Intro

Download a free simple promissory note template instantly and create a legally binding agreement. Learn how to use a promissory note to lend or borrow money, understand the essential elements, and discover the benefits of using a template. Get your free template now and ensure a smooth loan transaction with our easy-to-use and customizable document.

In today's fast-paced business world, lending and borrowing money is a common practice. Whether you're a small business owner, an individual, or an organization, having a clear and binding agreement is crucial to ensure that both parties understand their obligations. This is where a promissory note comes in – a powerful tool that helps you secure your loan and avoid potential disputes.

A promissory note is a written promise to pay a debt, typically with specified terms and conditions. It serves as a contract between the lender and the borrower, outlining the loan amount, interest rate, repayment schedule, and other essential details. Having a well-structured promissory note template can save you time and effort, reducing the risk of misunderstandings and miscommunications.

What is a Promissory Note?

A promissory note is a type of financial instrument that represents a loan agreement between two parties. It's a legally binding contract that contains essential details about the loan, such as:

- The loan amount (also known as the principal)

- The interest rate

- The repayment terms (including the due date and any installment schedule)

- Any security or collateral

- The governing law and jurisdiction

Promissory notes can be used for various purposes, including:

- Business loans

- Personal loans

- Real estate transactions

- Investments

Benefits of Using a Promissory Note Template

Using a promissory note template offers several benefits, including:

- Saves time: With a pre-designed template, you don't need to start from scratch, which saves you time and effort.

- Reduces errors: A template helps ensure that you include all the necessary details, reducing the risk of errors or omissions.

- Provides clarity: A well-structured promissory note template helps to avoid misunderstandings and miscommunications.

- Protects your interests: A promissory note template can help you establish a clear and binding agreement, protecting your interests as a lender or borrower.

What to Include in a Promissory Note Template

When creating a promissory note template, make sure to include the following essential elements:

- Loan amount: The amount borrowed by the borrower.

- Interest rate: The rate at which interest is charged on the loan.

- Repayment terms: The schedule for repaying the loan, including the due date and any installment schedule.

- Security or collateral: Any assets or property used to secure the loan.

- Governing law and jurisdiction: The laws and courts that govern the agreement.

- Default provisions: The consequences of failing to meet the repayment terms.

- Signatures: The signatures of both the lender and the borrower.

