Intro

Unlock the power of gifting equity with our comprehensive guide and downloadable template. Learn how to structure a gift of equity letter, understand the tax implications, and navigate the process with ease. Perfect for homeowners, real estate agents, and lenders, this resource covers everything you need to know about gifting equity, including rules, restrictions, and benefits.

Acquiring a home can be a thrilling experience, but it can also be a costly and complex process. One aspect of home buying that can be particularly beneficial for buyers, especially in certain situations, is a gift of equity. In this article, we will delve into the world of gift of equity, exploring what it is, its benefits, and providing a comprehensive guide on how to create a gift of equity letter template.

Understanding Gift of Equity

A gift of equity is a situation where a homeowner sells their property to a family member, typically a child or parent, at a price below the market value. This type of transaction is considered a gift, as the seller is essentially giving the buyer a portion of the equity in the property. Gift of equity is often used to help a family member purchase a home when they might not have otherwise been able to afford it.

Benefits of Gift of Equity

Gift of equity offers several benefits to both the buyer and the seller. For the buyer, it can provide an opportunity to purchase a home at a lower price, making homeownership more accessible. For the seller, it can be a way to help a family member achieve their dream of owning a home, while also potentially reducing their tax liability.

Some of the key benefits of gift of equity include:

- Reduced purchase price for the buyer

- Increased affordability for the buyer

- Potential tax benefits for the seller

