Intro

Receiving food stamps is a vital lifeline for many individuals and families in Texas who struggle to make ends meet. However, in some cases, recipients may inadvertently receive more benefits than they are eligible for, resulting in an overpayment. When this happens, the state of Texas may seek to recover the excess amount, leaving the recipient wondering about their obligations and the statute of limitations for Texas food stamp overpayment.

Understanding the concept of overpayment, its causes, and the statute of limitations is essential for recipients to navigate the complex world of food stamps and avoid potential pitfalls.

What is a Food Stamp Overpayment?

A food stamp overpayment occurs when a recipient receives more benefits than they are eligible for. This can happen due to various reasons, such as changes in income, family size, or expenses that are not reported to the Texas Health and Human Services Commission (HHSC). Overpayments can also result from errors made by the HHSC or the recipient's failure to report accurate information.

Causes of Food Stamp Overpayment

Some common causes of food stamp overpayment in Texas include:

- Failure to report changes in income or employment

- Failure to report changes in family size or composition

- Failure to report changes in expenses, such as childcare or medical costs

- Errors made by the HHSC in calculating benefits

- Recipient's failure to provide accurate information or documentation

Statute of Limitations for Texas Food Stamp Overpayment

The statute of limitations for Texas food stamp overpayment is a critical aspect of the law that recipients should be aware of. The statute of limitations is the time period within which the state of Texas can seek to recover an overpayment. In Texas, the statute of limitations for food stamp overpayment is six years from the date of the overpayment.

This means that if an overpayment occurs, the state of Texas has six years to initiate a claim to recover the excess amount. If the state fails to initiate a claim within this time period, the recipient may be relieved of their obligation to repay the overpayment.

Consequences of Food Stamp Overpayment

Receiving a food stamp overpayment can have serious consequences for recipients, including:

- Repayment of the overpaid amount

- Reduction or termination of future benefits

- Potential for fines or penalties

- Impact on credit score

Repayment Options for Food Stamp Overpayment

If a recipient receives a food stamp overpayment, they may be required to repay the excess amount. Fortunately, there are several repayment options available to recipients, including:

- Lump sum payment

- Monthly installment payments

- Reduction of future benefits

- Income withholding

Recipients who are unable to repay the overpayment in full may be eligible for a repayment plan or waiver.

Waiver of Food Stamp Overpayment

In some cases, recipients may be eligible for a waiver of the food stamp overpayment. A waiver is a formal request to the HHSC to forgive the overpaid amount. To be eligible for a waiver, recipients must demonstrate that repayment of the overpayment would cause them undue hardship or that the overpayment was not their fault.

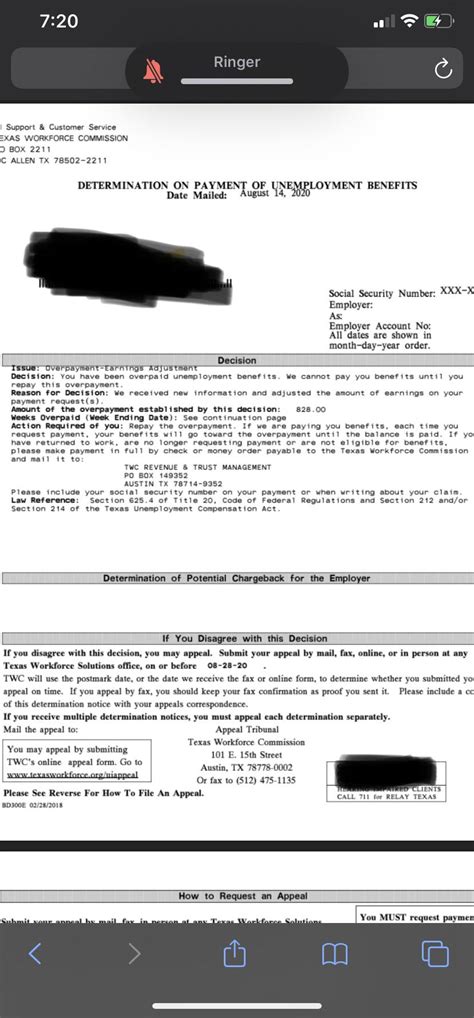

Appealing a Food Stamp Overpayment

If a recipient receives a notice of overpayment, they have the right to appeal the decision. To appeal, recipients must submit a written request to the HHSC within 90 days of receiving the notice. The appeal process involves a review of the recipient's eligibility and benefits, and the HHSC may request additional documentation or information to support the appeal.

Food Stamp Overpayment Appeal Process

The food stamp overpayment appeal process involves the following steps:

- Written request: Recipients must submit a written request to the HHSC within 90 days of receiving the notice of overpayment.

- Review of eligibility: The HHSC will review the recipient's eligibility and benefits to determine if the overpayment was accurate.

- Additional documentation: The HHSC may request additional documentation or information to support the appeal.

- Decision: The HHSC will issue a decision on the appeal, which may include a waiver of the overpayment or a repayment plan.

Texas Food Stamp Overpayment Image Gallery

We hope this article has provided you with a comprehensive understanding of Texas food stamp overpayment, including the statute of limitations, repayment options, and appeal process. If you have any questions or concerns about food stamp overpayment, please don't hesitate to reach out to us. Share your thoughts and experiences in the comments section below.