Intro

Securely outline loan terms with our free Colorado promissory note template. Download a customizable, legally binding document to formalize private loans, ensuring clear repayment terms and protecting both lender and borrower rights. Easily outline interest rates, payment schedules, and more with our comprehensive and user-friendly template.

As a business owner or individual in Colorado, you may find yourself in a situation where you need to lend or borrow money from someone. In such cases, having a written agreement in place can help protect your interests and prevent misunderstandings. One way to achieve this is by using a promissory note template.

A promissory note is a legally binding document that outlines the terms of a loan, including the amount borrowed, interest rate, repayment schedule, and any other conditions. In Colorado, a promissory note can be used for various types of loans, such as personal loans, business loans, or mortgages.

In this article, we will discuss the importance of using a promissory note template in Colorado, the benefits of having a written agreement, and provide a free template for you to download.

Why Use a Promissory Note Template in Colorado?

Using a promissory note template in Colorado can provide several benefits to both lenders and borrowers. Here are some reasons why you should consider using a promissory note template:

- Clarifies the terms of the loan: A promissory note template helps to clarify the terms of the loan, including the amount borrowed, interest rate, repayment schedule, and any other conditions. This can help prevent misunderstandings and disputes.

- Provides a written record: A promissory note template provides a written record of the loan agreement, which can be useful in case of disputes or if the borrower defaults on the loan.

- Protects the lender's interests: A promissory note template can help protect the lender's interests by outlining the terms of the loan and providing a clear understanding of the borrower's obligations.

What to Include in a Promissory Note Template

When creating a promissory note template, there are several key elements that you should include. Here are some of the most important:

- Borrower and lender information: The template should include the names and addresses of both the borrower and the lender.

- Loan amount and interest rate: The template should outline the amount borrowed and the interest rate charged on the loan.

- Repayment schedule: The template should outline the repayment schedule, including the frequency of payments and the amount of each payment.

- Default provisions: The template should include provisions for what happens if the borrower defaults on the loan, including any penalties or fees.

