Intro

Unlock strategic decision-making with the Ge/McKinsey Matrix Template in Excel. Learn 7 practical ways to apply this powerful tool, optimizing business portfolios, identifying growth opportunities, and allocating resources effectively. Discover how to prioritize investments, manage risk, and drive growth using this versatile framework.

In today's fast-paced business environment, companies are constantly seeking ways to evaluate their portfolio of products, services, or strategies to make informed decisions about investments, resource allocation, and growth. One widely used tool for this purpose is the GE/McKinsey Matrix, also known as the McKinsey Matrix or the GE Matrix. This article will explore the GE/McKinsey Matrix template in Excel, its significance, and provide a step-by-step guide on how to use it effectively.

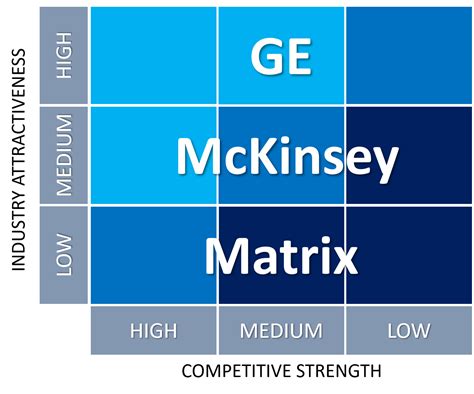

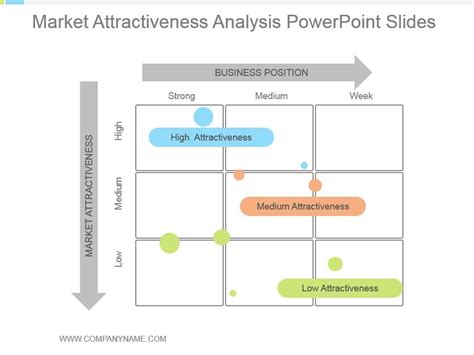

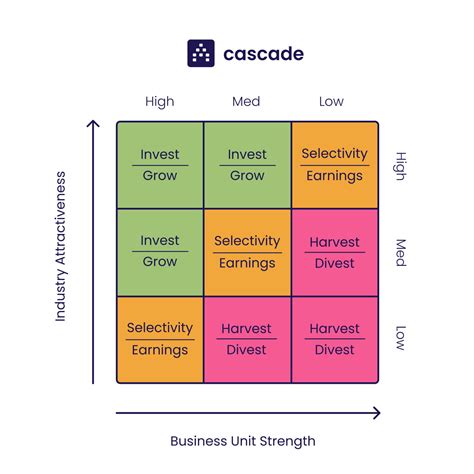

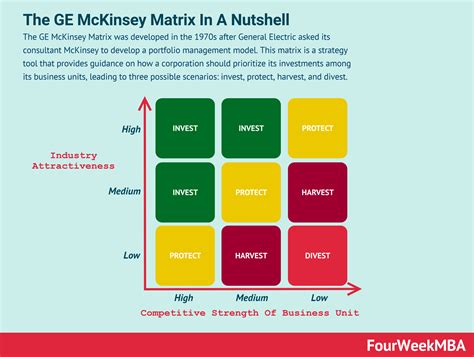

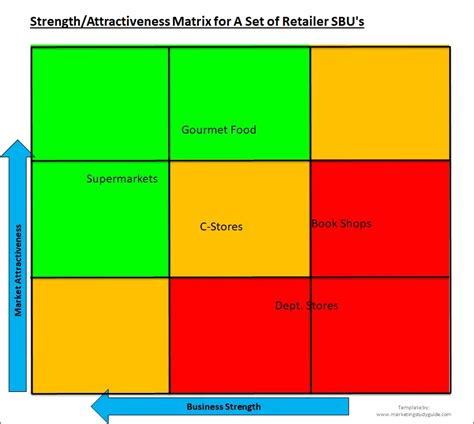

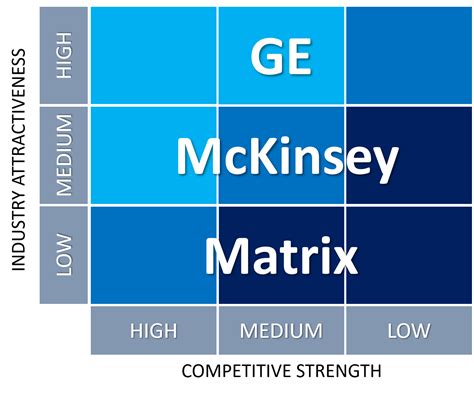

The GE/McKinsey Matrix is a strategic tool used to evaluate business portfolios based on two key dimensions: market attractiveness and competitive strength. It helps companies prioritize their investments, identify areas for growth, and make informed decisions about which businesses or products to retain, divest, or invest in.

What is the GE/McKinsey Matrix?

