Intro

Create a legally binding agreement with our free promissory note template, perfect for personal or business loans. Download and customize this template to outline loan terms, repayment schedules, and borrower obligations. Ensure secure lending with our comprehensive template, covering interest rates, late fees, and default clauses, ideal for lenders and borrowers.

Creating a Binding Agreement with a Free Promissory Note Template

When lending or borrowing money, whether for personal or business purposes, it's essential to have a written agreement that outlines the terms of the loan. A promissory note is a legally binding document that serves as a promise to repay a loan, including the amount borrowed, interest rate, repayment schedule, and any other conditions. In this article, we'll explore the importance of using a free promissory note template for personal or business loans and provide a comprehensive guide on how to create one.

Why Use a Promissory Note Template?

A promissory note template offers several benefits, including:

- Clear understanding of loan terms: A promissory note template ensures that both the borrower and lender understand the loan terms, reducing the risk of misunderstandings or disputes.

- Legally binding agreement: A promissory note is a legally binding document that can be enforced in court if the borrower fails to repay the loan.

- Protection for both parties: A promissory note template protects both the borrower and lender by outlining the loan terms and conditions, including the repayment schedule and interest rate.

- Convenience: A promissory note template saves time and effort by providing a pre-drafted document that can be easily customized to suit your needs.

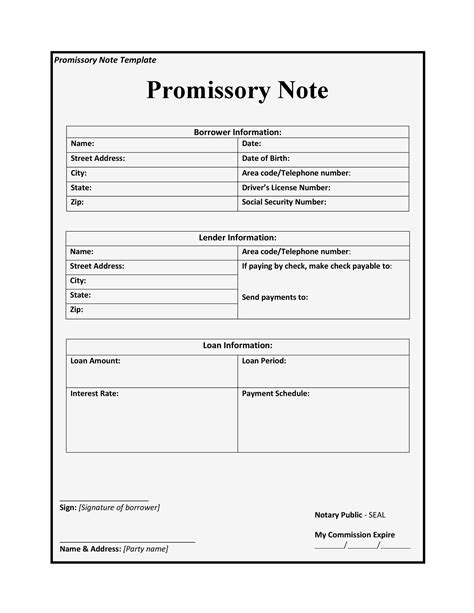

What to Include in a Promissory Note Template

A promissory note template should include the following essential elements:

- Loan amount: The amount borrowed by the borrower.

- Interest rate: The interest rate applicable to the loan.

- Repayment schedule: The repayment schedule, including the frequency and amount of payments.

- Loan term: The duration of the loan.

- Default provisions: The consequences of defaulting on the loan.

- Governing law: The law that governs the loan agreement.

Free Promissory Note Template for Personal Loans

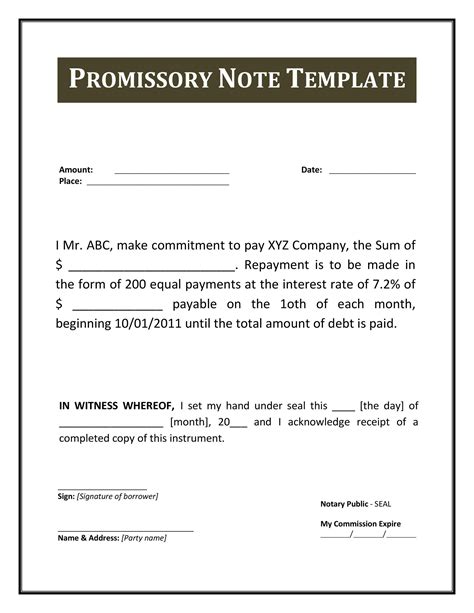

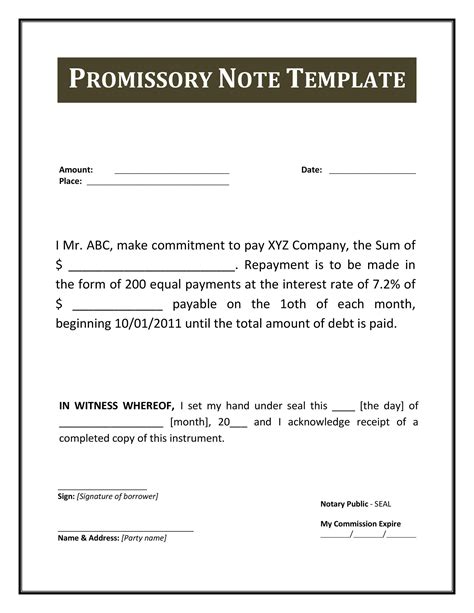

Here's a sample promissory note template for personal loans:

