Understanding the concept of compound interest and how to calculate it in Excel can be a game-changer for anyone looking to manage their finances effectively. Compound interest is the interest calculated on the initial principal, which also includes all the accumulated interest from previous periods on a deposit or loan. In this article, we will delve into the world of daily compound interest, its importance, and how to use the daily compound interest formula in Excel with ease.

Why Daily Compound Interest Matters

Daily compound interest plays a crucial role in various financial instruments, including savings accounts, certificates of deposit (CDs), and loans. Unlike simple interest, which calculates interest on the initial principal, daily compound interest adds the interest to the principal at regular intervals, meaning the interest earns interest. This process can lead to significant gains over time, making it essential to grasp how to calculate it accurately.

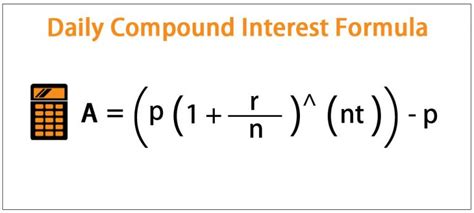

Understanding the Daily Compound Interest Formula

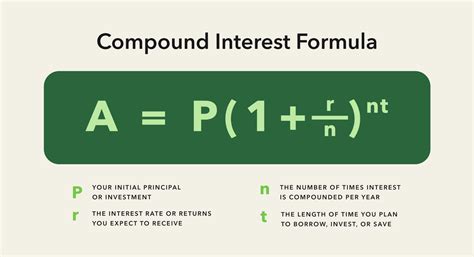

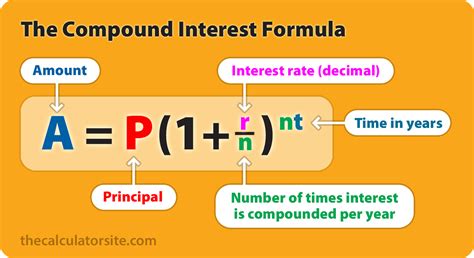

The daily compound interest formula is as follows:

[ A = P \left(1 + \frac{r}{n}\right)^{nt} ]

Where:

- (A) = the future value of the investment/loan, including interest

- (P) = principal investment amount (the initial deposit or loan amount)

- (r) = annual interest rate (in decimal)

