Intro

Forex trading is a complex and ever-changing field, and keeping track of your progress, successes, and failures is crucial to improving your trading skills. A Forex trading journal is an essential tool for any serious trader, allowing you to record, analyze, and refine your trading strategies. In this article, we will explore seven essential Forex trading journal templates that you can use to enhance your trading performance.

The Importance of a Forex Trading Journal

A Forex trading journal is a personalized record of your trading activities, including your thoughts, feelings, and actions before, during, and after each trade. By keeping a journal, you can identify patterns, biases, and areas for improvement, ultimately leading to better decision-making and increased profitability. A Forex trading journal also helps you to develop a growth mindset, acknowledging that mistakes are an essential part of the learning process.

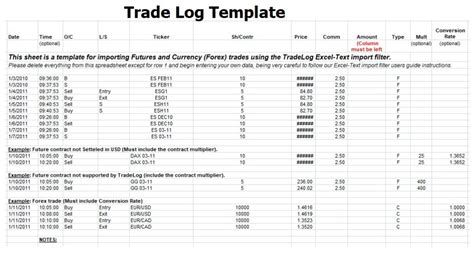

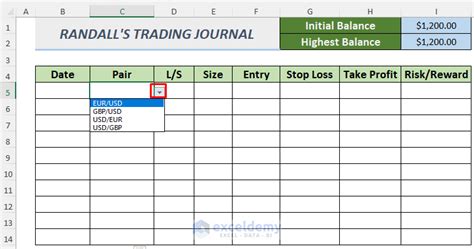

Template 1: Basic Trade Log

A basic trade log is a simple and straightforward template that records essential information about each trade. This template includes:

- Trade date and time

- Currency pair

- Entry price

- Exit price

- Position size

- Profit/loss

Using this template, you can quickly review your trading history and identify areas where you need to improve.

Template 2: Trade Analysis

A trade analysis template takes a deeper dive into each trade, examining the thought process behind your decisions. This template includes:

- Trade date and time

- Currency pair

- Entry price

- Exit price

- Position size

- Profit/loss

- Rationale for entering the trade

- Analysis of market conditions

- Post-trade reflections

By using this template, you can gain insights into your trading psychology and identify patterns in your decision-making.

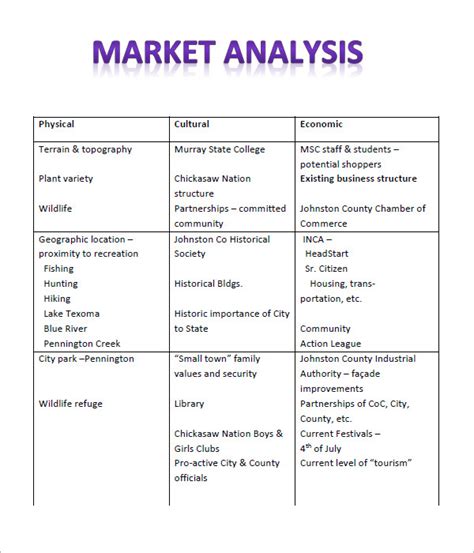

Template 3: Market Analysis

A market analysis template focuses on the broader market conditions that influenced your trades. This template includes:

- Market date and time

- Currency pair

- Market sentiment (bullish, bearish, neutral)

- Technical analysis (support/resistance levels, trends, etc.)

- Fundamental analysis (news, economic indicators, etc.)

- Trading opportunities identified

Using this template, you can develop a deeper understanding of market dynamics and improve your ability to identify trading opportunities.

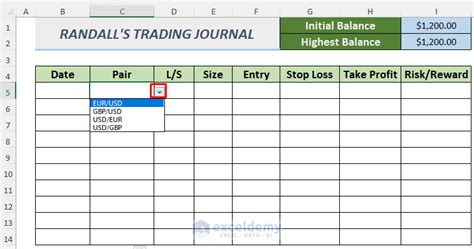

Template 4: Risk Management

A risk management template helps you to evaluate and refine your risk management strategies. This template includes:

- Trade date and time

- Currency pair

- Position size

- Stop-loss level

- Take-profit level

- Risk-reward ratio

- Post-trade reflections on risk management

By using this template, you can optimize your risk management strategies and minimize potential losses.

Template 5: Trade Planning

A trade planning template helps you to develop a clear plan for each trade, outlining your goals, risks, and strategies. This template includes:

- Trade date and time

- Currency pair

- Entry price

- Exit price

- Position size

- Trading strategy (scalping, day trading, swing trading, etc.)

- Risk management plan

Using this template, you can create a structured approach to trading and reduce impulsive decisions.

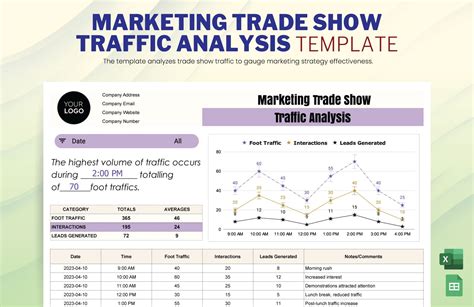

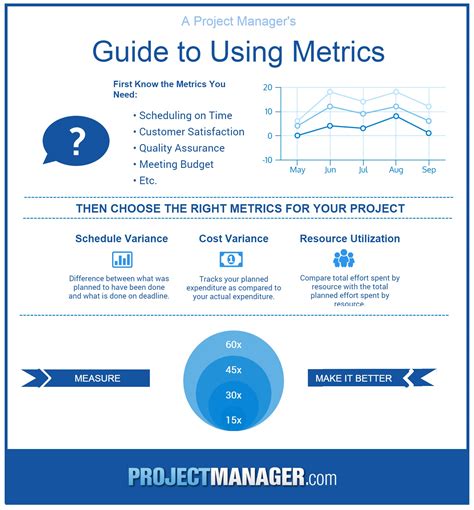

Template 6: Performance Metrics

A performance metrics template helps you to track and evaluate your trading performance over time. This template includes:

- Trading period

- Profit/loss

- Return on investment (ROI)

- Win/loss ratio

- Average trade duration

- Maximum drawdown

By using this template, you can monitor your progress, identify areas for improvement, and adjust your strategies accordingly.

Template 7: Reflection and Review

A reflection and review template helps you to regularly review your trading journal and reflect on your progress. This template includes:

- Review period

- Progress toward goals

- Lessons learned

- Areas for improvement

- Action plan for next review period

Using this template, you can cultivate a growth mindset, acknowledge your successes and failures, and refine your trading strategies.

Forex Trading Journal Templates Gallery

By incorporating these seven essential Forex trading journal templates into your trading routine, you can gain valuable insights, refine your strategies, and improve your overall trading performance. Remember to regularly review and reflect on your journal entries to maximize your growth as a trader.