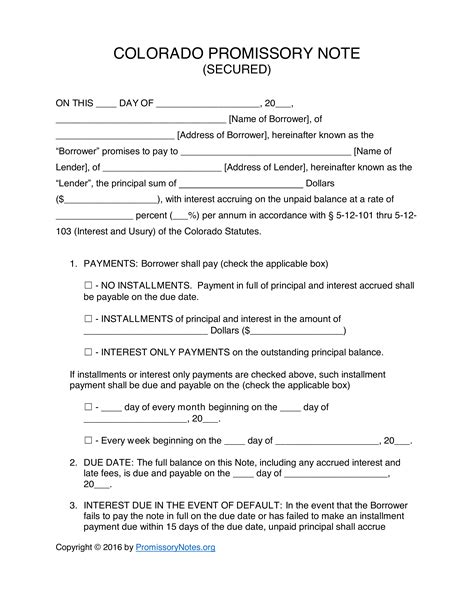

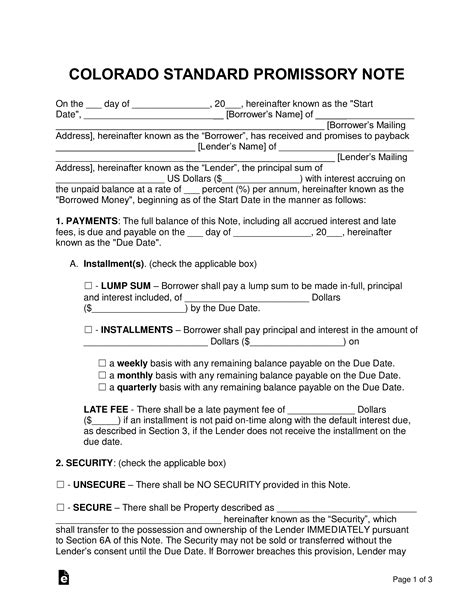

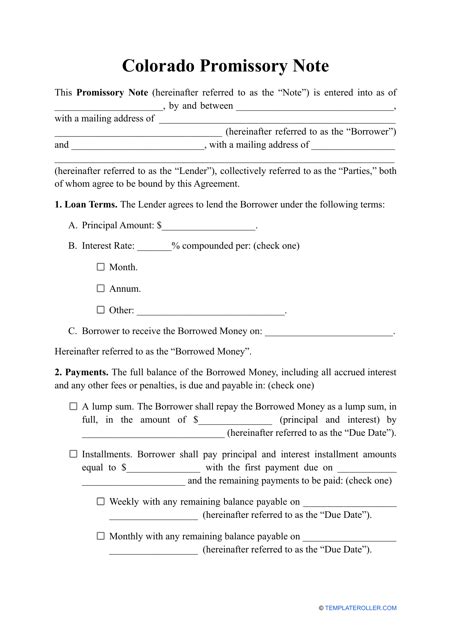

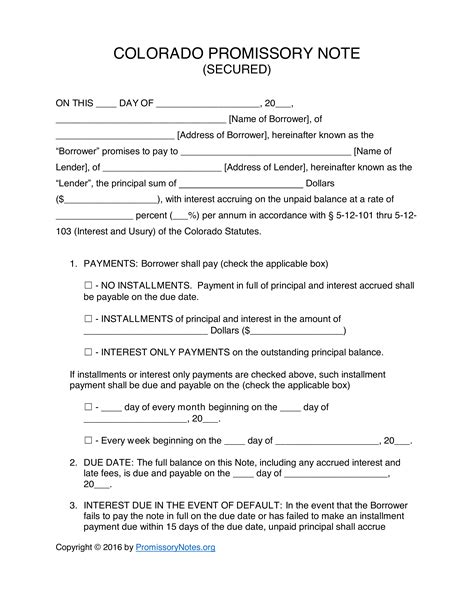

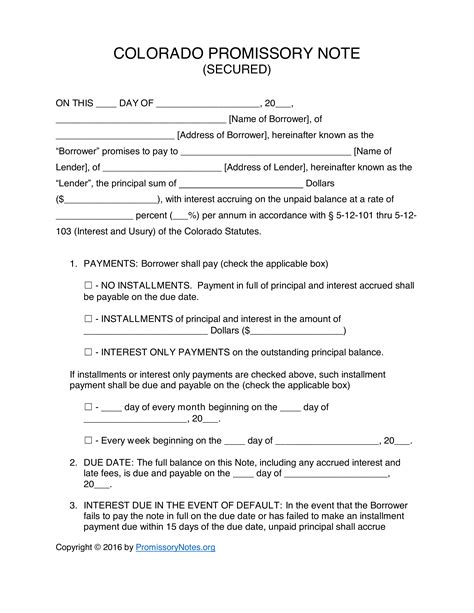

Colorado Free Promissory Note Template Download

To help you get started, we have provided a free Colorado promissory note template that you can download and use. This template includes all the necessary elements, including borrower and lender information, loan amount and interest rate, repayment schedule, and default provisions.

You can download the template here: [insert link]

Frequently Asked Questions

Here are some frequently asked questions about promissory note templates in Colorado:

What is a promissory note?

A promissory note is a legally binding document that outlines the terms of a loan, including the amount borrowed, interest rate, repayment schedule, and any other conditions.

Why do I need a promissory note template?

A promissory note template can help clarify the terms of the loan, provide a written record, and protect the lender's interests.

What should I include in a promissory note template?

You should include borrower and lender information, loan amount and interest rate, repayment schedule, and default provisions.

Gallery of Colorado Promissory Note Templates

Colorado Promissory Note Templates

We hope this article has provided you with a comprehensive understanding of promissory note templates in Colorado. Remember to always use a written agreement when lending or borrowing money to protect your interests and prevent misunderstandings.

If you have any questions or need further assistance, please don't hesitate to comment below. We would be happy to help.