- (n) = number of times that interest is compounded per year

- (t) = time the money is invested or borrowed for, in years

Applying the Daily Compound Interest Formula in Excel

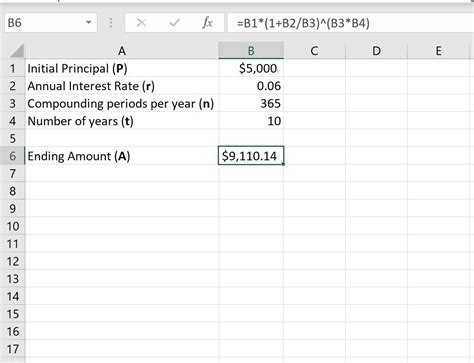

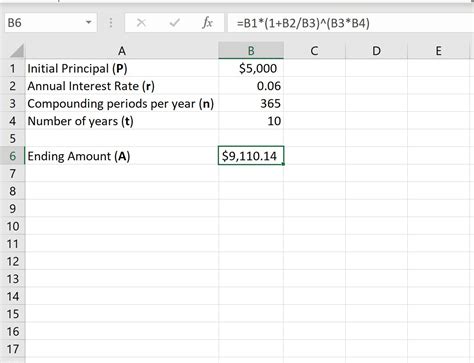

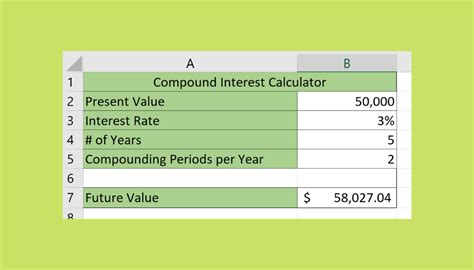

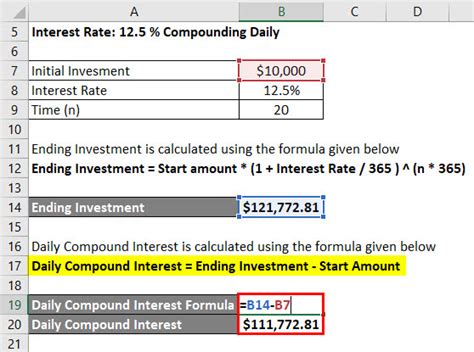

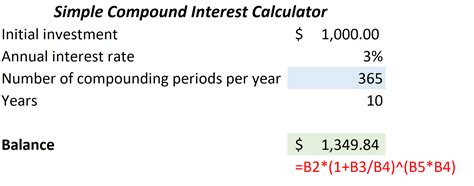

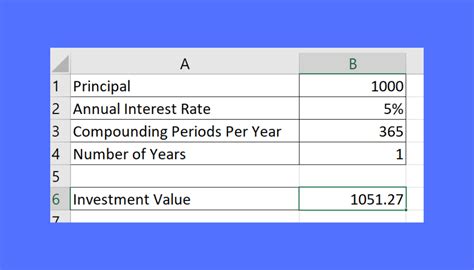

Excel provides an efficient way to calculate daily compound interest using the formula above. Here’s how you can do it:

-

Prepare Your Data: Open Excel and set up a table with columns for the principal amount, annual interest rate (as a percentage), compounding frequency (e.g., daily), and time (in years).

-

Convert Annual Interest Rate to Decimal: Convert the annual interest rate from percentage to decimal by dividing by 100.

-

Apply the Formula: In the cell where you want to display the result, enter the formula using the values from your table. For example:

=A1*(1+B1/365)^(365*C1)Where:

- (A1) = the principal amount cell

- (B1) = the cell with the annual interest rate (already converted to decimal)

- (C1) = the cell with the time in years

- 365 represents the daily compounding frequency

-

Calculate: Press Enter to calculate the future value of your investment or loan.

Benefits of Using Excel for Daily Compound Interest Calculations

Using Excel for daily compound interest calculations offers several benefits, including:

- Accuracy: Excel minimizes the chance of human error, ensuring your calculations are accurate.

- Speed: It saves time by automating the calculation process, allowing for quick changes and recalculations.

- Scalability: You can easily calculate daily compound interest for multiple investments or loans simultaneously.

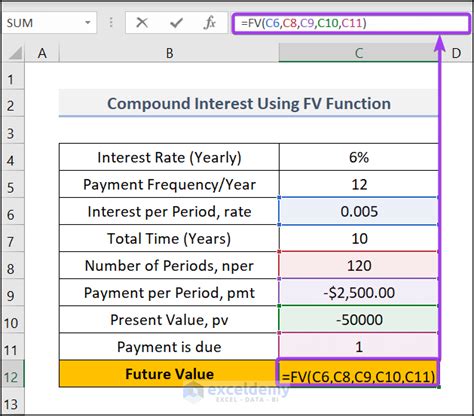

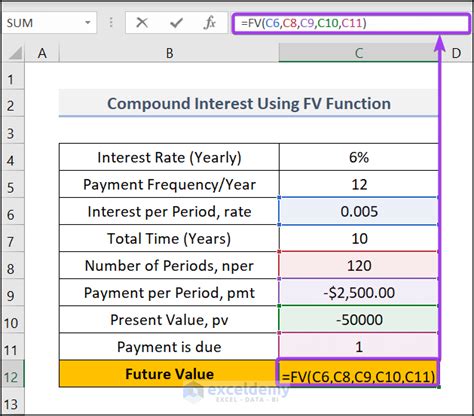

Tips for Advanced Users

For those looking to dive deeper, Excel provides several functions that can simplify the process even further. The RATE and IPMT functions, for example, can be used to calculate the interest rate and interest payment, respectively, given the principal, payment, and term.

Conclusion and Call to Action

Mastering the daily compound interest formula in Excel is a powerful tool for financial planning and analysis. Whether you’re a student, a professional, or simply someone looking to make informed financial decisions, understanding how to calculate daily compound interest can provide valuable insights into your financial health. Take the first step today by practicing with Excel and exploring the various scenarios where daily compound interest applies. Share your experiences, tips, and questions in the comments below, and don’t hesitate to reach out for further clarification on any of the concepts covered.

Daily Compound Interest Formula Gallery