Third Bank statement is a valuable tool that provides a comprehensive view of your account activity, helping you track your income, expenses, and savings. By learning how to read your statement, you can identify areas for improvement, detect any errors or suspicious activity, and make smart financial decisions.

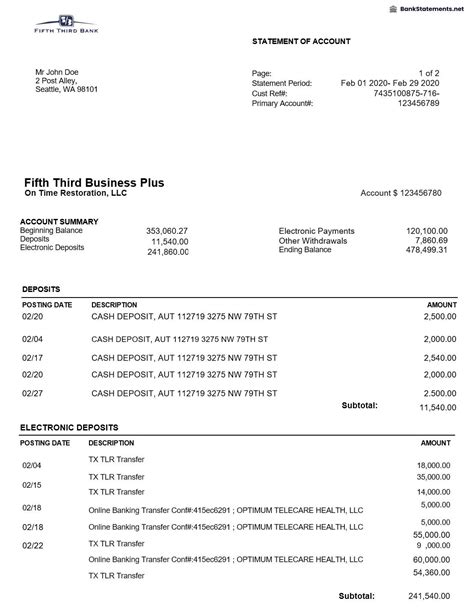

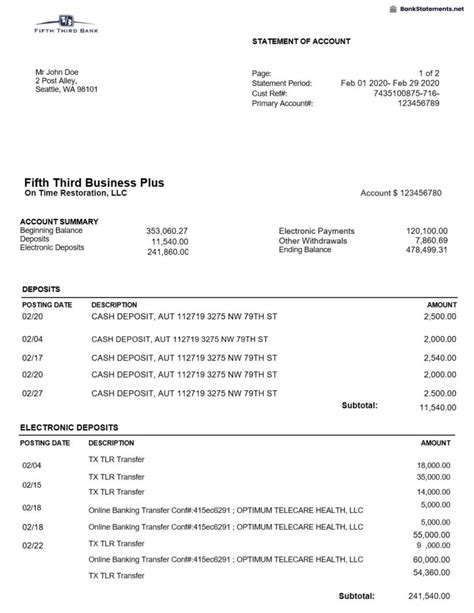

Understanding the Layout of Your Fifth Third Bank Statement

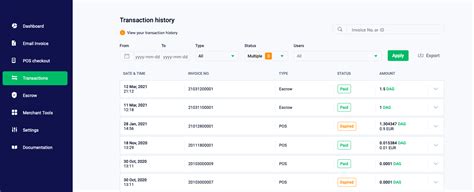

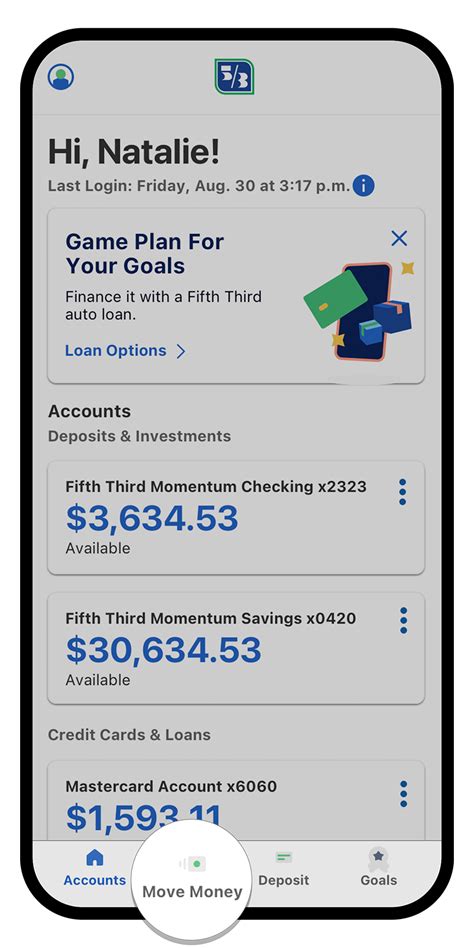

Your Fifth Third Bank statement typically consists of several sections, including your account information, transaction history, and balance summary. The layout may vary depending on the type of account you have and the services you use. Familiarize yourself with the different sections to quickly locate the information you need.

Key Components of Your Fifth Third Bank Statement

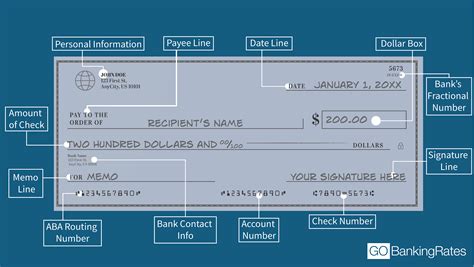

- Account Information: This section displays your account details, including your name, address, account number, and account type.

