Calculating the fiscal year in Excel is a common task for many professionals, particularly those in finance and accounting. The fiscal year is the 12-month period used by businesses and organizations for financial reporting and budgeting purposes. It may not necessarily coincide with the calendar year, which can make calculating the fiscal year a bit tricky. Fortunately, Excel provides several ways to calculate the fiscal year, and we'll explore five of them in this article.

Understanding Fiscal Years

Before we dive into the methods, it's essential to understand how fiscal years work. A fiscal year can start on any date, but it's typically aligned with the company's financial cycles. For example, a retail company might start its fiscal year on February 1st, coinciding with the end of the holiday season. The fiscal year is usually denoted by the year in which it ends, so the fiscal year starting on February 1st, 2022, would be referred to as FY2023.

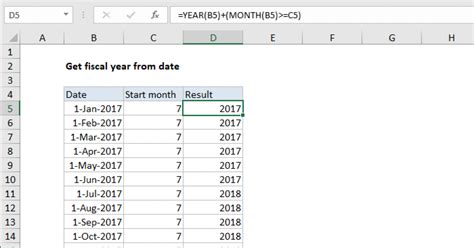

Method 1: Using the YEAR and MONTH Functions

One way to calculate the fiscal year in Excel is by using the YEAR and MONTH functions. This method involves creating a formula that checks the month of the date and adjusts the year accordingly.

Suppose you have a date in cell A1, and you want to calculate the fiscal year. Assuming the fiscal year starts on July 1st, you can use the following formula:

=IF(MONTH(A1)>=7,YEAR(A1),YEAR(A1)-1)

This formula checks if the month of the date is July or later. If it is, it returns the current year; otherwise, it returns the previous year.

Advantages and Disadvantages

Advantages:

- Easy to implement

- Works well for simple fiscal year calculations

Disadvantages:

- Limited flexibility for different fiscal year start dates

- May not work correctly for dates near the fiscal year boundary

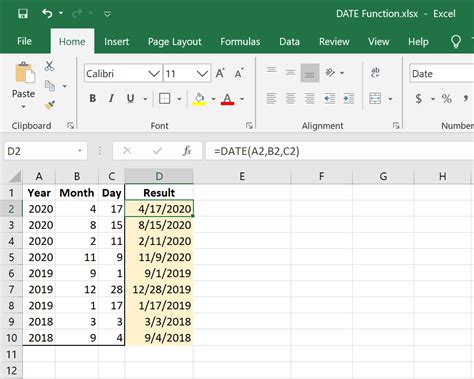

Method 2: Using the DATE Function

Another way to calculate the fiscal year in Excel is by using the DATE function. This method involves creating a formula that constructs a new date based on the original date and the fiscal year start date.

Suppose you have a date in cell A1, and you want to calculate the fiscal year. Assuming the fiscal year starts on October 1st, you can use the following formula:

=YEAR(DATE(YEAR(A1),10,1))+(MONTH(A1)>9)

This formula constructs a new date with the same year as the original date, but with the month set to October (the fiscal year start month). It then checks if the month of the original date is after October, and if so, increments the year by 1.

Advantages and Disadvantages

Advantages:

- More flexible than the YEAR and MONTH function method

- Works well for different fiscal year start dates

Disadvantages:

- More complex formula

- May require adjustments for dates near the fiscal year boundary

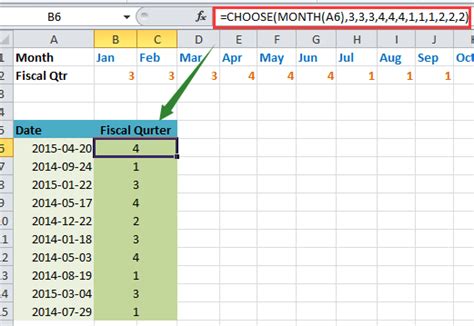

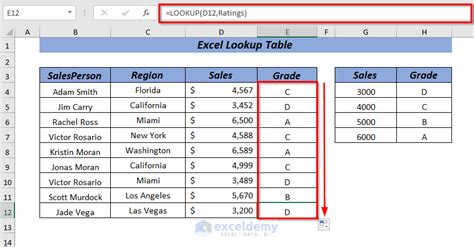

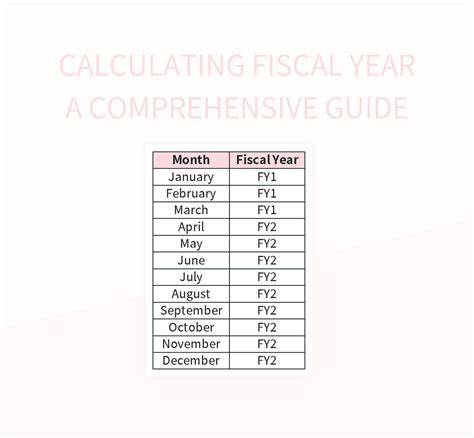

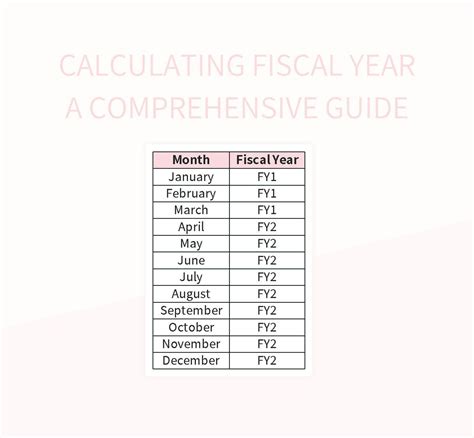

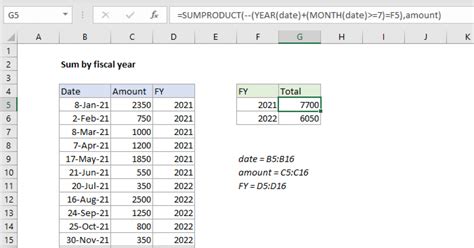

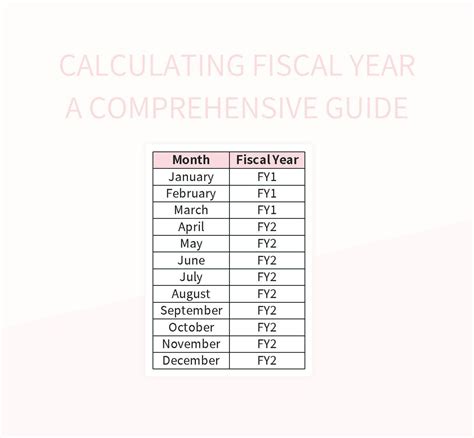

Method 3: Using a Lookup Table

A lookup table is a simple and effective way to calculate the fiscal year in Excel. This method involves creating a table that maps the month of the date to the corresponding fiscal year.

Suppose you have a date in cell A1, and you want to calculate the fiscal year. You can create a lookup table with the following structure:

| Month | Fiscal Year |

|---|---|

| 1-6 | FY2022 |

| 7-12 | FY2023 |

You can then use the VLOOKUP function to retrieve the fiscal year based on the month of the date:

=VLOOKUP(MONTH(A1),LookupTable,2,FALSE)

This formula looks up the month of the date in the lookup table and returns the corresponding fiscal year.

Advantages and Disadvantages

Advantages:

- Easy to implement

- Works well for simple fiscal year calculations

Disadvantages:

- Limited flexibility for different fiscal year start dates

- May require adjustments for dates near the fiscal year boundary

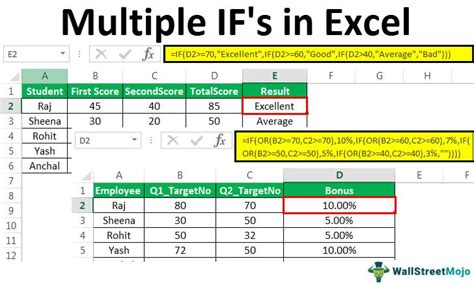

Method 4: Using a Formula with Multiple Conditions

If you need to calculate the fiscal year based on multiple conditions, you can use a formula that combines multiple IF statements.

Suppose you have a date in cell A1, and you want to calculate the fiscal year based on the following conditions:

- If the month is January-March, the fiscal year is the previous year

- If the month is April-June, the fiscal year is the current year

- If the month is July-September, the fiscal year is the next year

- If the month is October-December, the fiscal year is the current year + 1

You can use the following formula:

=IF(MONTH(A1)>=1 AND MONTH(A1)<=3,YEAR(A1)-1,IF(MONTH(A1)>=4 AND MONTH(A1)<=6,YEAR(A1),IF(MONTH(A1)>=7 AND MONTH(A1)<=9,YEAR(A1)+1,YEAR(A1)+1)))

This formula checks the month of the date and applies the corresponding fiscal year calculation.

Advantages and Disadvantages

Advantages:

- Flexible and can accommodate multiple conditions

- Works well for complex fiscal year calculations

Disadvantages:

- Complex formula

- May be difficult to maintain and update

Method 5: Using Power Query

Power Query is a powerful data manipulation tool in Excel that can be used to calculate the fiscal year.

Suppose you have a date in cell A1, and you want to calculate the fiscal year. You can use Power Query to create a custom formula that calculates the fiscal year based on the date.

To do this, follow these steps:

- Go to the Data tab in the ribbon

- Click on the "From Other Sources" button

- Select "Blank Query"

- In the Query Editor, click on the "Add Column" button

- Select "Custom Column"

- Enter the following formula:

=if (Month([Date]) >= 7, Year([Date]), Year([Date])-1) - Click on the "OK" button

This formula calculates the fiscal year based on the month of the date.

Advantages and Disadvantages

Advantages:

- Flexible and can accommodate complex fiscal year calculations

- Works well for large datasets

Disadvantages:

- Requires Power Query expertise

- May require additional setup and configuration

Fiscal Year Calculation Methods

We hope this article has helped you understand the different methods to calculate the fiscal year in Excel. Whether you're a finance professional or a business owner, calculating the fiscal year is an essential task that can be accomplished using various methods. Experiment with different methods to find the one that works best for your needs.

Take Action: Try out the different methods to calculate the fiscal year in Excel. Share your experiences and tips in the comments section below.