Intro

The Unsecured Promissory Note is a powerful tool that allows individuals and businesses to formalize loan agreements without the need for collateral. Whether you're lending or borrowing money, having a solid agreement in place is crucial for protecting your interests. In this article, we'll delve into the world of Unsecured Promissory Notes, explore their benefits, and provide you with a free template to get started.

What is an Unsecured Promissory Note?

An Unsecured Promissory Note is a type of loan agreement where the borrower promises to repay the lender a specified amount of money, plus interest, without providing any collateral to secure the loan. This type of agreement is often used for personal loans, business loans, or other types of financing where the lender is willing to take on more risk.

Benefits of Using an Unsecured Promissory Note

Using an Unsecured Promissory Note offers several benefits to both lenders and borrowers. Some of the key advantages include:

- Flexibility: Unsecured Promissory Notes can be tailored to fit the specific needs of the parties involved.

- Convenience: These agreements can be used for a wide range of loan purposes, from personal loans to business financing.

- Reduced risk: By formalizing the loan agreement, both parties can reduce their risk of disputes or misunderstandings.

How to Use an Unsecured Promissory Note Template

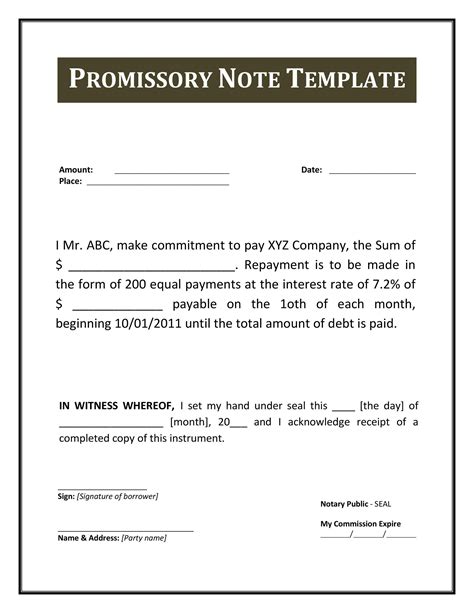

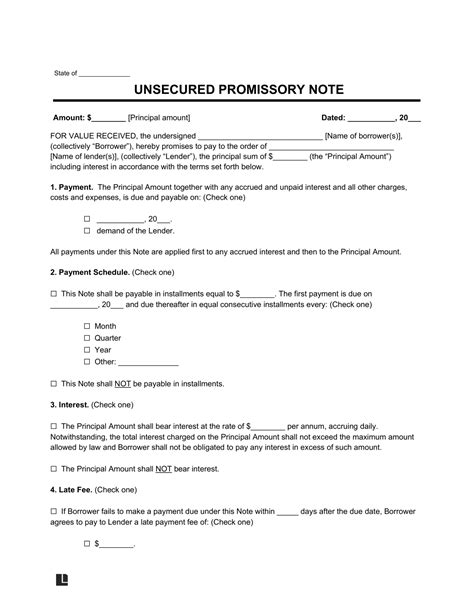

