Intro

Master financial management skills to drive business success. Discover how effective business leadership relies on strategic financial planning, budgeting, and risk management. Learn to analyze financial data, make informed decisions, and optimize resources for sustainable growth, increased profitability, and competitive advantage in todays fast-paced business landscape.

Effective financial management is the backbone of any successful business. It enables leaders to make informed decisions, drive growth, and maintain a competitive edge in the market. However, mastering financial management can be a daunting task, especially for entrepreneurs and small business owners who may not have a background in finance. In this article, we will explore the importance of financial management, its key components, and provide practical tips on how to master it for effective business leadership.

The Importance of Financial Management

Financial management is a critical aspect of business leadership, as it directly impacts the organization's ability to achieve its goals and objectives. Effective financial management enables businesses to:

- Make informed decisions about investments, funding, and resource allocation

- Manage risk and minimize losses

- Optimize cash flow and liquidity

- Improve profitability and competitiveness

- Enhance transparency and accountability

Key Components of Financial Management

Financial management involves several key components, including:

Financial Planning

Financial planning is the process of identifying and achieving financial goals. It involves creating a comprehensive financial plan that outlines financial objectives, strategies, and tactics. A good financial plan should consider factors such as market trends, competition, and regulatory requirements.

Financial Reporting

Financial reporting is the process of providing stakeholders with financial information about the business. It involves preparing financial statements, such as balance sheets, income statements, and cash flow statements. Financial reporting helps stakeholders make informed decisions about the business.

Financial Analysis

Financial analysis is the process of examining and interpreting financial data to make informed decisions. It involves using financial ratios, trends, and other metrics to evaluate the business's financial performance and identify areas for improvement.

Financial Forecasting

Financial forecasting is the process of predicting future financial outcomes based on historical data and trends. It involves using financial models and statistical techniques to forecast revenue, expenses, and cash flow.

Practical Tips for Mastering Financial Management

Mastering financial management requires a combination of technical skills, business acumen, and leadership abilities. Here are some practical tips to help you get started:

- Develop a comprehensive financial plan that aligns with your business strategy

- Use financial reporting and analysis to make informed decisions

- Monitor and manage cash flow to ensure liquidity and minimize risk

- Use financial forecasting to predict future outcomes and make adjustments accordingly

- Stay up-to-date with changes in the market, industry, and regulatory environment

Financial Management Tools and Techniques

There are several financial management tools and techniques that can help you master financial management. Some of these include:

Financial Modeling

Financial modeling involves creating a mathematical representation of the business's financial performance. It helps you forecast future outcomes, evaluate different scenarios, and make informed decisions.

Financial Ratios

Financial ratios are metrics that help you evaluate the business's financial performance. They include ratios such as the debt-to-equity ratio, return on equity, and return on assets.

Cash Flow Management

Cash flow management involves managing the business's cash inflows and outflows. It helps you ensure liquidity, minimize risk, and optimize financial performance.

Financial Dashboard

A financial dashboard is a visual representation of the business's financial performance. It helps you track key financial metrics, identify trends, and make informed decisions.

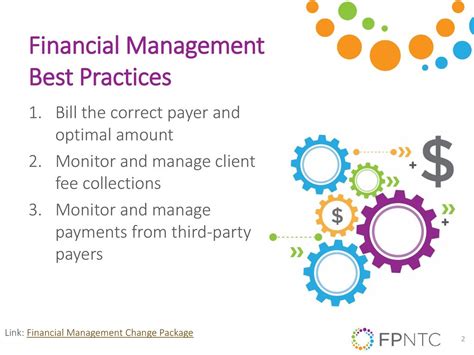

Best Practices for Effective Financial Leadership

Effective financial leadership requires a combination of technical skills, business acumen, and leadership abilities. Here are some best practices to help you become a financial leader:

- Stay up-to-date with changes in the market, industry, and regulatory environment

- Develop a comprehensive financial plan that aligns with your business strategy

- Use financial reporting and analysis to make informed decisions

- Monitor and manage cash flow to ensure liquidity and minimize risk

- Communicate financial information effectively to stakeholders

Conclusion

Mastering financial management is a critical aspect of effective business leadership. It enables leaders to make informed decisions, drive growth, and maintain a competitive edge in the market. By developing a comprehensive financial plan, using financial reporting and analysis, and monitoring and managing cash flow, you can become a financial leader and drive success in your business.

Financial Management Image Gallery

We hope this article has provided you with valuable insights and practical tips on mastering financial management for effective business leadership. Remember to stay up-to-date with changes in the market, industry, and regulatory environment, and to develop a comprehensive financial plan that aligns with your business strategy. By following these best practices, you can become a financial leader and drive success in your business.