In the Grand Canyon State, loans between friends, family members, or businesses are common occurrences. However, without a written agreement, these loans can quickly turn into messy disputes. This is where an Arizona free promissory note template comes in handy. A promissory note is a legally binding document that outlines the terms of a loan, including the amount borrowed, interest rates, and repayment terms.

Why Use a Promissory Note in Arizona?

A promissory note provides a clear understanding of the loan terms, protecting both the lender and borrower from potential misunderstandings. In Arizona, a promissory note can be used for various types of loans, such as personal loans, business loans, or real estate loans. Having a written agreement in place can help prevent disputes and ensure that both parties fulfill their obligations.

Key Components of an Arizona Promissory Note

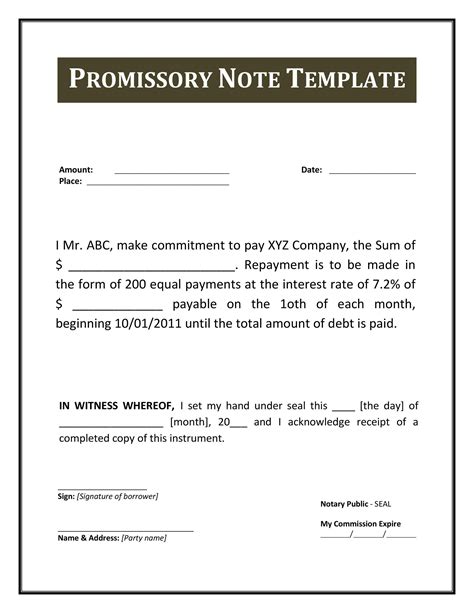

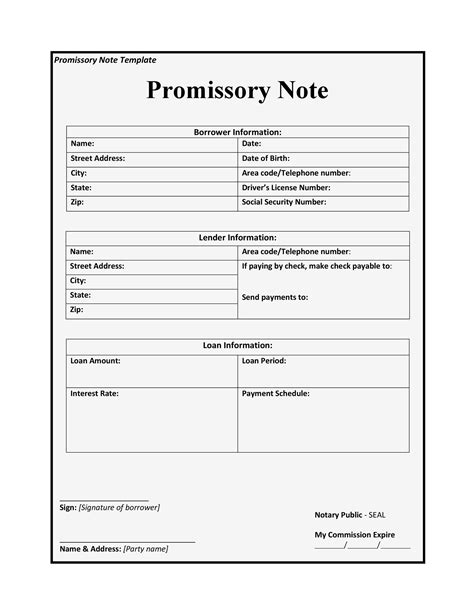

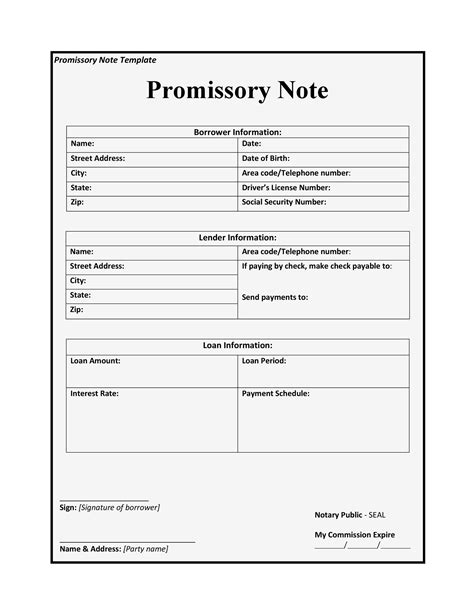

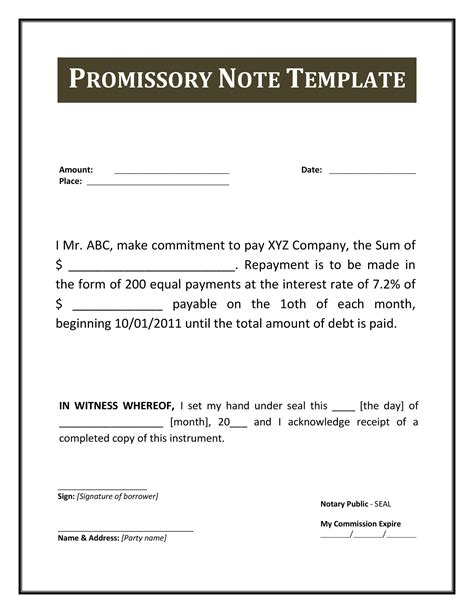

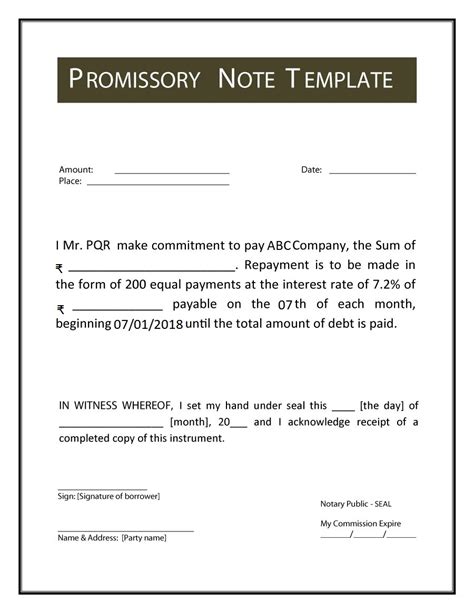

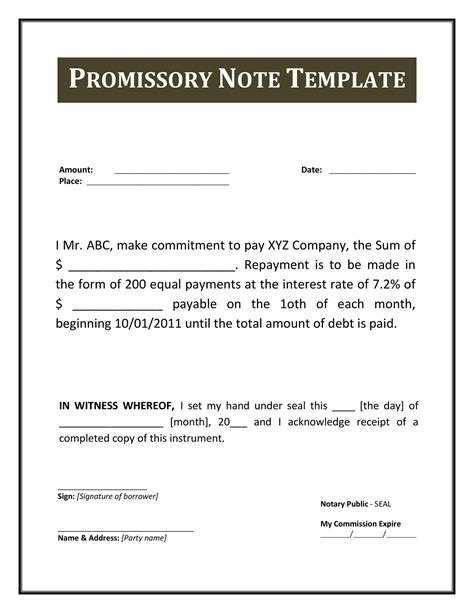

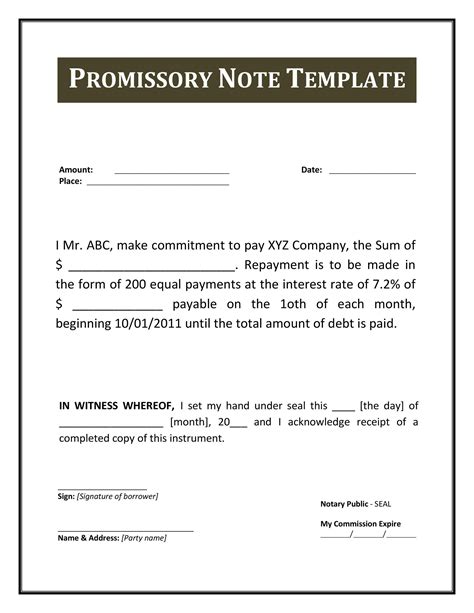

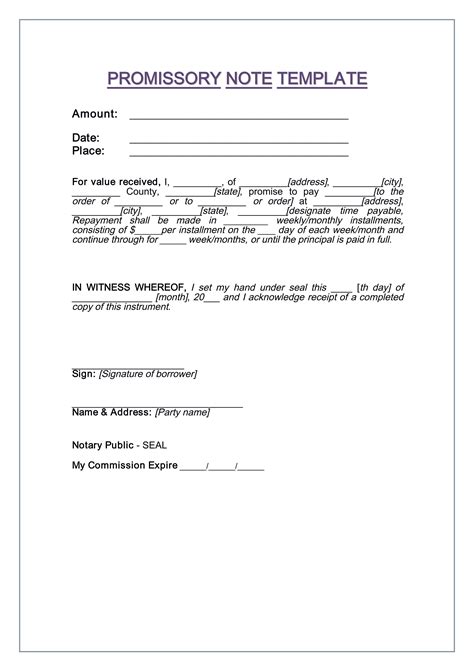

A typical Arizona promissory note template includes the following essential components:

- Borrower and Lender Information: Names and addresses of both the borrower and lender.

- Loan Amount: The total amount borrowed, including any interest or fees.

- Interest Rate: The percentage rate at which interest accrues on the loan.

- Repayment Terms: The schedule for repaying the loan, including the frequency and amount of payments.

- Default Clause: A provision outlining the consequences of failing to repay the loan.

- Governing Law: A statement indicating that the note will be governed by Arizona law.

Benefits of Using an Arizona Free Promissory Note Template

Using a promissory note template can provide several benefits, including:

- Clear Communication: A written agreement ensures that both parties understand the loan terms, reducing the risk of misunderstandings.

- Protection from Disputes: A promissory note can help prevent disputes by providing a clear outline of the loan terms and repayment schedule.

- Compliance with Arizona Law: A well-drafted promissory note template ensures compliance with Arizona state laws and regulations.