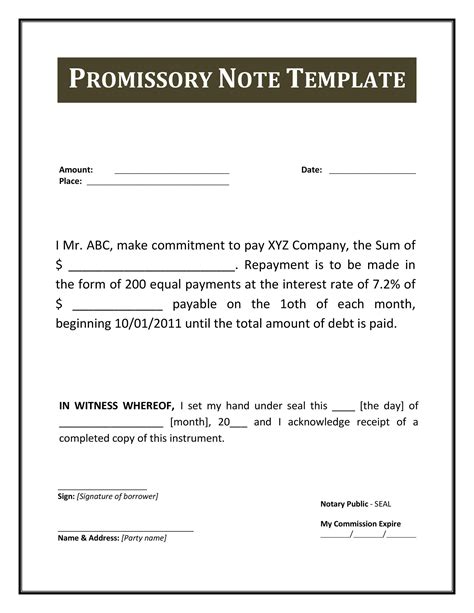

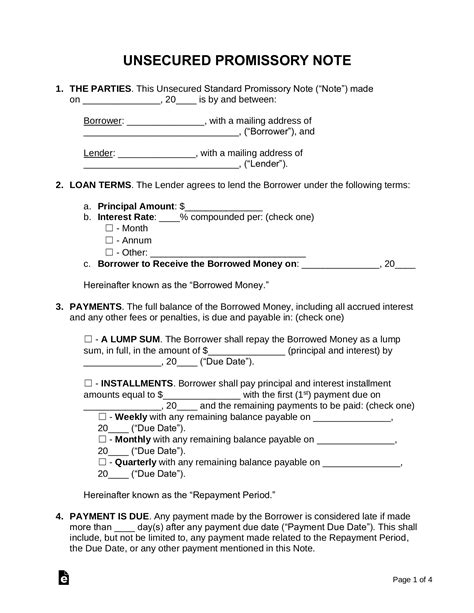

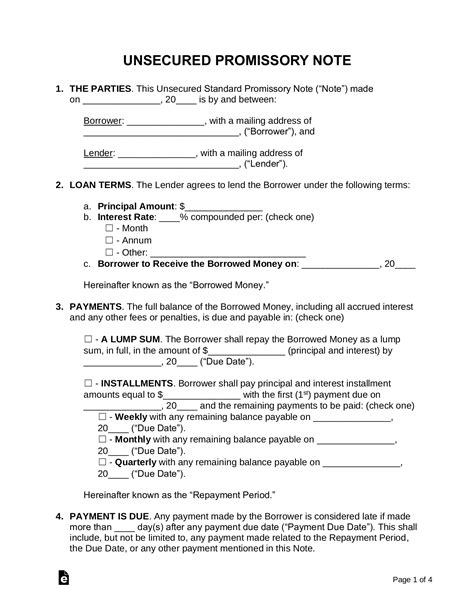

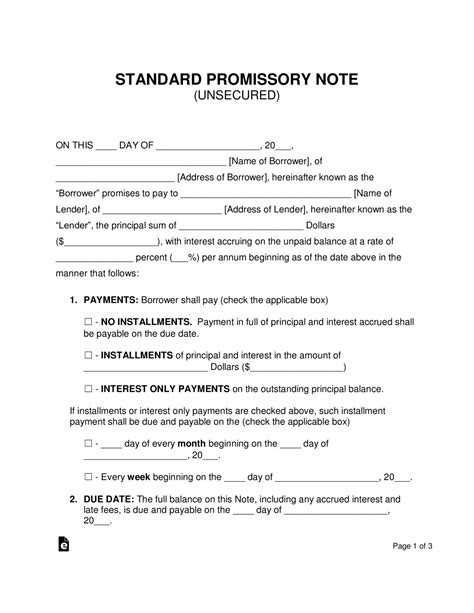

Using an Unsecured Promissory Note template can save you time and help ensure that your agreement is comprehensive and effective. Here's a step-by-step guide to using our free template:

- Download the template: Click the link below to access our free Unsecured Promissory Note template.

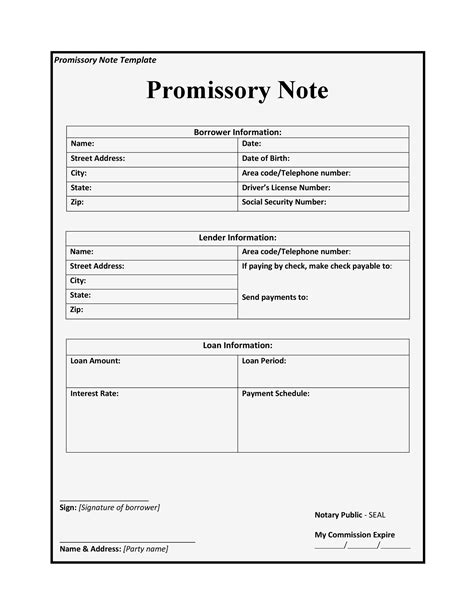

- Fill in the parties: Enter the names and addresses of the borrower and lender.

- Specify the loan terms: Include the loan amount, interest rate, repayment schedule, and any other relevant terms.

- Define the payment terms: Outline the payment schedule, including the amount and frequency of payments.

- Include any additional provisions: Add any additional clauses or provisions that are relevant to the loan agreement.

What to Include in Your Unsecured Promissory Note

When creating your Unsecured Promissory Note, there are several key elements to include. Here are some of the most important provisions to consider:

- Loan amount: The total amount of money being borrowed.

- Interest rate: The rate at which interest will be charged on the loan.

- Repayment schedule: The frequency and amount of payments.

- Payment terms: The method of payment, such as check or electronic transfer.

- Default provisions: The consequences of missing a payment or defaulting on the loan.

