Intro

Create professional pay stubs for contractors with our 5 free templates. Easily customize and download these contractor pay stub templates to streamline payroll processing. Say goodbye to manual calculations and tedious paperwork. Our templates are designed to meet your contracting business needs, ensuring accuracy and compliance.

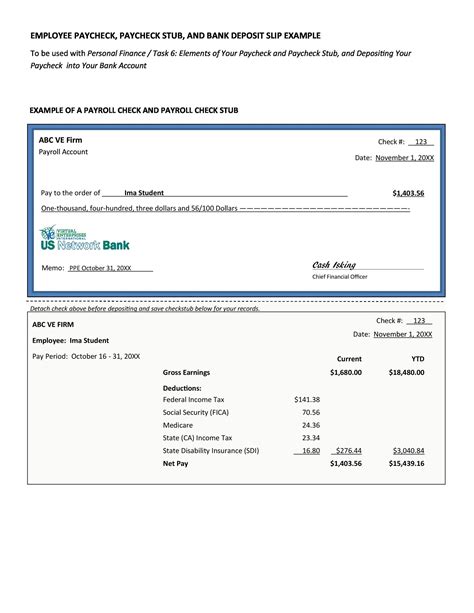

As a contractor, managing finances and keeping track of payments can be a daunting task. One essential document that can help streamline this process is a pay stub. A pay stub is a document that outlines an employee's or contractor's payment details, including gross pay, deductions, and net pay. In this article, we will explore five free pay stub templates for contractors that can help simplify payroll management.

What is a Pay Stub and Why is it Important?

A pay stub, also known as a paycheck stub or payslip, is a document provided by an employer to an employee or contractor, detailing their payment information. It serves as a record of payment, showing the amount earned, taxes withheld, and other deductions. For contractors, a pay stub is essential as it helps them keep track of their income, expenses, and taxes.

Benefits of Using Pay Stub Templates

Using pay stub templates can save contractors time and effort in managing their finances. Here are some benefits of using pay stub templates:

- Easy to use: Pay stub templates are pre-designed, making it simple for contractors to fill in their payment information.

- Time-saving: Contractors can quickly generate pay stubs, reducing the time spent on payroll management.

- Accuracy: Pay stub templates help reduce errors, ensuring that payment information is accurate and up-to-date.

- Professionalism: Using pay stub templates can give contractors a professional edge, as they provide a standardized and organized way of presenting payment information.

