Intro

Managing your business's finances effectively is crucial for its success. One essential tool for this is a profit and loss statement, also known as an income statement. It provides a clear picture of your business's revenues and expenses over a specific period, helping you understand where your money is coming from and where it's going. However, creating a profit and loss statement from scratch can be daunting, especially for small businesses or startups.

Fortunately, with the power of Google Sheets, you can simplify the process and make financial management easier and more accessible. A free profit loss template in Google Sheets can help you streamline your financial reporting, saving you time and effort. In this article, we'll explore how to create and use a free profit loss template in Google Sheets, making it simpler for you to manage your business's finances.

Benefits of Using a Profit Loss Template in Google Sheets

Using a profit loss template in Google Sheets offers several benefits:

- Easy to Use: Even if you're not an accounting expert, a template makes it simple to create a professional-looking profit and loss statement.

- Customizable: You can tailor the template to fit your business's specific needs, adding or removing sections as necessary.

- Automated Calculations: Google Sheets handles the math for you, reducing errors and saving you time.

- Collaboration: You can share the template with your team or accountant, making it easier to collaborate on financial reports.

Setting Up Your Free Profit Loss Template

To get started, you'll need to set up your template. Here's a step-by-step guide:

- Create a New Google Sheet: Go to Google Drive and create a new Google Sheet. You can give it a name like "Profit Loss Statement" or "Income Statement."

- Choose a Template: You can either use a pre-made template or create your own from scratch. If you're new to Google Sheets, using a pre-made template might be the easier option.

- Customize the Template: Once you have your template, customize it to fit your business's needs. You might need to add or remove sections, or change the formatting to make it more readable.