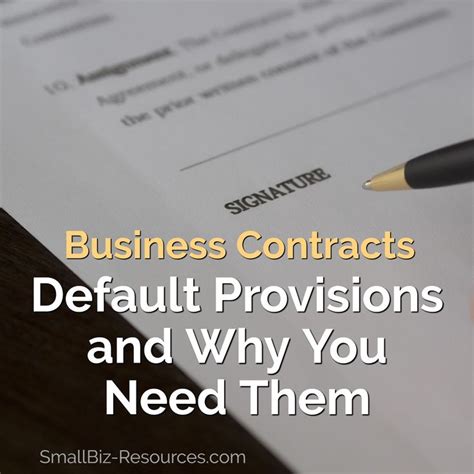

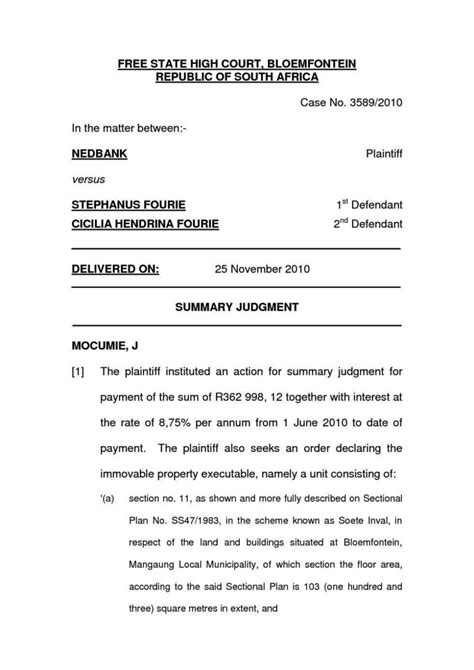

Default Provisions: What You Need to Know

Default provisions are an essential part of any loan agreement. These provisions outline the consequences of missing a payment or defaulting on the loan. Here are some key things to consider:

- Late payment fees: The amount charged for late payments.

- Default interest rate: The interest rate charged on the loan in the event of default.

- Acceleration clause: A clause that allows the lender to demand immediate payment of the full loan amount in the event of default.

Free Unsecured Promissory Note Template

Get instant access to our free Unsecured Promissory Note template. Simply click the link below to download the template and start creating your loan agreement today.

Download Free Unsecured Promissory Note Template

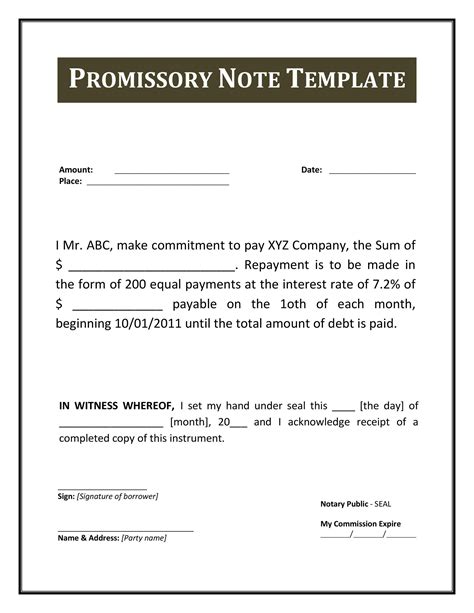

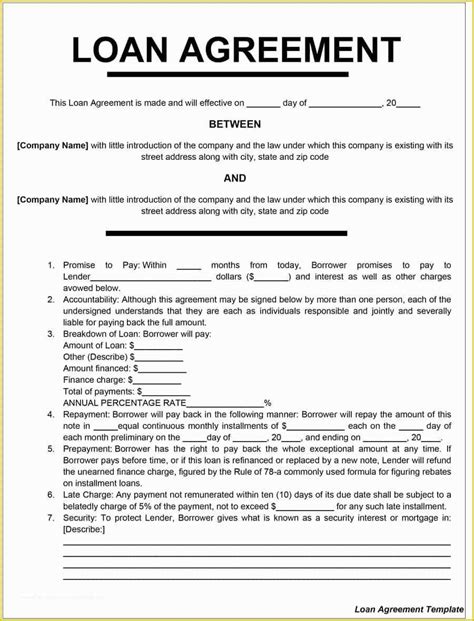

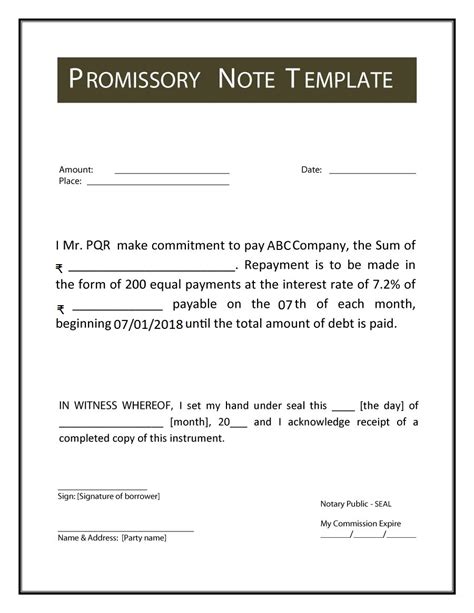

Unsecured Promissory Note Image Gallery

Unsecured Promissory Note Image Gallery

We hope this article has provided you with a comprehensive understanding of Unsecured Promissory Notes and how to use our free template to create a solid loan agreement. If you have any questions or need further assistance, please don't hesitate to reach out.