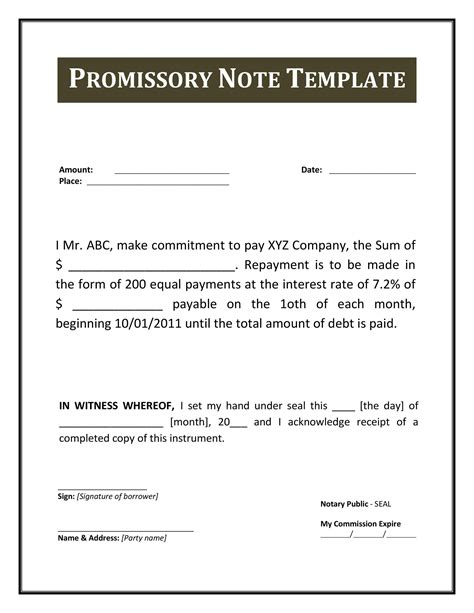

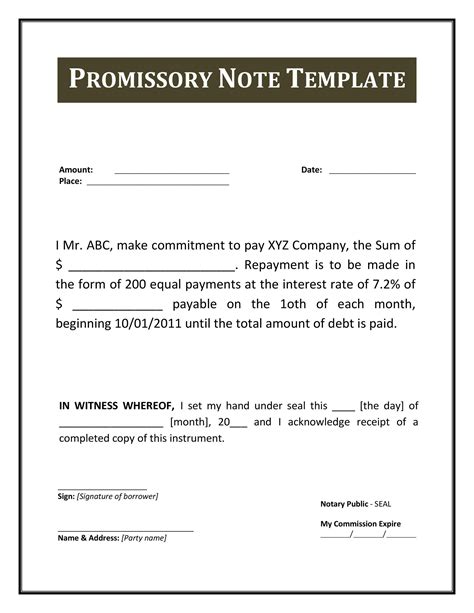

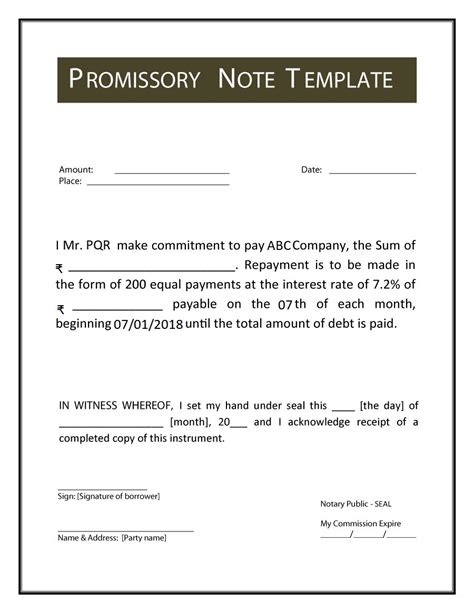

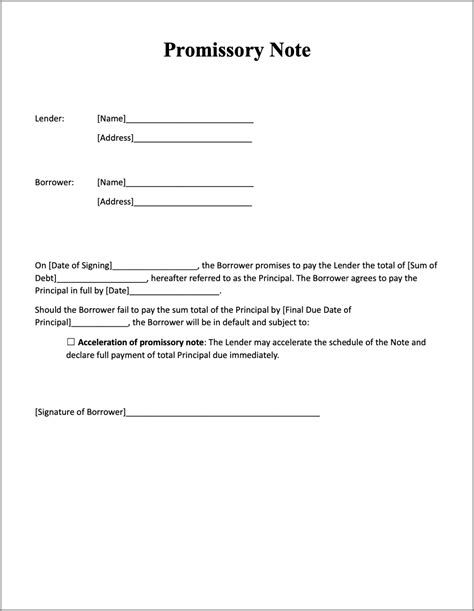

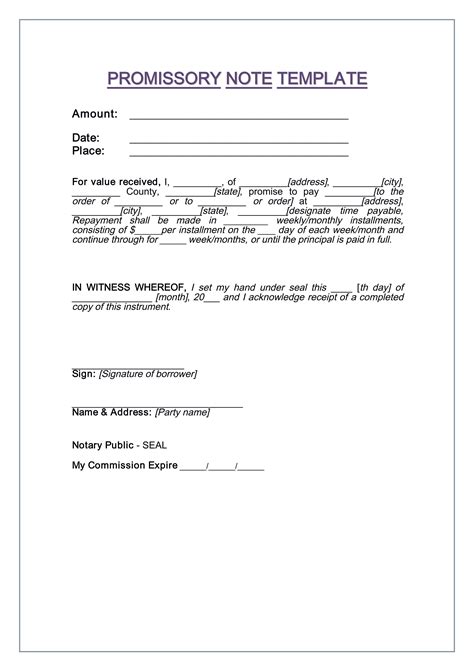

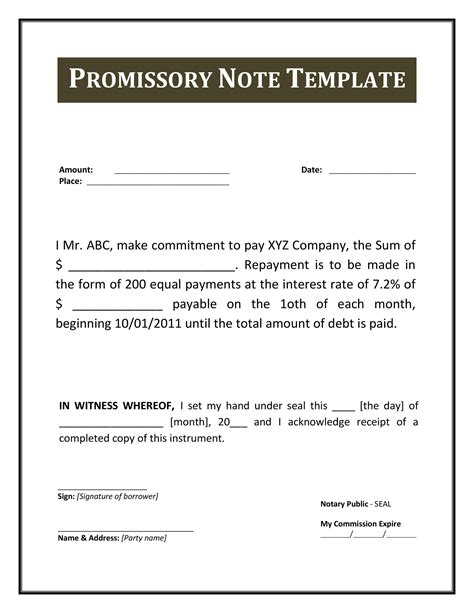

Sample Promissory Note Template

Here's a simple promissory note template you can use as a starting point:

Promissory Note

This Promissory Note ("Note") is made and entered into on [DATE] ("Effective Date") by and between [LENDER'S NAME] ("Lender") and [BORROWER'S NAME] ("Borrower").

- Loan Amount: The Lender agrees to lend the Borrower the sum of $ [LOAN AMOUNT].

- Interest Rate: The Borrower agrees to pay an interest rate of [INTEREST RATE]% per annum on the outstanding principal balance.

- Repayment Terms: The Borrower agrees to repay the loan on [REPAYMENT DATE] with [NUMBER] installments of $ [INSTALLMENT AMOUNT] each.

- Security or Collateral: The Borrower agrees to provide [SECURITY OR COLLATERAL] as security for the loan.

- Governing Law and Jurisdiction: This Note shall be governed by and construed in accordance with the laws of [STATE/COUNTRY].

By signing below, the parties acknowledge that they have read, understand, and agree to the terms and conditions of this Note.

Signature of Lender: ________________________ Signature of Borrower: ________________________

Date: ________________________

Get Your Free Promissory Note Template

Ready to get started with your promissory note template? Click the link below to download your free template instantly:

[Insert download link]

Conclusion

A promissory note template is an essential tool for any lender or borrower. It helps to establish a clear and binding agreement, protecting your interests and reducing the risk of misunderstandings. By using a well-structured template, you can save time and effort, ensuring that your loan agreement is comprehensive and effective.

We hope this article has provided you with valuable insights into the world of promissory notes. If you have any questions or need further assistance, please don't hesitate to reach out. Share your thoughts and experiences with us in the comments below, and don't forget to download your free promissory note template today!

Promissory Note Template Gallery

Note: This article is for informational purposes only and should not be considered as professional advice. Always consult with a lawyer or financial expert before creating or signing a promissory note.