- Flexibility: A promissory note template can be customized to fit specific loan agreements, allowing for flexibility in negotiating terms.

How to Use an Arizona Free Promissory Note Template

To use a promissory note template in Arizona, follow these steps:

- Download a Template: Obtain a free promissory note template from a reputable source.

- Fill in the Information: Complete the template with the required information, including borrower and lender details, loan amount, interest rate, and repayment terms.

- Review and Negotiate: Review the template with the borrower and lender, and negotiate the terms as necessary.

- Sign and Date: Sign and date the promissory note, ensuring that both parties receive a copy.

Common Uses of Arizona Promissory Notes

Promissory notes are commonly used in Arizona for various types of loans, including:

- Personal Loans: Loans between friends, family members, or acquaintances.

- Business Loans: Loans for business purposes, such as expanding operations or financing equipment.

- Real Estate Loans: Loans for purchasing or refinancing real estate properties.

- Student Loans: Loans for educational expenses, such as tuition or living expenses.

Arizona Promissory Note FAQs

Here are some frequently asked questions about Arizona promissory notes:

- Is a promissory note required for all loans in Arizona?: No, a promissory note is not required for all loans in Arizona. However, it is highly recommended to use a promissory note to protect both parties and prevent disputes.

- Can I use a promissory note template for a loan with interest?: Yes, a promissory note template can be used for loans with interest. The template should include the interest rate and terms for calculating interest.

- What happens if the borrower defaults on the loan?: If the borrower defaults on the loan, the lender can take legal action to recover the debt. The promissory note should include a default clause outlining the consequences of default.

A Guide to Arizona Promissory Note Templates

By using an Arizona free promissory note template, lenders and borrowers can create a clear and legally binding agreement that protects both parties. Remember to customize the template to fit specific loan agreements and review the terms carefully before signing.