Understanding Your Profit Loss Statement

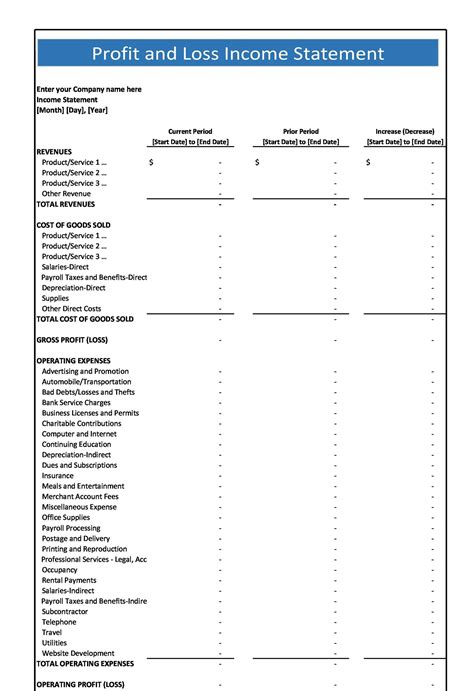

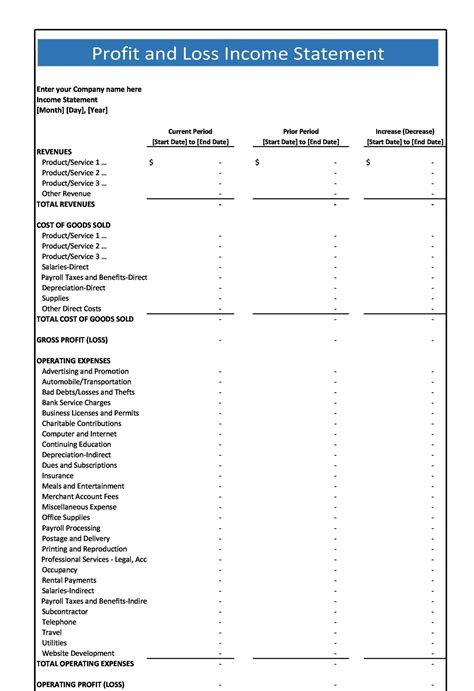

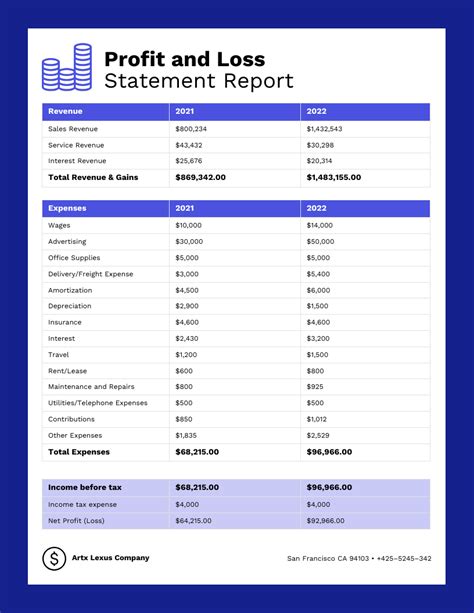

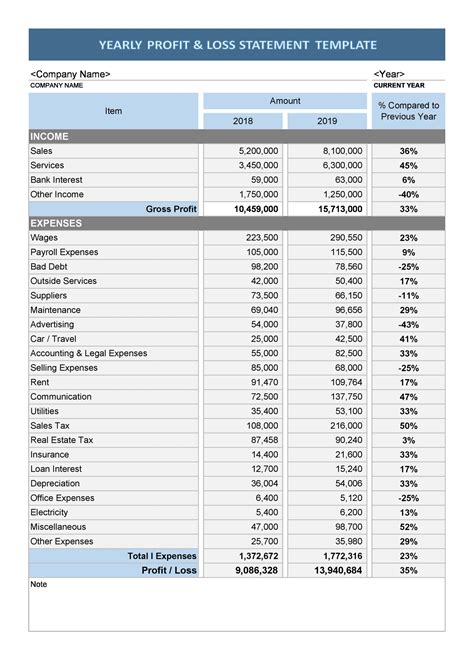

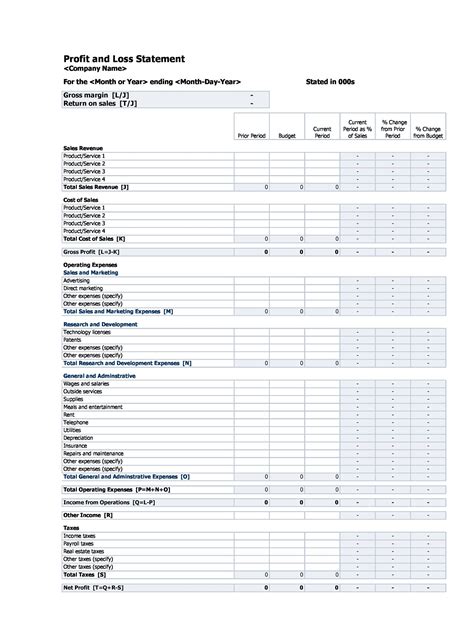

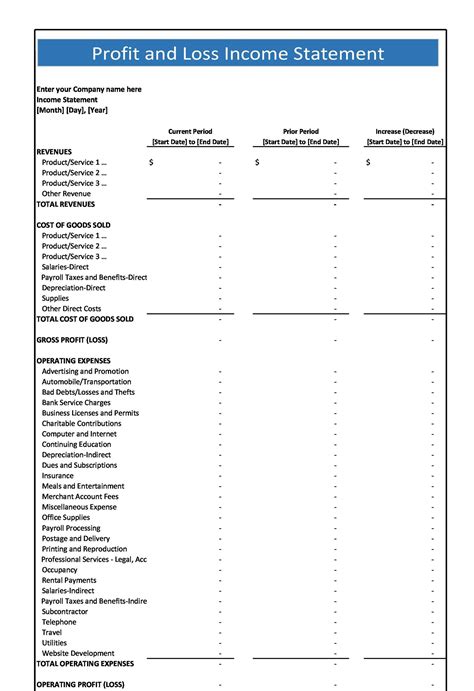

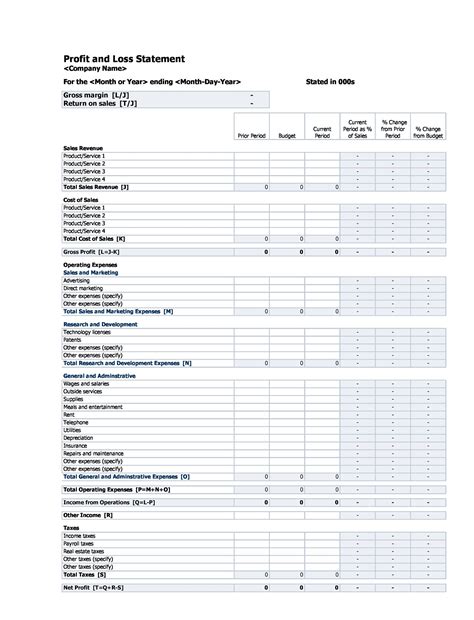

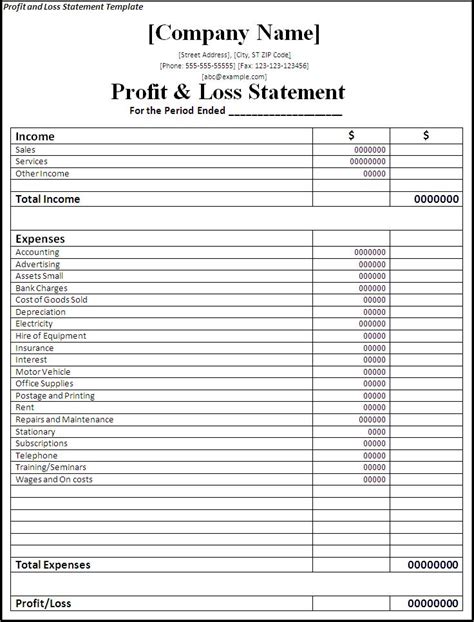

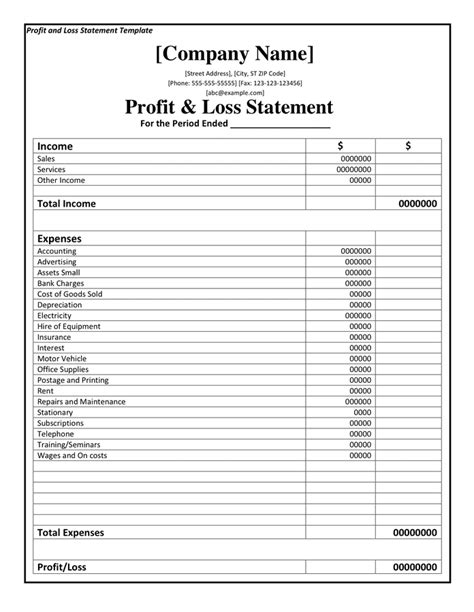

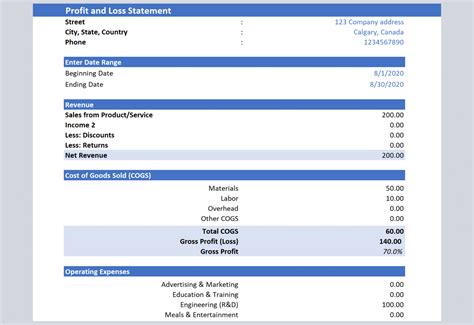

Your profit loss statement is divided into several key sections:

- Revenues: This section lists all the income your business has earned, including sales, services, and any other sources of revenue.

- Cost of Goods Sold (COGS): This section includes the direct costs associated with producing and selling your products or services.

- Gross Profit: This is the difference between your revenues and COGS.

- Operating Expenses: This section includes all the indirect costs associated with running your business, such as rent, utilities, and employee salaries.

- Operating Income: This is the difference between your gross profit and operating expenses.

- Net Income: This is your business's total profit, calculated by subtracting all expenses from your revenues.

Using Your Profit Loss Template to Make Financial Decisions

Your profit loss template is more than just a financial report; it's a tool to help you make informed decisions about your business. Here are a few ways you can use it:

- Identify Areas for Cost Reduction: By analyzing your operating expenses, you can identify areas where you might be able to cut costs and improve profitability.

- Set Financial Goals: Use your profit loss statement to set realistic financial goals, such as increasing revenues or reducing expenses.

- Monitor Progress: Regularly review your profit loss statement to see how your business is performing and make adjustments as needed.

