Managing financial data and calculations is a crucial aspect of any organization, and Microsoft Excel is often the go-to tool for these tasks. One common requirement is calculating the fiscal year, which can be a bit tricky, especially when dealing with different date systems and fiscal year definitions. In this article, we will explore five different methods to calculate the fiscal year in Excel, covering various scenarios and date systems.

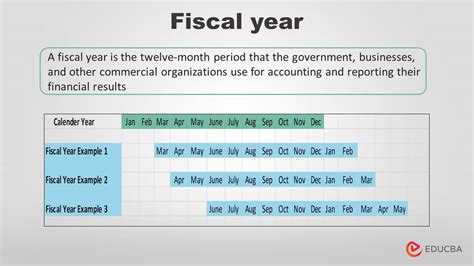

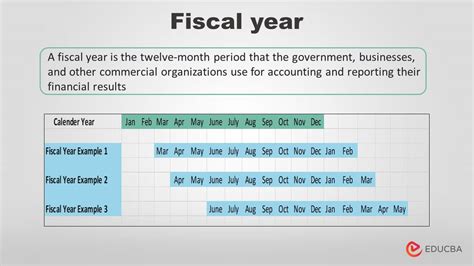

Understanding Fiscal Year Calculations

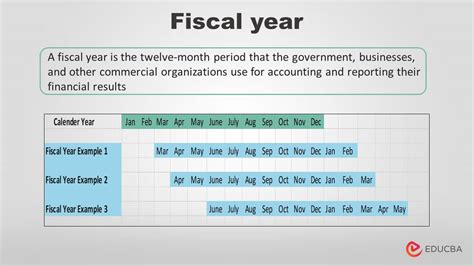

Before diving into the methods, it's essential to understand what a fiscal year is and how it differs from a calendar year. A fiscal year is a 12-month period used for financial reporting and budgeting, which may not necessarily align with the calendar year. The start date of a fiscal year varies depending on the organization or country, but it's commonly October 1st, January 1st, or July 1st.

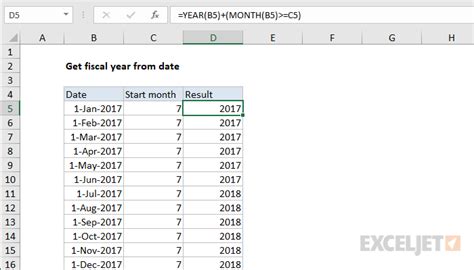

Method 1: Using the YEAR Function with a Fixed Start Date

One straightforward method to calculate the fiscal year is to use the YEAR function in combination with a fixed start date. Let's assume the fiscal year starts on October 1st.

Formula: =YEAR(A1)+IF(MONTH(A1)>=10,1,0)

- A1 is the date cell.

- The IF function checks if the month is October (10) or later. If true, it adds 1 to the year; otherwise, it keeps the year as is.

This method is simple and effective, but it assumes a fixed start date and doesn't account for variations.

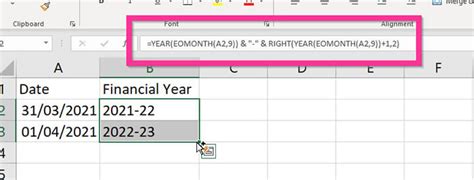

Method 2: Using the EOMONTH Function with a Variable Start Date

For a more flexible approach, you can use the EOMONTH function, which returns the last day of the month. This method allows for a variable start date.

Formula: =YEAR(EOMONTH(A1,-(MONTH(A1)-B1)))

- A1 is the date cell.

- B1 is the start month of the fiscal year (e.g., 10 for October).

- The EOMONTH function calculates the last day of the previous month, and then the YEAR function extracts the year.

This method is more versatile and can handle different start dates, but it still assumes a standard 12-month fiscal year.

Method 3: Using a Lookup Table with a Fiscal Year Schedule

For a more complex scenario, you can create a lookup table with a fiscal year schedule. This method is useful when the fiscal year doesn't follow a standard pattern.

Formula: =VLOOKUP(MONTH(A1),B:C,2,FALSE)

- A1 is the date cell.

- B:C is the lookup table with the month and corresponding fiscal year.