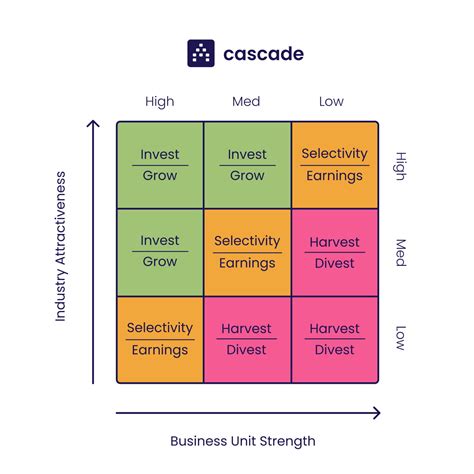

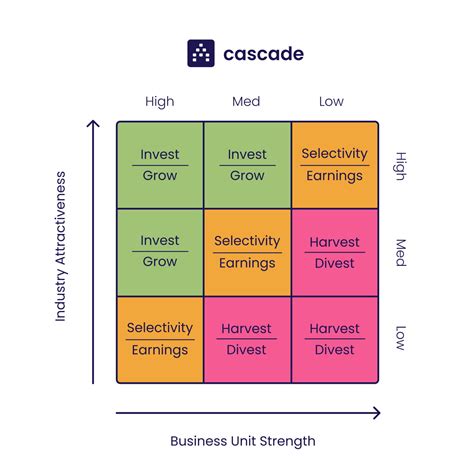

The GE/McKinsey Matrix is a 2x2 matrix that plots market attractiveness against competitive strength. The matrix is divided into four quadrants:

- High-High Quadrant: This quadrant represents businesses or products with high market attractiveness and strong competitive strength. These are the "stars" of the portfolio, and companies should invest in them to maximize growth.

- High-Low Quadrant: This quadrant represents businesses or products with high market attractiveness but weak competitive strength. Companies should invest in these areas to improve their competitive position.

- Low-High Quadrant: This quadrant represents businesses or products with low market attractiveness but strong competitive strength. Companies should consider divesting or restructuring these businesses.

- Low-Low Quadrant: This quadrant represents businesses or products with low market attractiveness and weak competitive strength. Companies should consider divesting or discontinuing these businesses.

How to Use the GE/McKinsey Matrix Template in Excel

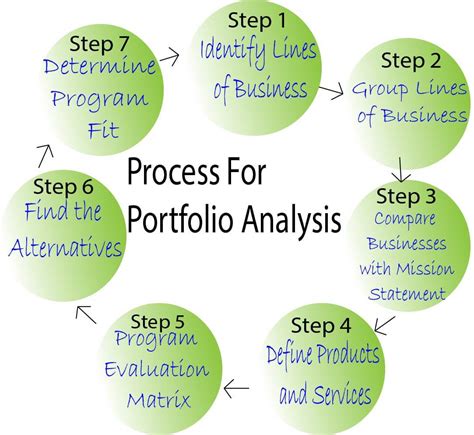

Using the GE/McKinsey Matrix template in Excel is a straightforward process. Here's a step-by-step guide:

Step 1: Identify Your Business Portfolio

Start by identifying the businesses, products, or services you want to evaluate using the GE/McKinsey Matrix. Make a list of these items in a spreadsheet.

Step 2: Evaluate Market Attractiveness

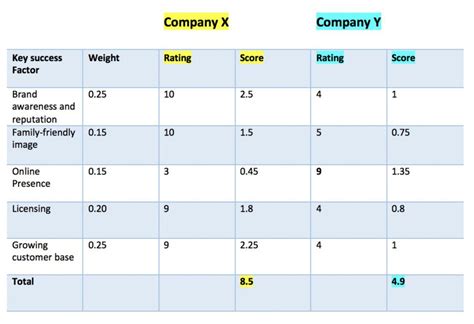

Evaluate the market attractiveness of each business or product based on factors such as market size, growth rate, competition, and profitability. Assign a score to each item based on its market attractiveness.

Step 3: Evaluate Competitive Strength

Evaluate the competitive strength of each business or product based on factors such as market share, brand recognition, and product quality. Assign a score to each item based on its competitive strength.

Step 4: Plot the Matrix

Plot the businesses or products on the GE/McKinsey Matrix based on their market attractiveness and competitive strength scores.

Step 5: Analyze and Interpret the Results

Analyze and interpret the results of the GE/McKinsey Matrix to identify areas for growth, investment, divestment, or restructuring.

Benefits of Using the GE/McKinsey Matrix Template in Excel

Using the GE/McKinsey Matrix template in Excel offers several benefits, including:

- Improved decision-making: The GE/McKinsey Matrix provides a structured approach to evaluating business portfolios, enabling companies to make informed decisions about investments and resource allocation.

- Enhanced strategic planning: The matrix helps companies identify areas for growth, investment, and divestment, enabling them to develop effective strategic plans.

- Increased competitiveness: By evaluating competitive strength and market attractiveness, companies can identify areas for improvement and develop strategies to enhance their competitive position.

Common Applications of the GE/McKinsey Matrix

The GE/McKinsey Matrix has several common applications, including:

- Business portfolio evaluation: The matrix is widely used to evaluate business portfolios and identify areas for growth, investment, and divestment.

- Strategic planning: The matrix is used to develop effective strategic plans by identifying areas for growth, investment, and divestment.

- Marketing strategy development: The matrix is used to develop marketing strategies by evaluating market attractiveness and competitive strength.

Conclusion

In conclusion, the GE/McKinsey Matrix template in Excel is a powerful tool for evaluating business portfolios and developing effective strategic plans. By following the steps outlined in this article, companies can use the GE/McKinsey Matrix to identify areas for growth, investment, and divestment, and make informed decisions about their business portfolios.

Take Action

Take action today and start using the GE/McKinsey Matrix template in Excel to evaluate your business portfolio and develop effective strategic plans. Share your experiences and insights with others, and don't hesitate to ask for help if you need it.

GE McKinsey Matrix Image Gallery