As the deadline for implementing GASB 87 looms closer, many organizations are scrambling to ensure compliance with the new lease accounting standard. GASB 87, also known as the "Lease Accounting Standard," requires governments to recognize lease assets and liabilities on their balance sheets, rather than just disclosing them in the footnotes. This change aims to provide a more accurate and transparent representation of government finances. However, implementing GASB 87 can be a complex and time-consuming process, especially for organizations with multiple leases.

Understanding GASB 87

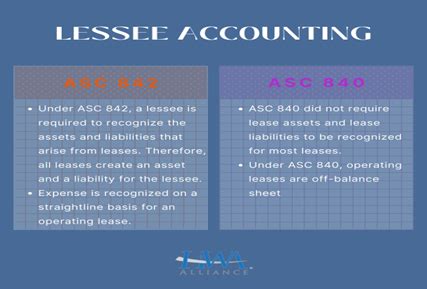

To comply with GASB 87, governments must identify all leases, including those embedded in service contracts, and determine the lease term, payments, and discount rate. They must also calculate the present value of the lease payments and recognize a lease asset and liability on the balance sheet. The standard applies to all leases, including:

- Operating leases

- Capital leases

- Service contracts with embedded leases

- Build-to-suit leases

Benefits of Implementing GASB 87

Implementing GASB 87 provides several benefits, including:

- Improved financial transparency and accountability

- Enhanced comparability with other governments

- Better decision-making through more accurate financial reporting

- Compliance with government accounting standards

Challenges of Implementing GASB 87

While implementing GASB 87 is essential, it can be a daunting task, especially for organizations with limited resources and expertise. Some of the challenges include:

- Identifying and documenting all leases, including embedded leases

- Determining the lease term and payments

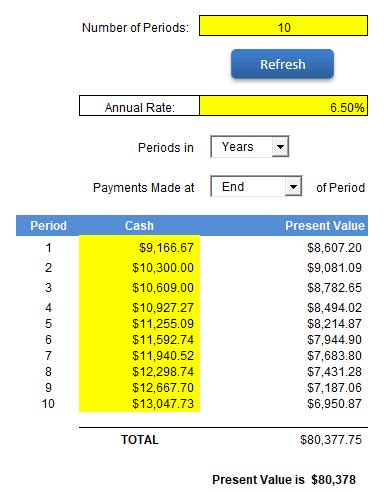

- Calculating the present value of lease payments

- Recognizing lease assets and liabilities on the balance sheet

- Ensuring compliance with the standard's requirements

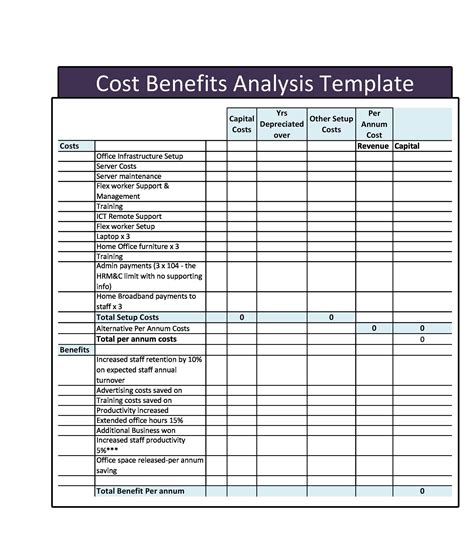

Streamlining GASB 87 Compliance with Excel Templates

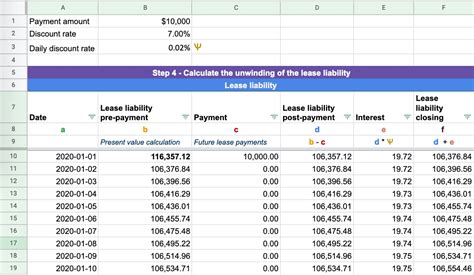

To simplify the implementation process, we have developed an Excel template that helps organizations streamline GASB 87 compliance. Our template provides a structured approach to identifying, documenting, and calculating lease assets and liabilities.

- Lease identification and documentation: Our template provides a comprehensive framework for identifying and documenting all leases, including embedded leases.

- Lease term and payment calculations: The template calculates the lease term and payments, including any variable lease payments.

- Present value calculations: Our template calculates the present value of lease payments using the discount rate and lease term.

- Lease asset and liability recognition: The template recognizes lease assets and liabilities on the balance sheet, ensuring compliance with GASB 87.

Benefits of Using Our Excel Template

Our Excel template provides several benefits, including:

- Simplified implementation process

- Improved accuracy and efficiency

- Reduced risk of non-compliance

- Enhanced transparency and accountability

- Cost-effective solution

How to Use Our Excel Template

Using our Excel template is straightforward. Simply:

- Download the template from our website

- Input your lease data, including lease term, payments, and discount rate

- The template will calculate the present value of lease payments and recognize lease assets and liabilities on the balance sheet

- Review and verify the output to ensure accuracy and compliance

Conclusion

Implementing GASB 87 can be a complex and time-consuming process, but with the right tools and resources, it can be streamlined. Our Excel template provides a structured approach to identifying, documenting, and calculating lease assets and liabilities, ensuring compliance with the standard's requirements.

GASB 87 Implementation Image Gallery

By using our Excel template, organizations can ensure compliance with GASB 87 and streamline the implementation process. Don't wait until the last minute to implement GASB 87. Download our template today and start simplifying your lease accounting process.

Share your thoughts and experiences with implementing GASB 87 in the comments below. Have you encountered any challenges or successes? Let's discuss!