PROMISSORY NOTE

This Promissory Note ("Note") is made and entered into on [DATE] ("Effective Date") by and between [BORROWER'S NAME] ("Borrower") and [LENDER'S NAME] ("Lender").

- Loan Amount: The Lender agrees to lend to the Borrower the sum of $[LOAN AMOUNT] ("Loan Amount").

- Interest Rate: The Borrower agrees to pay interest on the Loan Amount at the rate of [INTEREST RATE]% per annum.

- Repayment Schedule: The Borrower agrees to repay the Loan Amount, together with interest, in [NUMBER] equal installments of $[INSTALLMENT AMOUNT] each, due on the [DUE DATE] day of each [MONTH/QUARTER] commencing on [FIRST PAYMENT DATE].

- Loan Term: The Loan shall be repaid in full on [LOAN TERM].

- Default Provisions: If the Borrower fails to make any payment when due, the entire Loan Amount shall become immediately due and payable.

By signing below, the parties acknowledge that they have read, understand, and agree to the terms and conditions of this Note.

BORROWER'S SIGNATURE: ______________________ LENDER'S SIGNATURE: ______________________

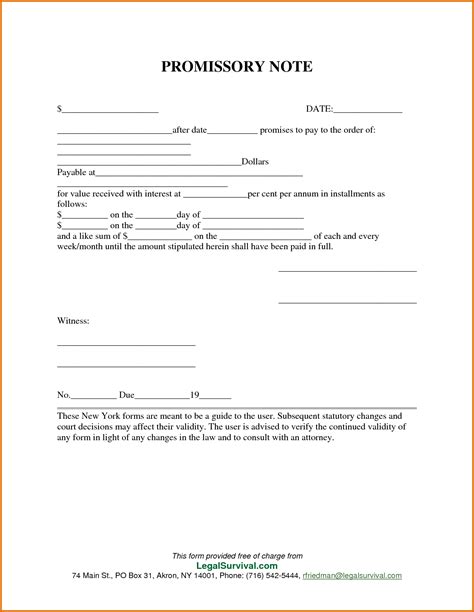

Free Promissory Note Template for Business Loans

Here's a sample promissory note template for business loans:

PROMISSORY NOTE

This Promissory Note ("Note") is made and entered into on [DATE] ("Effective Date") by and between [BORROWER'S BUSINESS NAME] ("Borrower") and [LENDER'S BUSINESS NAME] ("Lender").

- Loan Amount: The Lender agrees to lend to the Borrower the sum of $[LOAN AMOUNT] ("Loan Amount").

- Interest Rate: The Borrower agrees to pay interest on the Loan Amount at the rate of [INTEREST RATE]% per annum.

- Repayment Schedule: The Borrower agrees to repay the Loan Amount, together with interest, in [NUMBER] equal installments of $[INSTALLMENT AMOUNT] each, due on the [DUE DATE] day of each [MONTH/QUARTER] commencing on [FIRST PAYMENT DATE].

- Loan Term: The Loan shall be repaid in full on [LOAN TERM].

- Default Provisions: If the Borrower fails to make any payment when due, the entire Loan Amount shall become immediately due and payable.

- Collateral: The Borrower agrees to pledge [COLLATERAL] as security for the Loan.

By signing below, the parties acknowledge that they have read, understand, and agree to the terms and conditions of this Note.

BORROWER'S SIGNATURE: ______________________ LENDER'S SIGNATURE: ______________________

Tips for Using a Promissory Note Template

- Customize the template: Tailor the template to suit your specific needs and circumstances.

- Seek professional advice: Consult with a lawyer or financial advisor to ensure the template complies with local laws and regulations.

- Keep records: Keep a record of the loan, including the promissory note, repayment schedule, and any communication with the borrower.