5 Free Pay Stub Templates for Contractors

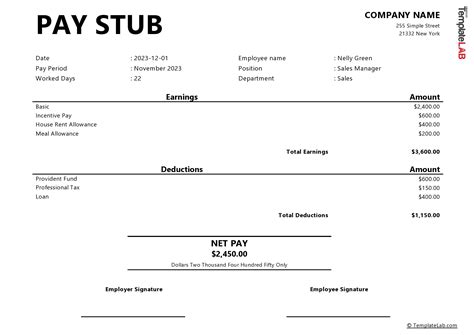

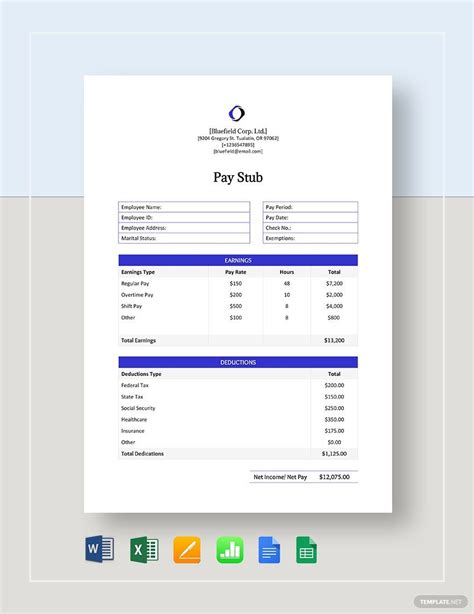

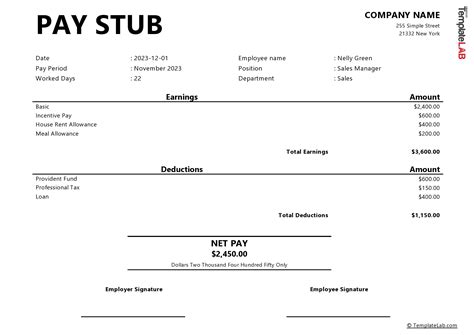

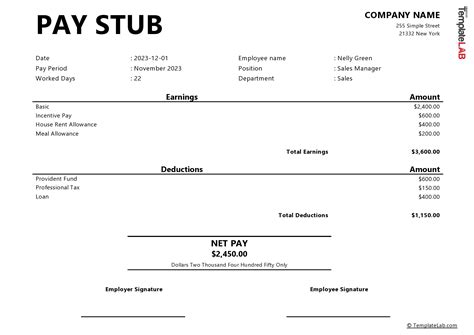

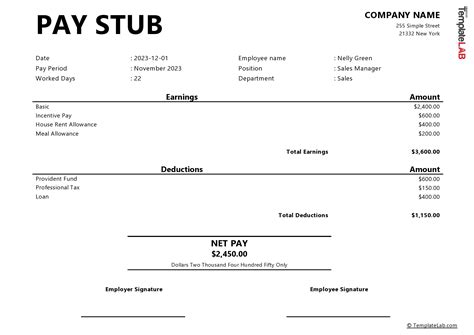

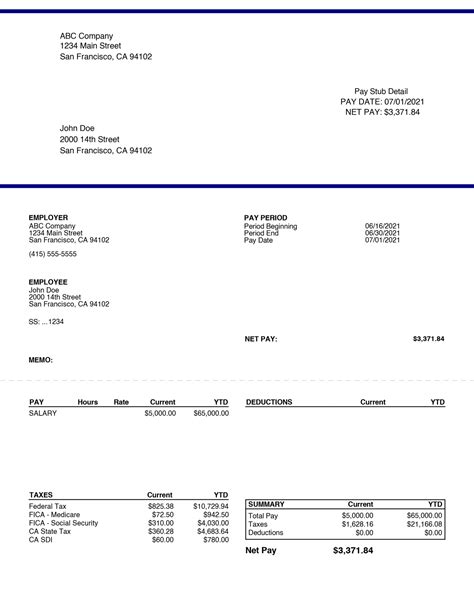

Here are five free pay stub templates that contractors can use:

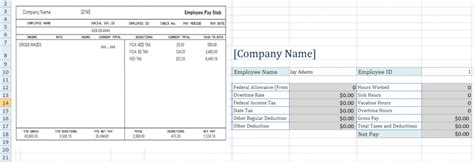

- Microsoft Excel Pay Stub Template This template is available for free on the Microsoft website and is compatible with Excel 2013 and later versions. It includes columns for date, pay period, gross pay, deductions, and net pay.

- Google Docs Pay Stub Template This template is available for free on the Google Docs website and can be easily customized to suit contractors' needs. It includes fields for date, pay period, gross pay, deductions, and net pay.

- PDF Pay Stub Template This template is available for free on the PDFCrowd website and can be downloaded in PDF format. It includes fields for date, pay period, gross pay, deductions, and net pay.

- Word Pay Stub Template This template is available for free on the Microsoft website and is compatible with Word 2013 and later versions. It includes fields for date, pay period, gross pay, deductions, and net pay.

- Pay Stub Template by Template.net This template is available for free on the Template.net website and can be downloaded in Word format. It includes fields for date, pay period, gross pay, deductions, and net pay.

How to Choose the Right Pay Stub Template

Choosing the right pay stub template depends on several factors, including the contractor's specific needs, the type of payment information required, and the desired level of customization. Here are some tips to help contractors choose the right pay stub template:

- Consider the type of payment information required: Contractors should choose a template that includes fields for the necessary payment information, such as gross pay, deductions, and net pay.

- Look for customization options: Contractors should choose a template that allows for customization, such as adding or removing fields, to suit their specific needs.

- Check the compatibility: Contractors should choose a template that is compatible with their software or operating system.

Gallery of Pay Stub Templates

Pay Stub Template Gallery

Conclusion

In conclusion, using pay stub templates can simplify payroll management for contractors. The five free pay stub templates mentioned in this article can help contractors generate accurate and professional pay stubs. By choosing the right template and customizing it to suit their needs, contractors can streamline their financial management and focus on their work.

We hope this article has provided valuable information on pay stub templates for contractors. If you have any questions or would like to share your experience with pay stub templates, please comment below.