This method requires more setup, but it provides flexibility and can handle irregular fiscal year schedules.

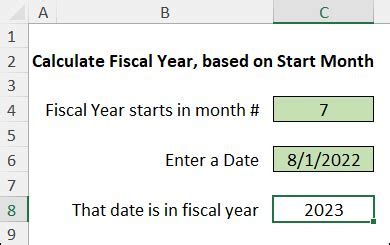

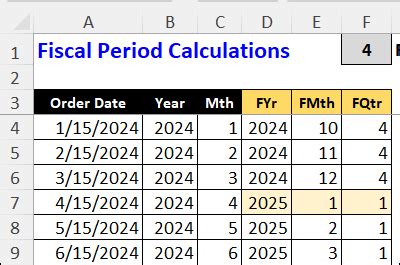

Method 4: Using a Custom Formula with a Fiscal Year Start Date

If you prefer a more straightforward approach, you can use a custom formula that takes into account the fiscal year start date.

Formula: =IF(MONTH(A1)>=C1,YEAR(A1),YEAR(A1)-1)

- A1 is the date cell.

- C1 is the start month of the fiscal year (e.g., 10 for October).

This method is simple and effective, but it assumes a standard 12-month fiscal year.

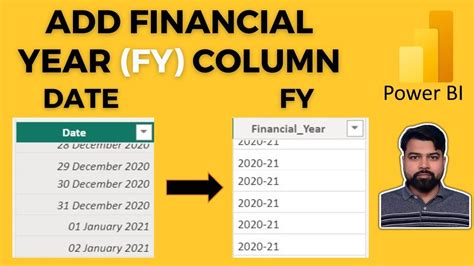

Method 5: Using a Power Query to Calculate Fiscal Year

For a more dynamic approach, you can use Power Query to calculate the fiscal year. This method is useful when working with large datasets.

Formula: =Year([Date])+(If(Month([Date])>=[Fiscal Year Start],1,0))

- [Date] is the date column.

- [Fiscal Year Start] is the start month of the fiscal year (e.g., 10 for October).

This method requires Power Query, which is available in Excel 2010 and later versions.

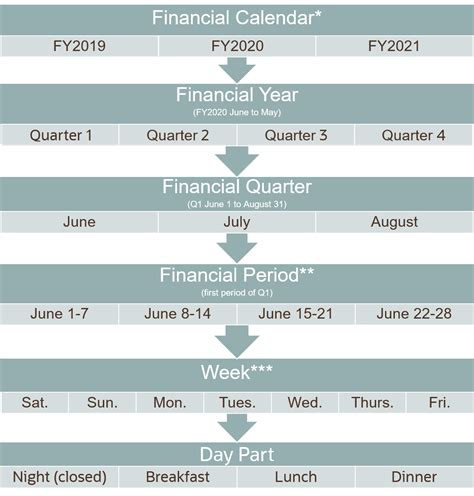

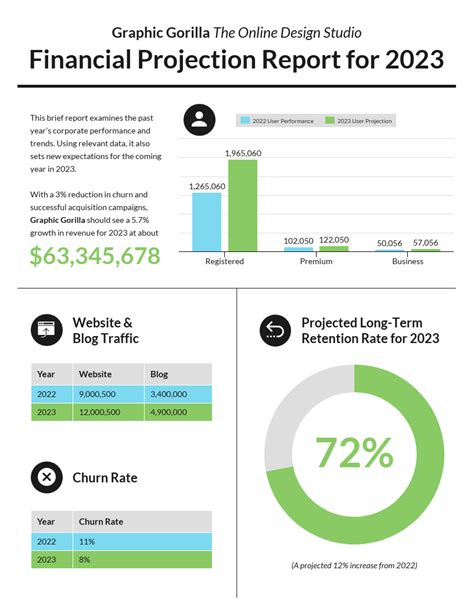

Gallery of Fiscal Year Calculations

Fiscal Year Calculations Image Gallery

We hope this article has provided you with a comprehensive understanding of how to calculate the fiscal year in Excel using different methods. Whether you're working with a simple or complex fiscal year schedule, these formulas and techniques will help you achieve accurate results. If you have any questions or need further clarification, please don't hesitate to ask in the comments below.