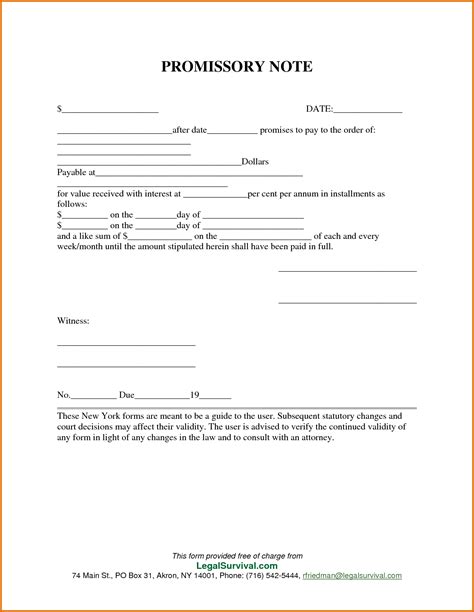

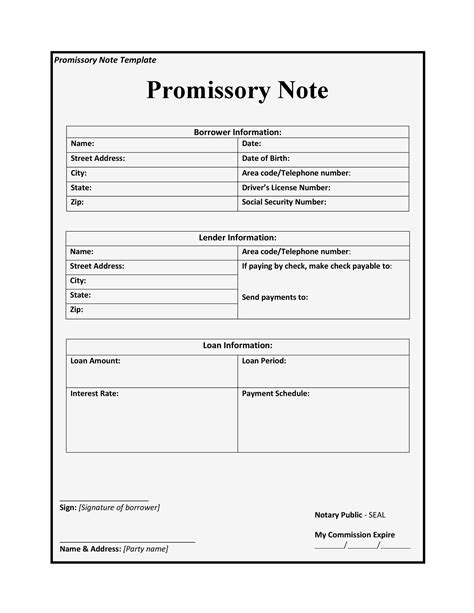

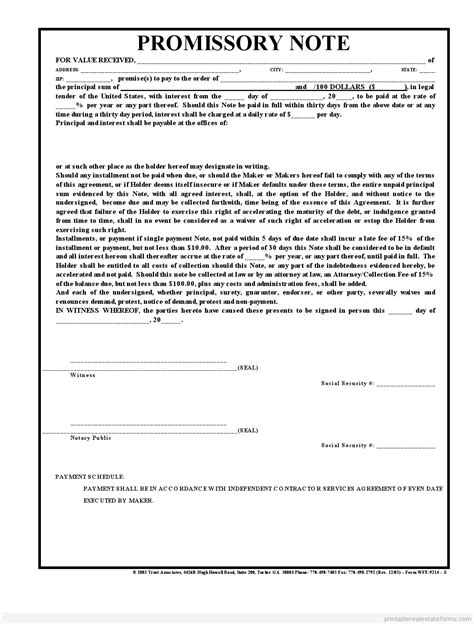

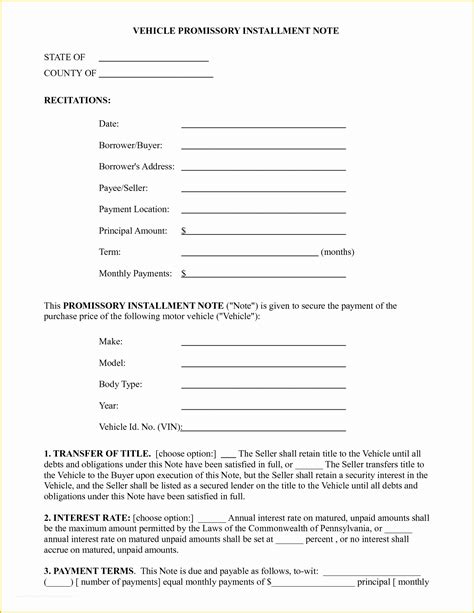

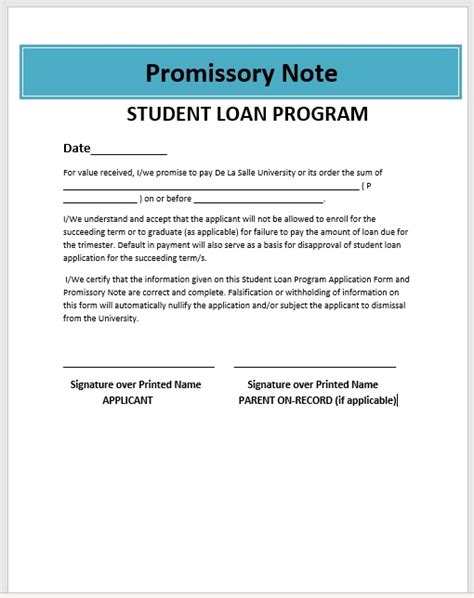

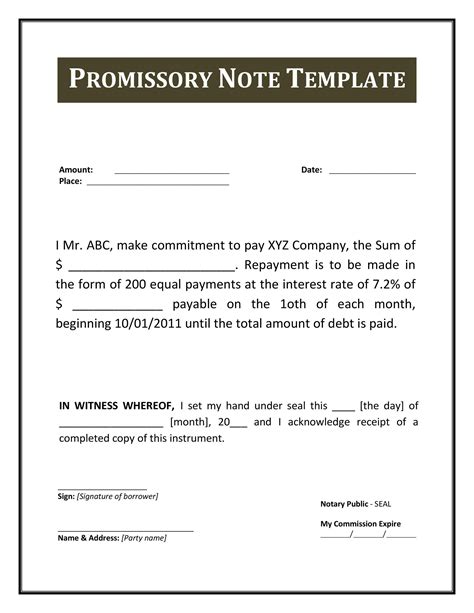

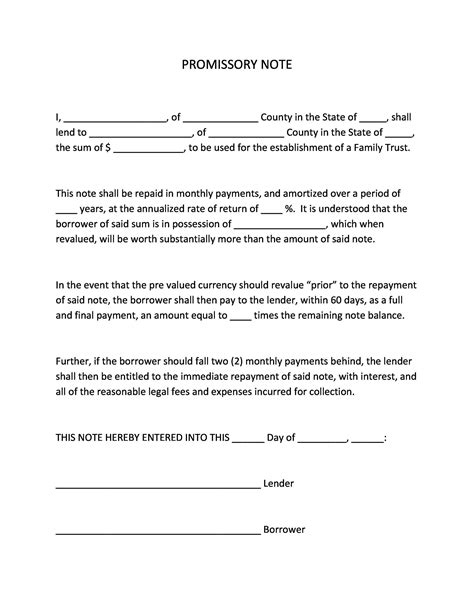

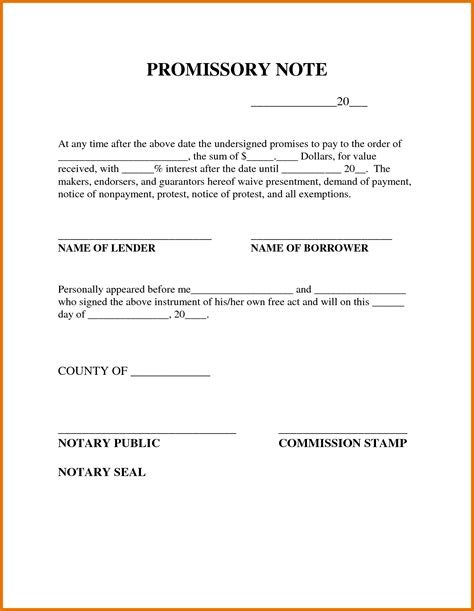

Gallery of Promissory Note Templates

Promissory Note Templates

Conclusion

A free promissory note template is an essential tool for creating a legally binding agreement between a borrower and lender. By using a template, you can ensure that the loan terms are clear, concise, and enforceable. Whether you're lending or borrowing money for personal or business purposes, a promissory note template can provide peace of mind and protect your interests.

What's Your Experience with Promissory Notes?

Have you ever used a promissory note template for a personal or business loan? Share your experience and tips in the comments below!

Share This Article

If you found this article helpful, share it with your friends and colleagues who may be in need of a promissory note template.

Take Action

Don't wait until it's too late! Download a free promissory note template today and protect your financial interests.