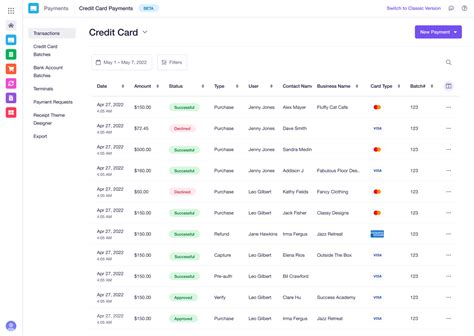

- Transaction History: This section lists all transactions that have occurred on your account since the previous statement, including deposits, withdrawals, and transfers.

- Balance Summary: This section provides an overview of your account balance, including your current balance, available balance, and any outstanding fees or charges.

1. Check Your Account Information

Start by verifying your account information to ensure it's accurate and up-to-date. Check your name, address, and account number to ensure everything is correct. If you notice any errors, contact Fifth Third Bank immediately to have them corrected.

Why is Accurate Account Information Important?

- Prevents Errors: Inaccurate account information can lead to errors on your statement, which can affect your ability to access your account or receive important notifications.

- Ensures Security: Accurate account information helps prevent unauthorized access to your account and reduces the risk of identity theft.

2. Review Your Transaction History

Carefully review your transaction history to ensure all transactions are legitimate and accurate. Check for any suspicious activity, such as unauthorized withdrawals or deposits. If you notice any discrepancies, contact Fifth Third Bank immediately to report the issue.

Tips for Reviewing Your Transaction History

- Check for Unfamiliar Transactions: If you notice any transactions you don't recognize, investigate further to determine the source of the transaction.

- Verify Transaction Dates: Ensure the transaction dates match your records and that there are no errors or omissions.

3. Monitor Your Balance Summary

Your balance summary provides a snapshot of your account balance, including your current balance, available balance, and any outstanding fees or charges. Monitor your balance regularly to ensure you have sufficient funds to cover your expenses and avoid overdrafts.

Why is Monitoring Your Balance Important?

- Prevents Overdrafts: Monitoring your balance helps you avoid overdrafts, which can result in hefty fees and negatively impact your credit score.

- Ensures Sufficient Funds: Keeping track of your balance ensures you have sufficient funds to cover your expenses and avoid declined transactions.

4. Look for Fees and Charges

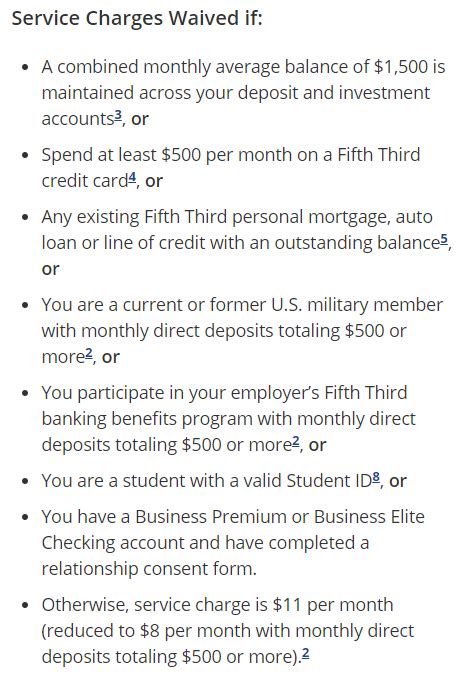

Check your statement for any fees or charges that may have been applied to your account. Understand the types of fees associated with your account and how to avoid them. If you have any questions or concerns about fees, contact Fifth Third Bank for clarification.

Common Fees Associated with Fifth Third Bank Accounts

- Monthly Maintenance Fees: Some accounts may have monthly maintenance fees, which can be waived if you meet certain requirements, such as maintaining a minimum balance.

- Overdraft Fees: Overdraft fees can be costly, so it's essential to monitor your balance regularly to avoid overdrafts.

5. Take Action on Any Errors or Discrepancies

If you notice any errors or discrepancies on your statement, take action immediately. Contact Fifth Third Bank to report the issue and have it resolved. Don't hesitate to ask questions or seek clarification on any aspects of your statement.

Why is Taking Action Important?

- Prevents Further Errors: Taking action on errors or discrepancies helps prevent further errors from occurring and ensures your account is accurate and up-to-date.

- Protects Your Finances: Taking action on errors or discrepancies helps protect your finances and prevents any potential financial losses.

Fifth Third Bank Statement Gallery

By following these five easy ways to read your Fifth Third Bank statements, you'll be able to effectively manage your finances, detect any errors or suspicious activity, and make informed decisions about your money. Remember to review your statement regularly, monitor your balance, and take action on any errors or discrepancies to ensure your financial well-being.