- Opportunity for the seller to help a family member

Creating a Gift of Equity Letter Template

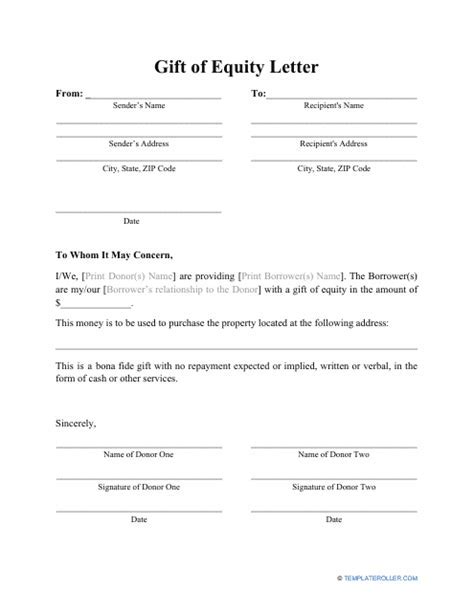

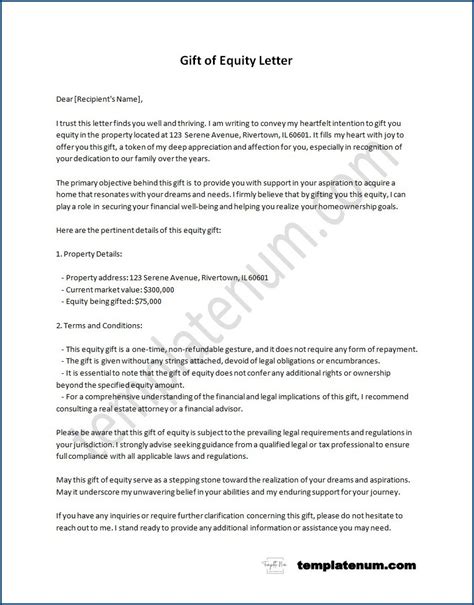

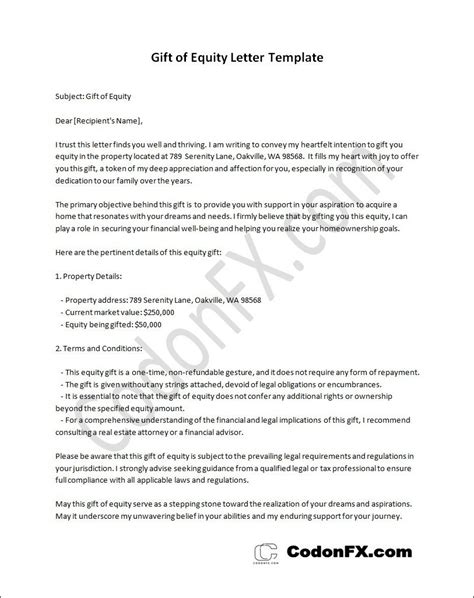

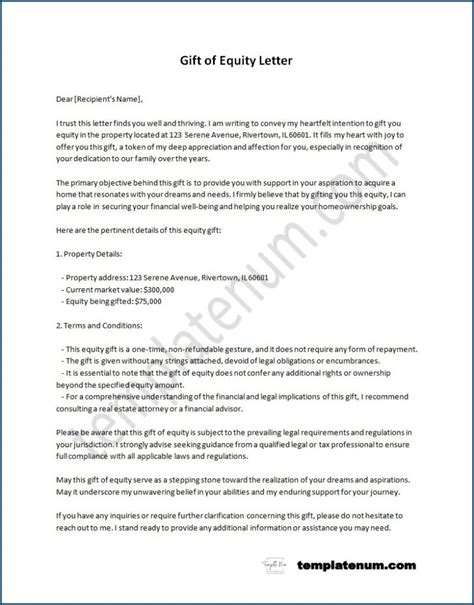

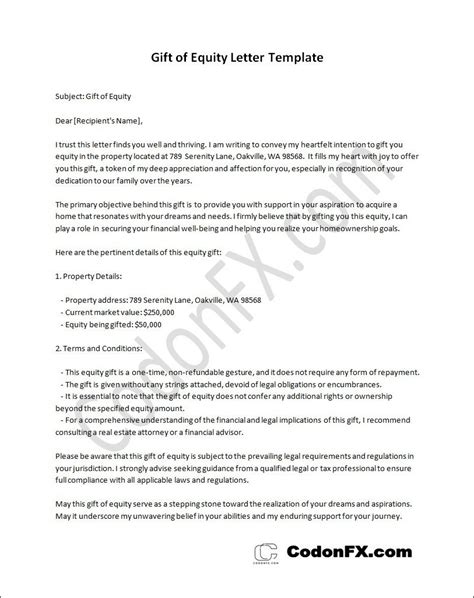

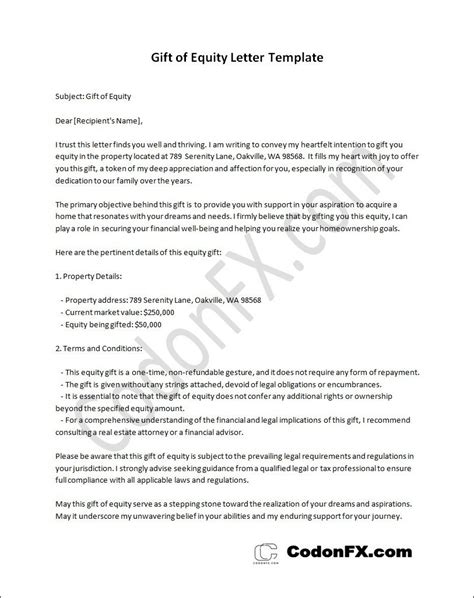

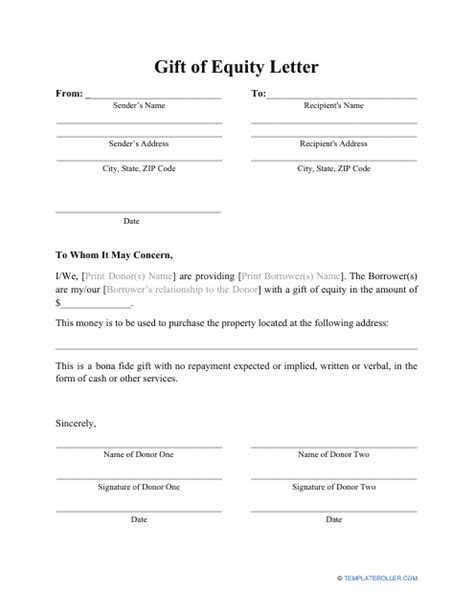

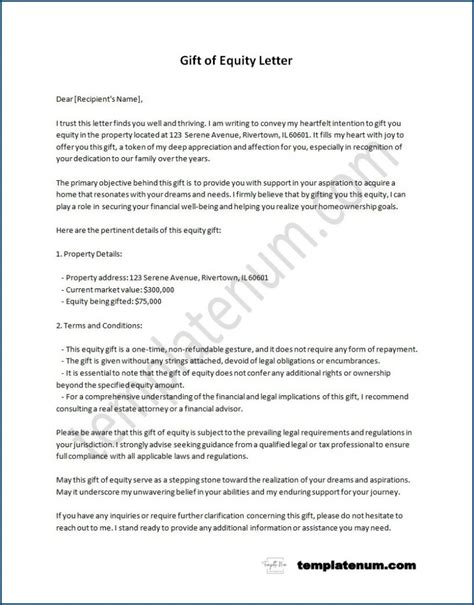

A gift of equity letter is a document that outlines the terms of the gift, including the amount of equity being gifted and the value of the property. This letter is typically required by lenders and is an essential part of the home buying process.

Here is a sample gift of equity letter template:

[h2]Gift of Equity Letter Template[/h2]

[Date]

[Borrower's Name] [Borrower's Address]

Lender's Name Lender's Address

Dear [Lender's Name],

Re: Gift of Equity for [Property Address]

I, [Donor's Name], am writing to confirm that I am making a gift of equity to [Borrower's Name] in the amount of [Amount of Gift] for the purchase of the property located at [Property Address]. This gift is being made without expectation of repayment or compensation.

The details of the gift are as follows:

- Property Address: [Property Address]

- Amount of Gift: [Amount of Gift]

- Value of Property: [Value of Property]

I understand that this gift may have tax implications, and I have consulted with a tax professional to ensure compliance with all applicable laws and regulations.

Please acknowledge receipt of this letter and confirm that it meets your requirements for a gift of equity.

Sincerely,

[Donor's Signature] [Donor's Name]

Steps to Complete a Gift of Equity Letter Template

To complete a gift of equity letter template, follow these steps:

- Identify the parties involved: Clearly identify the borrower, donor, and lender involved in the transaction.

- Describe the property: Provide the property address and a brief description of the property.

- Specify the amount of the gift: State the amount of the gift being made and the value of the property.

- Acknowledge tax implications: Confirm that the donor has consulted with a tax professional to ensure compliance with all applicable laws and regulations.

- Sign and date the letter: Sign and date the letter to confirm the gift.

Common Mistakes to Avoid

When creating a gift of equity letter template, there are several common mistakes to avoid:

- Failure to disclose tax implications: Ensure that the donor understands the tax implications of the gift and has consulted with a tax professional.

- Inadequate documentation: Ensure that the letter includes all necessary details, including the property address, amount of the gift, and value of the property.

- Insufficient acknowledgment: Ensure that the lender acknowledges receipt of the letter and confirms that it meets their requirements for a gift of equity.

Gallery of Gift of Equity Letter Templates

Gift of Equity Letter Templates Gallery

Conclusion

Gift of equity can be a valuable tool for buyers and sellers in a real estate transaction. By understanding the benefits and creating a comprehensive gift of equity letter template, parties can ensure a smooth and successful transaction. Remember to avoid common mistakes and ensure that the letter is properly executed to avoid any potential issues.

We hope this article has provided valuable insights into the world of gift of equity and has equipped you with the knowledge to create a comprehensive gift of equity letter template. If you have any questions or comments, please feel free to share them below.