Common Mistakes to Avoid When Using a Profit Loss Template

While a profit loss template can be a powerful tool, there are some common mistakes to avoid:

- Inaccurate Data: Make sure you're entering accurate data into your template. Inaccurate data can lead to poor financial decisions.

- Not Regularly Reviewing: Regularly review your profit loss statement to ensure you're on track to meet your financial goals.

- Not Adjusting for Seasonal Fluctuations: If your business experiences seasonal fluctuations, make sure you're adjusting your template accordingly.

Tips for Customizing Your Profit Loss Template

While a pre-made template can be a great starting point, you might need to customize it to fit your business's specific needs. Here are a few tips:

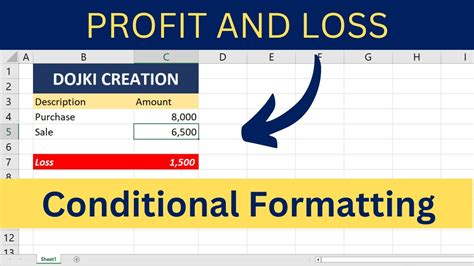

- Use Conditional Formatting: Use conditional formatting to highlight important information, such as negative numbers or unusually high expenses.

- Add Charts and Graphs: Use charts and graphs to visualize your data and make it easier to understand.

- Use Drop-Down Menus: Use drop-down menus to make it easier to select from a list of options, such as categories of expenses.

Conclusion

A free profit loss template in Google Sheets can be a powerful tool for managing your business's finances. By understanding how to set up and use a template, you can make informed financial decisions and drive your business's success. Remember to regularly review your template and make adjustments as needed to ensure you're on track to meet your financial goals.

Profit Loss Template Image Gallery

We hope you've found this article helpful in understanding how to use a free profit loss template in Google Sheets. By following these tips and best practices, you can create a powerful financial management tool that will help drive your business's success. If you have any questions or need further assistance, feel free to ask in the comments below.