Intro

Discover the simplified way to calculate payback period in Excel. Learn how to determine the time it takes to recover investments using Excel formulas and functions. Easily understand cash flow, ROI, and break-even analysis. Master payback period calculation with our step-by-step guide and make informed investment decisions.

Calculating the payback period is a crucial step in evaluating the feasibility of a project or investment. It represents the time it takes for the investment to generate returns equal to its initial cost. While calculating the payback period can be done manually, using Excel can make the process much easier and more efficient. In this article, we will guide you through the steps of calculating the payback period in Excel, providing you with a comprehensive understanding of the concept and its application.

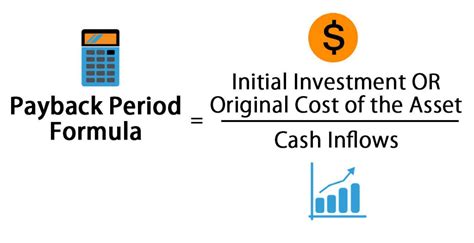

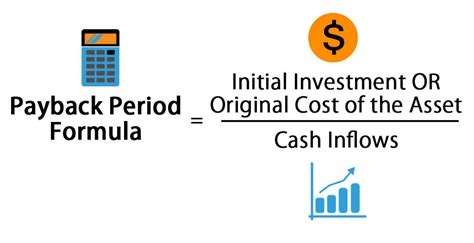

Understanding Payback Period

The payback period is a simple and widely used metric for evaluating investments. It is defined as the time it takes for the cumulative cash inflows from an investment to equal the initial investment cost. The payback period can be calculated for various types of investments, such as projects, assets, or businesses. A shorter payback period indicates a better investment opportunity, as it suggests that the investment will generate returns more quickly.

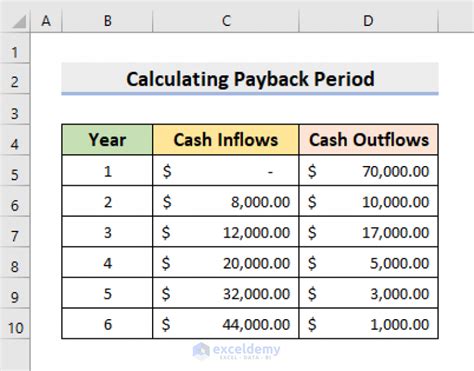

Calculating Payback Period in Excel

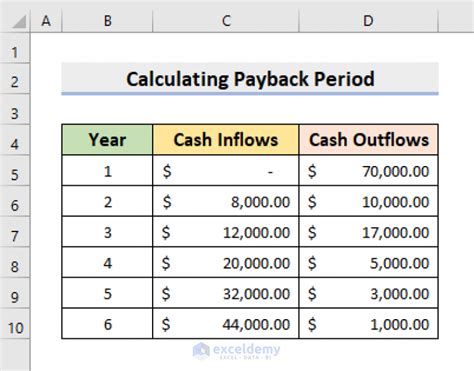

To calculate the payback period in Excel, you can use the following steps:

- Enter the initial investment cost: In a cell, enter the initial investment cost.

- Enter the cash inflows: In a separate column, enter the cash inflows from the investment for each period (e.g., years).

- Calculate the cumulative cash inflows: Use the formula

=SUM(B$2:B2)to calculate the cumulative cash inflows, where B2 is the cell containing the first cash inflow. - Determine the payback period: Use the formula

=MATCH(A2,B:B,1)to find the payback period, where A2 is the cell containing the initial investment cost, and B:B is the range containing the cumulative cash inflows.

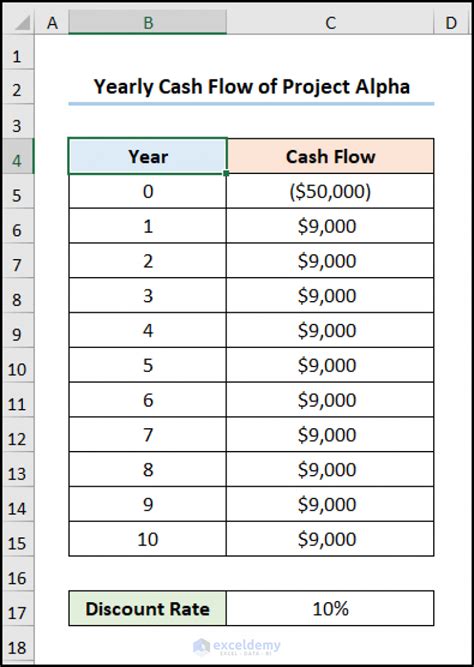

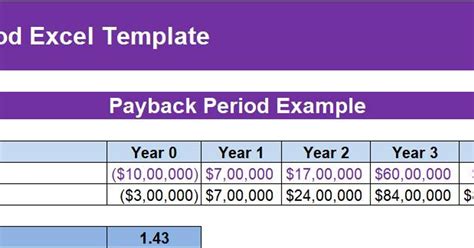

Example: Calculating Payback Period for a Project

Suppose you are evaluating a project with an initial investment cost of $100,000. The project is expected to generate cash inflows of $20,000, $30,000, $40,000, and $50,000 in the first four years. To calculate the payback period, follow these steps:

| Year | Cash Inflow | Cumulative Cash Inflow |

|---|---|---|

| 1 | $20,000 | $20,000 |

| 2 | $30,000 | $50,000 |

| 3 | $40,000 | $90,000 |

| 4 | $50,000 | $140,000 |

Using the formula =MATCH(A2,B:B,1), you can determine that the payback period is approximately 3.57 years.

Interpreting the Results

The payback period can be interpreted in various ways, depending on the context of the investment. A shorter payback period generally indicates a better investment opportunity. However, it is essential to consider other factors, such as the investment's potential for long-term growth, risk, and overall return on investment.

Advantages and Limitations of the Payback Period Method

The payback period method has several advantages, including:

- Simplicity: The payback period is easy to calculate and understand.

- Intuitive: The payback period provides a clear indication of the investment's potential for generating returns.

However, the payback period method also has some limitations:

- Ignores cash flows after the payback period: The payback period method only considers cash flows until the initial investment is recovered.

- Does not account for the time value of money: The payback period method does not take into account the time value of money, which can lead to inaccurate results.

Gallery of Calculating Payback Period

Calculating Payback Period Image Gallery

Conclusion

Calculating the payback period in Excel is a straightforward process that can be completed using a few simple steps. By understanding the concept of the payback period and its application, you can make more informed investment decisions. While the payback period method has its limitations, it remains a widely used and useful tool for evaluating investments. By combining the payback period with other metrics, such as the net present value (NPV) and internal rate of return (IRR), you can gain a more comprehensive understanding of an investment's potential for generating returns.

We hope this article has provided you with a comprehensive understanding of calculating the payback period in Excel. If you have any questions or need further clarification, please don't hesitate to ask.