Intro

Discover the alarming predictions of a housing market crash by Goldman Sachs. Learn the 5 key factors contributing to this downturn, including rising interest rates, housing affordability crisis, and market volatility. Stay ahead of the curve with insights into the impending real estate bubble burst and its impact on the economy.

As the world grapples with the ever-changing landscape of the global economy, Goldman Sachs, a renowned investment banking, securities, and investment management firm, has been closely monitoring the housing market. With their expert analysis, they have predicted a potential housing market crash. In this article, we will delve into the five ways Goldman Sachs predicts a housing market crash.

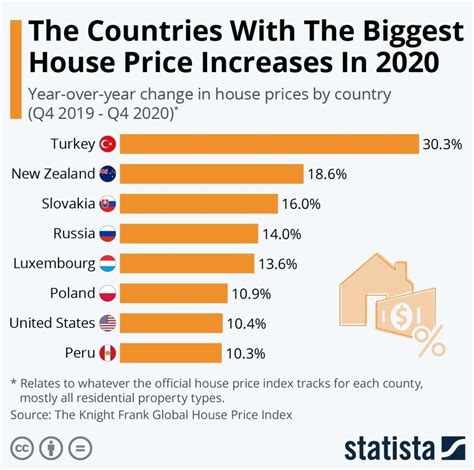

The Unstable Foundation of Housing Prices

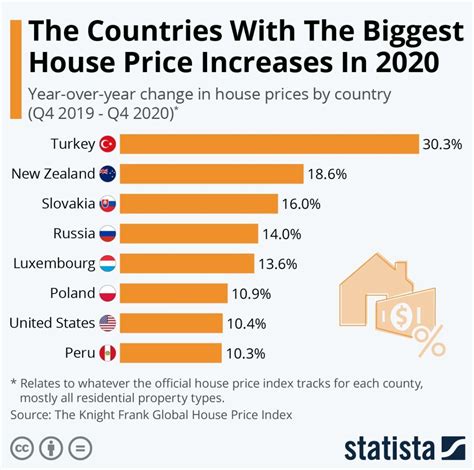

Goldman Sachs' prediction is based on the unstable foundation of housing prices. They argue that the current housing market is built on shaky ground, with prices inflated due to a combination of factors, including low interest rates, government policies, and a lack of affordable housing. This instability makes the market vulnerable to a crash.

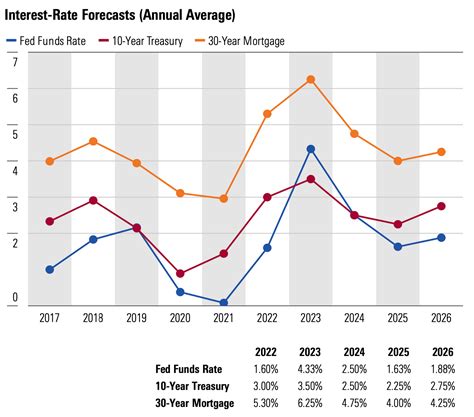

Low Interest Rates: A Double-Edged Sword

Low interest rates have been a major contributor to the housing market's growth. However, Goldman Sachs warns that this growth is unsustainable. With interest rates at historic lows, many homeowners have taken advantage of refinancing their mortgages, which has led to increased borrowing and spending. However, this increased debt burden could become a major issue when interest rates rise, leading to a housing market crash.

The Impact of Government Policies on the Housing Market

Government policies have played a significant role in shaping the housing market. However, Goldman Sachs argues that these policies have also contributed to the market's instability. For example, the government's decision to lower interest rates has encouraged more people to buy homes, which has driven up prices. However, this has also led to a shortage of affordable housing, making it difficult for first-time buyers to enter the market.

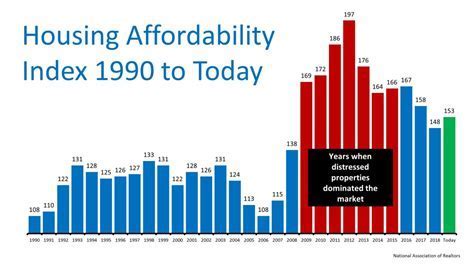

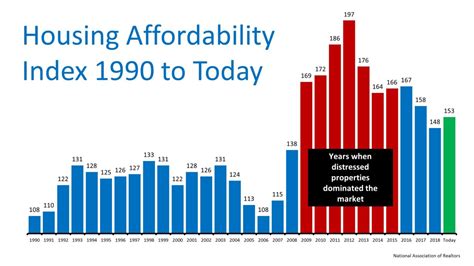

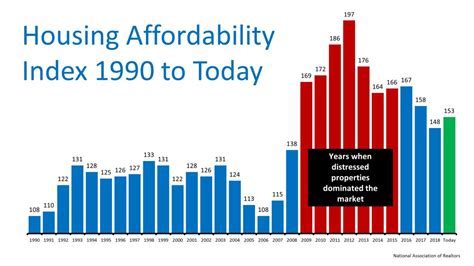

Affordability Crisis: A Major Concern

The affordability crisis is a major concern for Goldman Sachs. With housing prices rising faster than wages, many people are struggling to afford homes. This has led to a shortage of affordable housing, which could have serious consequences for the housing market. If prices continue to rise, it could lead to a housing market crash, as many people will be unable to afford homes.

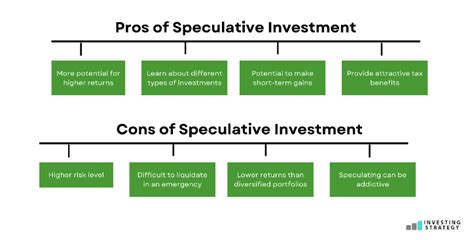

Over-Reliance on Speculative Investment

Goldman Sachs also warns about the over-reliance on speculative investment in the housing market. Many investors, including real estate investment trusts (REITs) and private equity firms, have been buying up homes in the hopes of making a profit. However, this speculative investment has driven up prices, making it difficult for first-time buyers to enter the market.

Risk of Market Correction

The over-reliance on speculative investment has led to a significant risk of market correction. If investors begin to sell their properties, it could lead to a flood of homes on the market, driving down prices and causing a housing market crash.

Housing Market Bubble: A Repeat of 2008?

Goldman Sachs' prediction of a housing market crash has drawn comparisons to the 2008 financial crisis. Many experts believe that the current housing market is experiencing a bubble, similar to the one that burst in 2008.

Risk of Global Economic Consequences

A housing market crash could have serious consequences for the global economy. The 2008 financial crisis led to widespread job losses, business closures, and a significant decline in economic output. A similar crash could have devastating consequences, making it essential for policymakers and regulators to take proactive steps to mitigate the risks.

Conclusion: Navigating the Uncertainty

Goldman Sachs' prediction of a housing market crash is a wake-up call for policymakers, regulators, and homeowners. While the prediction is based on expert analysis, it's essential to remember that the housing market is inherently unpredictable. As we navigate the uncertainty, it's crucial to be prepared for all eventualities and take proactive steps to mitigate the risks.

Housing Market Crash Image Gallery

We hope this article has provided you with a comprehensive understanding of Goldman Sachs' prediction of a housing market crash. Share your thoughts and opinions in the comments below. How do you think the housing market will perform in the coming years?